Over the last couple of years, India has seen much-anticipated frenzied launches of streaming media and video-on-demand giants – Netflix and Amazon Prime Video. In the same period, various broadcasters and content providers in India unveiled their over-the-top content platforms. Reliance’s launch of telecom services, especially data, at rock-bottom tariffs under the brand name JIO, has precipitated the question – are the business models of linear-TV providers under threat in India? Will India mimic the developed markets in the way media is consumed?

To get a grip on the real situation, GV interacted with many industry participants, content providers, and broadcasting companies to decipher: (1) the competitive landscape of the Indian broadcasting industry, (2) whether there has been any change in the video-consumption pattern of the Indian audience, and (3) how they plan to cope with increased penetration of connected devices.

Most Indian broadcasters are privy to the changing patterns of video consumption and realise that the number of screens via which a typical subscriber consumes content is multiplying. However, they seem to be unfazed by the entry of global giants in the OTT space, and believe that the Indian broadcasting space is unlikely to meet the same fate as their global counterparts. They accept that non-traditional TV viewing and non-subscription catch-up services will increase. Devices like smartphones and tablets will drive consumption of content on alternative internet-enabled platforms, particularly among younger audiences. However, for now, broadcasters believe these changes will merely open up new distribution platforms to monetise their content. Although increased connectivity presents challenges for them, as they attempt to navigate a landscape in which television is increasingly distributed and accessed online, they seem reasonably prepared.

The rising popularity of Over The Top (OTT) video (video carried along (or on top of) existing telecommunication pipelines and delivered to smart TV sets or to any mobile devices through the internet rather than through traditional cables or satellites) signals a major shift in US home entertainment. It promises to destabilise the traditional television ecosystem and threatens the business model of linear TV broadcasting. For many in the developed market, OTT is the future of televised or TV-like content consumption and is here to stay.

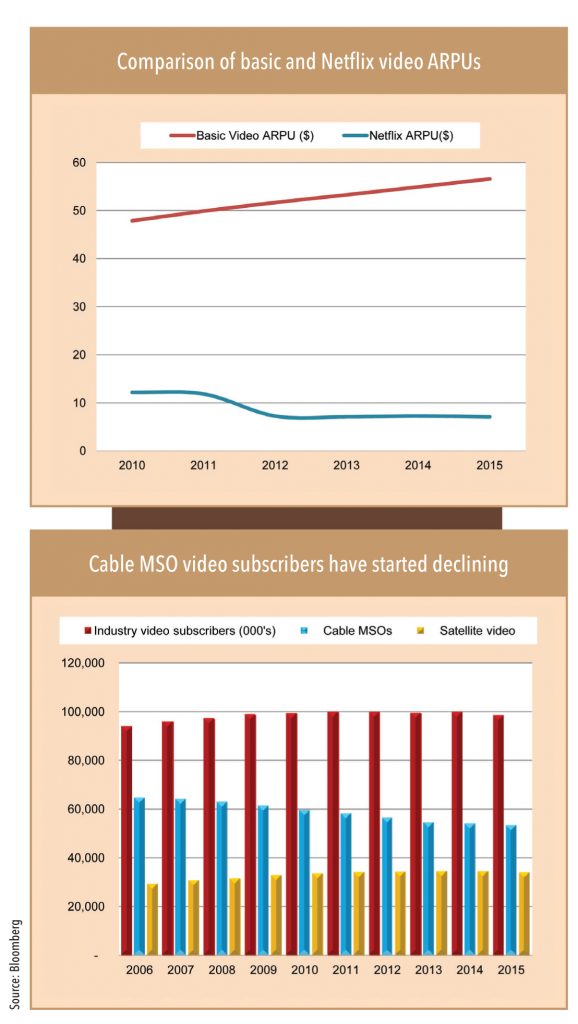

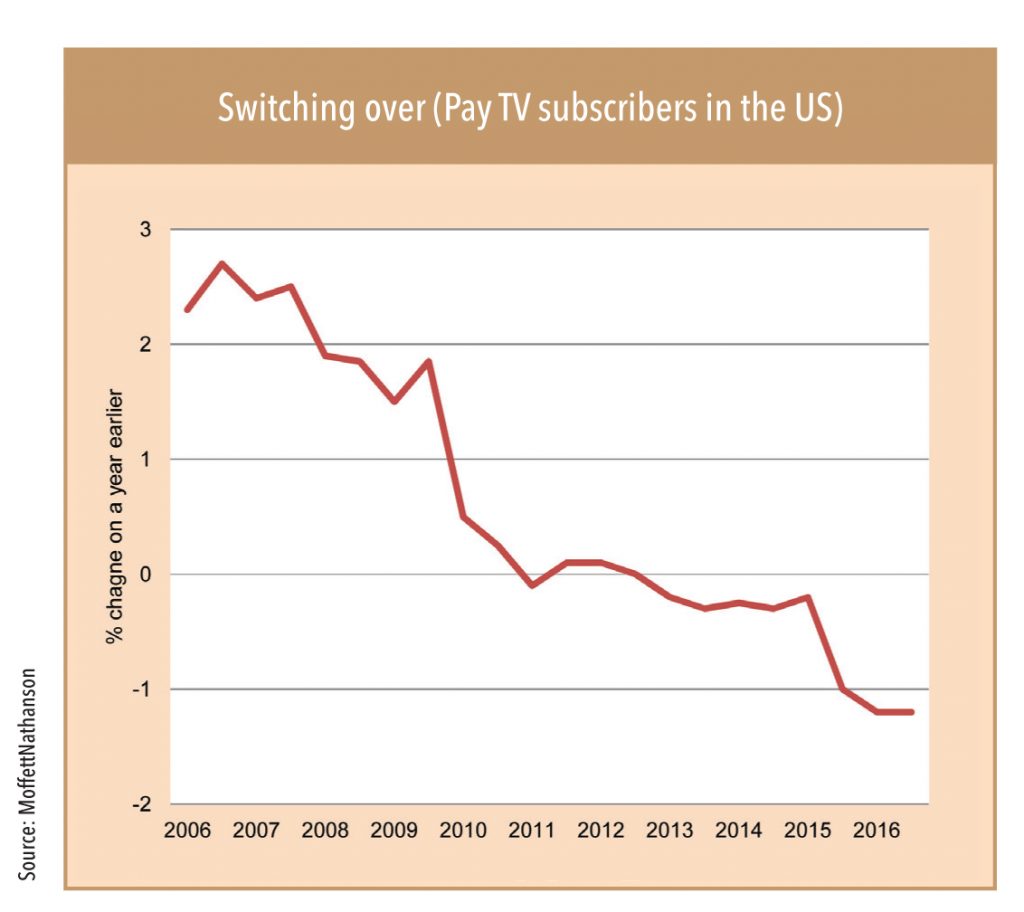

In developed markets, there has been a steady drumbeat of scepticism about the health of the traditional cable business. This is mainly a result of the growing phenomenon of “cord cutting” and the popularity of streaming services such as Netflix and Hulu. Industry experts have attributed the phenomenon to the high cost of cable TV services and viewers shifting to low-cost alternatives.

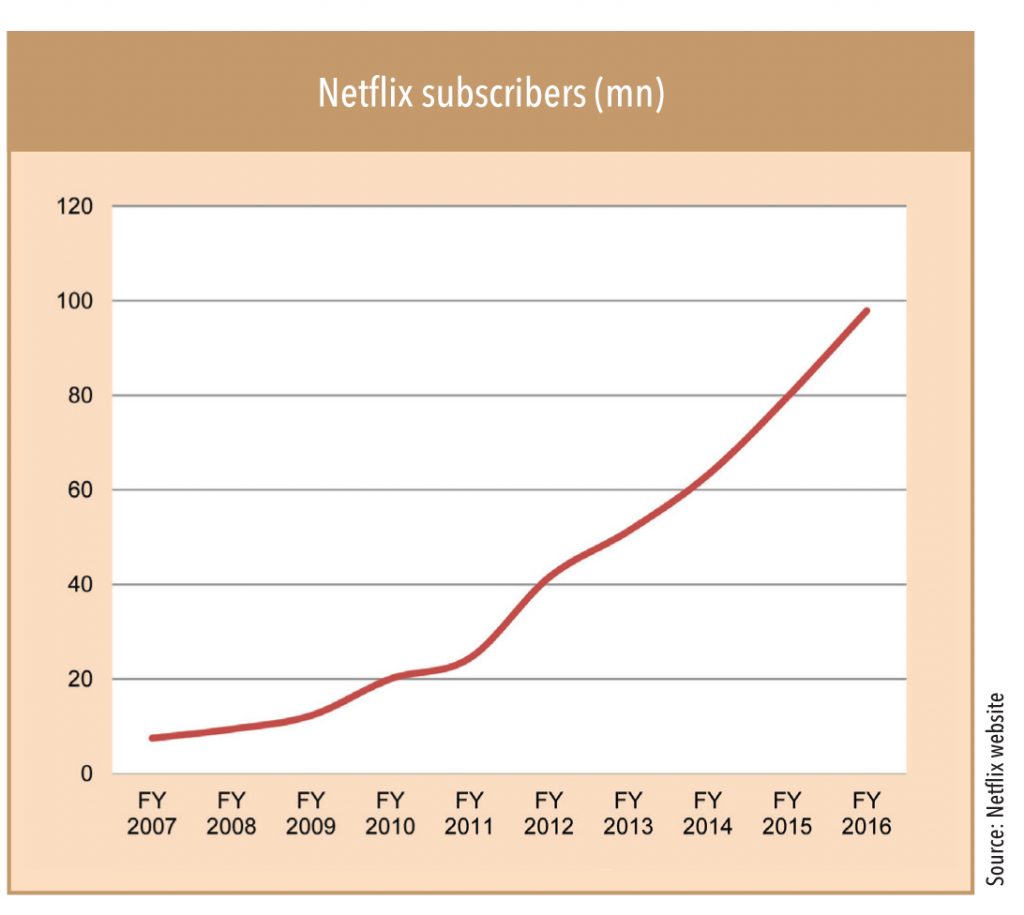

Netflix has had phenomenal success over the years as it expanded its footprint in the US, Europe, and other developed

nations. It streamed 42.5bn hours in 2015 and remains the poster boy of online video by a fair margin against its competitors. It has capitalised on consumer preferences and interests, and combined it with a compelling user experience to build a fast-growing and very loyal fan base. Consumers expect to stream the latest videos in high definition without buffering. Netflix says, “People love TV content, but they don’t love the linear TV experience, where channels present programs only at particular times on non-portable screens with complicated remote controls,” Netflix and other players that provide TV over the internet (on-demand, customised, and available on any screen) is replacing linear TV

The evolution of media viewing habits

In the US, radio was the first choice in home entertainment media for about 50 years until linear TV assumed control in the 1950s and ‘60s. Direct video into households was a remarkable improvement over radio as a medium to reach prospective audiences. The new period of internet TV, which started just 10 years ago, is probably going to be huge, given the adaptability and omnipresence of the web. In the past, television channels numbered just a handful and beamed programs on a fixed schedule.

As technology and connectivity underwent a sea change, people’s media viewing habits also evolved. Viewing is no longer limited to traditional linear broadcasts but encompasses catch-up and video-on-demand platforms, across both content and platform providers. Viewers are now able to decide what they want to watch, when they want to watch it, and where. The media landscape has continued to rapidly evolve in response to the rise of broadband internet and a wide adoption of internet-enabled smart devices. The high cost of cable TV in America is driving millions to “cut the cord” and subscribe to on-demand streaming services as inexpensive substitutes.

Internet TV is spreading rapidly because of: (1) the internet becoming faster and more reliable, while penetration of smart TVs and smart phones is rising, (2) consumers can watch content on demand, on any screen, and the experience is personalised to individual tastes, and (3) internet TV apps have frequent improvement updates, and streaming is the primary source of UHD 4K video content.

What are broadcasters doing to tackle the rising phenomenon of cord-cutting?

Linear TV (TV that is viewed at the time of broadcast) played an important role in subscribers’ viewing habits – it was particularly valued for event content, live sports, and other live events. Sector participants believe that if linear TV operators address certain negative aspects – such as excessive and distracting advertising, lack of personalisation, and no flexibility for catch-up services vs. on-demand services – they can stem their subscriber loss.

In order to address the growing demand of value-added services, networks are promising a significant increase in on-demand access to episodes of current seasons through set-top boxes, websites, and mobile apps. Similarly, pay-TV distributors are now pushing to make it the industry standard to “stack” each episode (after it airs on linear TV or at a pre-determined time) for video-on-demand in the duration of the show’s season. For example Comcast, US’ largest cable operator, will offer full-season stacks for 60% of original scripted series on the top-10 broadcast and cable networks, up from 31% two seasons ago.

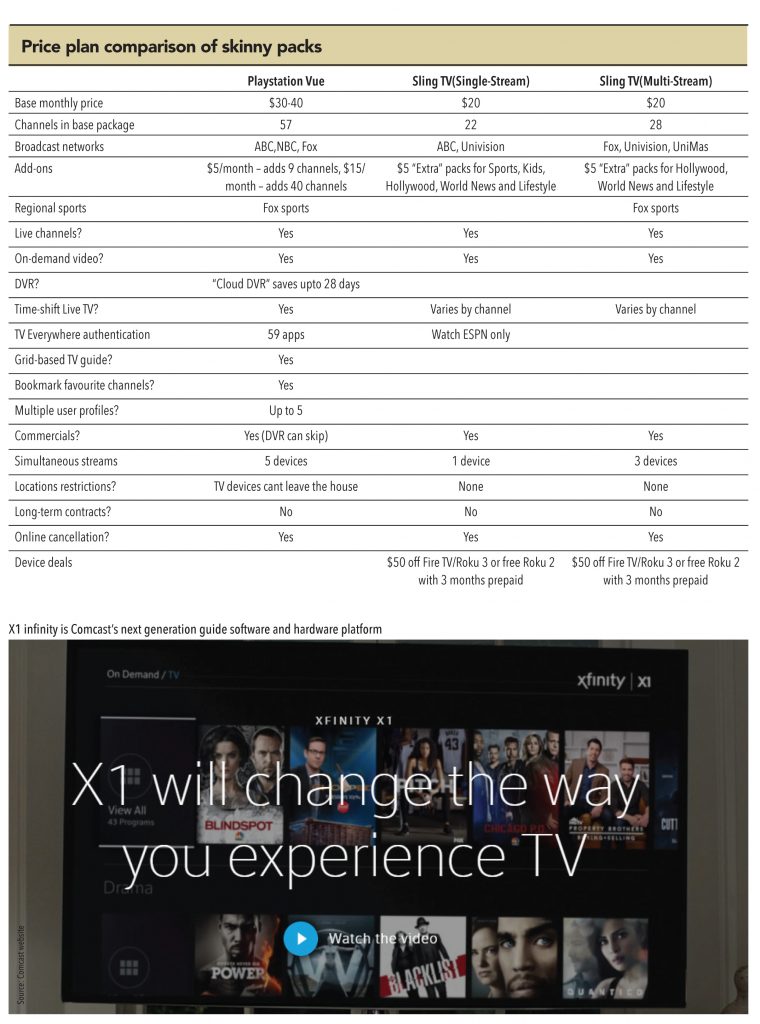

Similarly, there is proliferation of so-called “skinny bundle” service by various cable TV operators (Sling TV by Dish, Directv Now by Directv, Playstation Vue), which is basically an online streaming service of live television from a selection of well-known channels for as low as US$ 20 a month, with no annual contract. However, since US media companies license content with conditions attached (cannot record through Sling TV; on-demand viewing of previous broadcasts is available only for certain channels), several value-added services cannot be offered on skinny packs. But, this does address the concerns of a casual TV viewer who doesn’t want to shell out a bomb to subscribe to traditional cable-TV services.

Collaborations, new launches, add-ons

Cable TV operators have launched integrated platforms (like Comcast Xfinity X1) and have started providing triple-play services to subscribers to protect their household ARPUs. Cable TV companies are collaborating with Netflix and other streaming services and integrating them in their set-top boxes. These companies are also essentially internet service providers for customers; hence, it becomes difficult to cut the cord. X1 infinity service launched by Comcast quickly searches across live TV, on demand, and the DVR library, to find exactly what one wants to watch, and it even makes recommendations and gives shortcuts for what is most watched.

Launches of various add on services by cable-TV operators have helped them to not only slow down their churn, but also to start adding net subscribers over the last few quarters. Broadcasters are also launching streaming services, which are targeted at the cord-cutters. HBO Now is an over-the-top subscription video-on-demand service operated by HBO. It is available as a standalone service and does not require a television subscription, targeting cord cutters who use competing services such as Netflix and Hulu. This offers on-demand access to HBO’s entire library of original series, as well as original films and documentaries, along with acquired films from its library through the cable channel’s content partners (such as 20th Century Fox, Universal Pictures, and HBO’s sister company Warner Bros. Pictures).

CBS All Access is an over-the-top subscription-streaming video-on-demand service owned and operated by CBS. It offers original content, content newly aired on CBS’s broadcast properties, and content from CBS’s vast library.

Also, broadcasters are adding more original hours, increasing production costs, favouring in-house production, and introducing big stars to tackle the threat of rising popularity of non-linear TV viewing. The reason for this trend is two-fold. Viewership for reruns is lower than ever (and thus less profitable than ever) as streaming services with on-demand libraries of reruns win that market. Compounding this trend, the success of original series like Netflix’s “House of Cards” and Amazon’s “Transparent” are increasing competition.

The ascent of Netlfix and similar streaming services has offered viewers an alternative to broadcast television; they’ve also opened up a potential income stream for legacy shows and newer series produced by networks. Broadcast networks like ABC are now producing shows for Netflix (such as Daredevil).

Evolve or expire – if you can’t beat ‘em, join ‘em

The way a subscriber consumes content is evolving rapidly, and there is an ever-rising demand for various value-added services (catch-up, pause and play). Traditional broadcast networks have realised the rising threat of internet-TV and are now collaborating with these players to maximise their broadcast revenue streams; they are investing more in original content to suit the changing needs of their subscribers. Some have launched their own streaming services to target those customers who want to watch content on the go, thereby maximising their revenue streams. For example, Netflix in its recent earnings call outlined that it is going to spend over US$ 6bn on content – a huge opportunity for broadcast TV networks.

Similarly, traditional cable-TV and satellite companies are also evolving, and they have started providing various value-added services to tackle the threat of cord-cutting. They are now collaborating with on-demand service providers and providing triple-play services to reduce churn.

The rising popularity of on-demand services is therefore an opportunity for all stakeholders across the value chain.

Subscribe to enjoy uninterrupted access