Many people in India do not know about Hatsun Agro, but most people in south India know Arun ice cream. It is a brand that reaches most cities in south India and has one of the best distribution networks for an ice cream brand in India. Apart from Arun ice cream, Hatsun Agro’s liquid milk brand, Arokya, is well established and it has managed to successfully hold its turf in the highly competitive Tamil Nadu market, where the state cooperative brand Aavin is very strong. Hatsun’s success is built on slow-and-steady growth with an eye on the long term.

The Chennai-based Hatsun Agro Products was founded in 1986 and it is listed on the BSE since 1996. It is one of the largest private dairy players in the country. It serves Tamil Nadu (60% of sales), Andhra Pradesh, Telangana, Karnataka, and Maharashtra. The company operates majorly in the retail segment and its product portfolio includes milk, ice creams, and other value-added products. With a capacity of 2.5mn litres of milk per day, it currently handles 1.9mn litres of milk per day and has manufacturing plants at 12 locations.

Lean and strong – tricks of the trade

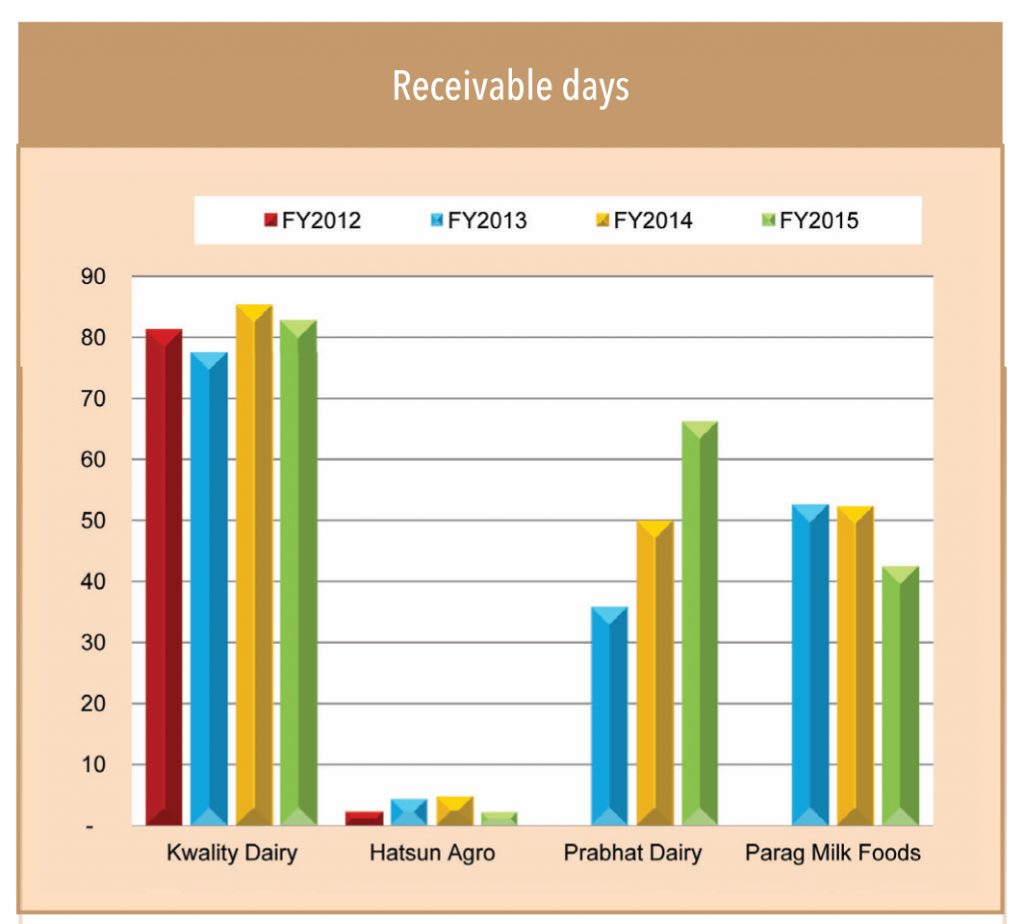

At 90%, the company has the highest share of sales from the retail segment among private dairy players. Since retail sales operate on cash/advance payment principle, it has receivables of only two days vs. more than two months for other listed players. Hatsun Agro derives a major portion of its revenues through sales of base milk (72%). Milk sales have seen 23% CAGR in the last five years and its primary focus is to increase milk sales in the retail market in the medium term. Ice creams (7% of sales) have grown in line at 23%. However, milk products (18% of sales) grew slower at 14% CAGR. The slower growth of milk products can be attributed to (1) more focus on growing milk sales, and (2) lower focus on working-capital-intensive institutional business for milk products.

Some risks with its retail model…

The company is prone to regulatory challenges like milk subsidies given by state governments to co-operatives. For example, in July 2013, the newly elected government in Karnataka doubled the subsidy to dairy farmers in the co-operative sector to Rs 4 per litre from Rs 2 per per litre. From 5th January 2016, this subsidy was increased further by Rs 3 per litre. Currently, Hatsun Agro directly procures milk from farmers in Tamil Nadu and Andhra Pradesh, but in Karnataka, it procures milk only from dealers. We believe further involvement of government in milk procurement markets will affect Hatsun Agro’s procurement model in Karnataka.

..but it has what it takes to succeed

Hatsun Agro is one of the few private dairy companies that has its act right. Its huge retail presence because of sale of base milk has helped it to create robust sourcing and distribution infrastructure. This would help to make its business model more sustainable going forward. Capex and working capital are under control because of right selection of its product portfolio and sales channels. As the company grows larger and starts increasing its presence in value-added products, it will start seeing operating leverage and register double-digit growth in revenues and earnings.

Kwality’s name rings a strong bell as one tends to immediately connect it with its namesake Kwality Walls. However, in its current form, Kwality Dairy has little to do with Kwality Walls and it cannot use the Kwality trade mark to sell its products. It markets its products under the brand Dairy Best.

Delhi-based Kwality Dairy was originally set up in 1992 as a backward integration unit of Kwality Ice Creams. The Kwality brand was acquired by Brookebond, which later merged with HUL. However, the dairy was acquired by current promoters in 2003 and has become one of the largest private dairy players in north India, catering majorly to the urban market of Delhi. It has milk processing capacity of around 3mn litres per day with six plants in Haryana, UP, and Rajasthan. It produces a variety of dairy products and is in the process of commissioning new facilities that will help generate additional revenues from the sale of higher-

margin value-added products.

Light and heavy

Kwality Dairy’s gross margins at 11% are far lower than other key private players’ such as Hatsun Agro and Prabhat Dairy (22-25%), because of a higher proportion of lower margin products such as ghee and skimmed milk powder in its portfolio. As gross fixed assets required to produce low-margin products is lower, its gross-fixed-assets to turnover is 42 vs 3.2/3.3/3.6 for Hatsun Agro/Prabhat Dairy/Parag Milk Foods.

However, due to significant institutional sales (69% in FY15), its receivable days are very high at 80 and it has short-term borrowings of Rs 10.9bn for annual sales of Rs 41.5bn. While it used to earlier operate majorly in the B2B segment,it has increased its retail sales proportion to 31% of sales by FY15 from from 9% in FY10. Retail sales will be augmented by expansion at its Softa plant (by 0.85mn litres per day) to produce primarily value-added products such as flavoured milk, variants of cheese, UHT milk, butter in tubs, cream in tetrapacks, etc. The addition of high-margin milk products for the retail channel will also help to improve gross margins, increase revenue and reduce working capital days.

Inflexion point still away

Once its new capacity addition at the Softa plant becomes operational, the company will have the ability to increase presence in the retail segment. However, currently, it is severely dependant on sales of low-margin milk products to institutional clients and it will take time for the company to decrease this dependence. This is because it has huge working capital employed in the institutional business and needs steady income to service its debt annually. Thus, institutional sales will continue to form a significant part of its revenues for some time and working capital will remain high.

“We will boost sales of our retail portfolio by making available quality products to the tier-2 and tier-3 markets,” says Ahmednagar-based Prabhat Dairy, a key private dairy player in Maharashtra. While tier-1 markets are highly penetrated and see fierce competition among various players, tier 2-3 towns are often less penetrated and have benign competition. Prabhat Dairy was incorporated in 1998 and listed on the BSE in 2015. The company has two manufacturing facilities with an aggregate milk-processing capacity of 1.5mn litres per day and handles 0.95mn litres a day. The company operates majorly in the B2B segment (72% of sales in Q2FY16) and has partnerships with many major food players.

Better ingredients, better business

“Dairy business typically has three major lines – ingredients, consumers, and professional services. We chose the ingredients business because of the lack of a credible player in this space that has the capability to supply quality products. We positioned ourselves on manufacturing excellence, which appealed to international companies like Modelez and now we supply to them globally,” says Amit Gala, CFO of Prabhat Dairy.

In 2006, Prabhat entered the dairy ingredients space, which did not have the presence of a strong domestic company. Driven by manufacturing excellence, it has built partnerships with top FMCG players such as Kraft Foods, Mondelez, Britannia, Nestle, and others. The company has very high receivable days (66) because of the payment policies of top FMCG companies to vendors.

Milking tier 2/3 markets

While the company is very strong in the institutional segment (72% of sales in Q3FY16), it wishes to gradually increase the share of sales from retail. While retail markets of tier-1 cities are rife, the company plans to penetrate tier-2 and tier-3 towns where the presence of major dairy brands is lower or non-existent. We believe that the company can expand the category in tier 2/3 markets through strong distribution and promotions, and gain share in tier-1 markets through trader incentives.

High and dry

While both Prabhat Dairy and Kwality Dairy have a high proportion of sales coming from institutional segments, Prabhat’s dairy gross margins are higher at 22% vs. Kwality Dairy’s 11%, because the former manufactures high-margin value-added products like condensed and concentrated milk and cheese. The largest product for the company is condensed milk (25% of sales) and it has the third-largest cheese-manufacturing capacity in the country and produces 1000 tonnes per month. The company has a huge fixed assets base, as it produces higher- margin products and has gross asset turnover of 3x vs. 40x for Kwality Dairy.

Prabhat Dairy has only recently commissioned its cheese plant production. Since cheese requires aging of 60-90 days, it will continue to see increase in working capital. We believe that its strategy to expand sales in tier 2/3 towns will help in the medium term by helping improve margins and reducing working capital. However, in the short term, increasing distribution reach will entail higher expenses and investments into the trade channel, which will strain margins and cash flows.

A few years ago, modern trade was suddenly flooded by a brand called ‘Go Cheese’, which most people thought was an international brand. The quality of product met international standards and soon people in investment circles started enquiring about the relatively inconspicuous dairy company “Parag Milk Foods,” which owns the Go Cheese brand. Armed with private equity funding from Motilal Oswal in 2008 and a vision of building a dairy company capable of churning out international quality products, Parag Milk Foods has one of the most promising narratives in the Indian dairy industry.

Pune-based Parag Milk Foods, founded in 1992, is one of the largest private dairies in Maharashtra with a distribution network spread across various states in the country. It has an aggregate milk processing capacity of 2mn litres per day and two manufacturing plants in Maharashtra and Andhra Pradesh. It also has the largest cheese plant in India with a production capacity of 40 tonnes per day and produces base milk and value-added products.

Innovations galore

With a focus on product differentiation, Parag has one of the largest portfolios of products in the dairy sector. The company produces various types of cheese including mozzarella, shredded, and cheddar, each in a variety of flavours. For example, its cheese wedges are available in four flavours – black pepper, tomato salsa, Mexican twist, and plain. The company also produces flavoured yoghurt (eight different flavours), buttermilk in (two flavours), liquid milk (three variants), flavoured milk (six flavours). The company has a very strong distribution system with presence across 13 states with 3000 distributors. Currently, its retail sales comprise 80% of the portfolio. Major institutional clients include leading restaurant and café chains such as Pizza Hut, Dominos, KFC, and others.

Taking pride in premiumisation

“Our average yield per cow is around 22 litres, but our highest yielding cow gives a whopping 52 litres of milk a day. Mr Shah has nicknamed her Aishvarya,” says the dairy guide at Bhagyalaxmi Dairy Farm. Spread over 35 acres, Bhagyalaxmi dairy farm houses 2,500 cows and is equipped with one of India’s first rotary parlours, which has mechanised the whole milking process. The dairy farm markets its fresh milk under the brand Pride of Cows, which is based on the concept of fresh farm milk delivered directly to home within hours of milking. The farm at Manchar, Pune, has one of the highest yielding breed of cows of the Dutch Holstein Friesian breed, which is known for quality and high yield of milk of ~23 litres/day (6x the Indian counterparts). The cows are kept in a happy, stress free, free-range environment, and on a healthy regimented diet, which is conducive for milk production of the highest quality. The cows are milked three times a day using milking machines. Using automation, the milk is instantly pasteurized, chilled, and packaged in bottles in less than three hours, and sent immediately for dispatch.The company currently distributes around 15,000 litres per day in Mumbai and Pune, and has the capacity of 25,000 litres per day.

Initially, the distribution started for product savvy consumers of south Mumbai, but as word of mouth spread and more and more people started enquiring about the brand, the company expanded its distribution. Now Pride of Cows reaches almost the whole of Mumbai and Pune. The branding and marketing is based on interesting concept of dairy tourism, where people are encouraged to visit the farm themselves to get a first-hand feel of the product. While the farm is managing to sell around 60% of its capacity in retail, if the model succeeds, it could be one of the most promising ones in the long-term and could become a benchmark for premiumisation.

Picking up steam

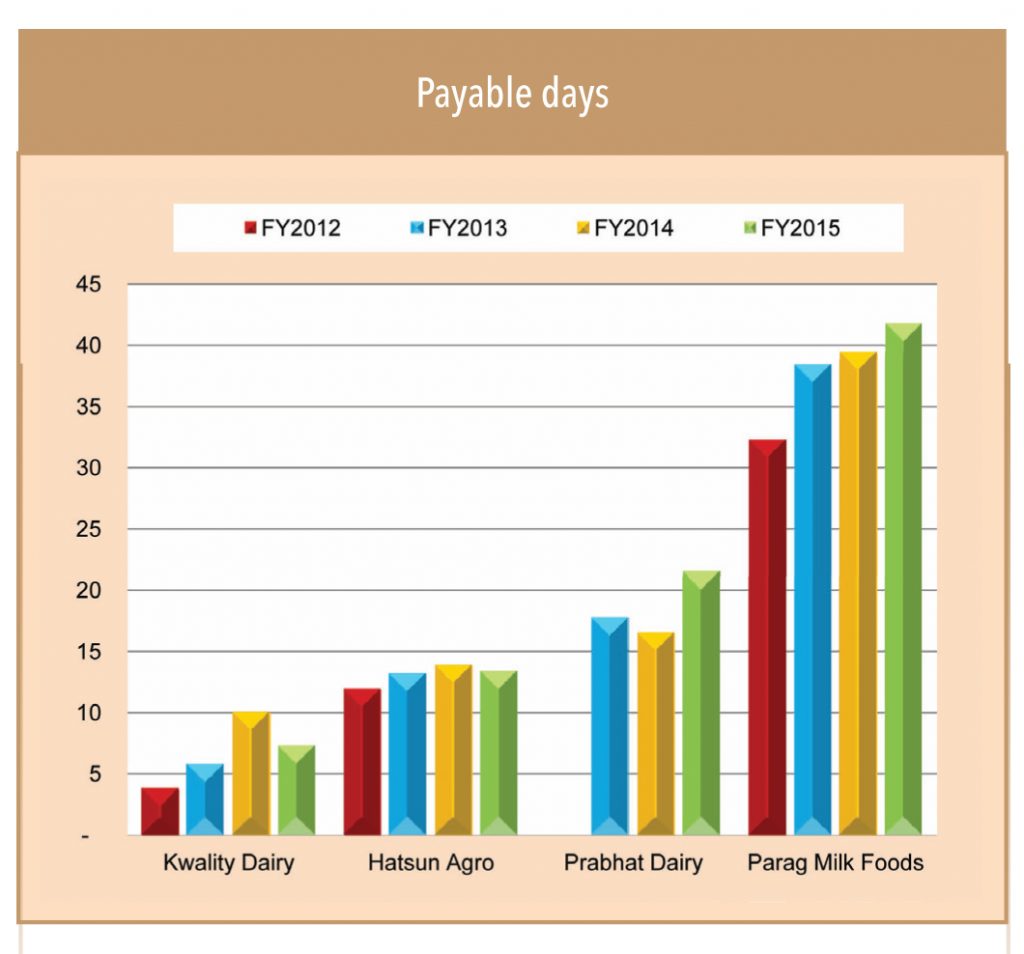

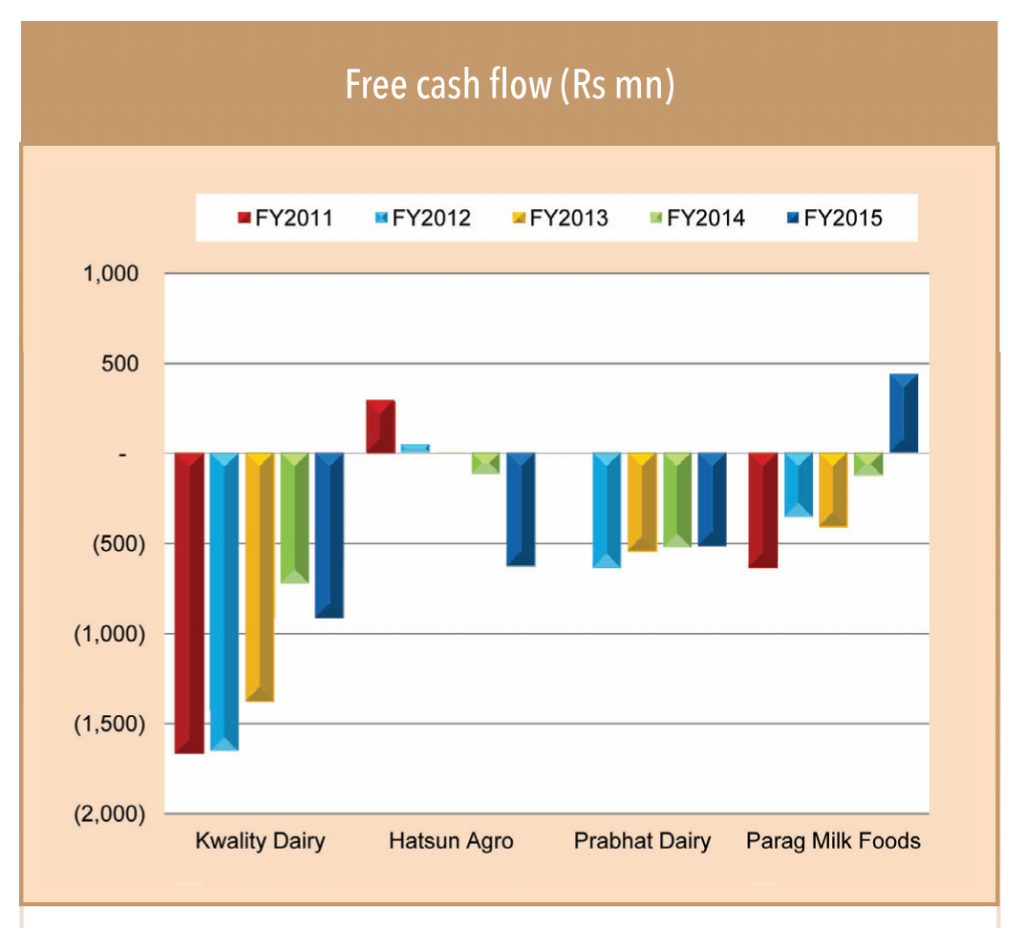

Over the years, Parag Milk Foods has developed a supply chain network in over 3400 villages in Maharashtra and south India. The company also has a higher bargaining power compared to its suppliers, which is evident from its payable days (highest among peers). The free cash flow from 2011-14 was negative (in line with the rest of the industry). However, higher payables and reduction in capital investment helped turn the free cash flow positive in 2015. The lower capacity utilization for Parag Foods currently indicates that peak of cyclical capex is already done and free cash flow should be strong for the next few years. The company will continue to gain share in retail due to strong distribution chain and innovations. Parag Milk Foods will be among the few successful private players in the medium to long term and the oncoming IPO of the company will sail through smoothly.

The Indian dairy industry is immensely complex and it is certainly not for the faint-hearted. Co-operatives will continue to dominate because of their traditional strength in milk sourcing. Consolidation of district milk brands in states such as Maharashtra (that has multiple district union brands) will help to further cement their dominance. However, the ability of co-operatives to invest and deliver quality products will remain constrained because of lower margins and negligible profitability. The biggest opportunity for private players is in premiumisation.The evolution of private players in the Indian dairy industry will depend on two factors – (1) their ability to increase retail presence and (2) their ability to invest in high-quality infrastructure, including supply chain. Both factors are long gestational. Retail presence depends on building brands through selling liquid milk while returns on large-scale investments are constrained by the margin profile of products.

Companies such as Hatsun Agro and Parag Milk Foods have the most promising business models because of strong retail presence and vision for value-added products. Hatsun has a strong portfolio in liquid milk, which will help it to expand profitably. Because of its strong presence in retail segments of ghee, cheese, and buttermilk, Parag Milk Foods will continue to outperform its peers. Due to strong competition in value-added milk products, other players such as Prabhat Dairy and Kwality Dairy will have to increase their retail presence by focussing more on liquid milk in core geographies, and then expanding into nearby geographies gradually. The focus on liquid milk will also help emerging players develop strong sustainable sourcing models that are necessary to establish a strong brand. Apart from the pure dairy players, other FMCG players such as Britannia have ambitious dairy-business plans. The case for developing a scalable business model is yet to be proven. However, in the case of brand extensions a lot depends on product saliency. With product innovations like dairy whitener (ahead of market when launched) Nestle has proven itself while others are still grappling with this aspect. Most players still have me-too portfolios and a highly innovative offering has been elusive. So, the wait continues.

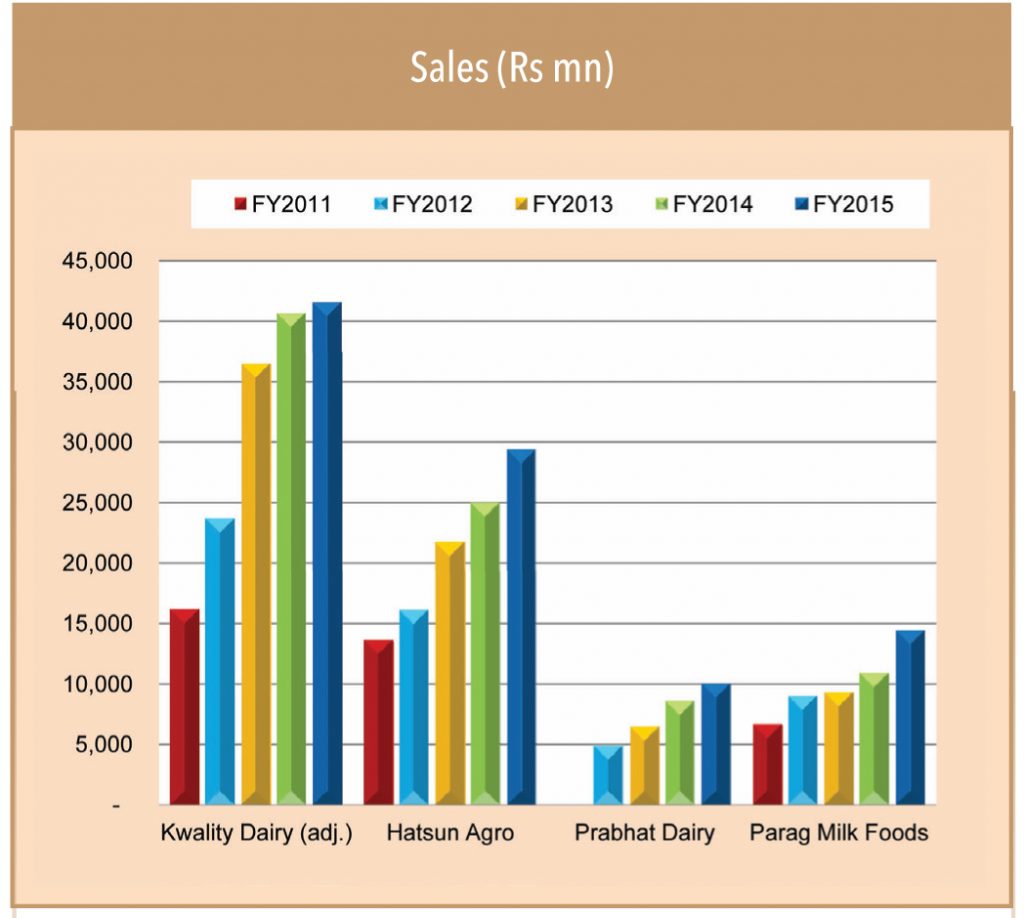

Sales have increased for all key players over the years

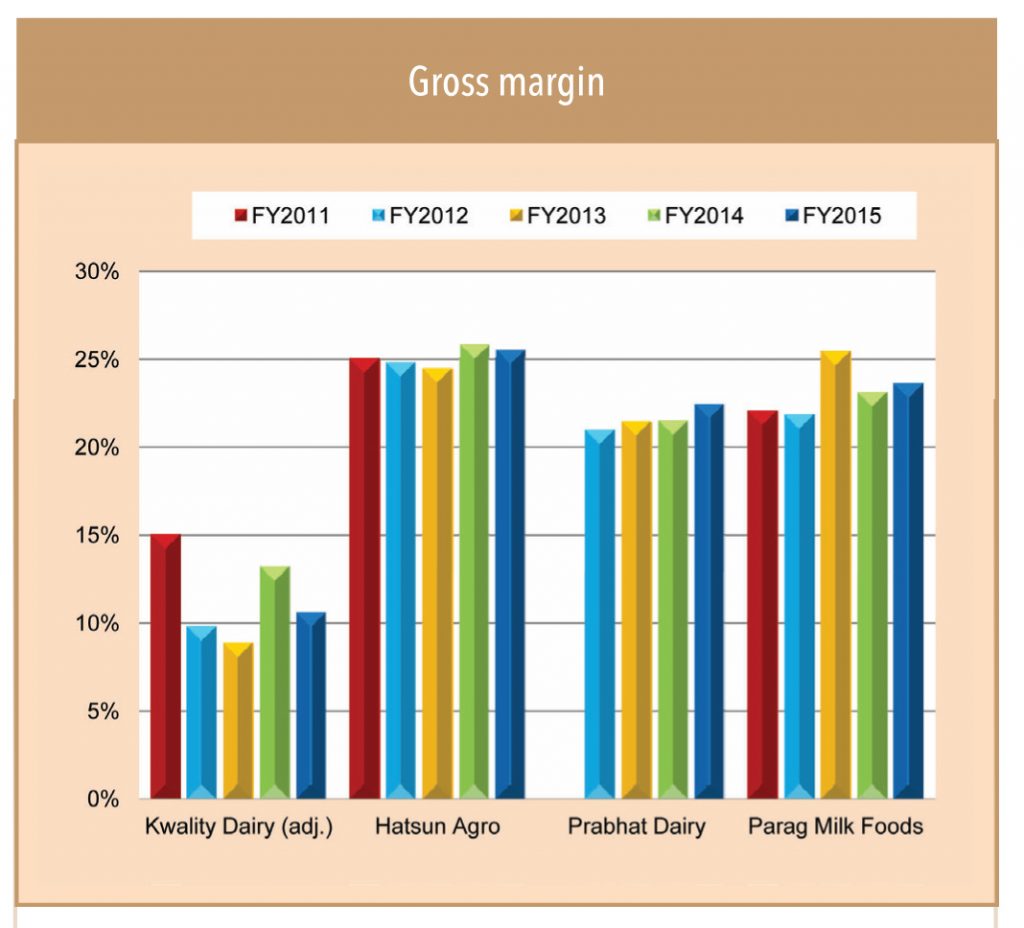

Except Kwality Dairy which sells more of low margin products, others have gross margins in range of 20-25%. Margins have not improved or fallen in last two years because of fall in prices of global commodities like skimmed milk powder

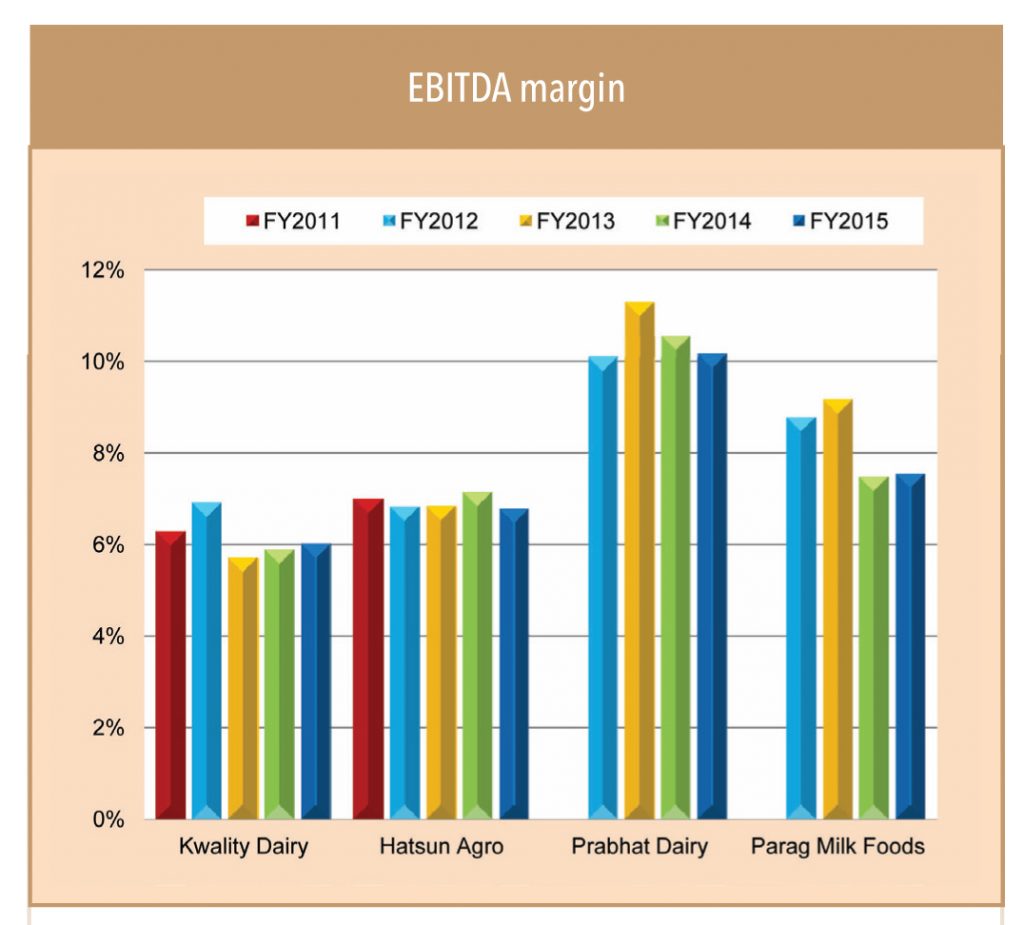

EBITDA margins are lower for dairy industry as a whole because of higher operating expenses

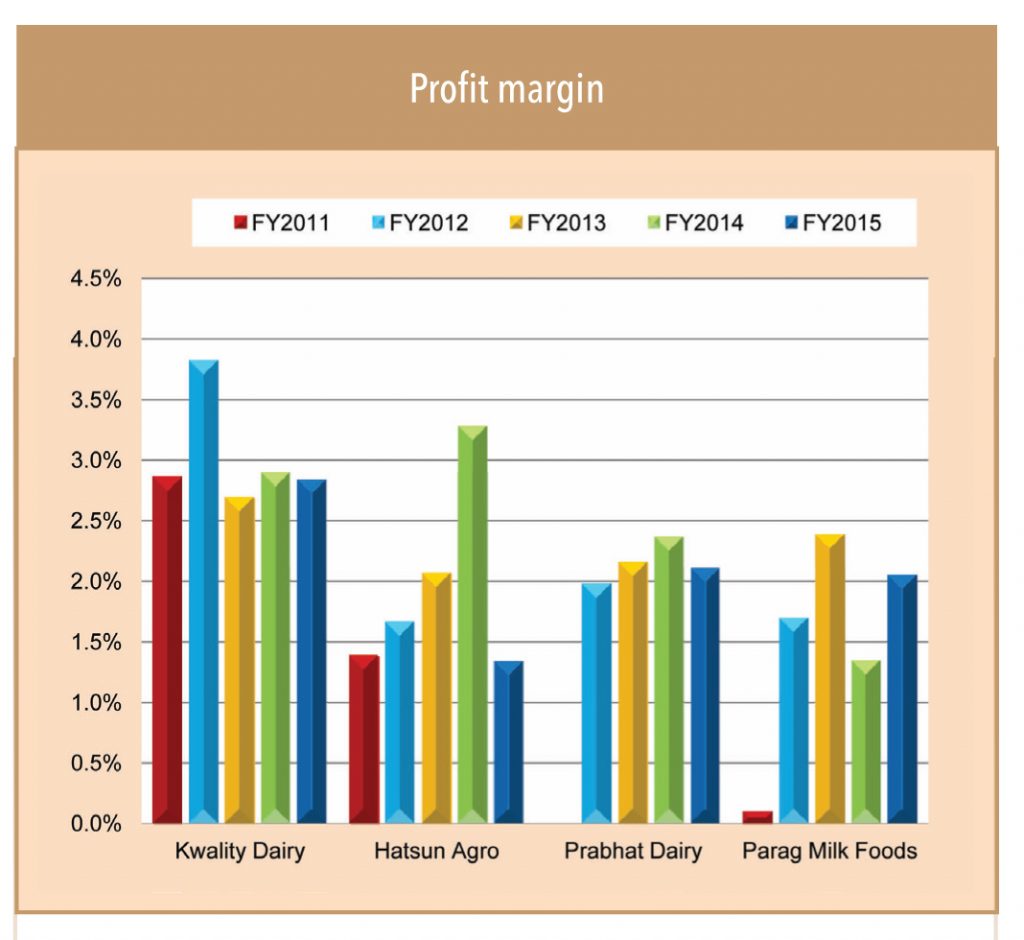

Dairy industry profit margins are lower than those of FMCG peers because dairy requires higher capital expenditure

and higher working capital

Except Hatsun Agro which has major portion of sales portfolio in retail, others have very high recievable days

Parag milk foods has high inventory days due to higher share of cheese in sales (cheese requires 3-6 months aging)

Parag Milk Foods has the highest bargaining power with suppliers

Most worrisome aspect of dairy industry is that free cash flow has been negative for most companies for most years because of high capital investment

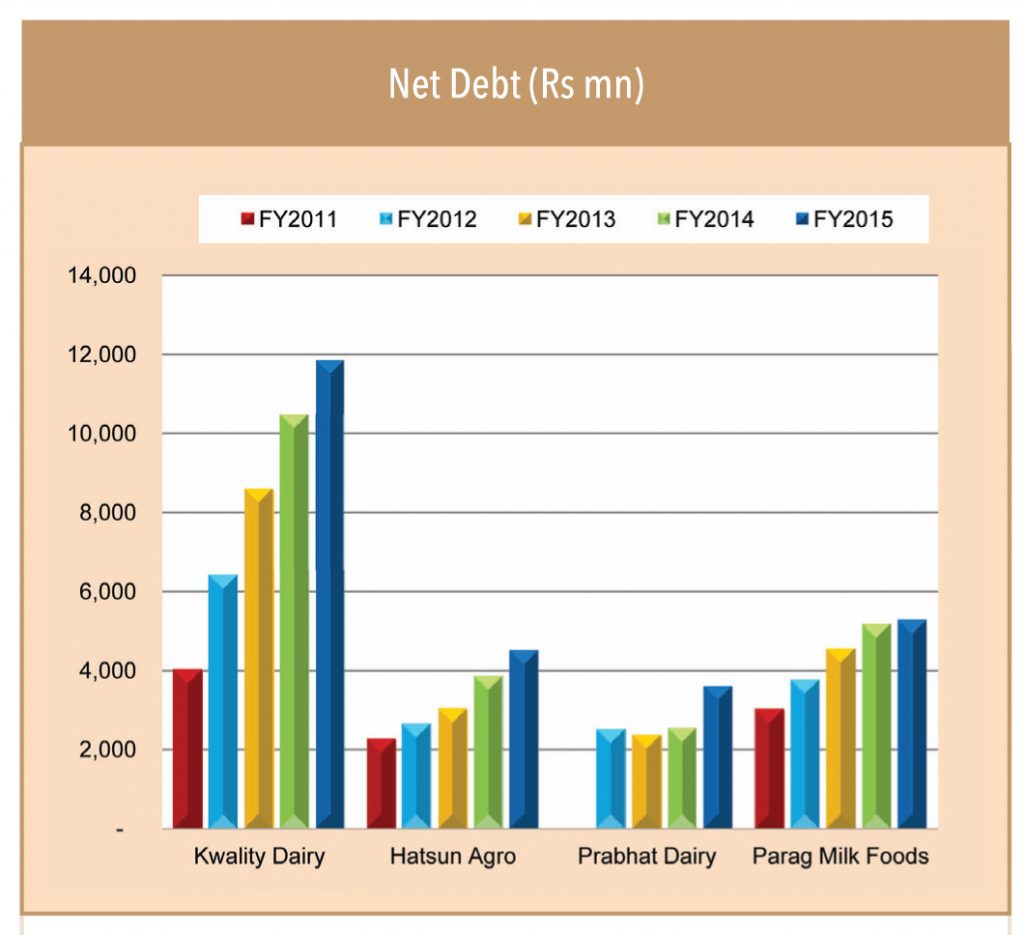

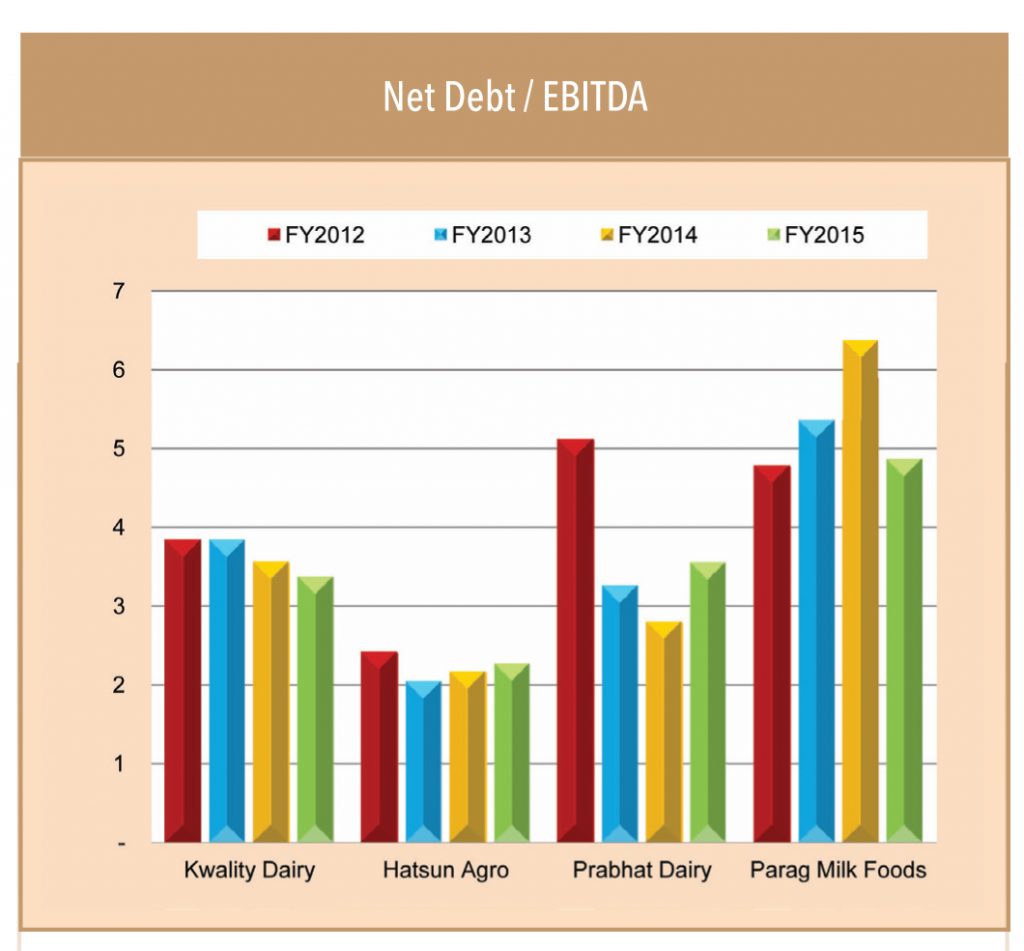

Net debt and net debt/EBITDA for all four companies is very high

Net debt and net debt/EBITDA for all four companies is very high

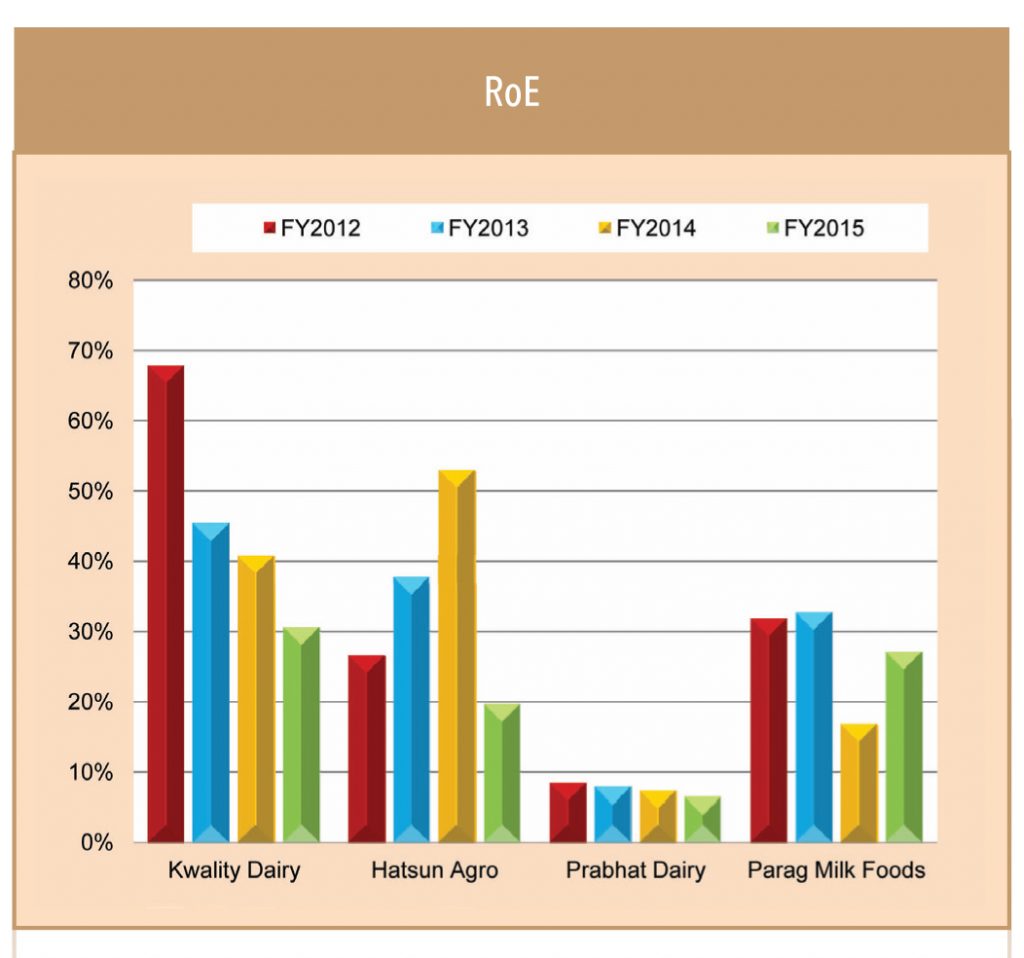

Most companies have seen continuous deterioration of RoE

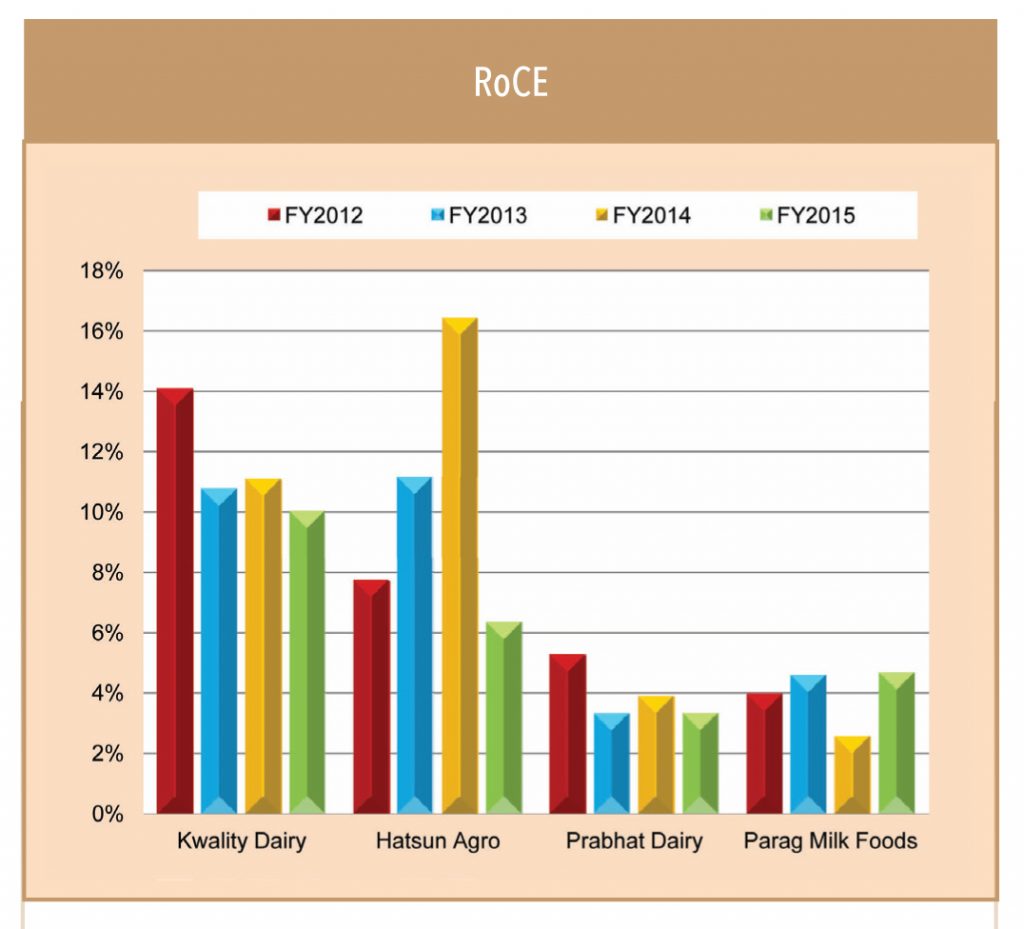

RoCE for dairy industry is poor because of high investment required

Subscribe to enjoy uninterrupted access