While two-wheelers are likely to be more dented due to BS6, things are not so bad for the passenger vehicles segment

Gasoline cars – Minor ‘make-up’ needed

What’s changing in gasoline PVs after BS6?

1) Non Methane Hydro Carbon (NMHC) parameter has been introduced for the first time in BS6.

2) Mass of particulate matter has also been introduced for the first time.

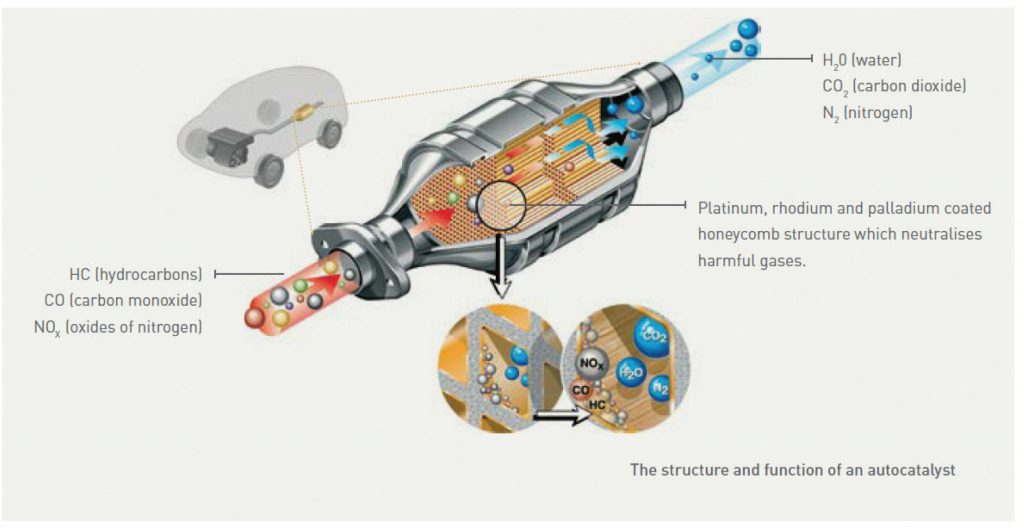

Industry veterans said that gasoline cars would need only mild changes to adhere to BS-6 norms. In the petrol engine, major changes have been made for carbon monoxide (CO), and hydrocarbons (HC) and Non Methane Hydrocarbon is added as separate category. “This is a minor challenge and can be controlled by increasing the thickness of the catalyst coating on the substrata of the honeycomb structure in the three-way muffler,” says an R&D expert at a leading OEM.

Palladium group metals (PGM) – namely platinum and palladium – are coated on the muffler to capture excess CO and HC, while rhodium reduces NOx. In BS-6, PGM coating will be increased by 50-100% leading to a cost pressure of c. Rs 12,000-24,000. Mr Matthew Beale, CEO of CDTi Technologies, a USA-based leader in exhaust emission control technologies said that with strict BS-6 norms, the demand of PGMs will increase substantially, making India a very good market for his company. CDTi would supply its advanced material technology to Indian OEMs through its JV with Sud-chemie, he was happy to note.

Industry opinion – BS-6 to be a cake walk for petrol cars compared with diesel cars

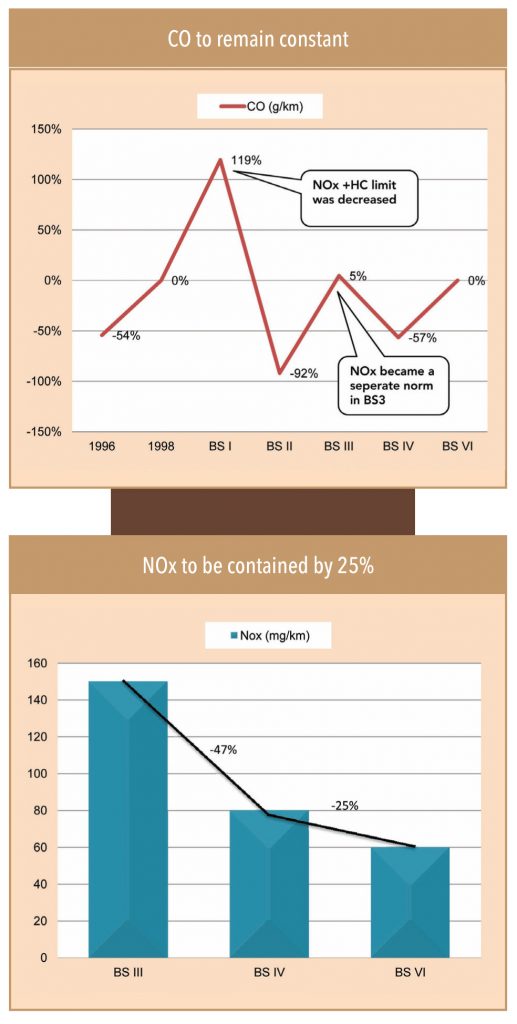

NOx limit has to be reduced by 25% only in the case of petrol vehicles. NOx is produced at high combustion temperatures in the engine. Temperature in the petrol engine is relatively lower (vs. diesel) so no additional ‘after treatment’ is needed for NOx control. Extra sensors would be installed for monitoring the temperature at exhaust and emissions. “Keeping the engine temperature will be one of the key focus areas for gasoline. Overall, the cost impact on gasoline vehicles would be very minimal,” said Atul, an R&D person working with an OEM. Turbocharger usage would also increase in petrol cars after BS-6. Turbocharger will help to produce the same BHP with a smaller engine, hence decreased PM emission.

What’s changing in diesel PVs post BS6?

Many diesel cars would be a ‘totally new machine’ with the same brand name

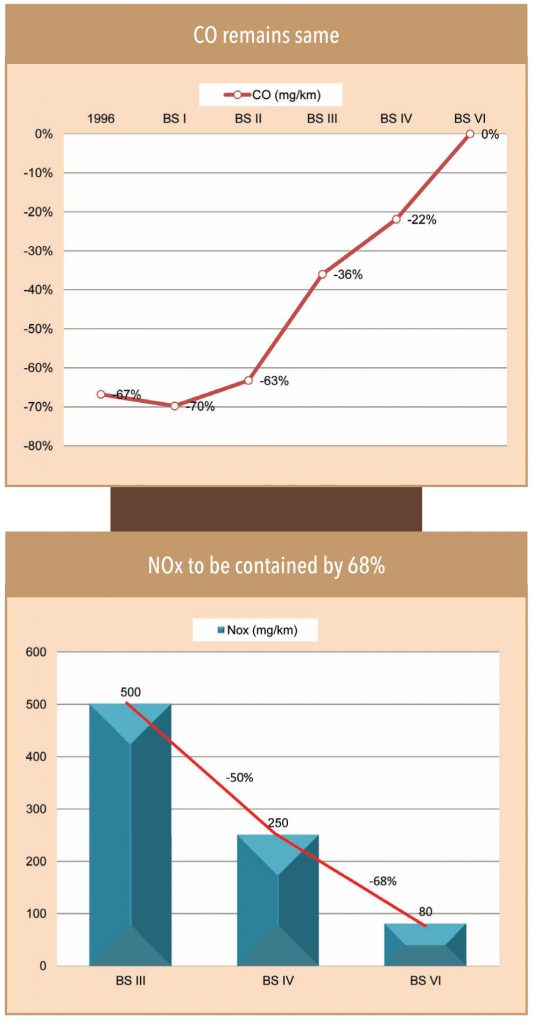

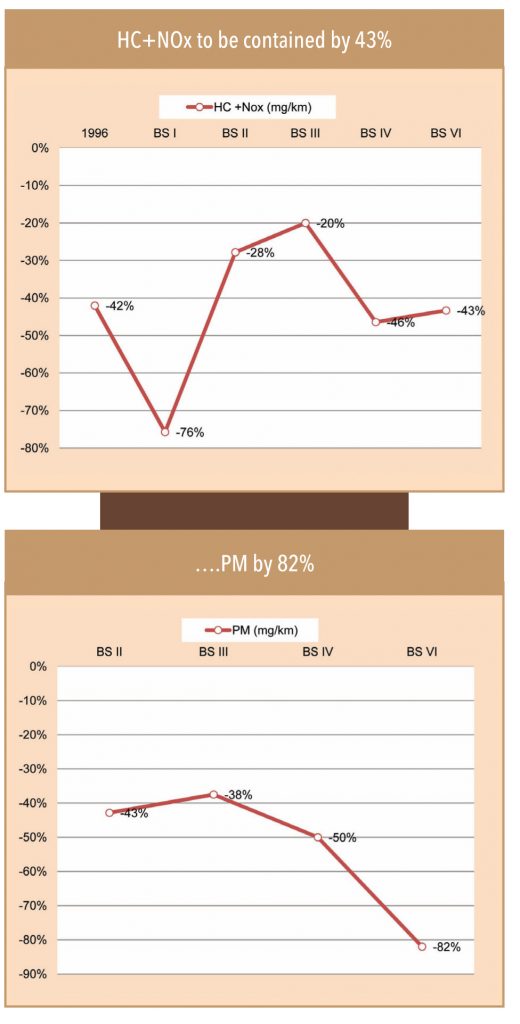

There will be significant tightening in the emission norms of diesel passenger vehicles. NOx limit has to be reduced by c.70%, particle matter by 92.5%. In order to comply with these norms, OEMs would need to take quantum leap in technological advancement. Diesel vehicles above 1.5-litres capacity will be impacted the most. An industry expert from a global OEM who is currently working on its fleet conversion to BS-6 said, “Many diesel cars would be a totally new machine in the same body with the same name, with SCR fitting being the biggest challenge.”

These reforms can be divided broadly into two categories

A) Intake system and engine reforms: Control the generation of NOx and particulate matter

B) Improving of exhaust system: Filter the exhaust gases before finally releasing them in the environment

Intake system and engine reforms: Led by changes in fuel injection systems and more sensors

In order to comply with BS-6 norms, two things need to happen – (1) fuel combustion has to increase to the maximum extent in order to decrease the particulate matter, and (2) temperature must be controlled inside the chamber in order to decrease the NOx emissions (NOx is generated at high temperature). This will be done by managing air/fuel ratio in the mixture in combustion cylinder using electronic fuel injectors. “Companies currently using mechanical fuel pumps will now shift to electronic fuel pumps. The quantity of fuel will be controlled by ECU for a particular air fuel ratio in order to maintain the combustion temperature within a particular range, which will minimise NOx emission and maximise fuel combustion to minimise particulate matter generation,” said a technical expert. Even fuel injectors will undergo an upgrade. For example, Bosch will upgrade its fuel injectors to the ‘KS’ series from its ‘K’ series with the aim of reducing friction by changing the nozzle diameter.

Currently, most engines have just one sensor on top to measure the temperature of the entire engine. Going forward, there will be multiple sensors to measure the temperature of cylinders individually. This is to manage the temperature per cylinder, which will help reduce NOx generation even further. The data from these sensors will work as an input for the electronic fuel injector.

A production manager at a leading global fuel injection company said: “While sophisticated fuel intake systems are already developed in western countries, for India it will be more of a technology transfer. However, it will still need a lot of investment in machinery and validation OEMs. Due to time constraints in developing products locally, initially, import content in the products will be high. But localisation of parts will increase eventually, thereby decreasing costs.”

Intake system and engine reforms would mainly imply improving piston rings, engine linings, turbochargers, fuel pumps, and adding more heat and pressure sensors. Cylinder profile in the engine is being improved by using special coating to decrease friction. However, the cost implication of this will be minimal compared to the overall cost. EGR coolers will be introduced to control the air temperature at intake, hence the combustion temperature. Traditional pneumatic turbo chargers will be replaced by electronic turbo chargers in BS-6 diesel passenger vehicles in order to control the intake of air, thus managing the temperature.

Exhaust system reforms: Might lead to the squeezing of sub-4mtr diesel cars

Exhaust gases need to be more filtered (within the prescribed limit) under BS-6, with the aim of causing minimum harm to the environment.

Passenger cars running on diesel will have to undergo a major upgrade in their exhaust system. Currently, lower horsepower cars do not sport a diesel particle filter, but they will have to add this under BS-6 in order to decrease the particulate matter in the exhaust. While the cost implications are small (c. Rs 3,000), DPF might mean an increase in bonnet and car size, thereby losing the excise benefit that a sub-4-mtr car enjoys. OEMs are working hard to customize DPF as per a model’s requirement so that they don’t have to increase the size of the vehicle. Larger diesel engines (1,600cc+) face big challenges as they would have to adopt SCR, which is expensive, along with additional catalyst coating. Mr Jain, an employee with a leading SUV manufacturer says, “Additional catalyst coating itself would cost us at least Rs 15,000. SCR cost is even higher. We are dealing with a total cost pressure of over Rs 60,000.”

While these technological changes seem as simple as ‘plug and play’ from developed nations, it really isn’t that easy. For instance, urea used in SCR technology becomes very dense at colder (sub-zero) temperatures, therefore it comes with a pre-fitted heating system in Europe. However, this is not needed for most Indian geographies. DPF is widely used in diesel cars, but it can’t be used straight away in India as most cars sold in the country are less than 4mtrs long. Customisations are not only time consuming, but also entail higher investment and R&D.

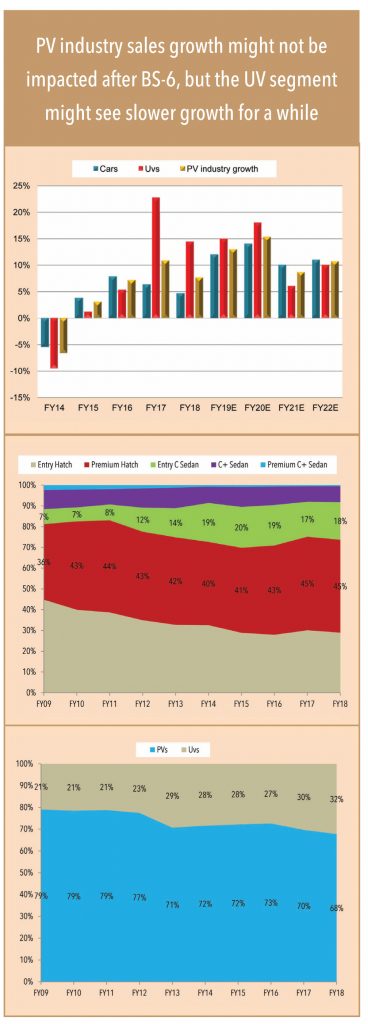

PVs might be the least impacted segment due to the BS-6 transition, but there could still be two major shifts:

(1) The compact sedan segment, which currently forms c.20% of passenger car sales, could see a substantial shift towards petrol, if Indian OEMs are unable to customize DPF and fit it in smaller diesel cars (maintaining the 4mtr length).

(2) SUVs might also see a shift to petrol as diesel SUVs would need to take a Rs 75,000-100,000 price hike, which would further increase the price differential between a gasoline vs. diesel engine SUV. A case in point – the difference between a petrol Hyundai Creta and a diesel one is c. Rs 200,000 currently. This will increase to nearly Rs 300,000 after BS-6, leaving no incentive for a buyer to go for the diesel version.

If this is the outcome of BS-6, Maruti, who is the king in gasoline vehicles in India today, could win a big share of the SUV segment. There could also be a pickup in the sales of ‘mild’ hybrids.

Subscribe to enjoy uninterrupted access