Europe represents a mammoth opportunity for the IT vendors, especially the Indians. Large numbers of companies, especially in Continental Europe (EU excl UK) are yet to outsource/offshore their IT operations. Conversations with multiple clients (takeaways in the special section) highlight that most firms are opening up to the idea of offshoring their IT (if not already doing so). The value proposition of the Indian vendors had moved up significantly from the ‘cheapest option’ to the ‘best value for money’ option. TCS has even managed to transcend to the top, and is now considered an ‘invaluable strategic partner’.

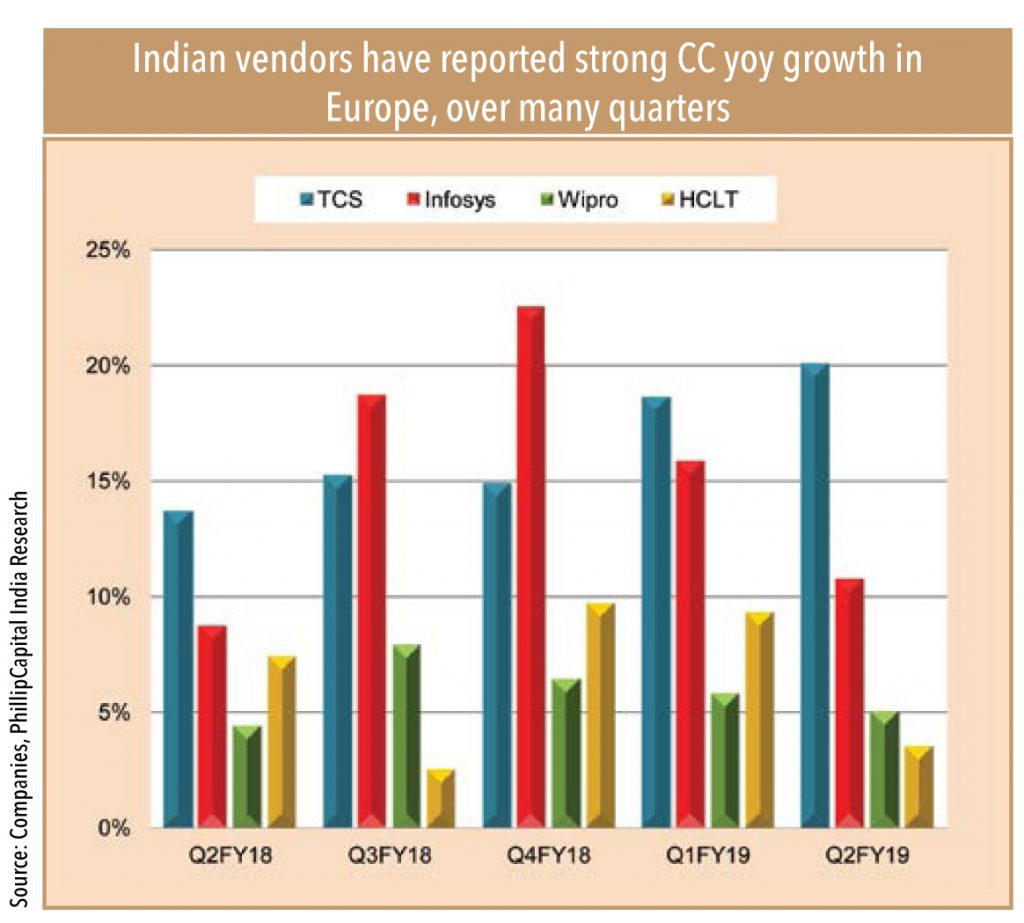

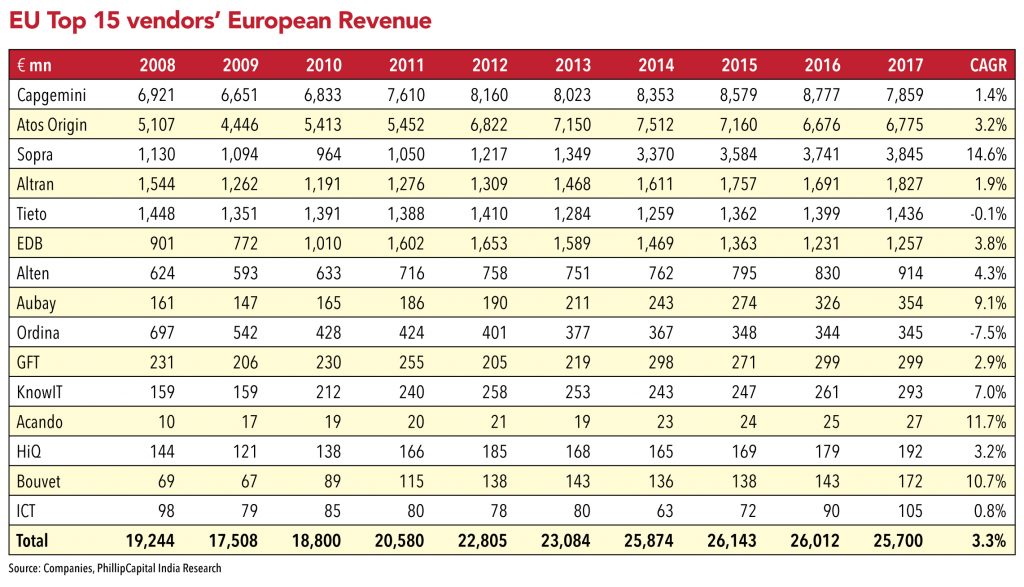

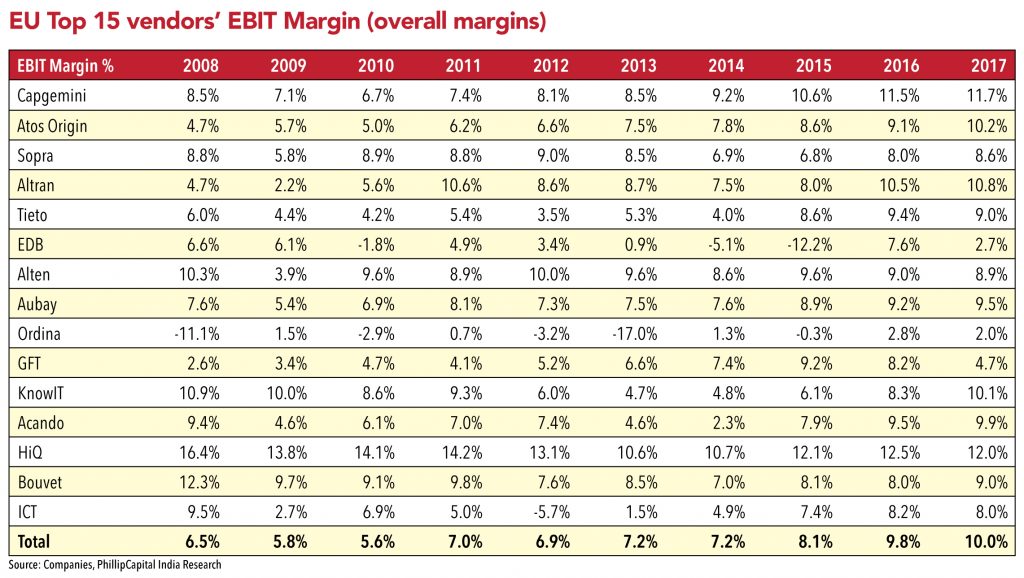

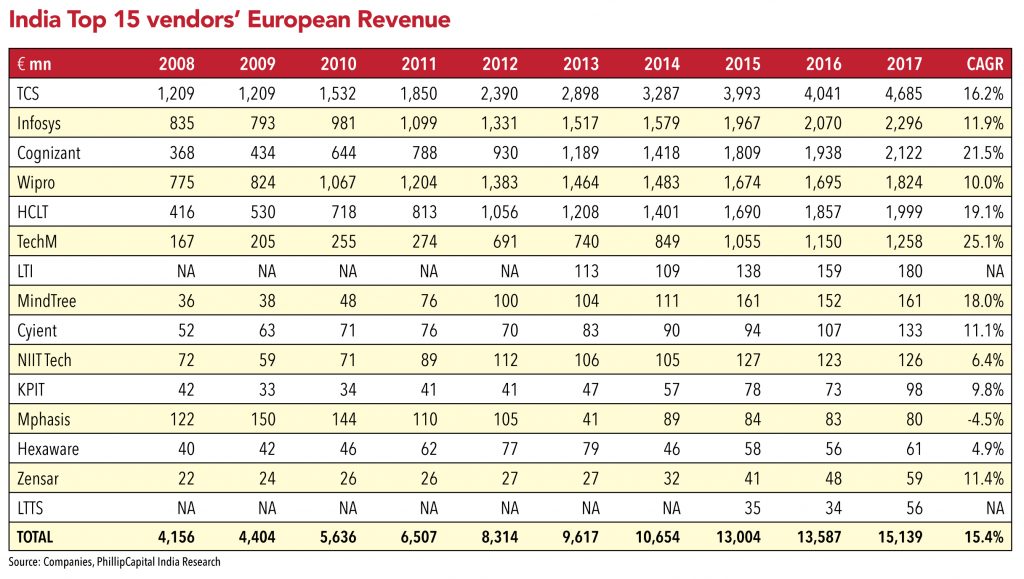

The growth rate of the Indian vendors over the last few quarters is a testimony to their new level of acceptance and how much market share they have captured. The average growth rate of the top-5 Indian IT firms in Europe has been 11.8%, significantly above the 3.4% average growth clocked by the top-5 EU vendors. This growth momentum is likely to continue in both the near and distant future, driven primarily by what TCS’ management mentioned in one of its calls – ‘leapfrogging’ by European clients.

TCS’ CEO, Mr. Rajesh Gopinathan, on being asked about the growth in Europe in Q2FY19 conference call said: “The more interesting and more dramatic thing that is going on is this aspect of leapfrogging (in European growth) – because they are at an early stage in the technology investment cycle”

EU clients ‘leapfrogging’ the technology landscape

Many mid-sized European firms still run on decade-old legacy systems. They never participated in the outsourcing wave, and were too reluctant or financially hard-pressed to carry-out IT modernization on their own. This has resulted in them being left with legacy systems, when the world was already moving onto next-generation digital platforms.

Contrary to most expectations, many of these EU firms have decided to leapfrog the technology landscape, and upgrade directly from their legacy systems to the new-age digital platforms. This translates into good news for the Indian vendors, as they still have expertise and employ huge resources in legacy systems. At the same time, they have also proven their expertise in the new-age digital platforms, and hence have a perfect combination of both legacy and new-age capabilities, to help these clients migrate. Most of the local European vendors are either strong in legacy systems or new-age technology – but very few are strong in both.

Indian vendors ‘acquiring’ their way up the ladder

The opportunity is mammoth. The foundation to capture is strong. However, Indian vendors cannot hope to grab this opportunity, just sitting on the laurels of their historic success. They will have to constantly make efforts to break the language and cultural barriers across relatively under penetrated regions like Germany, France, Spain, and CEE.

For Indian vendors, the primary obstacle that lies ahead is how they are perceived. Despite over two decades of strong growth and superior performance, Indian vendors are still viewed as the ‘cheaper alternative’. As underscored in exclusive interactions with clients across Europe (read the special section for more insights), Indian vendors are still thought to ‘seriously lack innovation related to how to change the business’ and are seen as having ‘no out-of-the-box thinking’.

While ostensibly this might appear to be a cultural problem (Indians are considered to be better at ‘taking orders’ than ‘deciding on their own’), an interesting admission from a client threw more light on the issue and showed its many layers: “Challenges with Indian vendors are actually of our own making. Earlier, we used to tell them to just implement the task and NOT ask any questions. Now we want them to ask questions, and they are struggling.”.

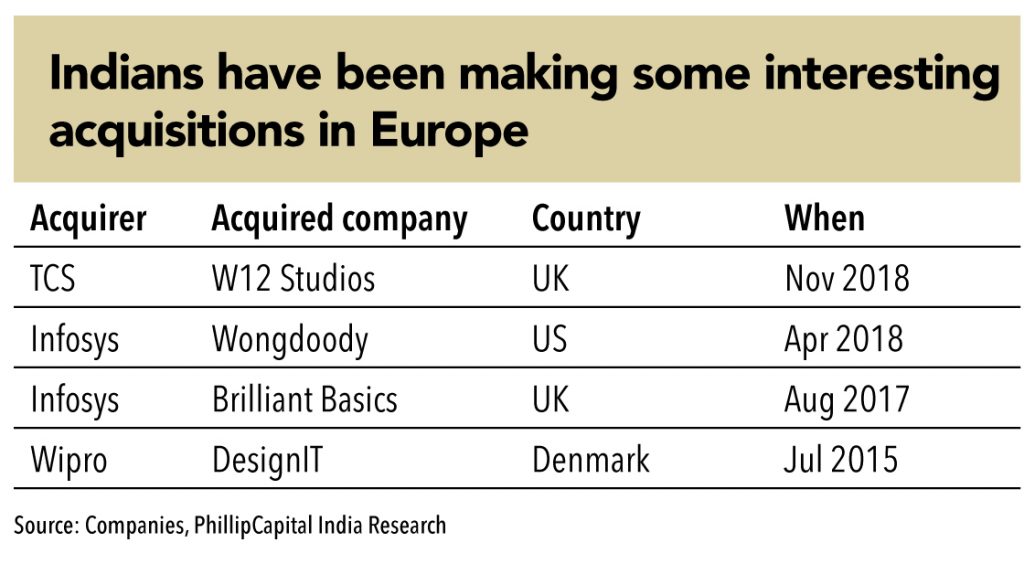

Indian vendors are trying to rectify negative perceptions through the inorganic route. While they made many acquisitions in the last decade (Alti, Lodestone, Axxon, Volvo), recent acquisitions by some Indian vendors seem promising. TCS acquired a design company W12 Studios recently. Before this Infosys acquired Wong Doody in the US and Brilliant Basics in UK. Wipro acquired DesignIt in 2015. Indian vendors are not acquiring software companies anymore and are in fact snapping up design firms in a bid to change the way they think and propose solutions to clients.

But, as was the case before, for any acquisition to prove fruitful, successful integration remains the key. The hope is that Indian companies would have learnt from their past mistakes!.

Continental Europe – the next destination

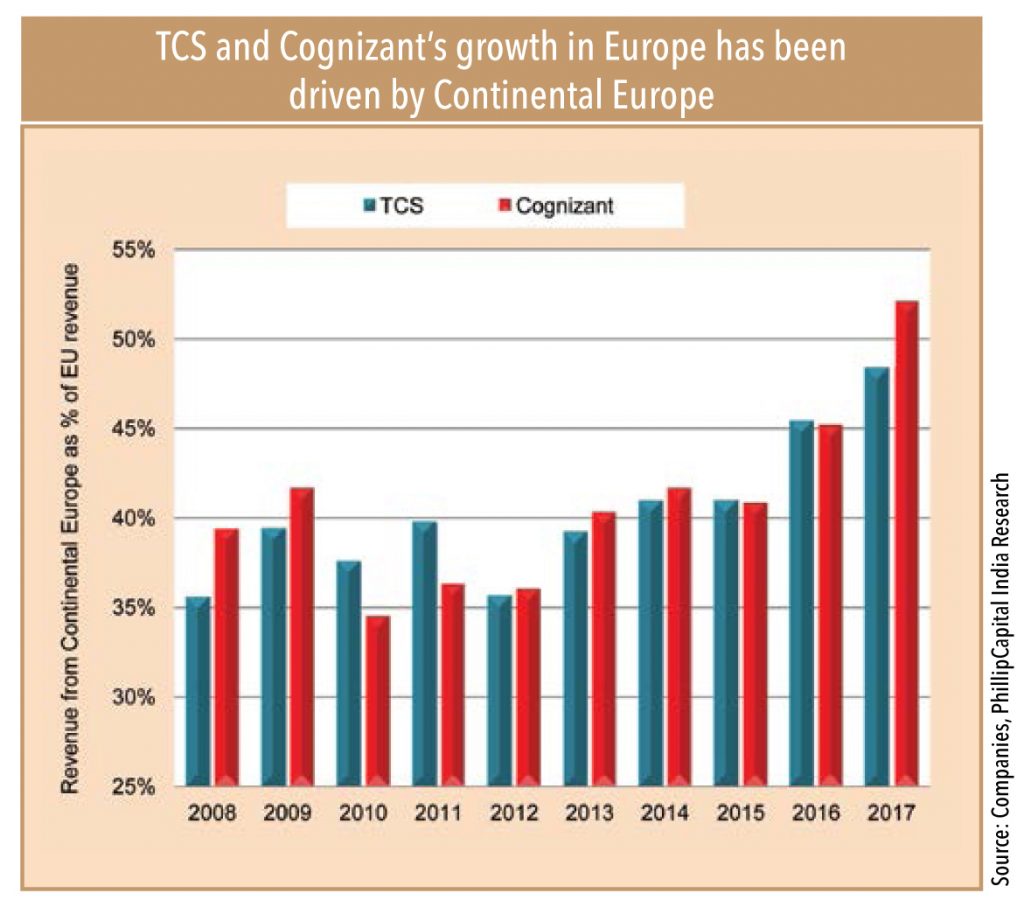

Offshore-based firms have had the greatest success in the UK market, but now a rapidly growing share of continental European customers are also adopting the Global Delivery Model.

“Challenges with Indian vendors are actually of our own making. Earlier, we used to tell them to just implement the task and NOT ask any questions. Now we want them to ask questions, and they are struggling”

Over the past 10 years. the growth in continental European revenues has exceed that from the UK, for most Indian vendors. At Cognizant, Continental European revenues exceeded those from the UK for the first time in 2017 and the gap has continued to widen: Today, Continental Europe accounts for 55% of its European revenues. Similarly at TCS, revenues from Continental Europe now represent about 48% of its total European revenues, up from slightly less than 30% in FY07. Other vendors, while official data is unavailable for them, would have followed the same trend.

Based on our interviews with decision makers across Continental Europe, demand for services based on the global delivery model is strong and growing. Given the relatively lower levels of penetration by the Indian vendors, it would not be incorrect to say that Continental Europe will form the core of the growth in European operation for the Indian vendors, over the next decade.

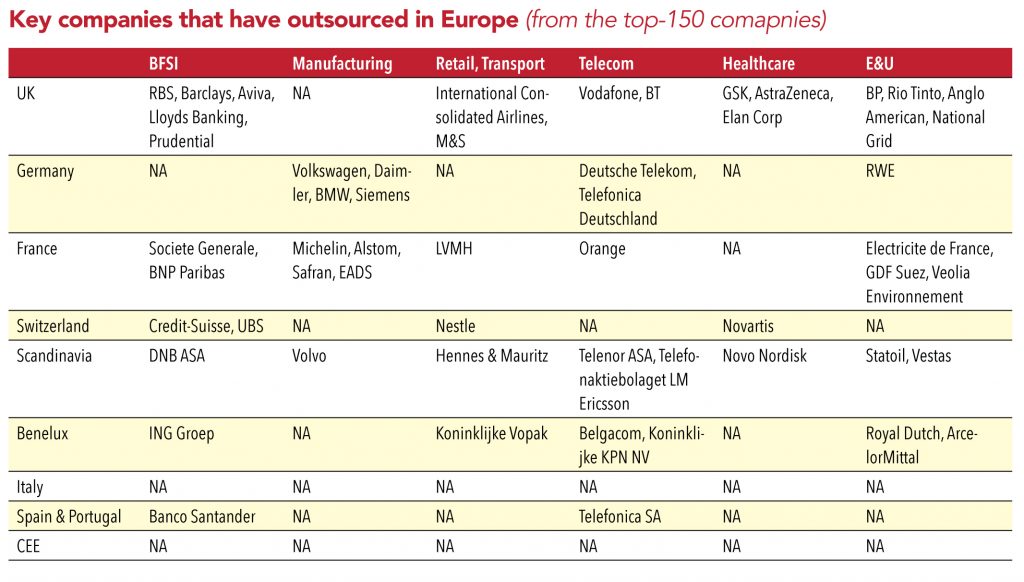

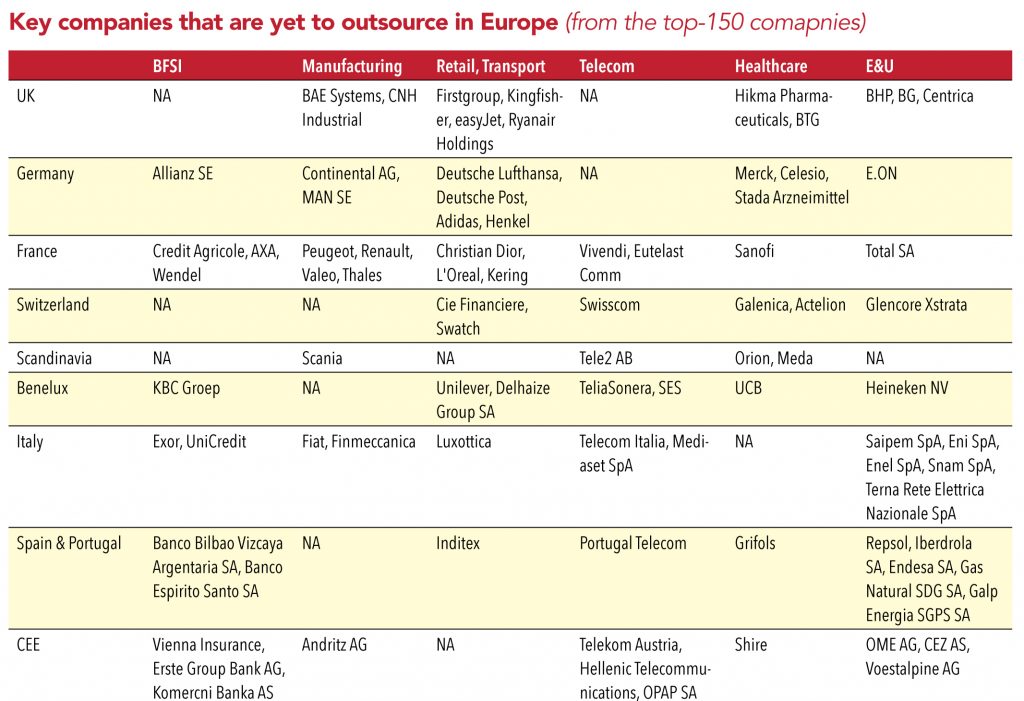

There have been various estimates of the potential outsourcing opportunity from the European region by various research firms. Most of these numbers impart an important bird’s eye view – but they fail to provide the necessary details, which could help in identifying the potential beneficiaries. Hence, GV decided to conduct a primary research, to quantify the opportunity, and to identify the pockets that represent the maximum potential.

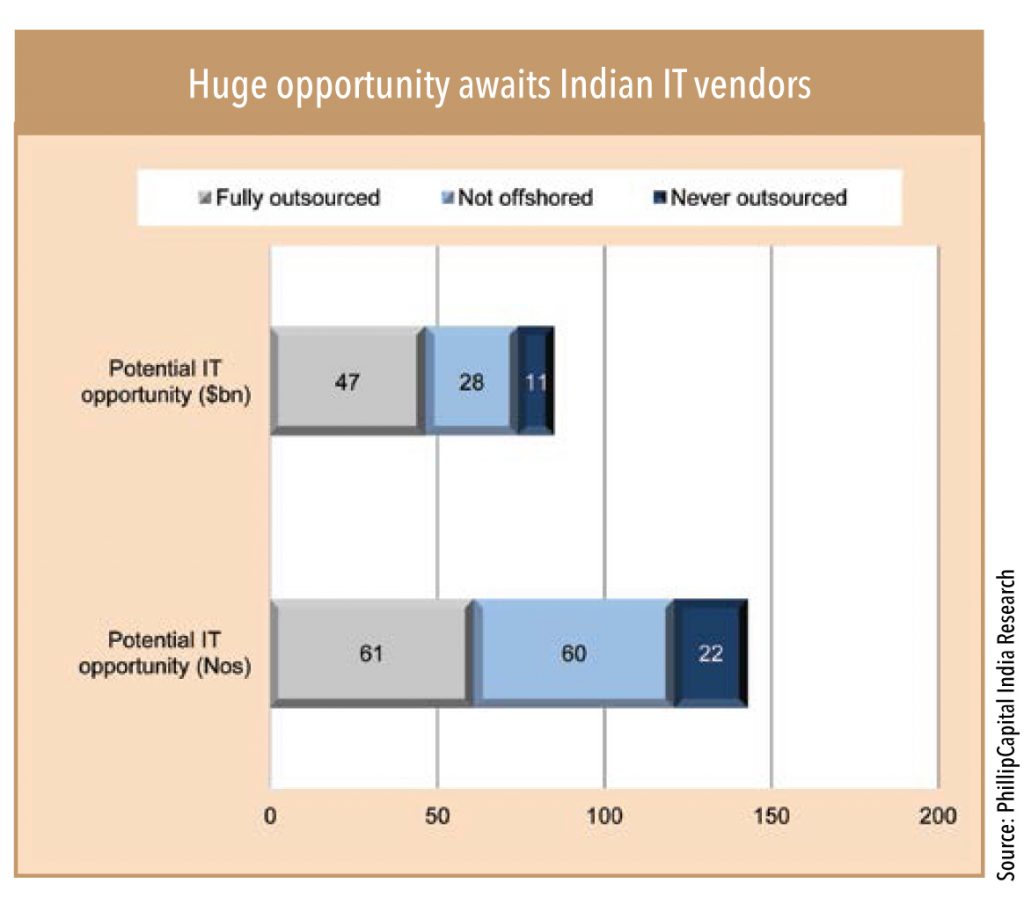

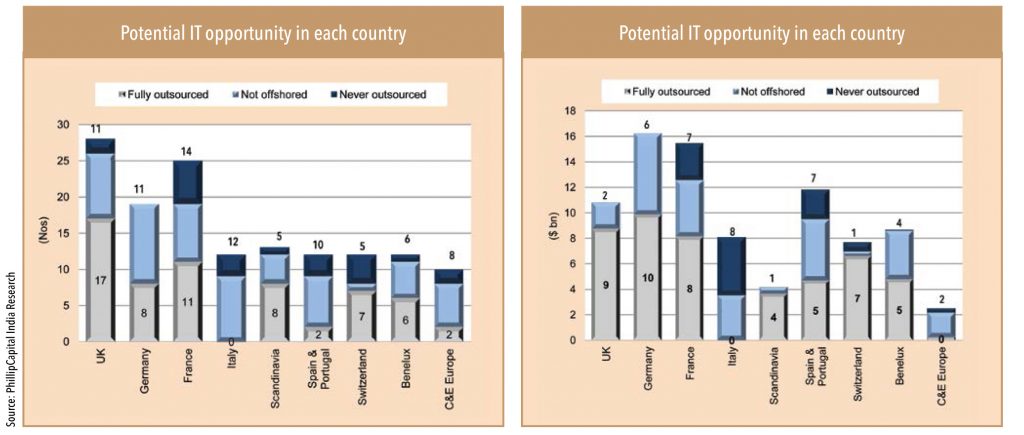

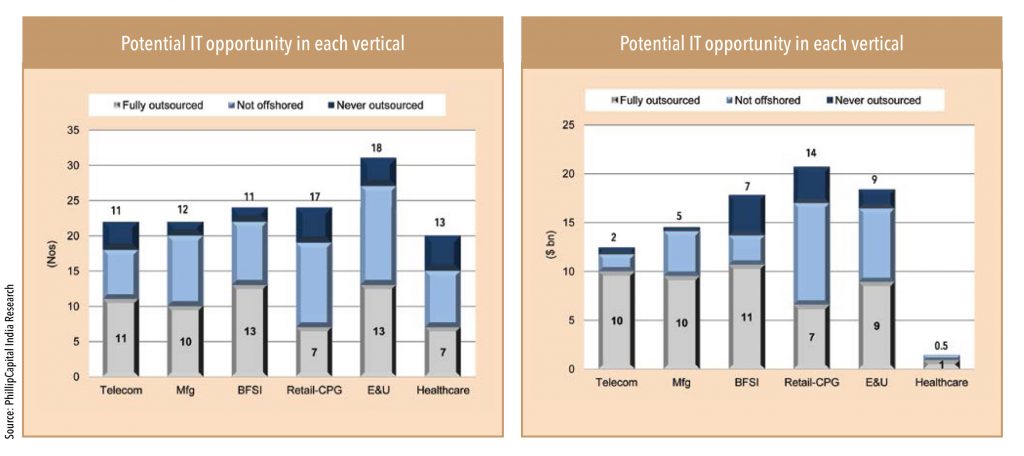

An analysis of 143 companies in the EU region – across 20 countries and 6 verticals – revealed that 22 of these companies (16% of the total) have never outsourced their IT operations. Of the remaining 121 companies, 60 (42% of the total) have outsourced, but not offshored their IT operations and development work. Put together, 82 companies (58% of the total) have not outsourced/offshored their IT operations – presenting a HUGE opportunity for Indian IT vendors.

Quantifying the opportunity, total capex outlay for the 143 companies stands at US$ 438bn for CY18, out of which, conservatively, IT capex should be US$ 85bn. Of this, IT capex for the “never outsourced” category is expected to be US$ 11bn and for the “never offshored” companies at US$ 28bn. Thus, these companies present a ~US$ 40bn opportunity for Indian IT vendors.

Methodology – a note from PhillipCapital’s IT analyst Vibhor Singhal:

“We took a total of 143 companies as our sample space — arrived at, by selecting top 10-12 companies by capex spread across nine regions in Europe (UK, Germany, France, Switzerland, Nordics, Benelux, Spain, Italy, and CEE) and across six verticals (BFSI, manufacturing, retail & CPG, telecom, healthcare, and energy & utilities). For each of those companies, the parameter considered was whether they have outsourced their IT operations, and if yes, whether they had offshored as well. This information was collated, by sifting through the annual reports, presentations, and newsflow about these companies. The same was then cross-verified by vendors and independent consultants.

Classifying these companies into ones that had ‘not outsourced their IT operations’ and ones that ‘had outsourced, but not offshored’ a list of potential outsourcers from the region emerged from amongst the top-150 spenders.

However, these numbers are meaningless without a dollar sign before them. So for each company, we took note of the vertical (BFSI, manufacturing, retail & CPG, telecom, healthcare, energy & utilities) it belonged to. Then we deduced (from companies belonging to the same sector and who HAD outsourced their IT operations) their IT capex as a percentage of total capex (for BFSI, we chose IT capex as % of revenues). Since these represent sectoral characteristics, they were fairly similar across the companies that belonged to the same sector. Using that number as the benchmark yielded the possible IT capex by non-outsourced and non-offshored companies – IF they were to outsource.

This provided the total potential outsourcing opportunity from the geography (but) represented by only the top-143 companies. The total opportunity would be much higher if one was to include other smaller listed/unlisted companies.

Importantly, since the total opportunity was derived by summing up the potential opportunity from each company belonging to a specific sector and geography, it was also possible to break-up the total opportunity into various sectors (BFSI, manufacturing, retail & CPG, telecom, healthcare, energy & utilities) and regions (UK, Germany, France, Switzerland, Nordics, Benelux, Spain, Italy and CEE) – and estimate which of those represented the biggest opportunity.”

Germany and France present the biggest opportunity;

Italy, CEE and Spain are massively underpenetrated Italy and CEE (Central & Eastern Europe) remain the most underpenetrated countries, with hardly 1/2 of the companies having outsourced/offshored their IT operations (10-12 top companies analysed in each region). Amongst bigger economies, Germany, France, and Benelux have 58%, 56% and 50% companies falling in the same bracket (never outsourced/offshored). As expected, UK, Switzerland, and Scandinavia remain the most penetrated.

Financially, Germany and France represent the largest IT opportunity at US$ 6bn and US$ 7bn respectively; Italy and Spain represent a potential of US$ 8bn and US$ 7bn respectively – but might be more difficult to penetrate. UK – though largely penetrated – still presents a significant opportunity of US$ 2bn.

Retail-CPG; BFSI still offers huge potential

Among verticals, Retail-CPG (consumer packaged goods) and healthcare are the most underpenetrated, with 71% and 65% of companies having never outsourced/offshored their IT operations. BFSI remains the most penetrated, with over 50% companies having already offshored their IT operations. Telecom, Manufacturing and E&U also represent a sizeable opportunity.

Financially, retail-CPG represents a mammoth US$ 14bn opportunity, followed by US$ 9.5bn in E&U. Although BFSI is already well penetrated, it still represents a large opportunity of US$ 7bn; conversely, while healthcare is still very much underpenetrated, it represents a small US$ 0.5bn opportunity for offshoring.

Subscribe to enjoy uninterrupted access