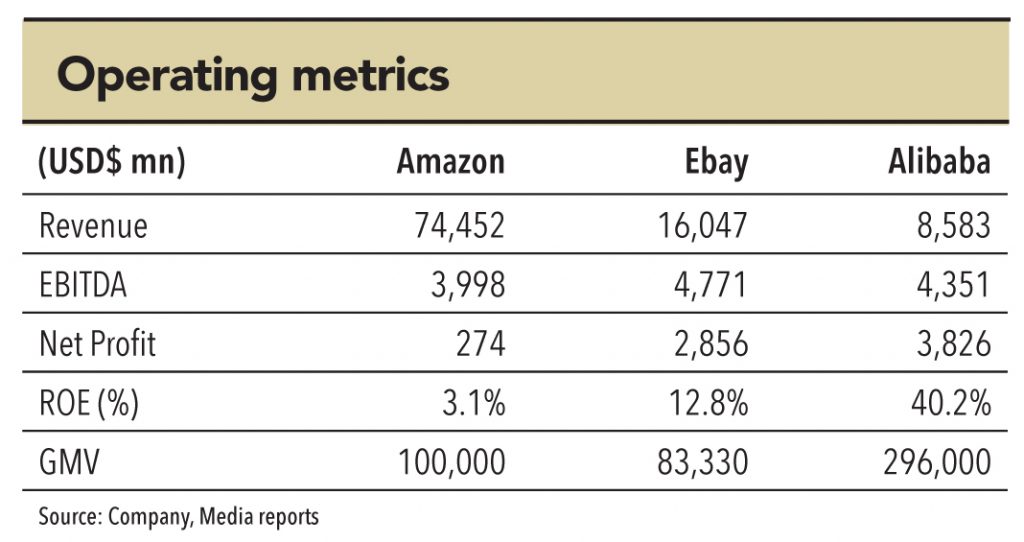

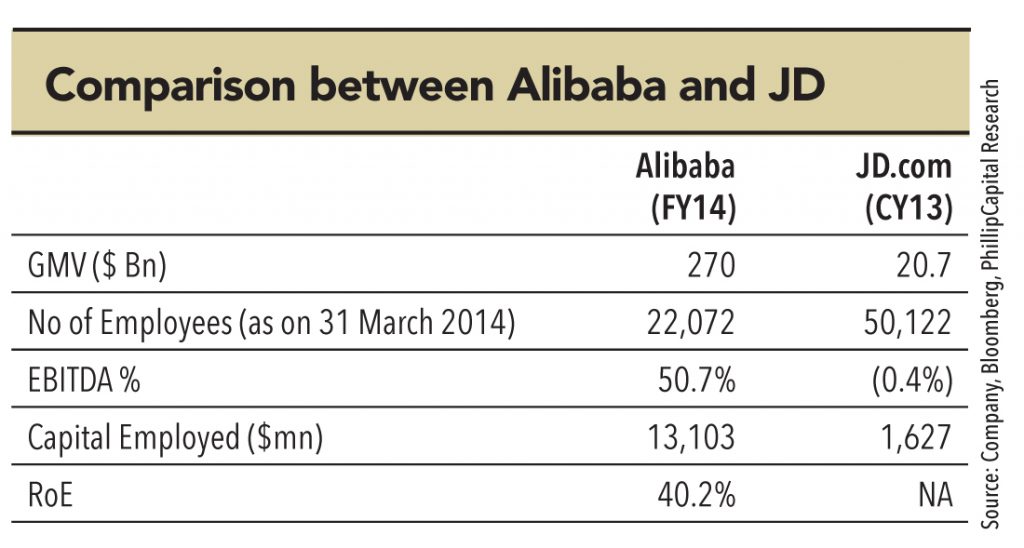

Alibaba Group’s FY14 GMV was more than Amazon’s and Ebay’s combined GMV (US$ 158bn). The group sold a GMV of US$ 296bn, which is nearly 60% of the overall Indian retail market. The company enjoys EBITDA margins of 48% (FY14) while Amazon made operating margins of just 1% and Ebay made 21%. It is pertinent to highlight that Alibaba operates as a pure ecommerce facilitator while Amazon is a B2C player. Also, so far, Alibaba has had lesser competition than others have had in markets outside China; so it has benefited from operating leverage on the scale it has achieved.

The Chinese ecommerce giant also shares its name with one of the famous Arabian Nights fables – Alibaba and the 40 Thieves. The Indian market may turn out to be more competitive than the Chinese one (in fact, it already is) and the chase for the consumers’ wallet share may well hold some yet untold lessons for the entire retail space — not just its subset, the ecommerce industry.

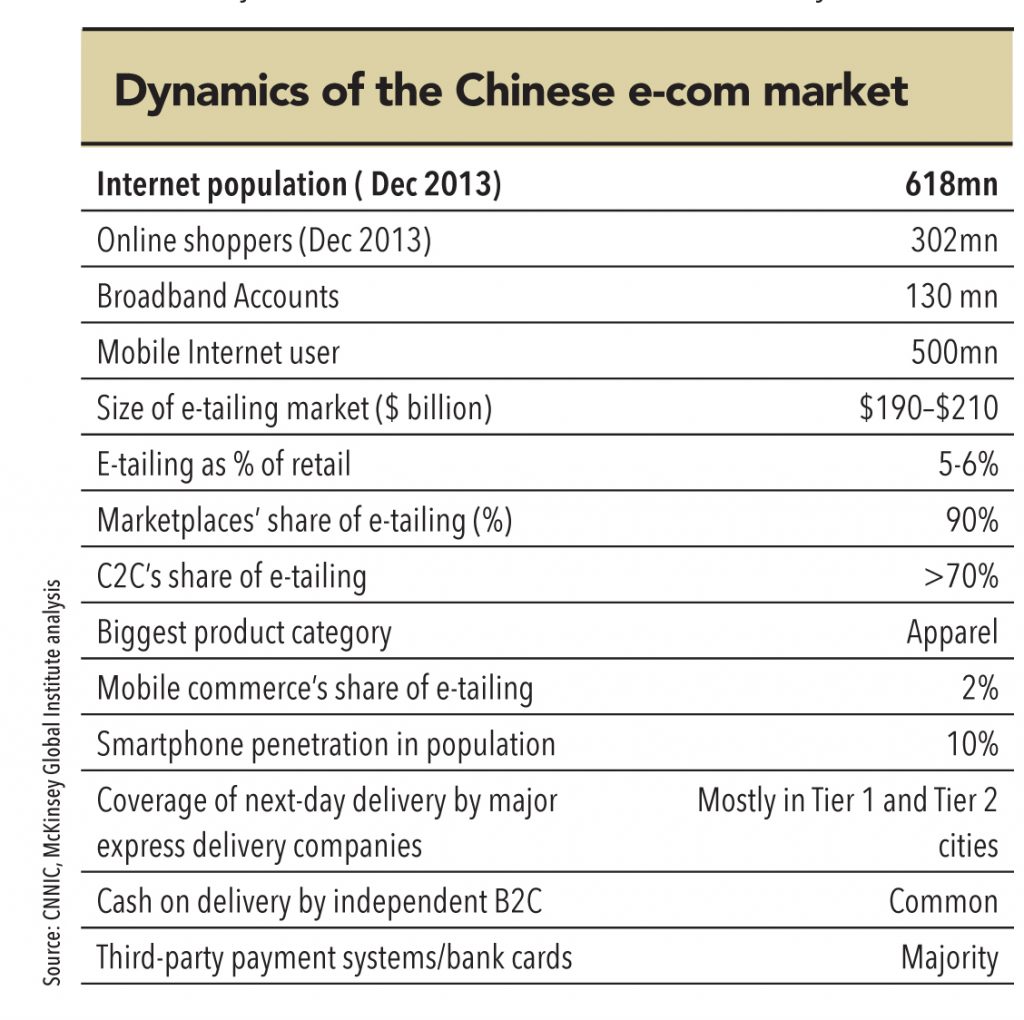

Internet users in China grew from 298mn (23% of China’s total population) in 2008 to 618mn (46%) in 2013, according to CNNIC, the administrative agency responsible for internet affairs under the Ministry of Information Industry of the People’s Republic of China. The agency reckons there were 302mn Internet shoppers in China in 2013, representing 49% of its total internet users. Mobile shoppers will bypass the conventional mode of internet purchases and make it more convenient for purchasing online. China’s mobile internet user base reached 500mn as of December 31, 2013, according to CNNIC. Smartphone shipments in China reached 351mn in 2013 and will exceed 435mn in 2014, according to projections by IDC (International Data Corporation). Market research company iResearch believes that online shopping, which represented 8% of China’s total consumption in 2013, is projected to grow at a CAGR of 36% from 2013 to 2016, as more consumers shop online and e-commerce spending per consumer increases.

Tapping the opportunity in smaller towns and cities

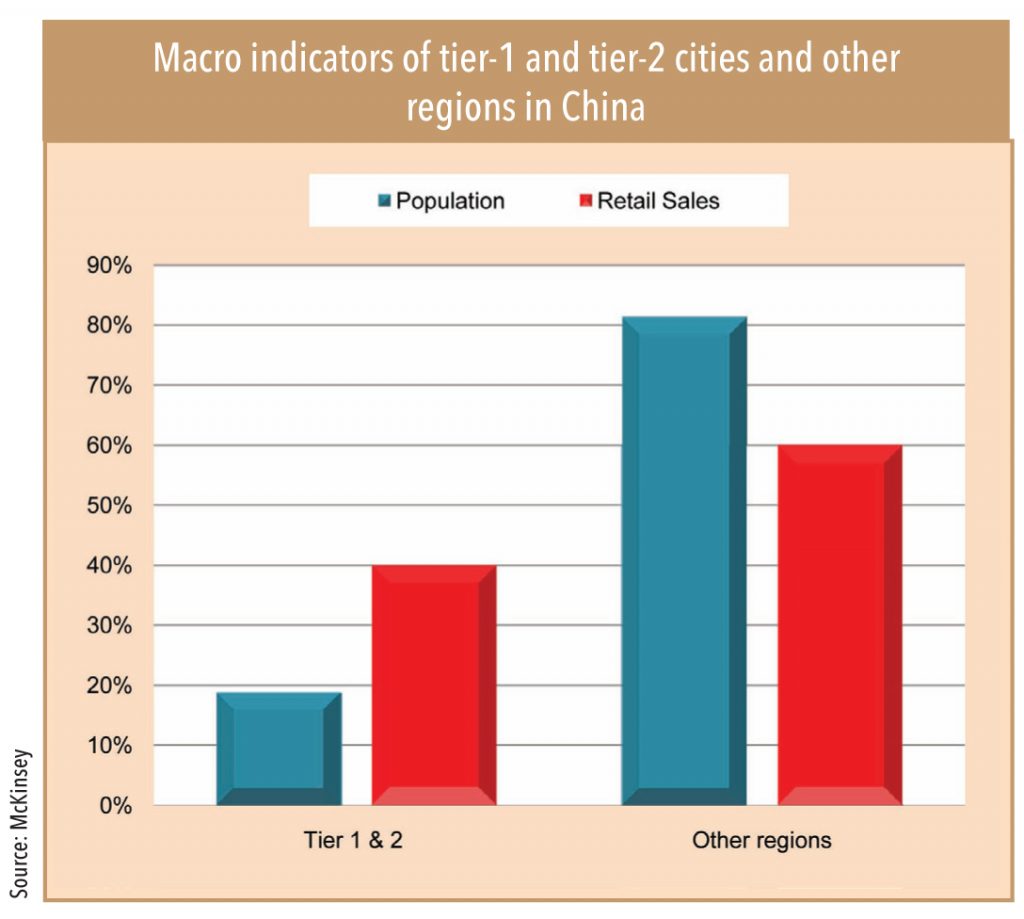

According to Euro monitor International, the top-20 offline retailers in China had a combined market share of approximately 11.6% in 2013 vs. 40% in the United States. This sort of fragmentation in the market is favourable for creating a large online marketplace. For China too (like in India), the online opportunity is not restricted to its big cities. In 2012, approximately 60% of China’s online retail sales were in regions outside of tier-1 and tier-2 cities (National Bureau of Statistics of China).

In addition to the 35 tier-1 and tier-2 cities that have populations of over 1 million each, there are 92 other cities with population greater than one million as of December 31, 2012, according to the National Bureau of Statistics of China. In these smaller cities and towns, China’s offline retail market faces significant challenges due to few nationwide brick-and-mortar retailers, an underdeveloped physical retail infrastructure, limited product selection, and inconsistent product quality.

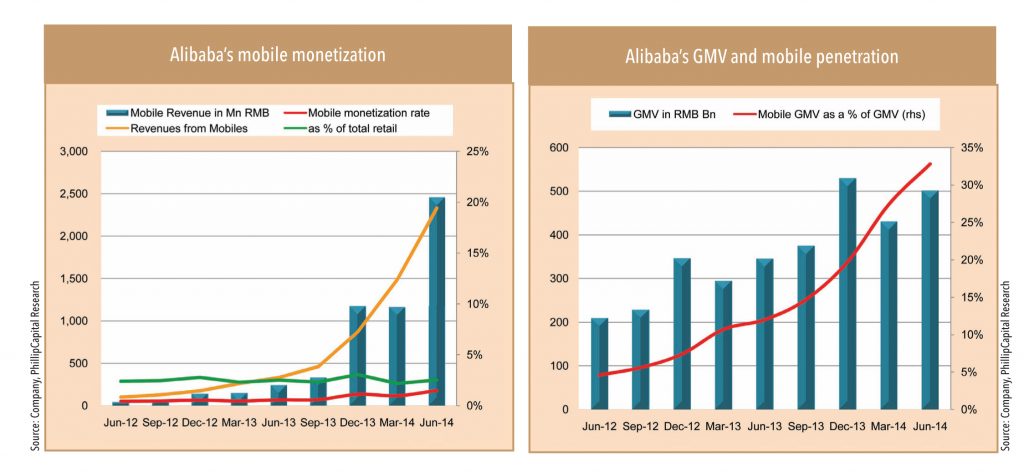

Alibaba’s GMV has seen a breakneck speed of 56% CAGR over 2011-14. During this period, the Chinese ecommerce market grew by 52%. Leadership in mobile commerce has played a vital role in its growth. Alibaba is the leader in mobile commerce in China in terms of mobile retail GMV, with mobile GMV transacted on its China retail marketplaces accounting for 86% of the total mobile retail GMV in China (in the three months ended June 30, 2014, according to iResearch).

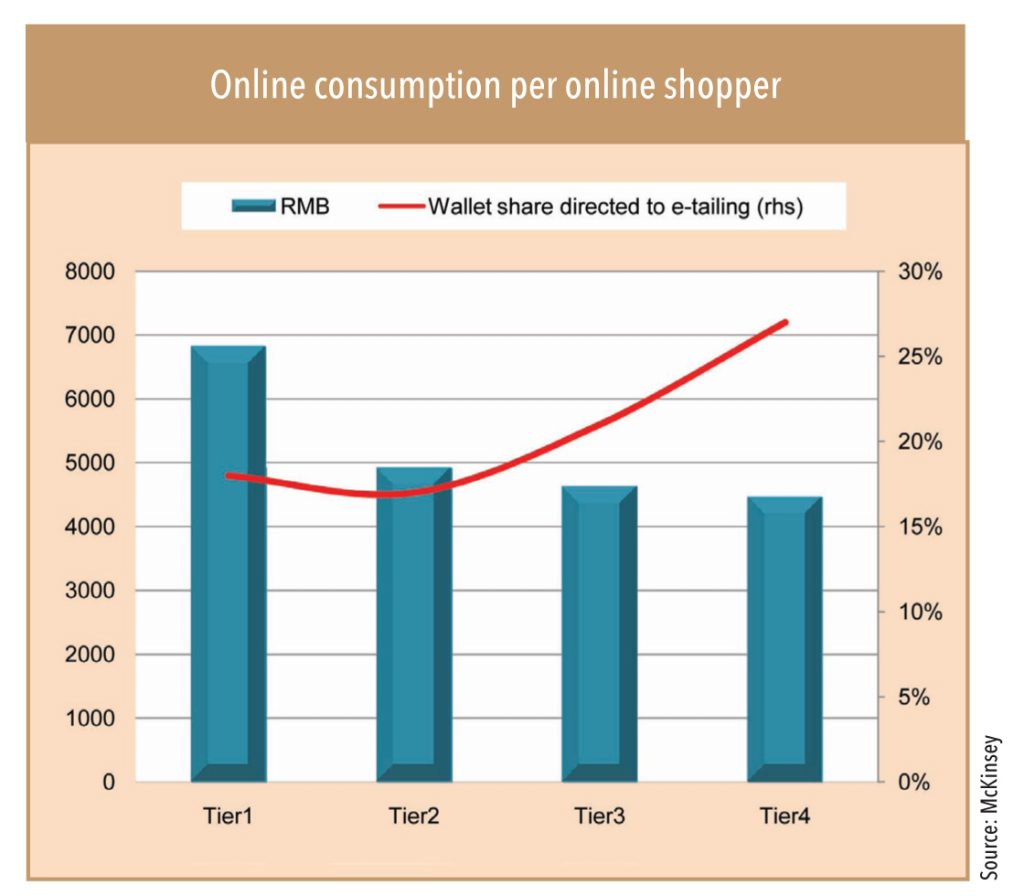

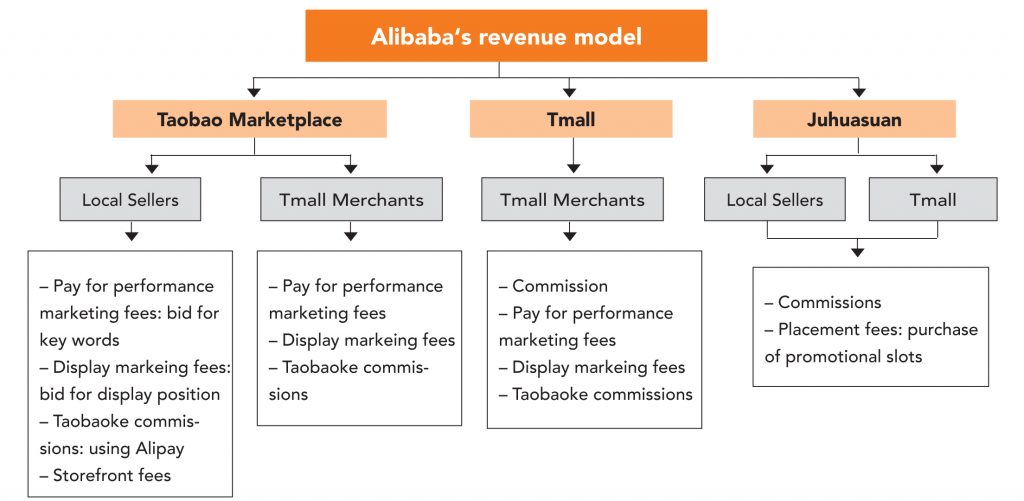

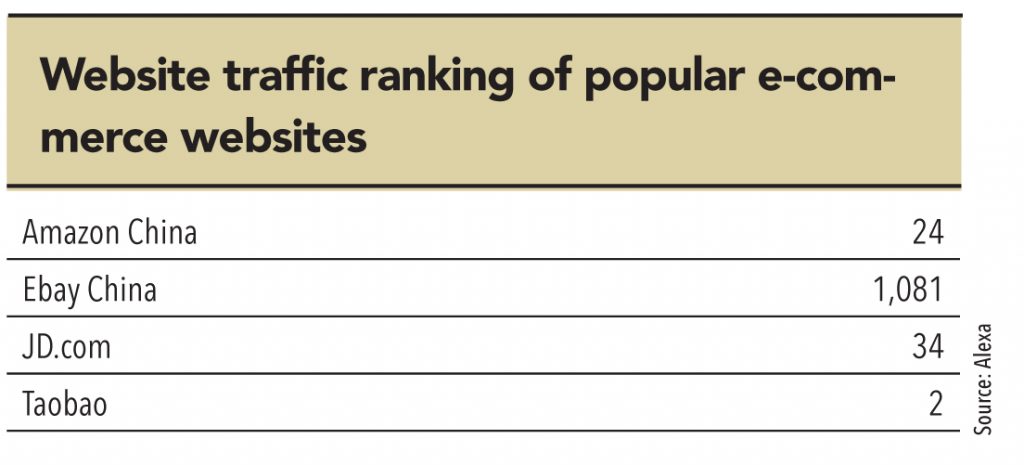

Taobao (similar to Amazon, C2C retail) and Tmall (sells branded goods, B2C retail) are Alibaba’s retail market places — they generated revenues of RMB 500bn for Q1FY15 and RMB 1.83tn in the 12 months ended June 2014 (GMV of US$ 296bn). These marketplaces contributed to 82% of Alibaba’s FY14 revenues. Their revenue model is primarily marketing fees and commission, which complement each other. For example, Tmall sources a significant amount of buyer traffic from Taobao’s marketplace, thereby substantially reducing its customer acquisition costs. Sellers on Tmall may acquire buyer traffic through online marketing services displayed on Taobao’s marketplace.Taobao means search for treasure in Chinese. This marketplace is a free platform for buyers to explore and discover products and sellers to establish a low-cost online presence. According to iResearch, Taobao was the number one C2C marketplace in terms of gross merchandise volume in China in 2013. Major physical-product categories on Taobao’s marketplace include apparel and accessories,electronics and appliances, home furnishings and maternity and baby products. The substantial majority of products listed on Taobao consist of new merchandise. During the twelve months ended June 30, 2014, 173.3 million active buyers, or approximately 62% of all active buyers on China’s retail marketplaces,were located outside of tier-1 and tier-2 cities, while approximately 4.5 million sellers, or 52% of total active sellers on China’s retail marketplaces, were located outside of tier-1 and 2 cities.

Tmall is an online platform featuring brands and retailers who operate their own stores on the Tmall platform with unique identities and look and feel, enabling sellers to control their own branding and merchandising. According to Alibaba, the strong buyer traffic, autonomy, and flexibility for sellers to operate their own stores, and the fact that Tmall does not operate a direct sale business to compete for customer traffic, makes it the platform of choice for brands and retailers.

Major physical product categories on Tmall include apparel and accessories, electronics and appliances, home furnishings, home appliances and maternity and baby products. Sellers on Tmall and Tmall Global pay commissions based on pre-determined percentages (0.3% to 5% depending on the product category) of GMV for transactions settled through Alipay. Sellers also pay an annual upfront service fee, up to 100% of which may be refunded depending on sales volume achieved by the seller within each year.

For all of Alibaba’s success, Indian ecommerce companies seem to follow JD.COM Alibaba’s next biggest (though distant) competitor is JD.com, China’s largest online direct sales company. JD clocked a GMV of US$ 20.7bn (63% electronics) in 2013 – less than 10% of Alibaba’s GMV. The fundamental difference is that JD procures and manages its own inventories, sells products directly to consumers online, and provides delivery and after-sales services. It is modelled on Amazon with the addition of making the last-mile delivery itself. It had over 50,000 employees in April 2014 and nearly half of those were for delivery of products. JD reported an operating loss of US$ 96mn on a turnover of US$ 11.45bn for the calendar year 2013. Interestingly, its gross margin increased from 8.4% in 2012 to 9.9% in 2013, primarily due to the increase in net revenues from services and others attributable to its online marketplace and higher share of general merchandise.

JD is an important reference point for the Indian context, says an expert. He explained that players such as Flipkart and Amazon are replicating the JD model of last-mile delivery. It possibly explains why Flipkart may end up with 25,000 employees on a US$ 3bn GMV for FY15. The expert gives further insight into Amazon’s strategy in India. He says that in the US, Amazon doesn’t make the last-mile delivery — however, for the Indian market it seems to have picked up the strategy from JD and is building its own delivery network.

But why is there no model like Alibaba? An expert explains that, “Taobao, a C2C market place like Ebay, succeeded in China because of its huge manufacturing base and export market. In a C2C model, even an individual can sell his product on the platform unlike in a B2C, which restricts itself to vendors and businesses.” Alibaba succeeded because it connected Chinese suppliers with overseas buyers. China has a huge manufacturing base and most households manufacture something — it could be toys, furniture, sports goods, just about anything. Hence there are multiple sellers that have a large variety of products, thus attracting buyers to the marketplace. Taobao is the platform for such producers and buyers. Our expert suggests that in India, software is our biggest exports and we need to have a strong manufacturing base for an Indian Taobao to evolve.

Alibaba’s competitors misread the market and went with the wrong business model. What went wrong for Ebay and Amazon in China? The expert explains that Ebay failed to understand local market demands and payment systems, which Taobao leveraged on. Alipay, Alibaba’s payment solutions platform is fundamental to its success. For a market where cash-on-delivery payments are high (33% for JD in 2013), Alipay, which functions as an escrow account for buyers and sellers, changed the game. Buyers preferred CoD, whereas sellers were unwilling to ship the products until they were assured that payment was forthcoming. This lack of trust posed a stifling challenge for the development of online commerce in China. Alipay introduced its escrow service as a solution to this problem. Alipay is Alibaba’s password to the treasure cave.

Amazon entered China by acquiring joyo.com; however, it faced integration issues and this perhaps explains why it set up its business from scratch in India instead of acquiring an existing entity.

The Indian ecommerce market is smaller at about US$ 4bn and is more competitive. In the Arabian Nights, Alibaba had to contend with the 40 thieves vying for the treasure. The Indian ecommerce market is no different. While almost every player aspires to be the Indian version of the Alibaba Group, there are many learnings for the players in Indian market, both online and offline.

Competition – There are over 30 active ecommerce sites vying for consumers’ wallets and models are evolving. The market is big, untapped, and more importantly, open. Amazon was nowhere in the picture till 2013 and has rapidly scaled up operations in India, adopting a marketplace model, something it hasn’t been able to do in China.

Alibaba is a pure market place – As highlighted in the earlier section, the Indian market has many hybrid models or companies that have evolved from hybrid models. Snapdeal and Ebay seem to be pure-play marketplace models. Amazon is reported to have an indirect stake in some of its vendors. In any case, all Indian companies are already building up scale. Alibaba, with US$ 300bn GMV had around 26,000 employees in China as on June 2014. Flipkart (with a US$ 1bn GMV in FY14) has 13,000 employees and plans to add another 12,000 employees in FY15. Snapdeal has around 1,300 employees and plans to double the headcount soon.

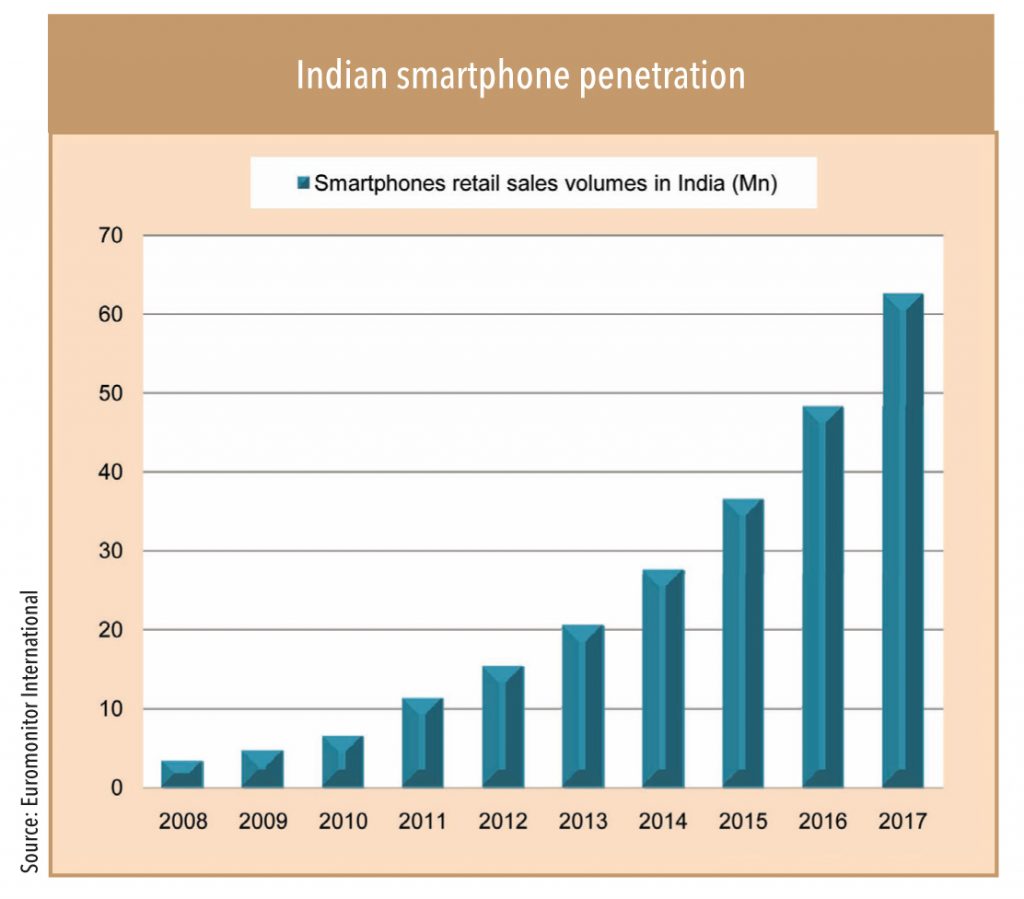

Mobile is the way ahead – Access to smartphones bridges the gap of internet availability to India’s 150mn (and growing) mobile internet users just as it is has in China. Businesses have to evolve beyond ecommerce – they have to be ecommerce ready – be it mobile websites (websites which are optimised for viewing in smart phones) or mobile apps. The share of Jabong’s mobile transactions increased from 4.4% in the first quarter of 2013 to 27% in the second quarter of 2014, while its monthly average visits using mobile devices increased from 1.8 million to 13.5 million over the same period.

Striking similarities – India and China both have underpenetrated retail markets. The opportunity becomes even larger in tier-3 cities and beyond. Technology is the new and one-stop store for these locations. Opening stores rapidly is passé — reaching through technology is the future.

The competition for offline is only going to intensify — Alibaba’s success has increased investors’ risk appetite to invest in ecommerce companies in India. And these investors are willing to back some players in the hope of winner takes it all. This means funding (that has already touched US$ 4bn in 2014) will only increase.

Subscribe to enjoy uninterrupted access