1.Changing consumption patterns

Over the past decade, the Indian market has seen a strong structural shift in terms of consumption pattern of tiles driven by variables such as innovation, price efficiency, and installation costs.

2.Favourable mathematics

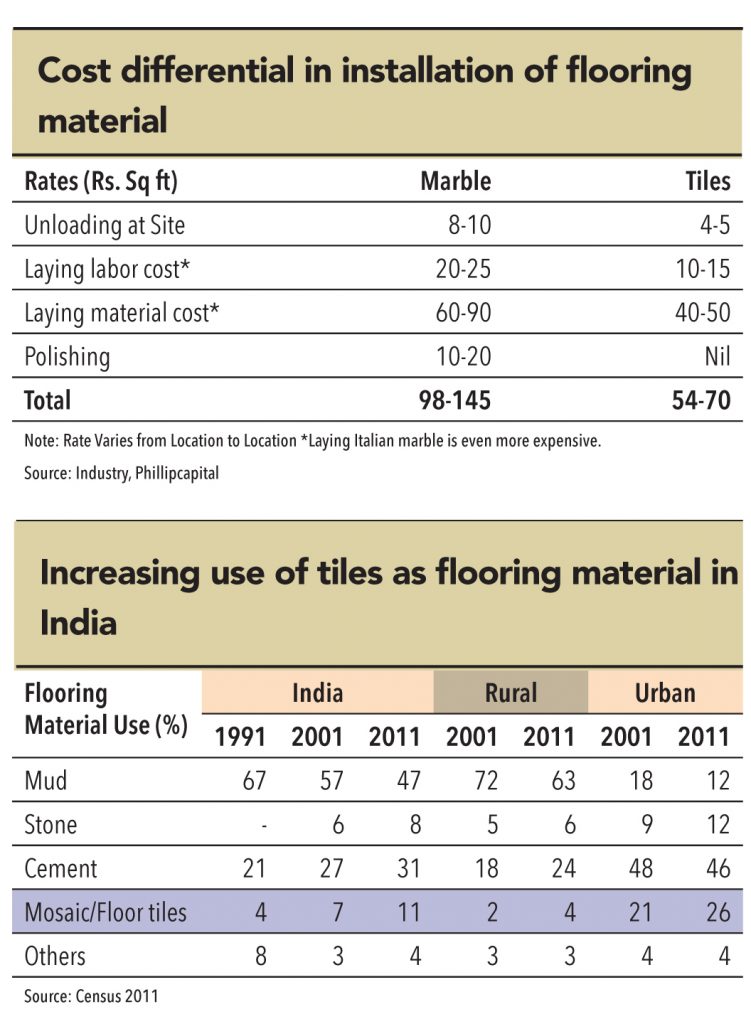

Over the past decade and half, ceramic tiles of all hues (soluble salt, vitrified, PGVT) have found an increased acceptance over traditional Indian flooring materials such as marble, kota stones, granite, and mosaic). Competitive per-unit costs of purchase, lower installation cost, shorter lead times to delivery, and ease of installation, are key variables influencing purchase decisions in favour of tiles

Tile Industry: Structural shift towards vitrified tiles

Interactions with architects, real estate developers, tile manufacturers, and government agencies showed that there is solid growth argument for the domestic tile industry.

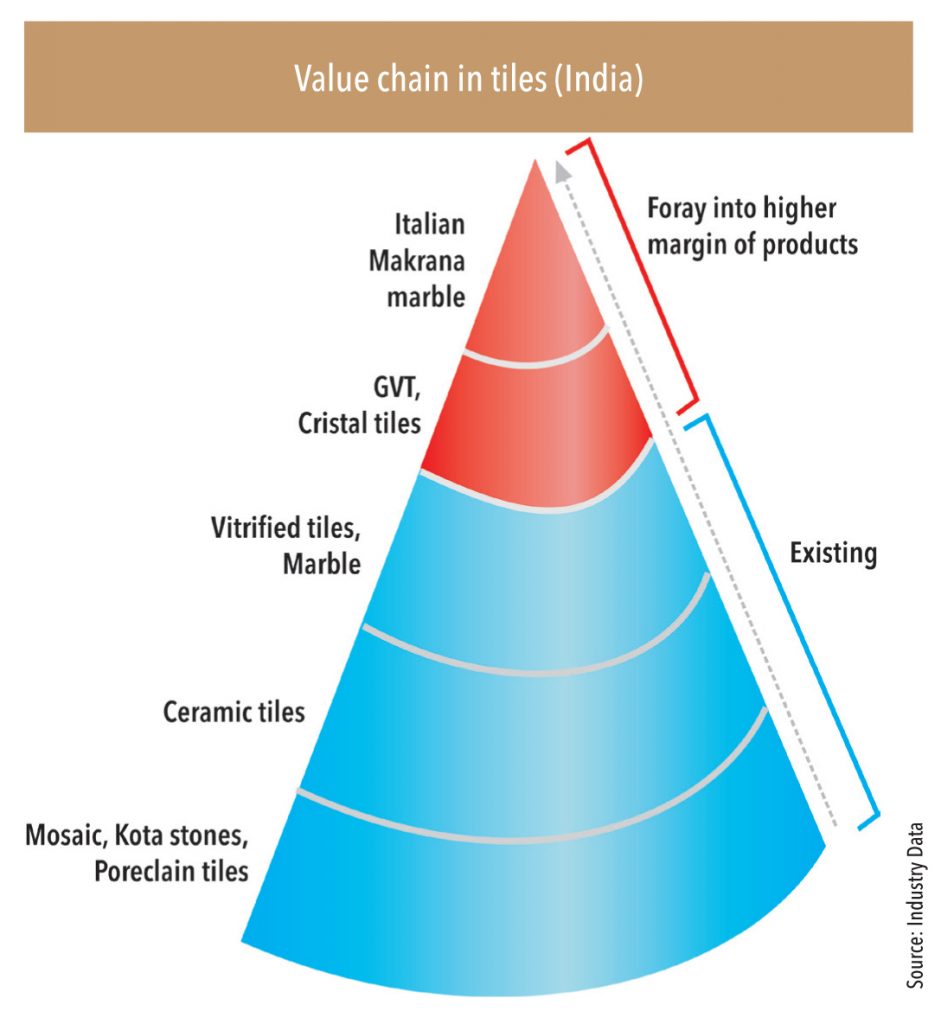

3.Moving up the value chain

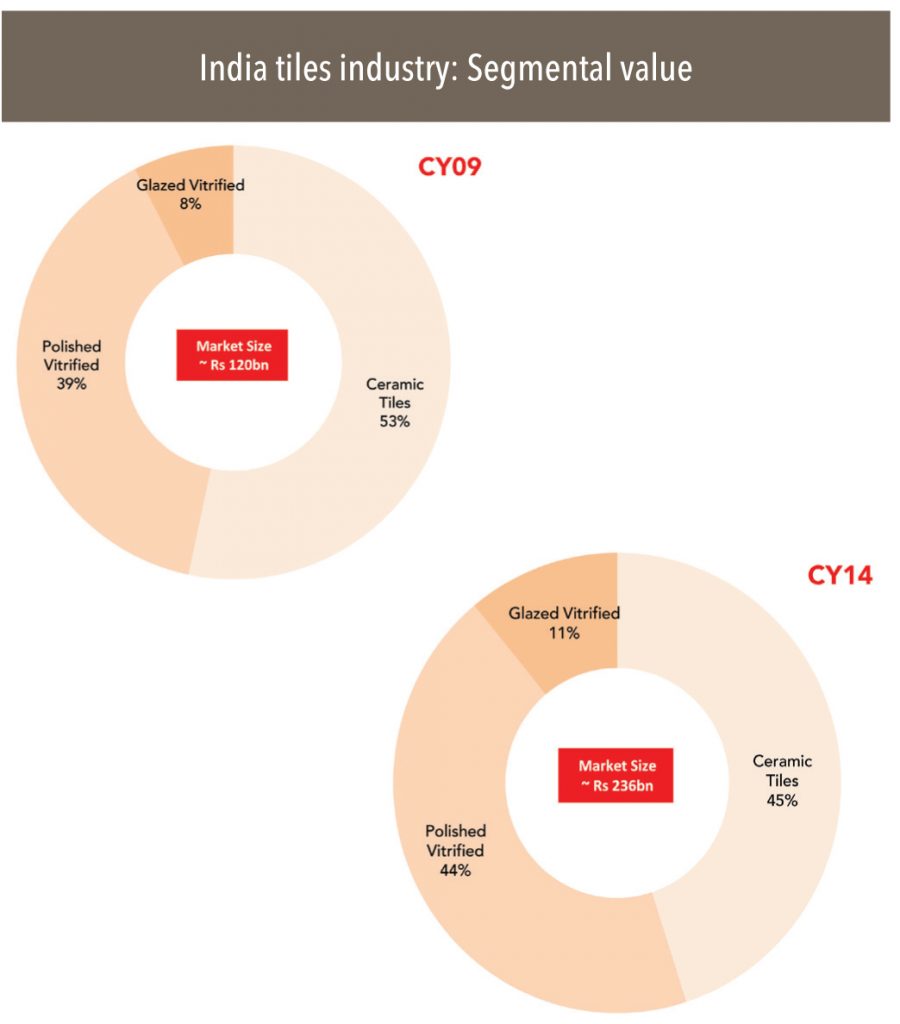

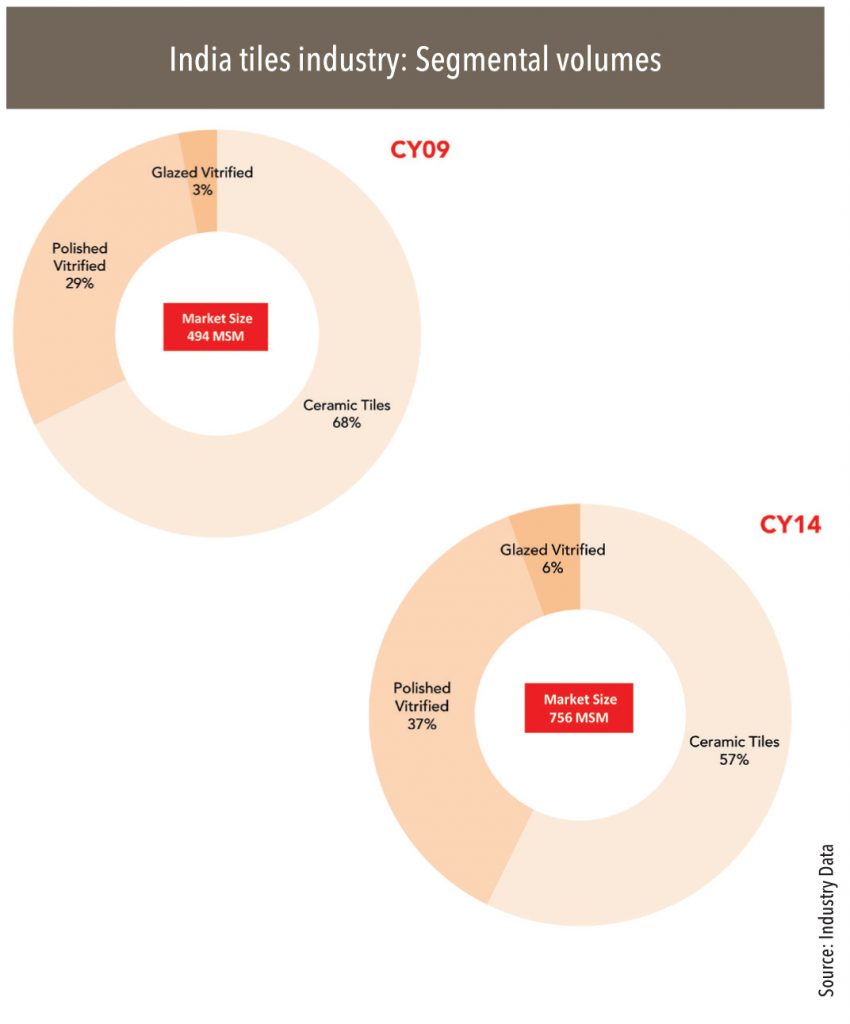

The upward migration in the ceramic-tiles value chain is most visible in its segmental consumption – while volumes of the domestic tile industry saw 10% CAGR in CY09-14, polished vitrified tiles (PVT) and glazed vitrified tiles (GVT) CAGRs were 14% and 23%. Increasing affordability and a wider variety have seen consumers upgrade their choices from a decade and half ago.

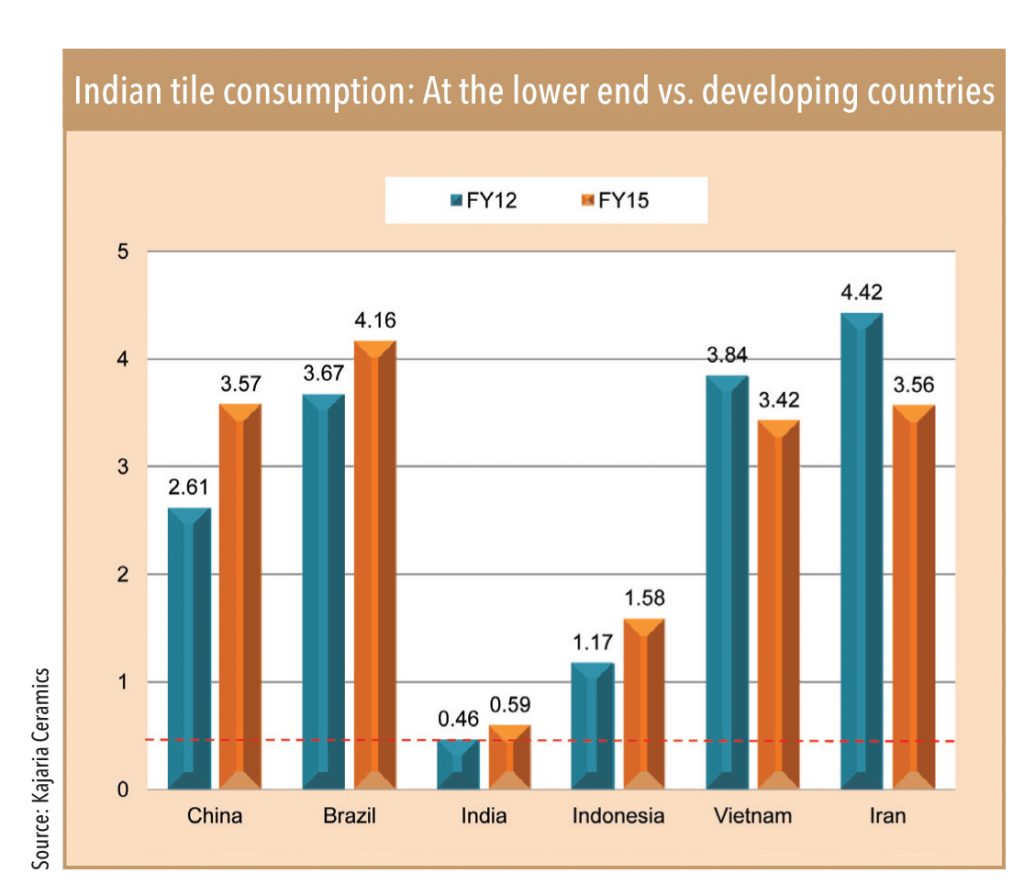

4.Low per-capita consumption

The potential for the industry is significant, considering the low per-capita consumption of ceramic tiles in India – at 0.59 sq. mt. per person vs. more than 2 sq. mt. per person in countries such as China, Brazil, Vietnam, and Iran.

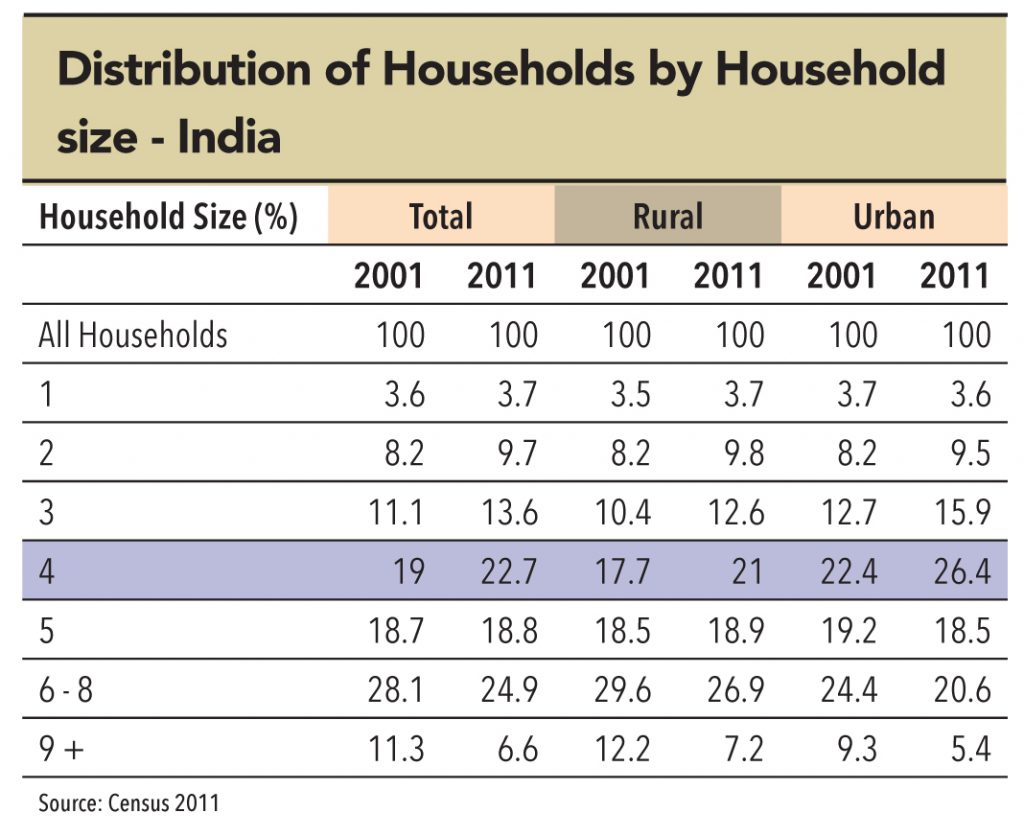

5.Rising incidence of nuclear families

With the average Indian household size expected to decline to about 4.4x from 4.8x, demand for housing units is expected to increase by ~10mn units (Source: Kajaria FY15 Annual Report). With ~35% of India’s population between 15-35 years, demographics seem to support housing demand driving consumption of tiles over the next 15 years.

6.Continuing urbanisation

With ~10mn people moving to Indian cities each year and per-capita income in urban India expected to treble to US$8,300 in 2028 from US$2,800 in 2012, the construction of new housing units is a likely source of demand for tiles (Source: Kajaria).

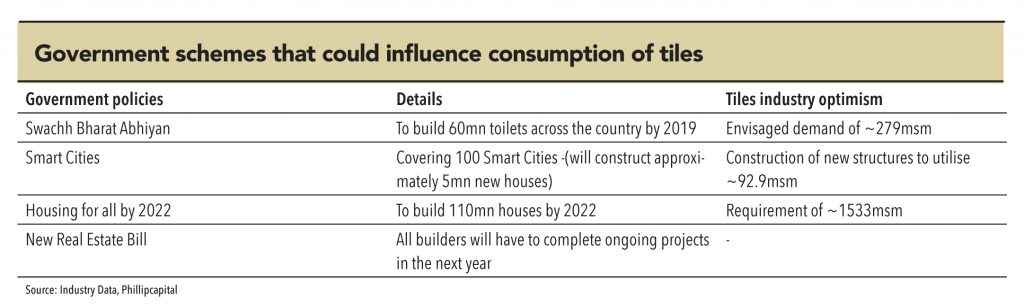

7.Increasing government spend on the social sector

The implementation of several crucial policies should facilitate investment and accelerate construction activities. These schemes aim to meet the needs of around 40% of India’s population and hold significant promise for the prospects of the Indian tile sector.

8.Ease of use

Other traditional flooring materials (marble, Kota stone, granite) still pose a formidable threat to tiles at the higher end of usage. However, lower installation costs and uniformity in quality have seen these traditional choices being replaced by ceramic tiles in India over the past decade, especially in the middle of the customer pyramid.

9.Better affordability

Economies of scale and lower fuel prices have seen a dramatic reduction in production costs for ceramic tiles. Coupled with an increase in average domestic disposable income, ceramic tiles have found widespread acceptance as flooring material.

Subscribe to enjoy uninterrupted access