“Activity in construction and automobiles determines the steel consumption scenario in India,”

– Mr Vinesh Mehta, Flat steel trader based in Mumbai

“Activity in construction and automobiles determines the steel consumption scenario in India,” says Mr Vinesh Mehta, who expects rising activity in these sectors to translate into improved steel demand. Mr Sandeep Goyal, Director, Bajrang Ispat appreciates the efforts of the National Housing Board, which increased real estate activity and led to a good uptick in steel demand in Raipur.

Real Estate: FY14 – negatively impacted; FY15 expected to improve

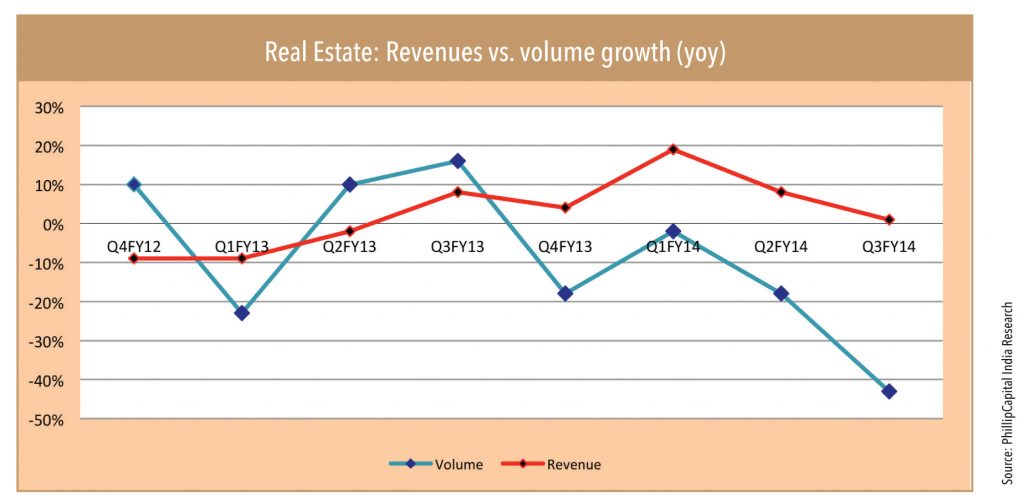

Rising real estate prices and weak sentiment had led to a slowdown in the overall construction activity in FY14. This can be seen from sales volumes of major real estate companies across India as well as the nationwide completion progress of units committed during CY13. All India volume growth for 25 major real estate companies, as compiled by Knight Frank, has been declining over the past year. However, corresponding revenue growth has been positive, implying higher prices impacted volumes.

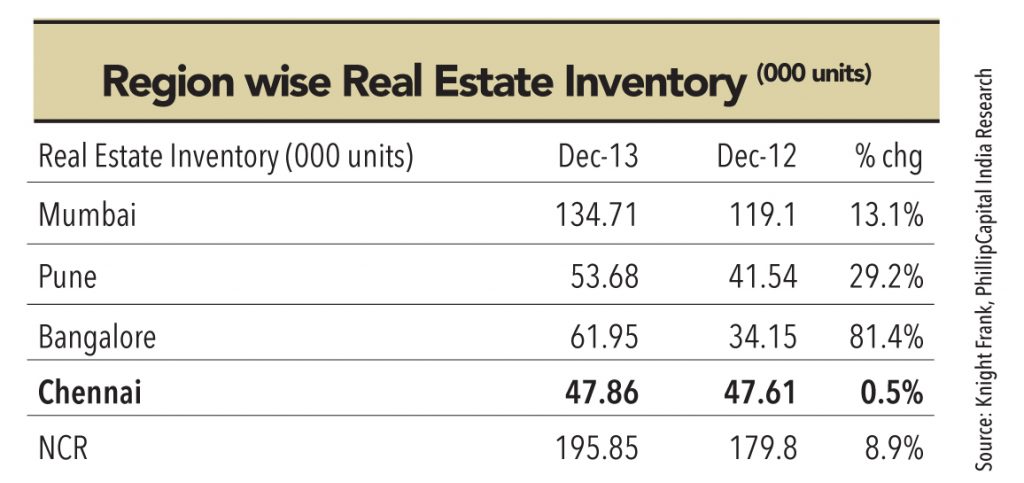

The slowdown in FY14 is also visible from the fact that total units completed in CY13 stood at 290,926 vs. a committed supply of 406,537. Increasing inventory in various cities was one of the factors that lowered execution.

Price hikes coupled with weak sentiments impacted volumes

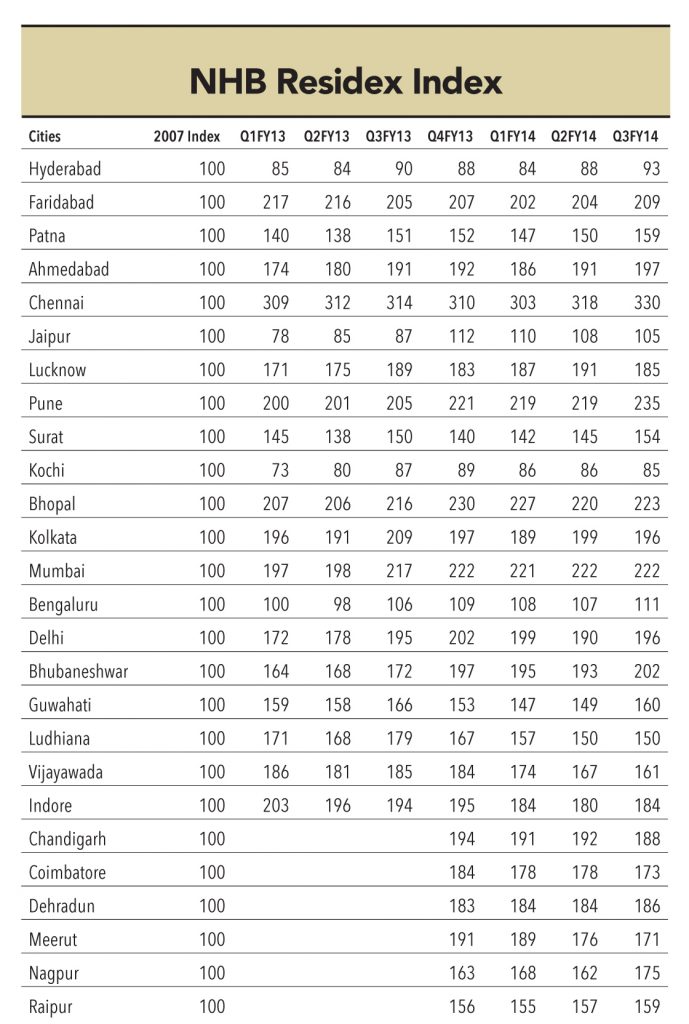

Increasing prices coupled with slowing growth impacted sentiments,which affected real estate volumes. National Housing Board’s Residex Index (index for real estate prices) shows the price increases over a period — 16 of the 26 cities reported price rises over the past year. Price hikes were prominent in the last 6 months with 18 cities reporting higher prices.

Activity to pickup from FY15

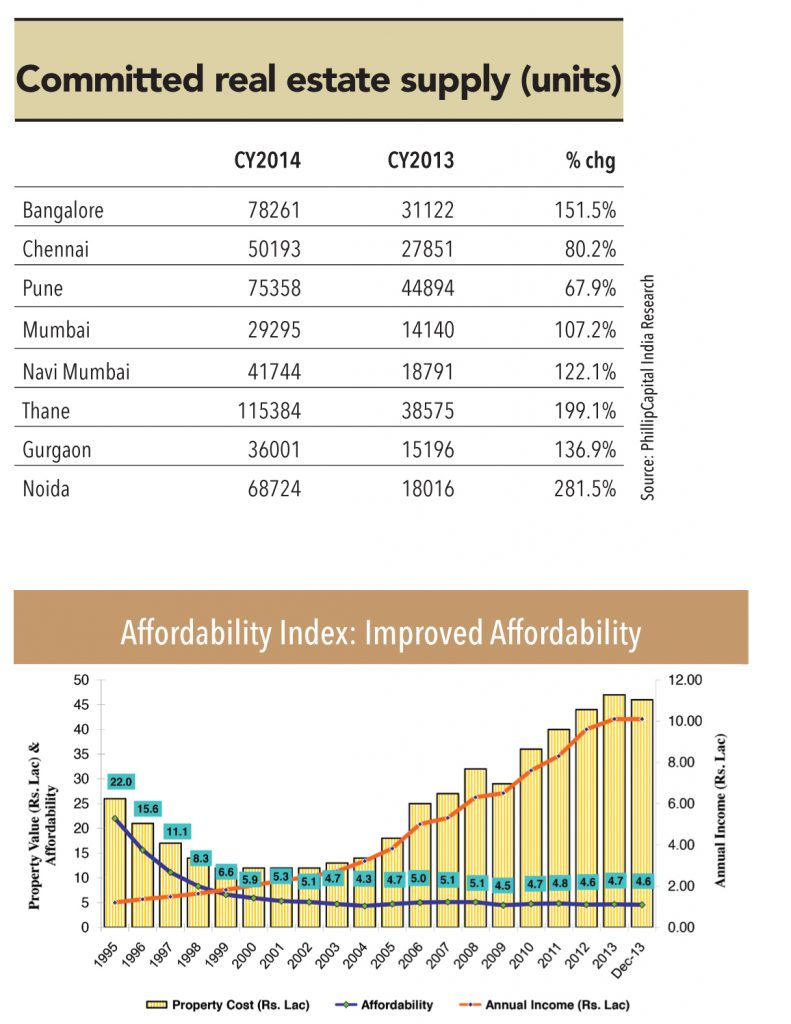

FY15 is likely to see an uptick in activity based on the committed supply for CY14 — note that the CY14 target is much higher than CY13 and taking into account backlog completion in addition to the fresh target, even if there is a slip up, overall construction would be higher than CY13. This bodes well for steel consumption, which can see growth in FY15. Committed supply for CY14 across India has seen a growth of 62% (659,789 units in CY14 vs. 406,539 units in CY13). This coupled with the backlog of the past year will see good pickup in steel demand in FY15.

A pick up in the industrial capex and improving sentiments towards growth in income will ensure further demand growth from FY16. Higher affordability as seen from the chart below will see the residential demand improve with improving sentiments. The demand improvement is expected despite the rising prices (see NHB Residex Index below) because of perception of better growth prospects.

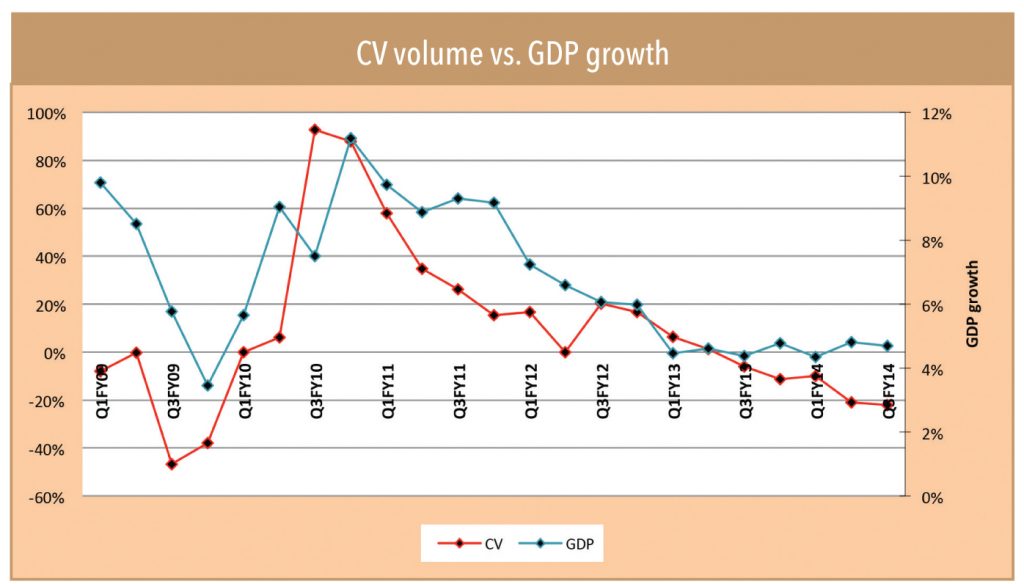

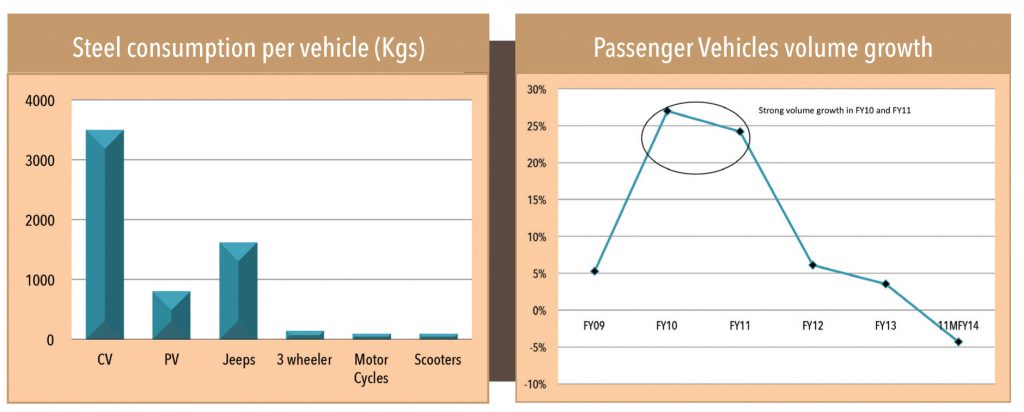

The automobile sector accounts for around 12% of the overall steel consumed in India. A slowing economy has taken its toll on the sector with both passenger and commercial vehicle sales dwindling for more than a year. The two-wheeler segment has shown resilience with strong sales defying the slowing economy. However, two wheelers have been growing at the cost of passenger vehicle sales and this does not augur well for overall steel consumption, as the amount of steel consumed in a two-wheeler is a fraction of that in the PVs and CVs.

Can the auto segment be a saving grace for steel demand in FY15?

The sector performance is likely to be mixed going ahead and two-wheelers are likely to continue strong volume growth. Recent excise duty cuts and replacement demand will help the PV segment buck its current declining trend and show some revival. However, overcapacity and low economic activity is expected to impact the already ailing CV segment in FY15. Steel demand is expected to see some uptick in FY15 (pinning hopes on the PV segment), but healthy growth will happen only in FY16 with an expected recovery in the PV and CV segments.

PV segment

Excise duty cuts and replacement demand to help boost volumes: After seeing strong growth in the last five years, PV volumes (domestic as well as exports) have softened in FY14 with 11MFY14 registering 4.3% fall. The slowdown in the domestic market was partly offset by strong exports. Domestic volumes declined by 6.7% yoy in 11MFY14 whereas exports grew 7% helped by rupee depreciation. The recent excise duty cut (in Feb 2014 to 8% from 12% earlier) and replacement demand for cars will help volumes grow in FY15 and FY16. Strong volume growth in FY10 and FY11 is expected to drive replacement demand, assuming a 5-year replacement cycle.

CV segment – still a while away:

Slowing domestic demand and significant capacity created in FY10 and FY11 impacted CV volumes in FY13 and majorly in FY14. Overcapacity was accentuated by the iron ore mining bans in Karnataka and Goa. CV volumes fell 3% in FY13 and have seen an almost 19% yoy fall in 11MFY14. These volumes are not expected to pick up materially except for significant ramp up in the overall economic activity in India. Easing of the iron ore mining restrictions and increasing output will also play a major role in industry utilizations and hence the volume growth.

Subscribe to enjoy uninterrupted access