The time for cement prices to start improving directionally has come. The sector is undergoing a cultural revolution. The searchlight for efficiency and price improvement should firmly settle on supply-chain efficiency as production level improvements yield limited results. Tackling rising compliance costs will come into sharper focus.

Slow and steady price hikes likely; regulation-driven changes and search for inherent efficiencies will lead to an almost automatic rise in cement prices

After travelling exhaustively across all regions of India – north, east, central, south, and west and touring Delhi, Rajasthan, Gujarat, Madhya Pradesh, Uttar Pradesh, West Bengal, Tamil Nadu, Andhra Pradesh, Telangana, Chhattisgarh, Karnataka, and Maharashtra, analyst Vaibhav Agarwal believes that the time for cement prices to start improving directionally has come. The key intention of this extensive journey was to understand cement-pricing nuances and fathom why prices were not recovering despite healthy demand. This was a great opportunity to observe cultural changes in the sector in terms of the operating business environment.

It will not be correct to look at short-term price movements to gauge the direction of cement prices – over the long-term they will be on an uptrend. The search for efficiency in the industry has become very intense and few companies have already recognised that it is not just production efficiency, but also supply-chain efficiency that matters. In fact, supply-chain leakages prove to be a major dampener for cement prices. Also, all efficiencies do not translate to cost savings; many of them are structurally required due to compliance factors such as environmental norms, social responsibilities, and adherence to the broader regulatory framework in each area of operations. Many of these efficiencies will also ensure smooth continuous operations and minimum breakdowns, thereby reducing repairs, maintenance, and spare-parts costs. These efficiencies will push cement prices up directionally in the medium to longer term. Rising cement prices are no more a matter of choice, but indeed a ‘need’ for all.

It is generally well accepted that cement pricing and its direction are a function of demand-supply and production obedience. But beyond this, a few critical factors determine pricing. These include efficient management of the supply-chain and the distribution channel, alignment in the business philosophy of all individuals within an organisation, and importantly, that individual cement manufacturers accommodate each other’s needs – that vary by business models and market conditions. The operational business environment has changed dramatically in terms of tighter compliance prerequisites at every level – right from limestone quarrying to production and then distribution – which makes better cement prices the need of the hour for ALL manufacturers.

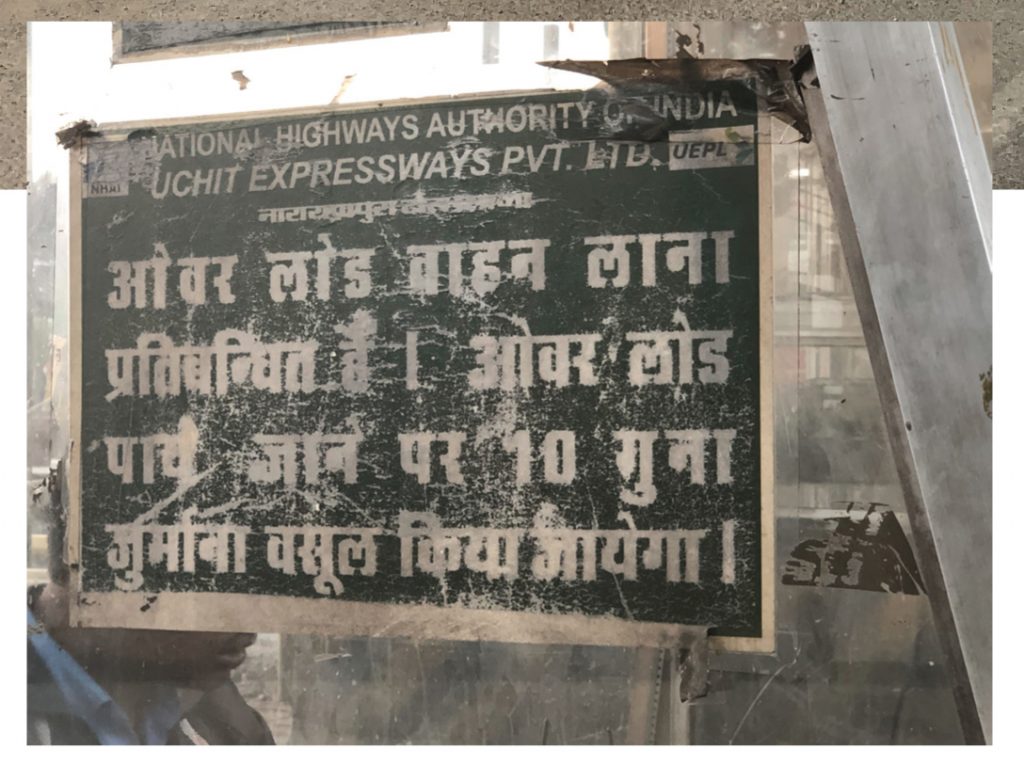

Overloading in many states is a thing of the past

Historically, most regions in India ignored loading norms and remained relaxed with truck loads. This ‘advantage’ for the sector is largely over, as norms are strictly enforced in most parts of the country. This implies an increase in the costs of operations

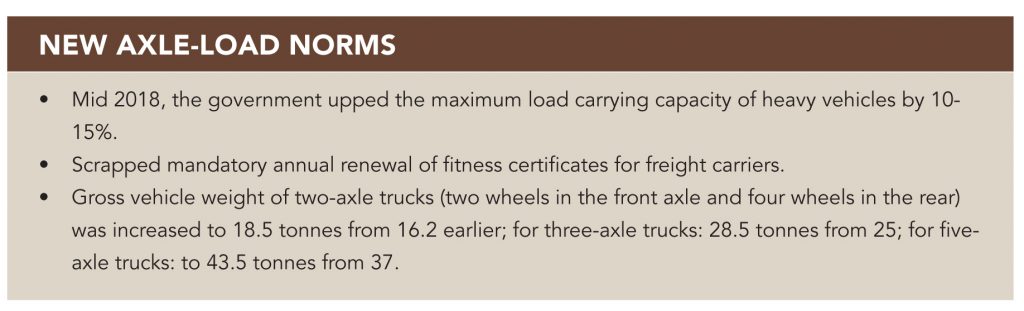

In July 2018, the government announced initiatives to increase axle-load norms, which would enable trucks to carry more loads. This is a mild breather for the sector – about 3-7% of freight costs. However, these initiatives have not yet been fully implemented across all states, and procedural delays with local state governments and road transport authorities are bottlenecks. Eventually, all states will comply.

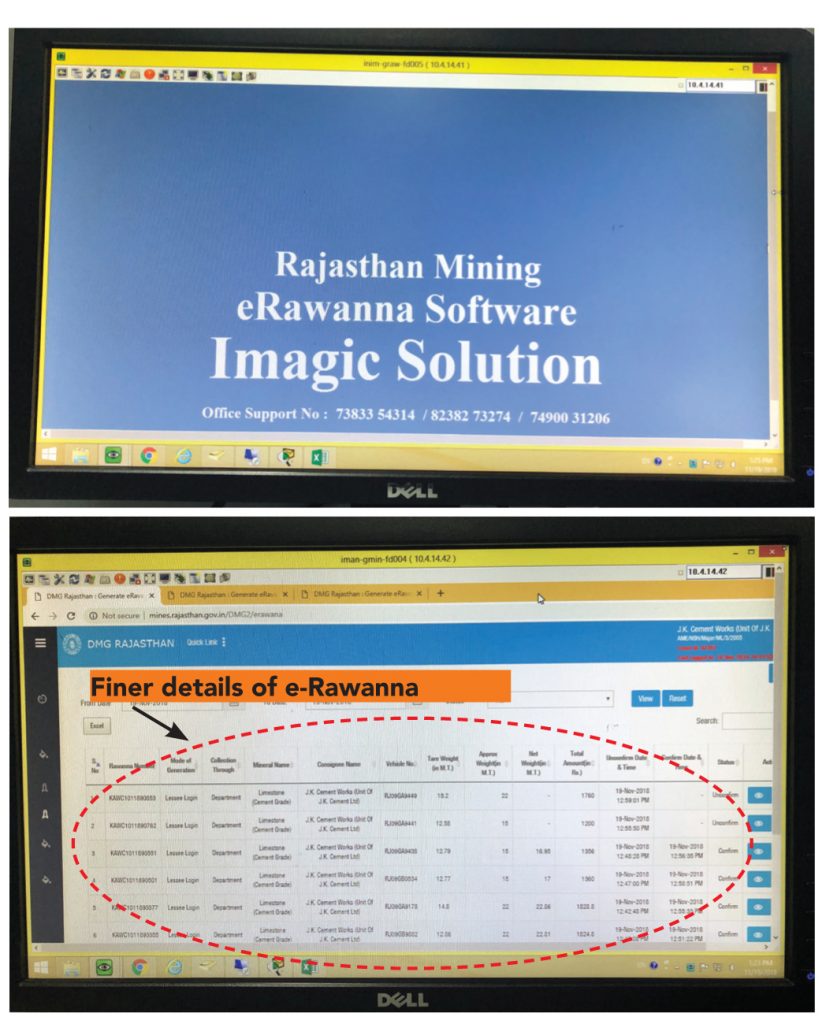

In many states, the governments have implemented stringent norms for revenue collection. Royalty for mined limestone was earlier paid after mining and usage at cement plants. But many state governments have now implemented a pre-paid royalty payment system. Under this, if cement manufacturers have recharged or deposited say a royalty of Rs 100 with the government, they will be allowed to evacuate limestone equivalent to Rs 100 worth of royalty from the mines. These manufacturers have to keep depositing money in advance with state governments to continue their mining operations.

It is a small change, but it increases daily working capital requirements of cement manufacturers. This move is expected to eventually reduce fraud and cases of intentional non-payment of statutory dues to regulators. In the past, there were a few such cases, which were eventually referred to the NCLT for takeover and revival. Each state has a different terminology and procedure for the permission to move from the mine. For example, in Rajasthan, this permission is called e-Rawanna (in Hindi rawanna means setting off).

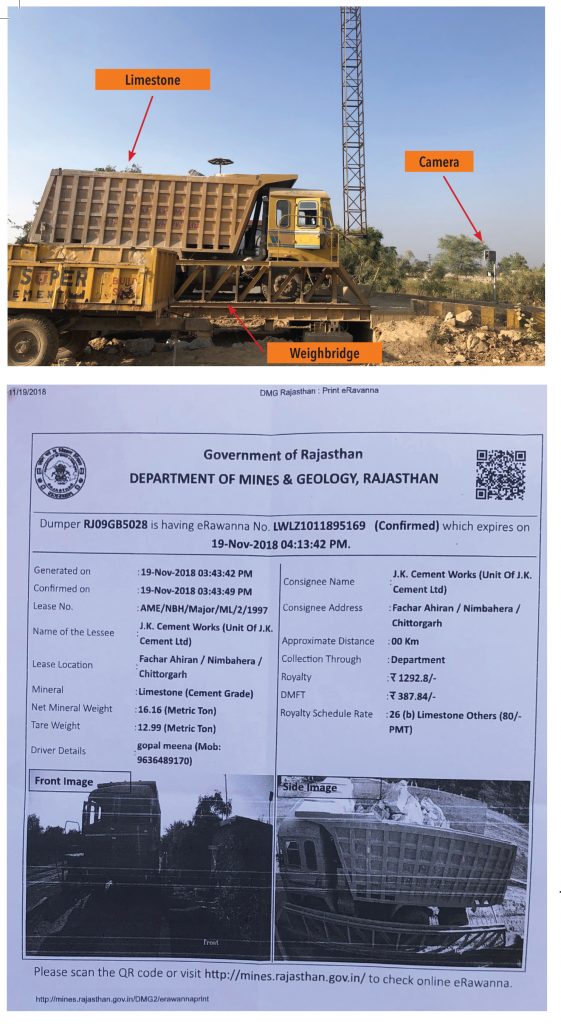

In places where hi-tech systems are being implemented final challan or permission to proceed is provided only when these trucks are compliant and found fit to proceed. Trucks are being monitored real time in all functions of operations including raw material movement, inward movement of fuel, and outbound movement of finished material. Monitoring tools (cameras) and barometers (weighbridges) are being installed at all necessary checkpoints. All vehicles are now mandated to pass through such check points for readings and documentation before the challans that allow them to proceed are generated. Designated state agencies approve pictures and readings at such sites. That’s not all, the government has made it mandatory for pictures and readings to be incorporated on challans. This will act as a verification tool for all regulatory authorities all along the vehicle’s route.

For vehicles carrying inbound cargo to factories (such as raw materials and fuel), there is an inward check at the company’s receiving gate through similar means (camera, weigh bridge), which is matched with the original readings at the time of loading. Regulatory authorities in several states have risen to the need for a fully compliant, error-free transport mechanism – and these are all steps to achieve these goals.

A newly installed camera at the exit gate of a limestone mine. Next to the camera is a weigh bridge. The e-Rawanna copy confirms the front and side image of the dumper and also captures the load of the truck. The copy details the time of generation, time of confirmation, and time of expiry – which implies that if the dumper does not reach the unloading location by a certain time, the e-Rawanna becomes invalid. The purpose of this is to ensure better transparency in mining operations, bring better transparency in vehicle turnaround times and plug loopholes of overloading at mines. In many villages adjoining cement plants, damage to roads by overloaded limestone trucks is a common complaint to local authorities and such initiatives will help address them. The e-Rawanna also has all basic details such as name and number of the driver, gross and net weight of the truck, and royalty details, which help authorities en-route to verify details. It also forces truck operators to remain more compliant.

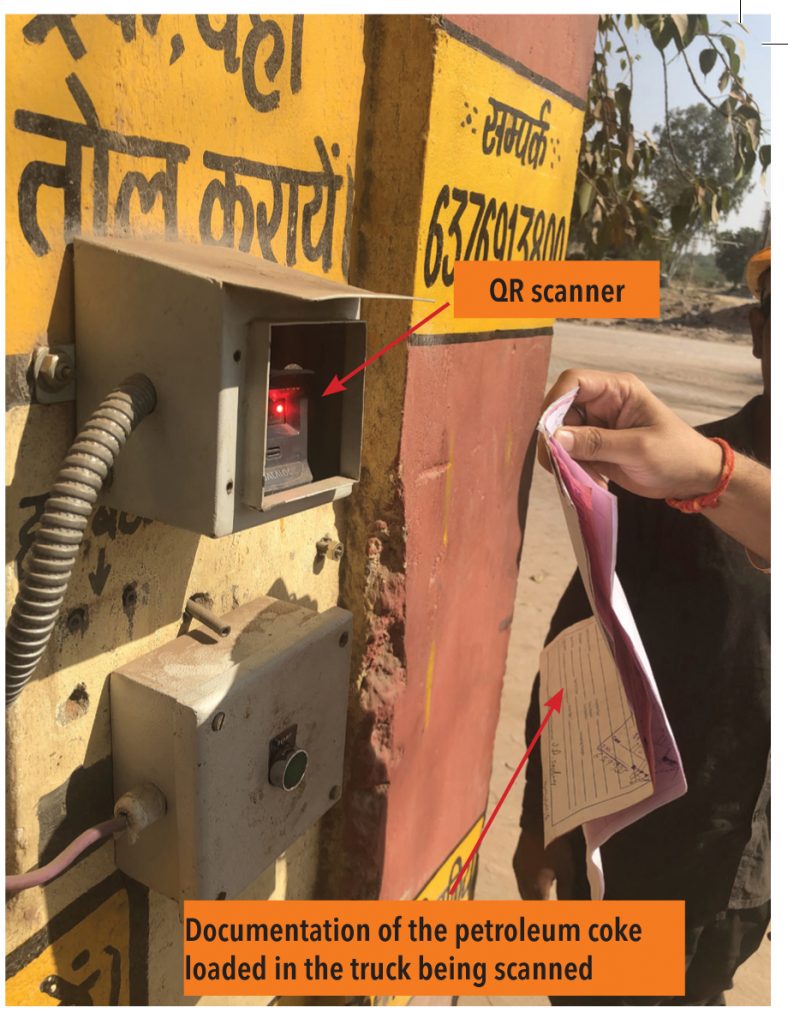

Trucks loaded with fuel and travelling long distances also have similar rules

This is especially true if unloading takes place in a state that is fairly compliant or in a state that is moving towards better compliance. It is not just about the truck-load factor, but also about the way the fuel is loaded. For fuels such as pet coke and coal, due to pressure from regulatory authorities, cement companies have mandated transporters to ensure efficient storage mechanisms (such as proper covers) to comply with environment norms; fuel trucks normally have a tendency to release particles. More so, these norms also act as checks against pilferage.

Toll checkpoints are becoming stringent about regulations, and automated (even inter-state)

Many toll checkpoints were seen developing infrastructure to check overloading. Even inter-state ones have initiated the process of installing weighbridges to check suspicious vehicles. Drivers are being educated about the severe penalties. Human intervention at most of these points has reduced drastically; they are now almost automated.

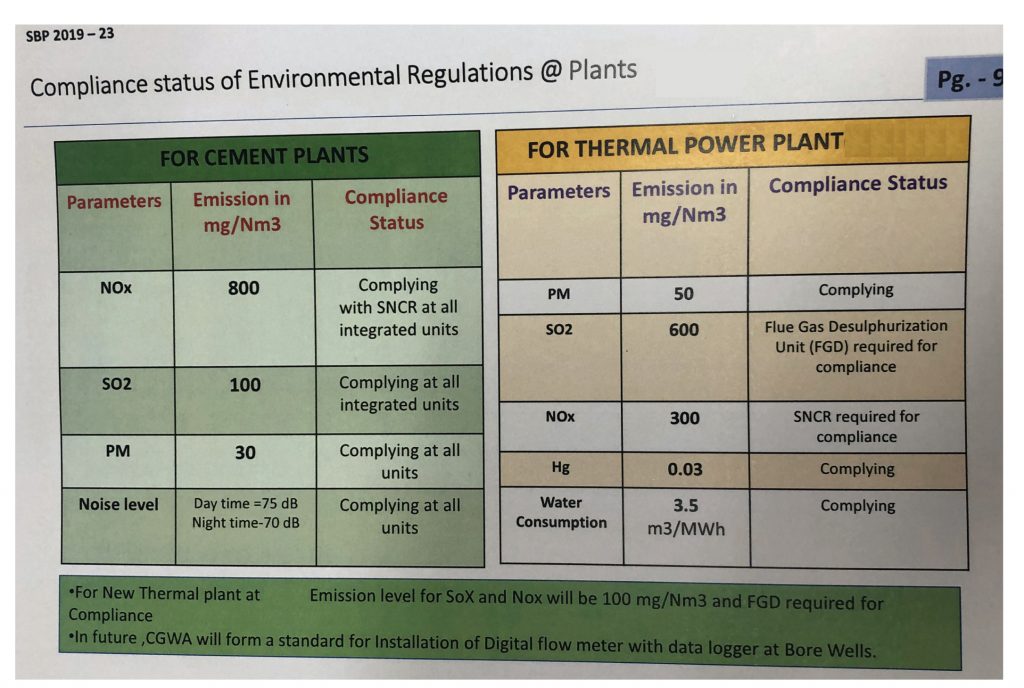

Almost all cement factories across the country have been asked to compulsorily submit environmental emissions, real time, to regulatory authorities. Penalties for deviations can be severe and may trigger shutdown notices.

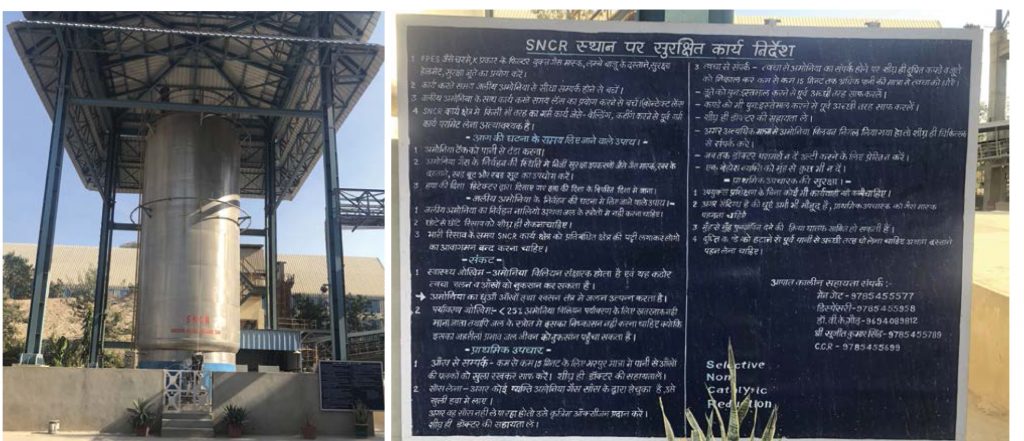

SOx and NOx (sulphur oxides and nitrogen oxides) compliance have added to the operating costs of cement companies – more so NOx. To control these emissions, cement companies have been incurring additional capital costs to install Selective Non-Catalystic Reduction (SNCR units). Higher NOx emissions leads to acidic rains and the regulatory authorities have made it mandatory for cement manufacturers to keep emission levels below 800mg/Nm3 (milligrams per cubic metre). For this, they have to install SNCR units and spray ammonia at the pre-heater. In addition to the capital cost, the process incurs an additional recurring cost of Rs 15-30/tonne of clinker, depending on the age of the plant and status of its regular maintenance (upgraded, not upgraded).

Besides SOx and NOx, the government has also established new norms for other environmental hazards such as particulate matter (PM) and noise levels. To avoid non-compliance notices, plant heads across the industry have been working over the last 1-2 years for ensuring that all plants are fully compliant to these norms.

Grinding cost for fuel has increased after the ban on using pet coke in power plants

In November 2017, to protect the environment, pet coke was disallowed in power plants. Since then, cement companies’ cost of grinding has increased as they have to use coal (coal needs to be more finely grinded) for their captive power plants. In addition, the cost of coal is generally higher than pet coke in terms of calorific value.

Subscribe to enjoy uninterrupted access