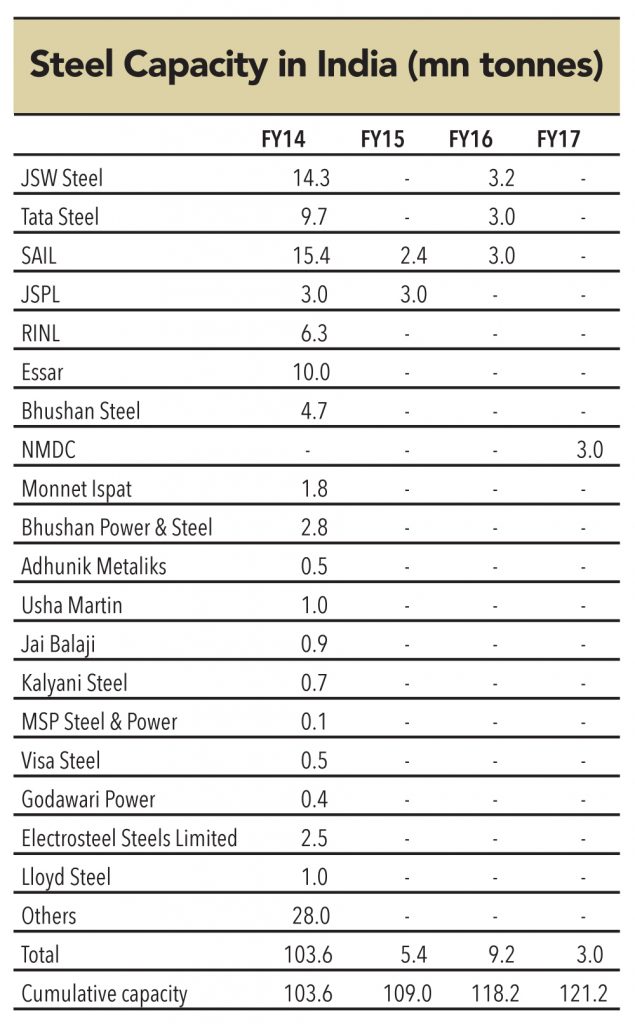

A pick up in the overall steel consumption in India (due to the growth in auto and real estate) will improve the financial state of the secondary sector in the coming 6-12 months. However, it will be short lived with steel capacity expansions coming up — capacity is expected to grow from the current 104mn tonnes to 121mn tonnes in the coming three years with a bulk of the expansions coming from the primary producers.

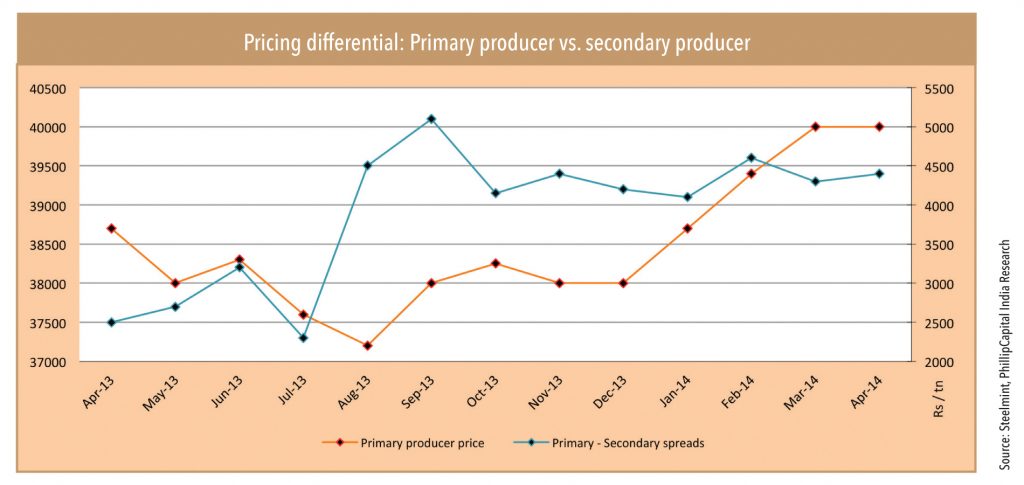

New capacities along with already low utilizations across the industry will lead to fierce competition. Surplus steel capacity will continue to limit spreads earned at lower levels. This can be seen from the widening price spreads between primary and secondary producers.

The chart above highlights the primary producer prices for TMT Bars and the spread they earned over the secondary producer. The pricing differential between the primary producers and the secondary producers has not corrected materially despite a 7.5% move up in the primary producer prices since August 2013. Secondary producers are keeping the differential high to at least ensure volume growth.

Fresh investments required to sustain current volumes and margins

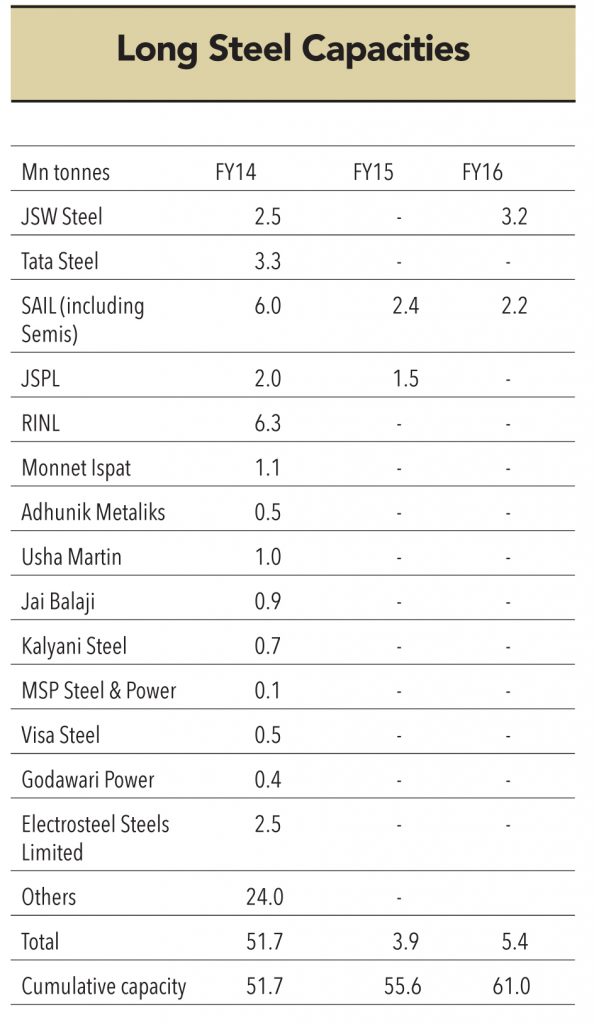

The secondary sector, which mainly supplies long-steel products will need fresh investment for reducing the cost (increasing integration levels) and improving the product profile (through value additions). This will help them sustain margins, given the expansion plans of the primary producers. Long-steel capacity is expected to rise by ~9mn tonnes by FY16 and is entirely being expanded by primary producers. This can significantly dent the volumes of the secondary producers, but for them getting their costs leaner to sustain competition.

“The key to survival is reducing costs by increasing the integration levels. Our integration level is what has helped us earn profits and retire majority of our debt,”

Mr Sandeep Goyal from Bajrang Ispat

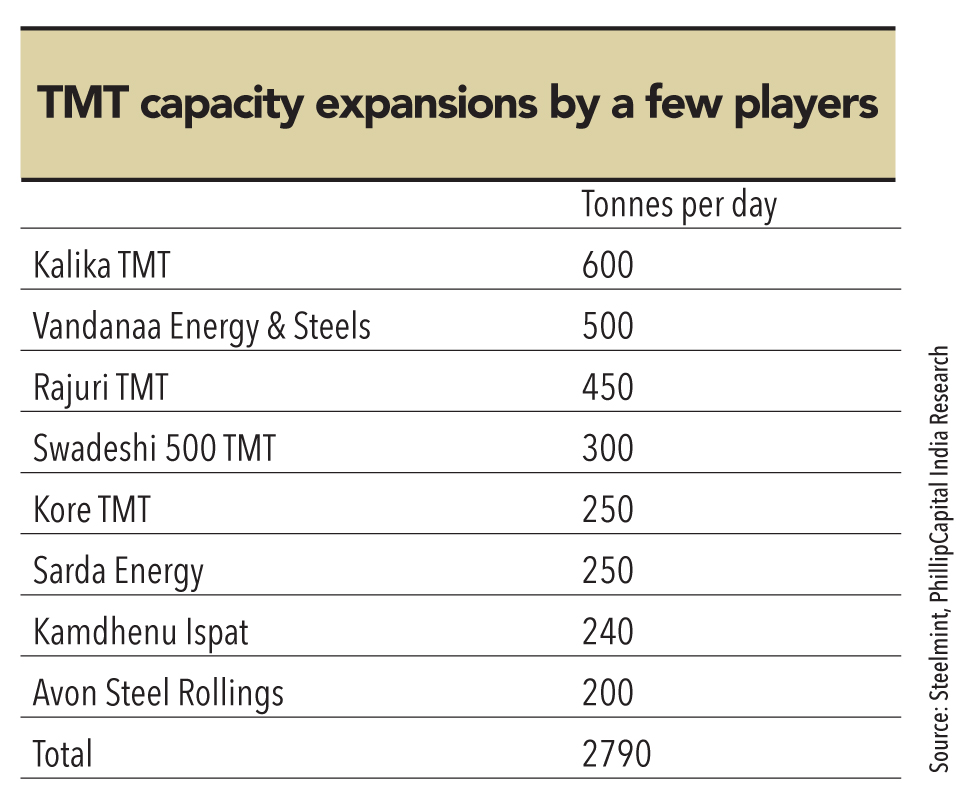

“The key to survival is reducing costs by increasing the integration levels,” says Mr Sandeep Goyal from Bajrang Ispat who operates an integrated TMT mill with operations spanning from making pellets to long-steel products such as TMT and wire rods. “Our integration level is what has helped us earn profits and retire majority of our debt,” he says. Secondary sector will need higher investments to reduce end-product costs, which will help sustain their margins. This trend is seen from the increasing number of secondary producers currently producing billets (semi-finished product) that are looking at setting up TMT facilities. Secondary producers are adding around 1mn tonne of new capacity in the TMT segment. This forward integration will help them utilize their already existing semi-finished steel capacity and enhance margins.

Secondary producers are adding around 1mn tonne of new capacity in the TMT segment.

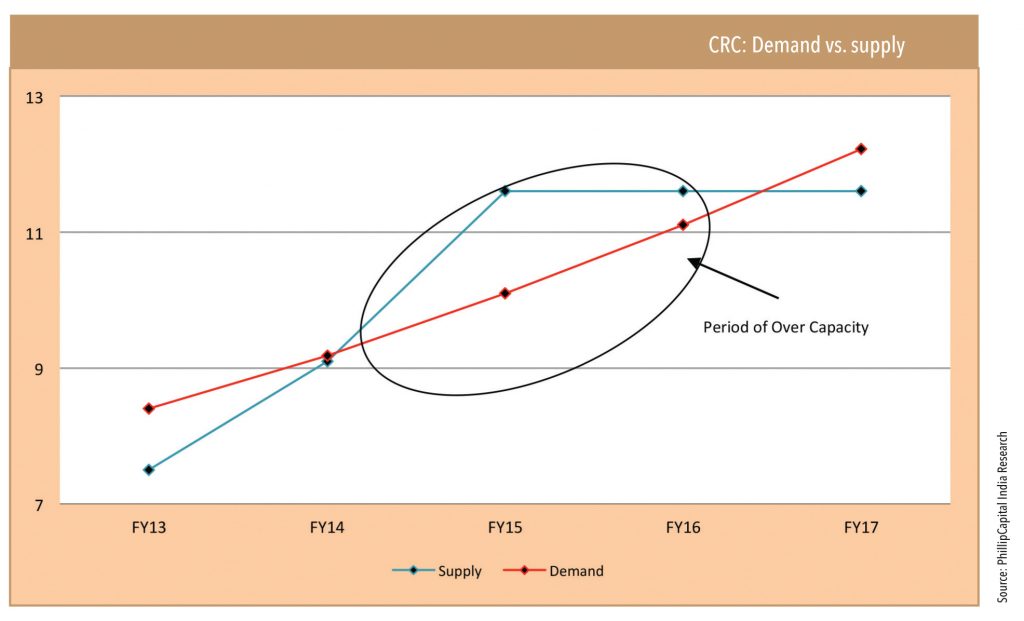

Improving the share of value-added products is beneficial for the secondary long-product players. However, the story is different for the flat-steel producers. Primary producers are specifically expanding CRC capacity — they have plans to commission 4.1mn tonnes of new CRC capacity, which will account for around 55% of the existing capacity of 7.5mn tonnes. While the capacity addition is targeted at import substitution (11MFY14 net imports of 0.7mn tonnes), standalone re-rollers will see further compression in business once the capacity expansions start kicking in. “SAIL has started trial runs for its new CRM and the material was really good. The volumes from these new capacities will not only replace the imports but also impact the small re-rollers given the quality edge and lower cost for the primary producers,” says Mr S K Gupta who trades in flat products in the Northern markets.

As seen from the chart below, FY15 and FY16 will continue to see over capacity for the CRC products despite a 10% annual growth in expected demand. This will see players with weak balance sheets and the ones who do not have a technological edge move out of the system making way for the primary producers capturing the market.

To conclude, the prospects of the larger players look far better than the smaller players. A significant rise in demand due to government initiatives may ease the problems of secondary players for a while. However, to survive the onslaught of the larger players who are focused on capturing the traditional bastions of the smaller ones, these companies are going to have to shape up both in terms of finance and technology. Over the next decade or so, we could see a scenario where primary steel producers have captured a majority of the market and only highly efficient value-adding smaller players dominate the rest.

“SAIL has started trial runs for its new CRM and the material was really good. The volumes from these new capacities will not only replace the imports but also impact the small re-rollers given the quality edge and lower cost for the primary producers,”

– Mr S K Gupta who trades in flat products in the Northern markets.

Subscribe to enjoy uninterrupted access