For a long time, the market was dominated by international chains like McDonald’s, KFC and Dominos. A few Indian chains, like Café Coffee Day and Barista, competed successfully against the global players. But over the past few years several Indian chains are not only competing successfully against global chains but also expanding rapidly. Some of these chains are Box8, Faasos, Maarosh, Jumbo King and Goli.

Global players have been active and aggressive but Indian players have been no less—they have successfully launched restaurant chains in the QSR and fine dining spaces. They compete aggressively across categories and many firms have attracted private equity and venture-capital funding. The most interesting home grown restaurant chains are Café Coffee Day, Barista, Speciality Restaurants and Faasos.

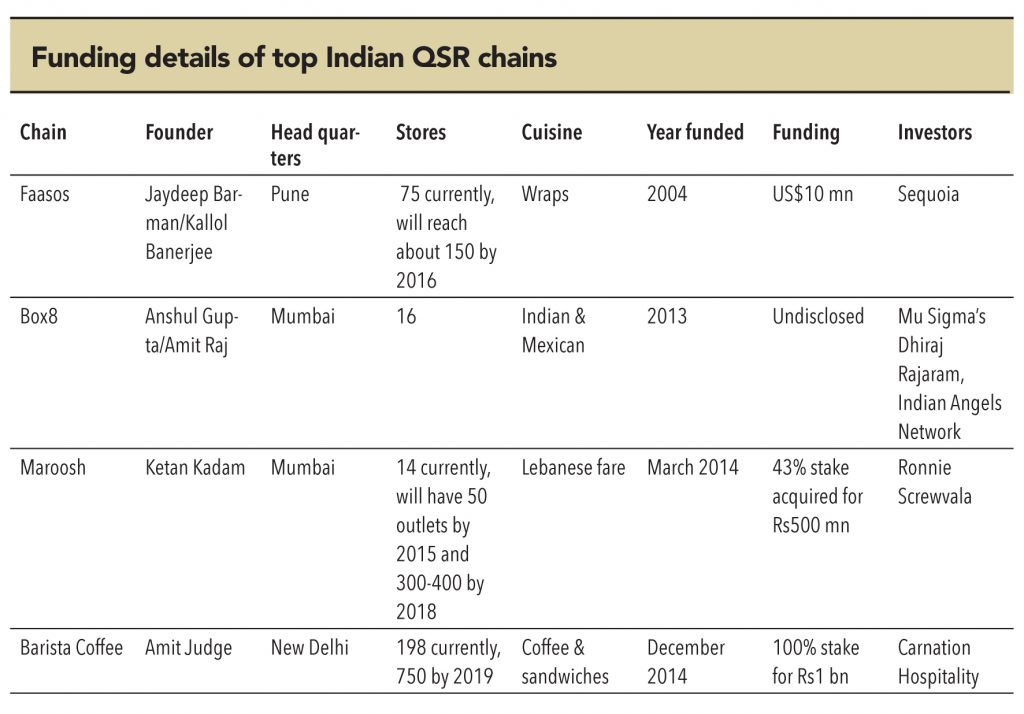

Indian chains have evoked a lot of interest in Venture funds. The table below captures the funding details for some top domestic chains.

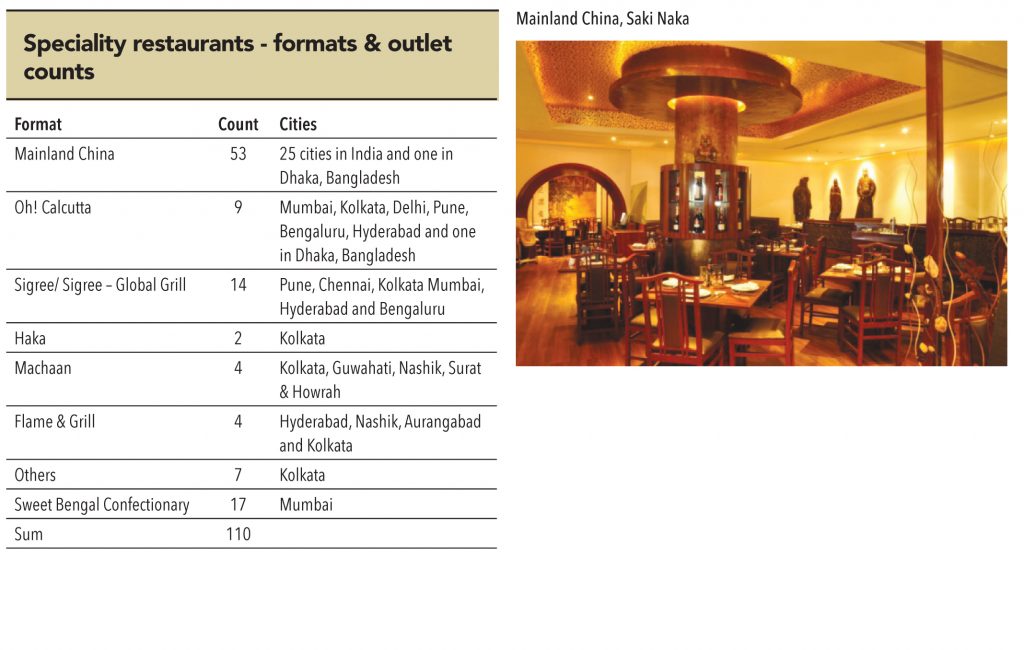

Anjan Chatterjee a passionate foodie with a background in advertising and branding started Speciality Restaurants in 1992 with “Only Fish” restaurant serving foods containing the nostalgic flavours of Kolkata, in Mumbai. The 40 by 40 square foot crowded dining place drew gourmets and food critics alike with the unique flavours of Kolkata. Mr. Chatterjee quickly realized the dearth of specialty cuisines and started two brands, Oh! Calcutta and Mainland China, in 1994. Mainland China and Oh! Calcutta operate in the fine dining space, which is growing briskly, especially in the specialty-cuisine segment.

Today the company has 112 outlets in various formats, The flagship brand is Mainland China, with 53 outlets. The Other brands, Oh! Calcutta, Sigree Global Grill, Café Mezzuna, Sweet Bengal and other brands are significantly smaller than the flagship brand but some are gaining ground. The chain plans to go global soon, expanding to the Middle East, Africa, the UK and elsewhere.

Fine dining not so fine for the moment

Speciality restaurants had a successful IPO in 2012 but the stock performance over the years has not been inspiring due to the economic slowdown and high inflation, which severely dented its profitability. Speciality operates mainly in the fine dining space, which has some unique factors differentiating it from QSR space. Fine dining is marked by customization, emphasis on table service and frequent changes to the menu. Inventory includes alcoholic beverages and a wide variety of ingredients. Economic cycles impact fine dining more than the QSR category because of higher operating leverage and lower volumes. Huge fixed costs are incurred in the fine dining format for rent, air conditioning, manpower, replenishment of quality food even in slack times, resulting in protracted breakeven time-frames and slower payback.

Cutting the fat

It’s no secret that in the restaurant business operational efficiency is the single most critical aspect for maintaining long-term profitability. Speciality is making the required changes to its supply chain and business model to reduce costs per store to enhance long-term profitability. It has reduced the kitchen area from an average of 2,000 square feet to 800 square feet by making key changes like procurement of desserts from a centralized commissary, renting cheaper godowns in for restaurants in up-market areas for food storage and focusing on efficiency based on footfalls. These factors result in significant savings on rentals and energy costs.

Biggest leverage on achhe din

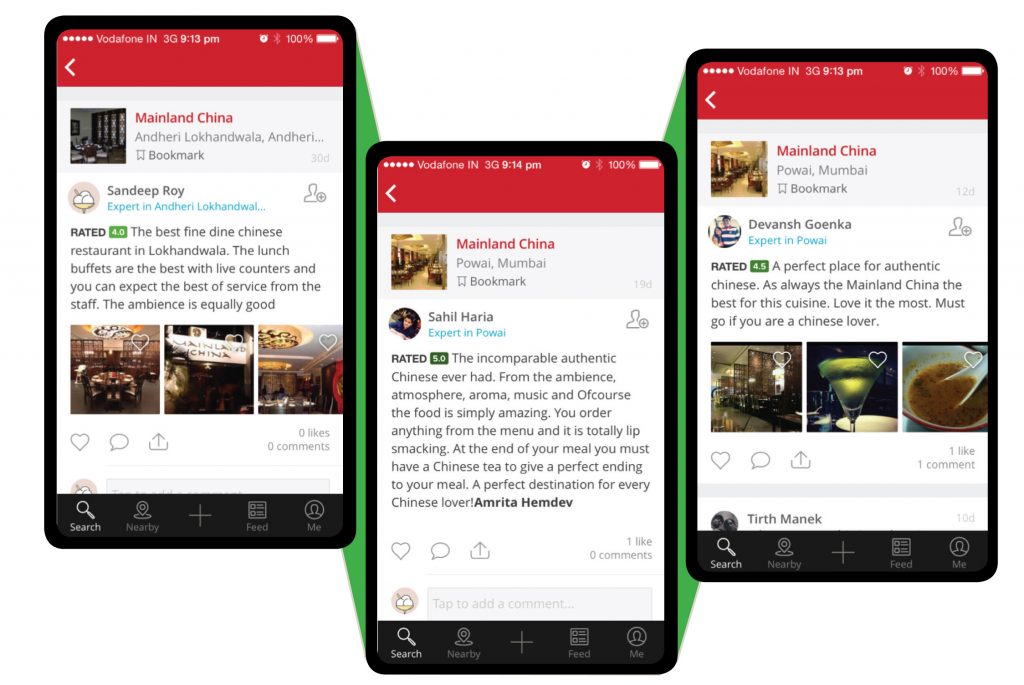

Operating leverage for Speciality is quite high for volume improvement. During stressed times, business tends to be strong only on weekends while on weekdays, especially lunch hours, it is dull. In delivery-based models, staff costs can be managed by juggling between temporary and permanent staff, based on dull and peak periods as the skill involved in delivery is limited. But fine dining restaurants must maintain their staff count as table service is a critical element of the service. This bloats the cost structure for fine dining but also offers the biggest opportunity when corporate activity recovers—lunch hours pick up and both volume and average ticket size rise. In 2007-08, the average daily cover-turns for Mainland China were 1.7-1.8, which has now dropped its dropped to 1.4-1.5; margins hovered at 30% and now have dropped to below 20%. Although the peak is quite far away, improved cover-turns will lead to huge operating leverage.

“The improvement in corporate activity over the next few quarters will lead to a revival of fine dining. Southern markets like Bangalore have started performing better but most are still significantly below their peak operating performance”.

-Mr. Rajesh Mohta, CFO – Speciality

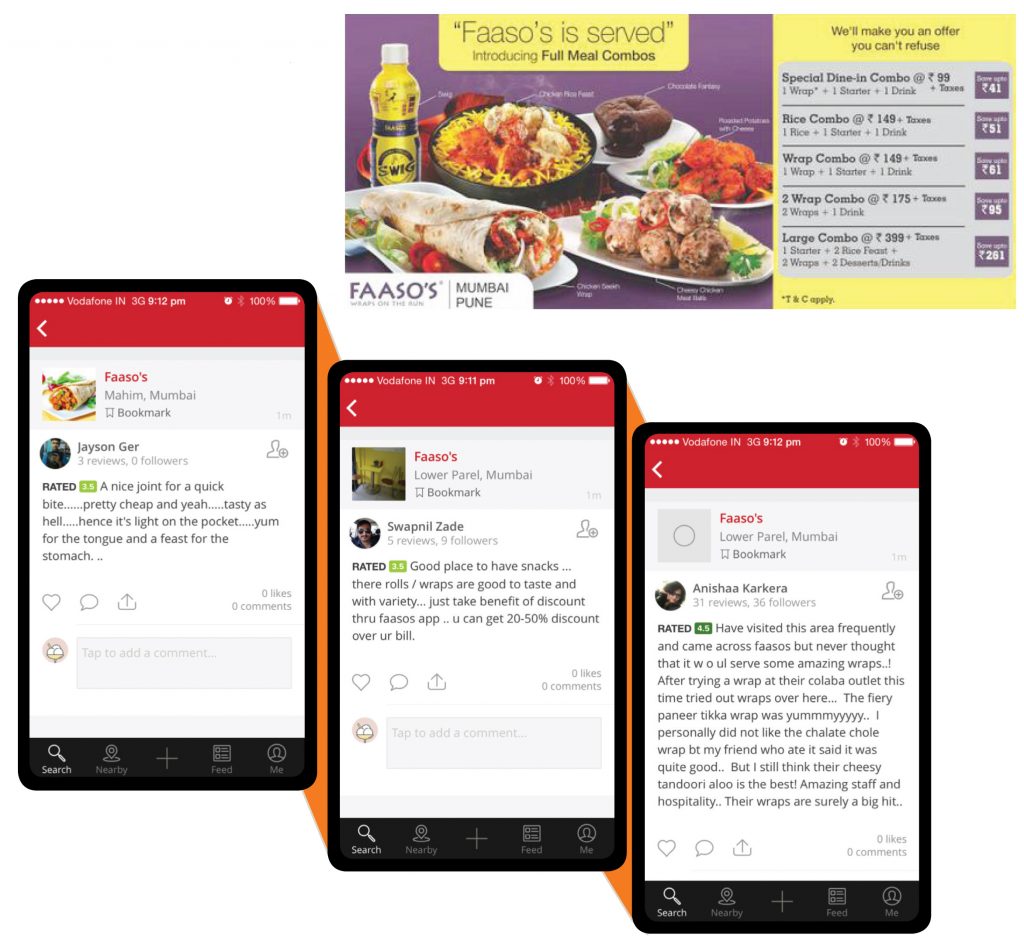

Faasos is a fledgling Indian QSR chain that serves wraps and rolls with an Indian twist. It also serves rice and other snacks. Faasos (Fanatic Activism Against Substandard Occidental S**t) was founded in 2003 by Jaydeep Barman, an IIM Lucknow alumnus, and Kallol Banerjee, inspired by kathi rolls served in Kolkata. Today Faasos has 85 outlets in six metros in India and plans to grow aggressively,by the end of 2015, to 150 outlets.

Faasos’ proposition is taste with value for money. Interestingly, Faasos competes in the meal replacement casual dining cate“ gory (CDR) and not necessarily in the QSR space. Eighty percent of its revenues are generated from takeaways and delivery. Delivery time is about 24 minutes, which is quicker than most fast-food chains. With this interesting proposition, it has bucked the market trend of slowdown in same-store sales with growth of 28% and 35% in Q2FY15 and Q3FY15 respectively. It has set an ambitious target of same-store sales growth of 50% in FY2016 and plans to become profitable over the next six months. The chain generates per store revenue of Rs9 mn a year.

Faasos has an amazingly quick breakeven of one month and a payback period of only 12-15 months, significantly lower than McDonald’s and Dominos. It is consistently investing in social media and has developed mobile applications for ordering. It is in IT systems for supply chain, which will make the business model leaner. Faasos’ management has the mindset of global restaurant chains and have secured funding from Sequoia, a venture capital and private-equity investor. Faasos is a promising company poised for long-term growth.

Mad Over Donuts (MOD) was started by Indian-origin entrepreneur, Lokesh Bharwani, in Singapore. Mr. Bharwani realized that though Donuts are very popular in the US & are consumed as breakfast or as anytime snacks, this category is almost non-existent in India. Due to the huge opportunity available in India, Mr. Bharwani shifted base to India and opened the first MOD outlet in India in 2008. Today MOD has 50 outlets in India, out of which 23 are in Mumbai.It serves donuts and coffee.

Reviews of MOD are consistently positive and many prefer MOD to Dunkin Donuts. MOD store locations are strategic and the company generates average revenue of Rs30,000 a day. MOD competes aggressively with Dunkin and the recently launched international chain, Krispy Kreme. MOD is another Indian chain with a promising future.

Subscribe to enjoy uninterrupted access