Making a mark and sustaining can be very challenging

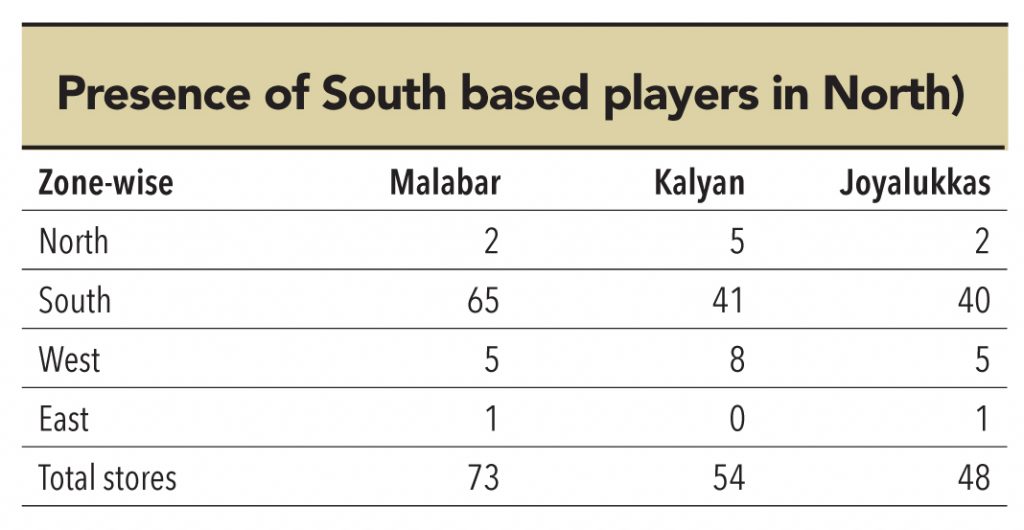

One of the leading south-based players told us that, “It takes around three years to establish trust and reputation outside the home market. And it’s not an easy business as it is all about satisfying the consumer and it entails product range, service, and flexibility. The customer needs lot of pampering.”Since south India as a market is already saturated, the south-based players (Malabar, Kalyan, and Joyalukkas) are looking at making their mark on the north Indian jewelry market, which is still largely unorganized.

The purity card

Mr. Acharya of WGC said that, “Out of half a million jewelry retailers in India, only 10,000 outlets retail hallmarked gold. Awareness levels are low and choices are limited.” Moreover, the practice and level of under-karatage is very high in the North.

Purity is one the positioning points for the South based players in North. As a west-based player put it, “South jewelers are considered more trustworthy.The north Indian market is fragmented and under-karatage is deeply prevalent there.”

Inventory and supply chain – the challenge behind all that glitter

South-based players come with the experience on operating a network of stores. A large network of stores and presence across India helps in strengthening a jewelry brand. However, with scale come the perils of managing high-value inventory across different locations. The fact that none of these players hedge gold is a risk to the balance sheet of the business as they expand. Titan is one of the few players to hedge gold.

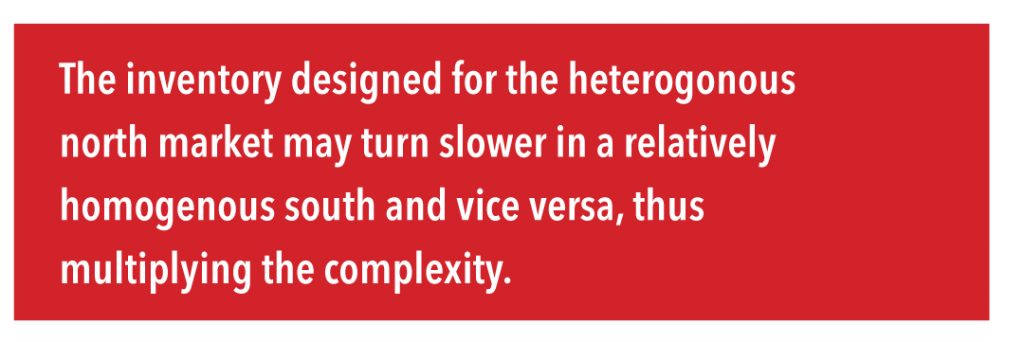

As the variety of inventory increases, managing it becomes more complex. The inventory varies in every micro market within a region as well, and moving it over locations is challenging. Moreover, the inventory designed for the heterogonous north market may turn slower in a relatively homogenous south and vice versa, thus multiplying the complexity.

The south players need to accept this and move away from centralized proprietary decision making to a de-centralized system. A case in point is the recent closure of Kirtilals’ Ludhiana store within three years of opening. Kirtilals is an extremely reputed diamond jeweler from TN and has been in the business for over 75 years in TN and has a strong presence across south India.

One of the associates of a largest south based player acknowledged that, “Ability to have the right stock at the right location and a robust supply chain is fundamental to succeed in this business as we scale up.”

Titan has been the leader of the pack in this aspect and runs a well-oiled supply chain seamlessly across its network. Titan’s ability to manage inventory across 162 stores (including those operated by franchisees), integrate a robust demand forecasting mechanism with its supply chain, and manage its tail (slow-moving designs) sets it apart and helps it introduce new designs frequently.

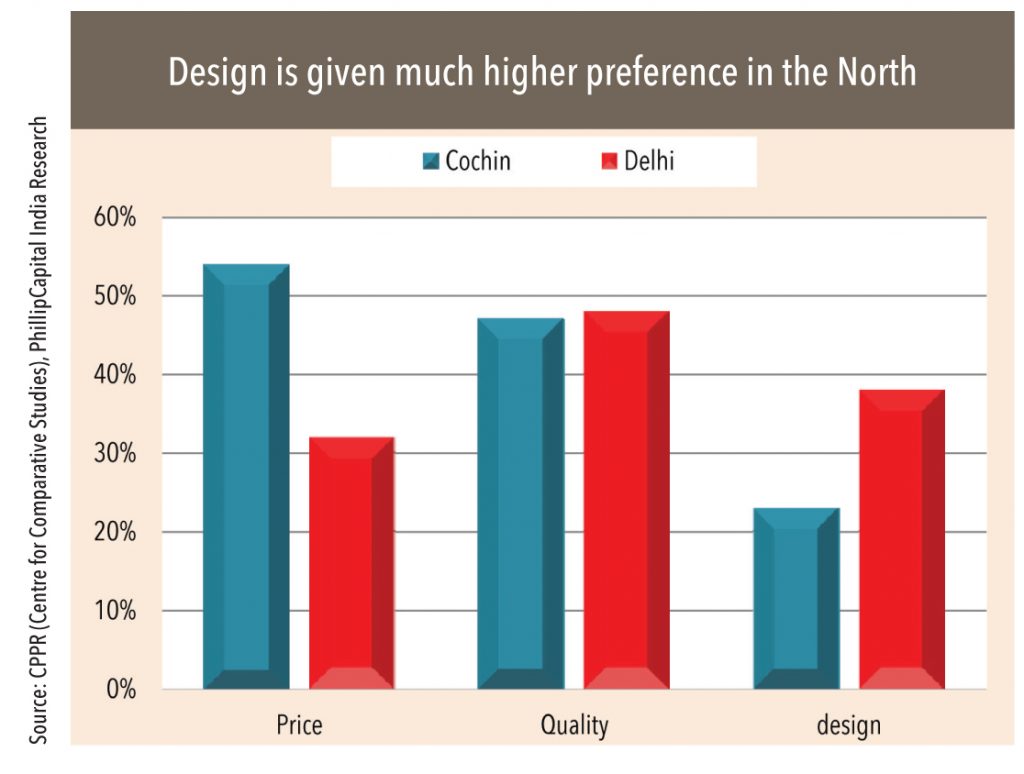

Can low making charges substitute for designs? No

The other aspect which they would play on is pricing. As one the players puts it, “We come from a very competitive market where customer expects good pricing, great designs, and excellent service”

South players entering the north will be competitive in terms of pricing at least in the initial years as they establish a presence in the region. While all of them maintain that it’s the unorganized market that will move towards them, the fact is that the unorganized market still continues to thrive because of its competitive price points. Kalyan Jeweller’s ad campaigns in the west and the north was to position itself on purity and low making charges. However, one of Kalyans’ competitors states, “Kalyan advertises low making charges but actually they are higher. For every like-to-like product, our making charges are lower.”

In any case, making charges is not the magic ingredient in the north. Mr. Acharya of WGC says, “Making charges are relevant to the consumer but not all important as they don’t materially affect the cost.” Mr. Bhatia of PC Jewellers corroborates that “Making charges are linked more to the designs than for brand and purity. If there is another organized player nearby then purity is not an USP.” Designer items and unique designs tend to command a premium as there is seldom any direct comparison. According to Mr. Bhatia, “For designer items, making charges cannot be compared. It can be compared for items such as machine-made bangles and chains”. Here begins the challenge for the South-based players — how to deliver unique designs and diamond jewelry up north vs. delivering more conservative and traditional designs, gold jewelry, and coins to the investment-motivated South Indian.

The jewelry purchased in north India for weddings comprises studded, diamond, and kundan, and is generally more contemporary.

A Mumbai-based player with a presence in the north adds, “A customer enters the store for variety and range, then she likes the design, and then she enquires about making charges.South-based players tend to stock more south-Indian designs and more plain gold jewelry. Their customer base in the North seems to be south-Indians residing in the north.”

Some of the differences in designs are the setting of diamonds – south-based players tend to retail closed-setting diamonds (popular in the south) while in the north, open setting is preferred.

A quick survey at a Kalyan Jewellers’ store reveals that designs seem skewed towards south Indian designs and inventory towards gold.

“There has been a push towards studded jewelry because it’s a very opaque market. Diamond doesn’t have a proper secondary market. Consumers buy more diamonds because of marketing efforts by De Beers. It’s (diamonds) marketed as an aspirational product. De Beers has done a fantastic job. It was never marketed as an investment purely an aspirational product.” A gold industry expert

However, he cautions that diamond jewelry is an opaque market and only a few jewelers have technical knowledge about diamonds and the rest go by the certification of the suppliers. Therefore, customer trust becomes very important in an era where customers are researching more (on the internet) before they buy.

The south players, which are used to catering to gold-oriented purchases, are facing a totally different market in the north, where the diamond market is large and designs are based on larger stones. The shift to diamonds has happened faster in the North. Mr. Bhatia of PC Jewellers says, “Upper class has already shifted to diamonds as they don’t won’t adorn themselves with only gold. If someone was buying four sets of gold wedding jewelry earlier, they buy one or two diamond sets now.”

Literally cashing in on the brand

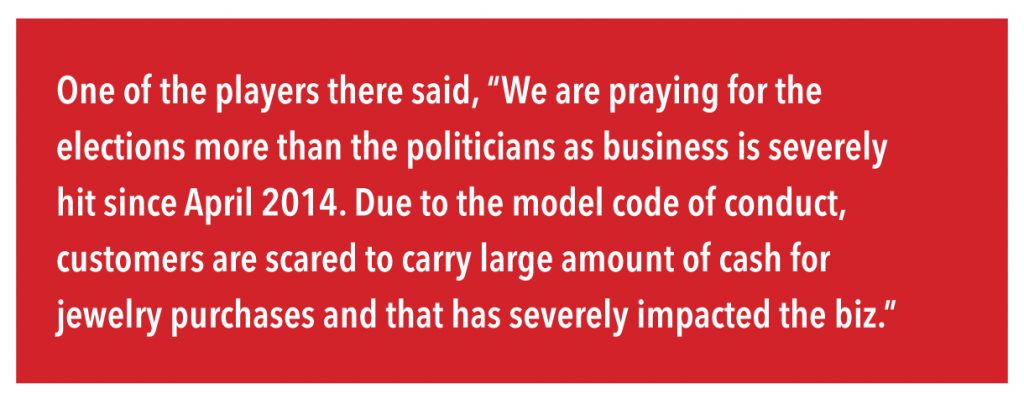

The option of making large-ticket purchases in cash at large branded stores will attract clientele. Nearly 40-50% of jewelry purchases across north are in cash. This is true for the south as well but there recycled gold accounts for 40% of sales. Therefore, the discerning spender of cash at unorganized outlets now has the choice of spending it in a branded outlet without worrying about compliance. The rule, basically mandates furnishing of PAN card for any purchase in Cash over Rs 500,000. But most jewelers easily break it by splitting the bills.

Every player and store (with the exception of some organized players such as Tanishq, Orra etc) we visited in both the south and north stated that they deal in cash including high-ticket items above Rs 500,000. One of the players there said, “We are praying for the elections more than the politicians as business is severely hit since April 2014. Due to the model code of conduct, customers are scared to carry large amount of cash for jewelry purchases and that has severely impacted the biz.”

We visited many of the stores during this period and not surprisingly found that store with maximum footfalls was Tanishq, which possibly enjoys strong patronage from the white-collared class.

Even as some of the larger players deal in cash transactions with ease, Tanishq stores clearly stated that they would require Permanent Account Number (PAN) card details to conclude any cash transaction above Rs 500,000. One of the employees cited an example of how a customer who had finalized a purchased of Rs 700,000 refused to close the transaction as he was asked to furnish his PAN card. Apparently, the customer’s argument was that he had just purchased jewelry worth Rs 800,000 in cash from another large jeweler in the vicinity without any “problem”.

This ability to deal with cash transactions will help south players to gain market share from the unorganized market. However, even as they garner more share of the cash transactions, the risk of stringent regulations being put in place is always there.

Customer service – pitfalls of expansion and lack of woman power

Once the customer likes a design and it falls in her budget, what clinches the transaction for the jeweler is the sales service. As one of players puts it, “The level of service is very important. It’s like a stay in a luxury hotel, the customer needs pampering.”

Mr. Bhatia of PC Jewellers adds, “The role of the sales person is to help the buyer and when required reinforce the view by saying its looks good on her.”

The established players such as Tanishq and PC Jewellers are known for excellent sales service.

One of the major competitors also gave credit to the Tata brand saying, “Tanishq has excellent service levels and they are the benchmark.”

While the players from south may have these qualities as well, there are challenges. Some of the chains such as Kalyan Jewellers have more south Indian staff, even in the stores in the west and north — this is to keep costs and attrition lower, and because they trust their native staff. Moreover, there are very few sales women (most of the sales staff is men). In a business where the customer and decision maker is the lady, female staff and communicating in the local language becomes very important.

One of the customers visiting a Kalyan store in Mumbai said, “Amitabh Bachchan can speak Hindi but I am not too sure their staff can.” Another south-based competitor to Kalyan adds, “Advertising campaigns can boost footfalls but what builds the business after initial euphoria is the product, design, and service, which translates to customer loyalty.” Ability to converse in the local language helps understand the customer needs. Moreover, this helps overcome community bias — north Indians may be apprehensive of entering a store with a south Indian ambience.

Decentralizing the business management — Easier said than thought

The issue of having different designs, higher mix of slower-moving diamonds, higher level of customer service (would increase the cost), and managing this inventory across diverse consumption locations needs system-driven processes and devolution of power. Accepting this and many other cultural changes as they enter newer geographies requires a change in the mindset of regional entrepreneurs and needs a professional approach towards building an organized management structure.

Designs for a new market need a good and new merchandising team. Retailing requires skilled staff (including women) that has an ability to communicate and connect with the customer in their local language. Managing the diverse inventory across stores requires investment in systems, processes, back-end, and people.

“Hiring native (south Indian) staff is a substitute to establishing processes and systems for checks and balances. Most of the promoters still run the business like a proprietorship. To achieve scale this has to change first,” says the head of retail of an organized jeweler.

One of the leading diamond players adds, “Many times, family members interfere in the day-to-day operations with whimsical demands and impose their ideas. Professionals find it difficult to adapt in such organizations and end up quitting. Professionals can’t help bring about desired changes unless the “Lala” mentality changes.”

Cracking the north Indian market is anything but easy. Lower pricing comes at the cost of designs and customer service, which in many ways seem non-negotiable in this geography. Above all, the key to running this business (as any other) is looking at the bigger picture and changing your own mindset, which, empirically, has never been easy.

As one player put it, “It takes around three years to establish the brand, win the trust, and gain customer loyalty.” It hasn’t been easy at home and it won’t be easy so far away from home either.

Subscribe to enjoy uninterrupted access