The Indian chemicals industry has traditionally been oriented towards domestic consumption, unlike China, which was focused on low-cost manufacturing and exports. Naturally, a steadily growing domestic market (the last seven years’ domestic consumption volume growth was 6%) has been a key success factor of Indian specialty chemicals. However, something has changed now. The Indian chemicals industry (largely focused on specialty chemicals) seems to be all set to ride on the huge exports opportunity flowing in from China’s policy-bound curtailment of production and exports of chemicals.

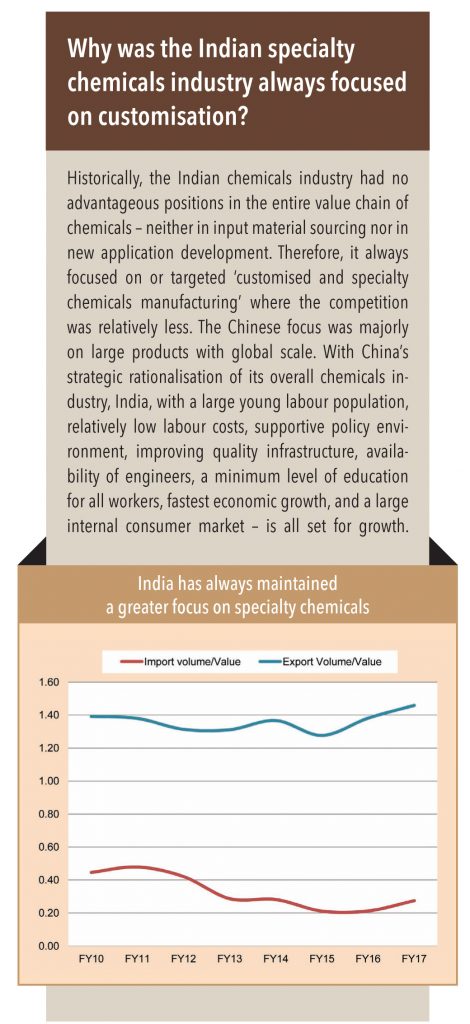

The key question here is: How well positioned really is the Indian Industry in terms of grabbing this visible opportunity? It’s not just the exports opportunity emerging from China’s slowdown that excites the Indian industry though; stabilization in chemicals prices (with lesser likelihood of Chinese dumping) and MNCs’ shifting focus towards India (from China) as an alternate source of chemicals – both factors have boosted growth visibility for the Indian industry. While China’s chemicals exports into India declined 14% over the last two years (indicating less dumping), China’s key advantage of low labour costs is no longer a reality. This, coupled with the rise in its operating costs due to compulsory effluent treatments makes India a preferred destination for chemicals sourcing for global peers. In addition, India’s traditional focus on customisation (against China’s “global-scale play”), import substitution, and rising adoption of vertical integration – all bode well for the long-term health and accelerated growth of the Indian chemicals/specialty chemicals industry.

In a strange twist, China’s new five-year plan (with prime focus on “innovation” and “environmental protection”) actually complements India’s chemical industry in two ways:

1. Through innovation, China is focusing on moving up in the chemicals value chain by reducing overcapacity in basic chemicals. This is already resulting in price stabilisation, because of no/less dumping

2. China is developing R&D capability in selected specialty chemicals with global scale potential, but not in limited-size opportunities with customisation – which has been a traditional focus of the Indian industry.

The Chinese chemicals industry is almost equally distributed among state-owned enterprises (SOEs), multinational companies (MNCs), and private companies. Over the last few years, MNCs expanded their base in China, lured by its large domestic market (the largest in the world in fact), its low-cost advantages, and supportive regulatory/government agencies. However, the industry dynamics changed dramatically with the nation’s changing priority – from traditional regional economic growth to structural qualitative progress, which resulted in policy uncertainty, a spike in operating costs, and ultimately, increasing discomfort for MNCs in China. This could prove to be one of the key growth drivers for the Indian industry, as these unique circumstances position India as a prominent alternate hub for sourcing various chemicals.

Mr Jan Kreibaum, country head of Clariant Chemicals, China, said, “China’s drive for pollution control and environmental safety will last long, and the consequent relocation of a large part of the Chinese chemical industry is a must. KPIs of local party authorities are now linked to their achievement on environmental protection. So, policy restrictions are the new norm for the chemicals industry in China. Simultaneously, labour problems have accentuated and the operating costs (including input material, energy cost) saw an upward move, adding to the woes of the MNCs. Therefore, multinationals are on the lookout for an alternate sourcing base for various chemicals, including India”.

However, Mr Jan also believes that the ongoing environmental policy constraints would wipe out small and marginal players, resulting in industry consolidation, benefitting MNCs that are serious about China (i.e., those who are in China for China).

Dr Hu explains further, “Operating costs and material prices have jumped recently, and MNCs are certainly finding it difficult to pass these on to their customers outside China. Hence, most established MNCs are operating with an “in China for China” objective. Additionally, the frequency of inspections for chemicals manufacturers has become as high as a couple of times in a week.”

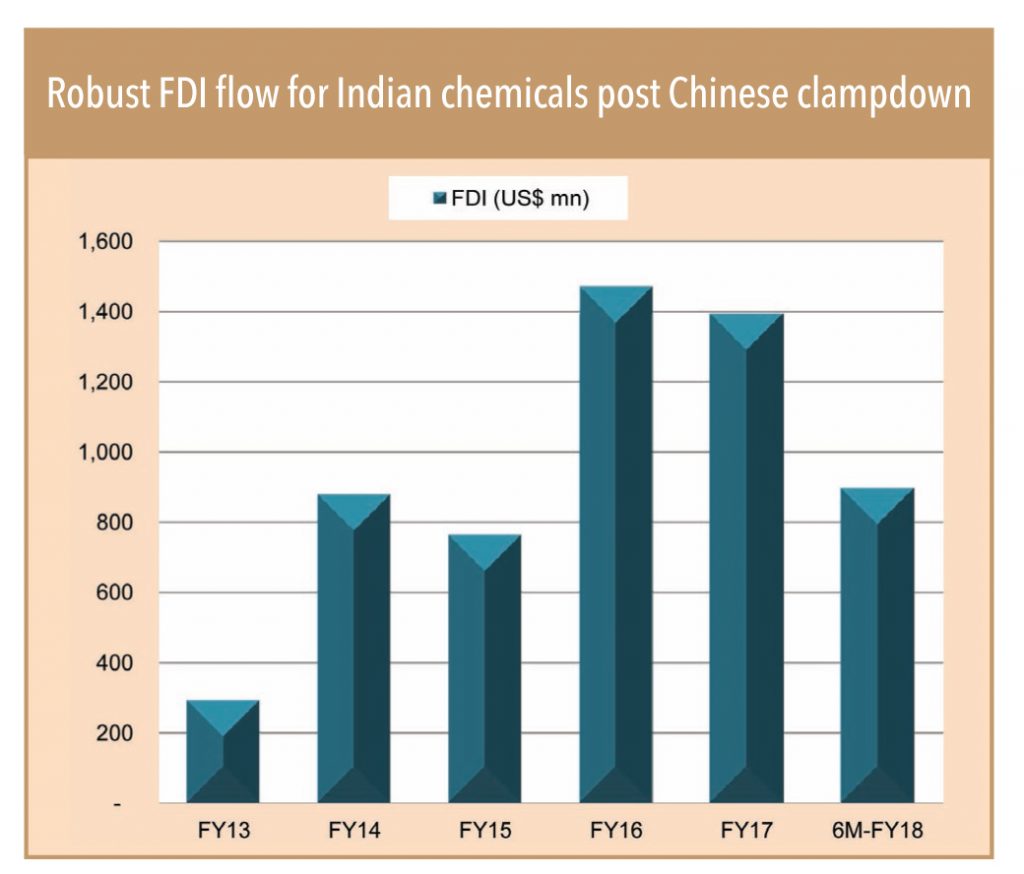

MNCs’ rising interest in India (either to de-risk their chemicals procurement, or to participate in the fastest growing chemicals market in the world) is visible in the doubling of FDI inflow into India in FY16, and in the similar momentum maintained throughout FY17 and 6MFY18 – by which time annualised FDI inflow into chemicals at +US$ 1.5bn seems to be a record high.

Slowing Chinese exports of chemicals throws up great exports visibility for India, but how geared up is India to provide such a large manufacturing capability? India currently plays a very tiny role in the overall global chemicals and specialty chemicals market; its global share is just about 3% vs. China’s 40%. A fragmented industry and lack of innovation have been key deterrents for India. For India to differentiate, create greater customer value, and develop strategic partnerships with customers, industry experts have emphasised the need for the country to invest in global-scale capacity, technology platforms, R&D, and IPR.

“Accelerated growth visibility for the industry comes from huge export opportunities due to:

-Mr Sanjay Chaturvedi, President – Praj Industries and ex-Strategy Director, Rohm and Haas and Dow Chemicals

(1) weakening Chinese competition (because of curbs imposed by Chinese environmental policies),

(2) de-risking procurement policy of global MNCs from China, and

(3) higher focus on outsourcing manufacturing to India by advanced countries such as North America, Europe, and Japan.”

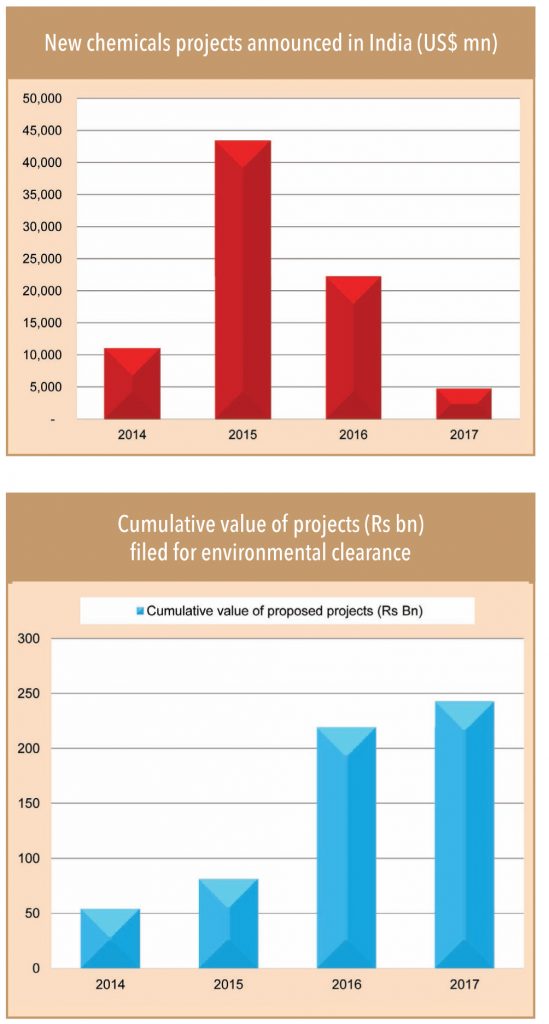

In order to cope with an ever-rising need for chemicals manufacturing, the Indian industry has geared up for capacity creation. As per Centre for Monitoring Indian Economy (CMIE), the announced capital expenditure of the chemical industry saw a spectacular jump to US$ 44bn in 2015 (from US$ 12bn in 2014) and US$ 23bn in 2016 which will be executed in the near future (typically takes about 2-3 years between announcement and execution).

“The Indian chemicals industry is an integral part of the Indian economy and the government has been taking initiatives to address the challenges in infrastructure, feedstock availability, complex tax and duty structure, and to overcome other system intricacies. One of the initiatives is the ‘Make in India’ campaign, which aims to facilitate investment, foster innovation, enhance skill development, and build best-in-class manufacturing infrastructure. The benefits of such initiatives can be seen from healthy FDI flow into Indian chemicals. To boost FDI and the technical capability of the Indian chemical industry, the government is perusing bilateral talks with countries such as Korea”

-Shri Dharmendra Kumar Madan, Director at Department of Chemicals and Petrochemicals – Ministry of Chemicals and Fertilisers GOI

A rapid capex trend is also visible from the Ministry of Environment & Forests (MoEF)’s clearance statistics. A study of capex projects (already accepted by the State Expert Appraisal Committee) over 2014-17 shows that the cumulative value of projects under the environmental clearance process has zoomed to Rs 242bn in 2017 from Rs 54bn four years ago.

As per MoEF’s environmental clearance statistics, SRF will play a leading role in creating manufacturing capability for the Indian industry, with a capital commitment of Rs 66bn in specialty chemicals and packaging films. Other leading chemicals peers with large capex plans are Gujarat Alkalies and Chemicals (planned capex of around Rs 56bn), Grasim Industries (Rs 38bn), Seya Industries (Rs 25bn), Pidilite Industries (Rs 21bn), Styrolution India (Rs 16bn), Deepak Nitrite (Rs 8bn) and Vinati Organics (+Rs 7bn). All such capacity creation initiatives along with China’s exports softening and global peers looking at India as an alternate source of specialty chemicals ensures a leading role for the Indian industry in the global specialty chemicals markets.

Mr Rajendra Gogri, Chairman and Managing Director of Aarti Industries says, “Indian chemical companies have just started benefiting from china slowdown and there is a strong visibility of sourcing shift from China to India, implying a huge long term export opportunity. On the other hand, India’s GDP is expected to grow at ~7% in the visible future then specialty chemical industry can potentially grow +10% for next few years”.

He said, “Indian players are on capex mode right now, the capex will create visibility for long term growth opportunities arising from china slowdown. All leading specialty chemical players are likely to benefit from their capacity expansions in existing as well as in downstream products.” He also believes that China (despite all restrictions) to remain the biggest consumer of chemical in the world market but when it comes to export of specialty chemical Indian players are gaining momentum and its exports share can grow progressively and qualitatively from current ~3% in the longer term.

Subscribe to enjoy uninterrupted access