It is well established that cement demand is closely linked to GDP growth. For India, the link is even closer because several parts of the country still lack many basic infrastructure facilities. Therefore, cement consumption in India will remain high and will continue to be driven by development.

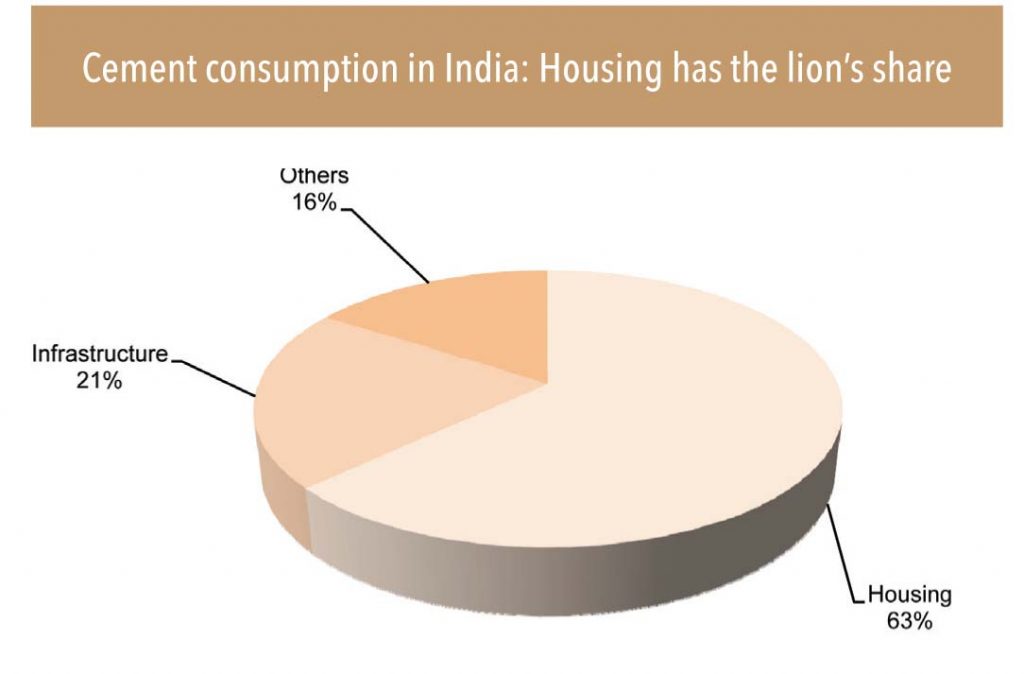

India’s current cement demand is largely driven by housing. Though the share of infrastructure in total cement demand will increase, barring the sentiment support to cement prices, the core driver for cement consumption is likely to remain housing.

Infrastructure can provide intermittent support to the demand curve, but sustainable support seems unlikely in the near term. The offtake from infrastructure demand will probably start 12-18 months from now. However, the intensity of infrastructure cement consumption is supposed to be higher than housing, and hence can be a significant driver once this demand starts coming in steadily. For example, if the ballpark cement consumption in housing is 25kg for per square feet of construction,it is estimated to ~35-40 kg per square feet of construction for infrastructure projects (depending on the nature of project).

Cement prices will continue to remain driven by industry sentiment and cost-push

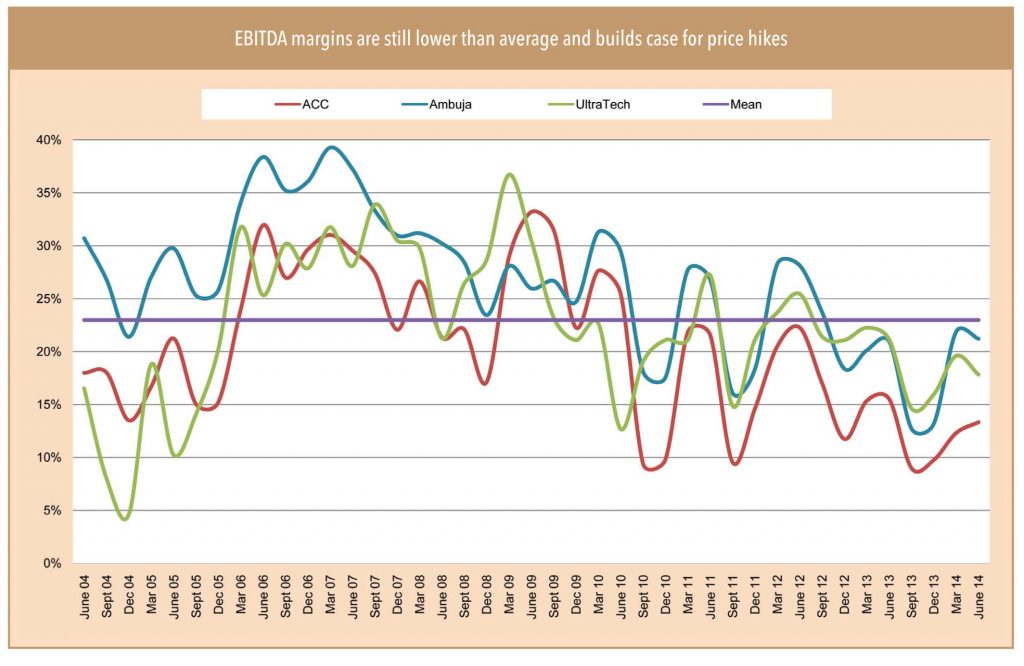

Over the past few years, cement prices have been a factor of industry sentiment, production, and pricing discipline. Cost push has been also a key reason, as reflected in the lower EBITDA levels (industry has often justified price hikes because of cost push). However, other than cost push, industry sentiment has played a pivotal role in driving cement prices. Though this seems to be relatively truer for South India, in most regions in India, sentiment has been a key driver for prices.

That fundamentals (other than cost push) do not support or drive prices for the Indian cement industry is clearly visible in utilisation levels — North and Central India are the only regions where utilisations are relatively stable (80% plus). Other regions such as South, East and West continue to operate at 55-80%. Therefore, barring cost push, cement prices will continue to remain driven by sentiments.

Brief background of the Indian cement industry

Cement business in India (and globally) is a regional one. High freight costs deter long and inter-regional transportation. In most cases, the maximum distance cement travels is 700kms beyond which travel becomes unviable. Therefore, India is divided into 5 broader regions/zones — North, South, East, West and Central. South and North account for about 60% of India’s capacity. In inter-regional transfers, North largely caters to West and Central, while South caters to West and East — overlaps in service regions cause pricing distortions and regional imbalances. However, most times, the cement industry manages these pricing distortions well and is capable of restoring prices quickly.

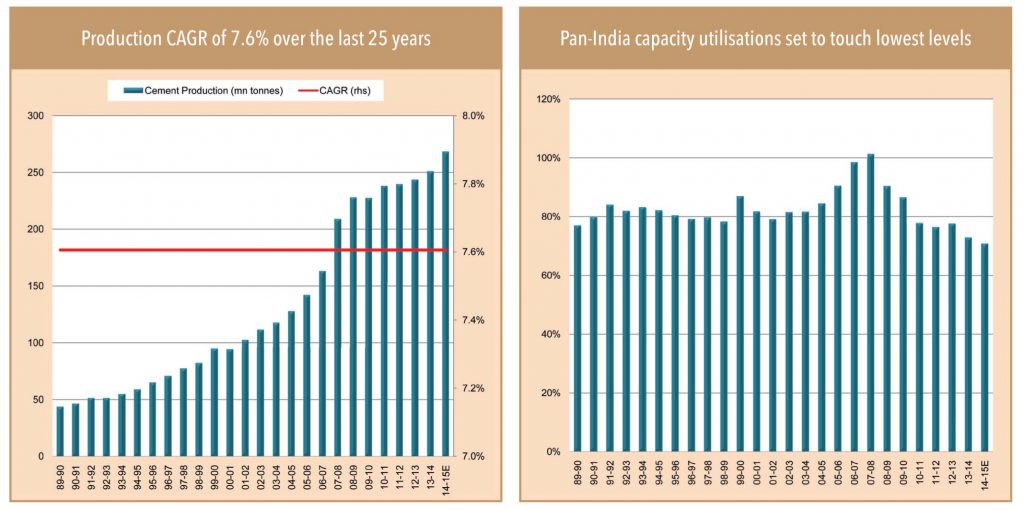

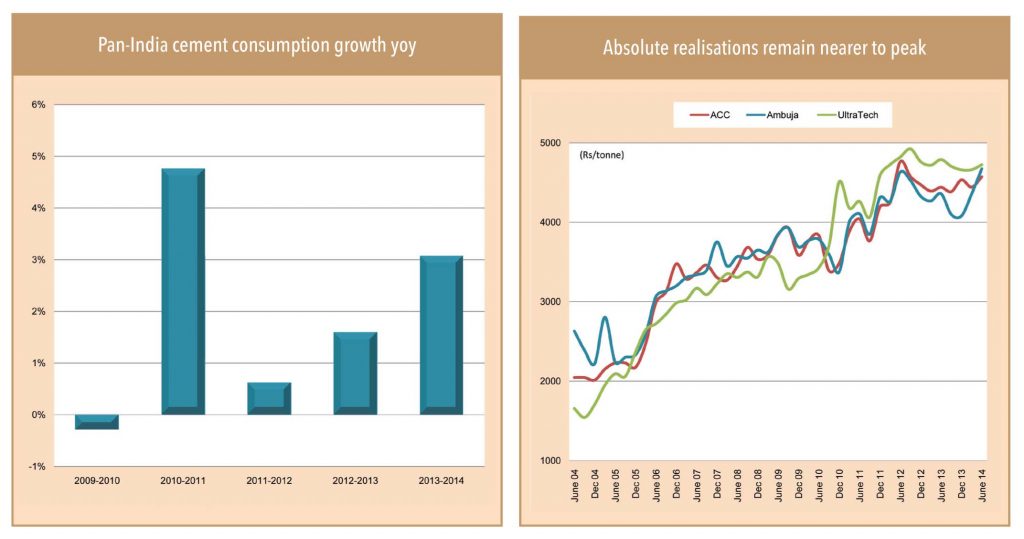

Over the last 25 years, pan-India cement production CAGR was almost 8%. However, over the last 5 years, cement production growth has been dismal due to lack of policy initiatives and weak governance at centre and state. With a much firmer government in place, the industry believes growth will increase.

With dismal consumption growth and increasing capacities, and with a view to keep cement prices favourable, the industry (pan-India) lowered its utilisation levels to nearly 71% (lowest in the past 25 years). Though demand revival will improve utilisations,they are unlikely to recover beyond 75% in the near to medium term.

Though pan-India utilisations levels are dishearteningly low, at regional levels there are stark differences.North continues to operate at nearly 90% while South operates at merely 55-60%. Hence, it is unfair to look at pan-India average — it is far more interesting to look at expectations and realities of cement manufacturers at regional levels largely North and South.

Despite lowest-ever utilisations, cement prices are almost at peak levels — visible in the average realisation trends of cement majors. This clearly speaks for pricing discipline and the ability of the industry to maintain favourable prices in tough times.

EBITDA margins of cement majors are currently lower than their average — since cement prices are at their peak, it is very clearly cost push that is causing weak margins. Therefore, price hikes seem necessary, but it is unlikely that sharp hikes will go down well with consumers. However, with a sentiment boost in terms of demand recovery, the industry can announce sustainable price hikes.

What are the concerns?

Though the industry has shown that it is capable of restoring prices quickly, the key concern is the lack of demand and increasing capacity, due to which sustaining better price levels becomes increasingly difficult despite the price discipline and maturity of cement manufacturers. Fundamental support, such as sustainable demand growth, is essential for sustainable price growth.

Over the last 5-7 years, the cement industry has almost doubled its installed capacity betting on huge demand creation in the country, but so far, demand has failed to live up to expectations. This has resulted in capacity utilisations falling from record highs to record lows in FY15.

With a change of command at the centre, a lot is being bet upon demand revival for the cement industry, which in turn may lead to better capacity utilisations. Though it is easy to say that utilisations are now at the bottom of the cycle, it is difficult to predict how much these will improve. Even with an 8% pan-India increase in demand, it is unlikely that there will be more than 2-4% improvement in utilisation every year for the next two years. Hence, at best, pan-India capacity utilisations could touch 75% in FY16.

Subscribe to enjoy uninterrupted access