Price controls is not such a big problem, yet

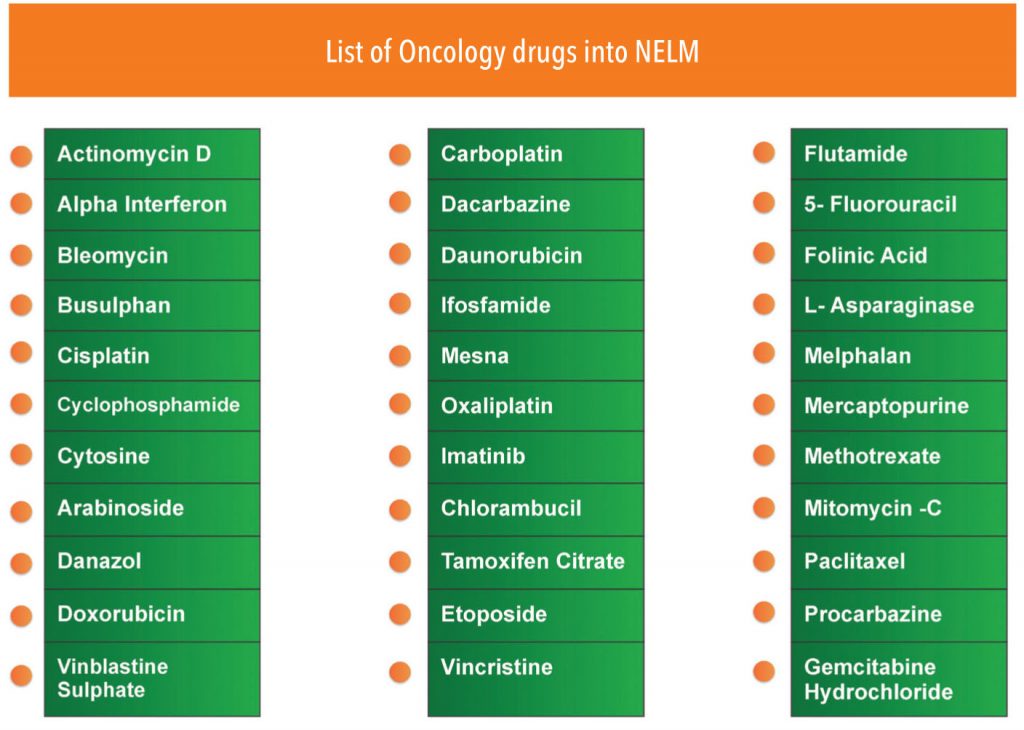

Regulatory price control seems like a big challenge—the government recently included 33 oncology drugs in the national list of essential medicines (NELM) 2014 for price control and there is speculation that more cancer drugs will get into the price control list by National Pharmaceutical Pricing Authority (NPPA). However, the reality is that manufacturers will not be all that impacted by price control because the transaction price for most traditional cancer drugs is much below the indicated MRP anyway (due to the prevalent practice of ‘special rates’). On the contrary, the margins of corporate hospitals that make the maximum out of drugs procurement at discounted special rates will get squeezed.

Regulatory restrictions and loose patent protection are bigger issues

Regulatory problems such as restrictive clinical trials and delays in clinical trials and drug approvals are the key concerns— these delay the launch of new drugs in the market and ultimately moderate growth. For, innovative MNCs, India’s loose patent protection is a big concern. Recently, Natcowas issued a compulsory license against Bayer’s Nexaverpatent (on the ground of affordability) and Novartis’ Gleevec patent was invalidated (on the ground of ever greening) — this has raised serious concernsabout patent protection in India.

Due to poverty, low government support, and a mostly unorganised healthcare sector, a large section of patients remains untapped and deprived of medical treatment– this makes it difficult for the oncology marketto expand. In such a scenario, neither the patient nor the manufacturer is benefiting.

Despite challenges, India offers huge business opportunity for oncology players because of the sheer number of people affected by cancer and its ever-rising incidence coupled with limited access to cancer care. Despite regulatory price control and rising price competition, the Indian oncology market is currently growing by 15-18% annually. Increasing awareness about early detection andprevention,rising cancer-care access, and better acceptance of biologic/targeted therapy indicates that Indian oncology market will see enhanced growth momentum in the mediumterm.

• Introductions of innovative or differentiated products by MNCs in the country should offer generic opportunity for domestic players. As per IMS Health, around 22 innovative molecules have been introduced globally over 2004-2011, but just 4 of those were launched in India. This leaves scope for more new launches and generic opportunity.

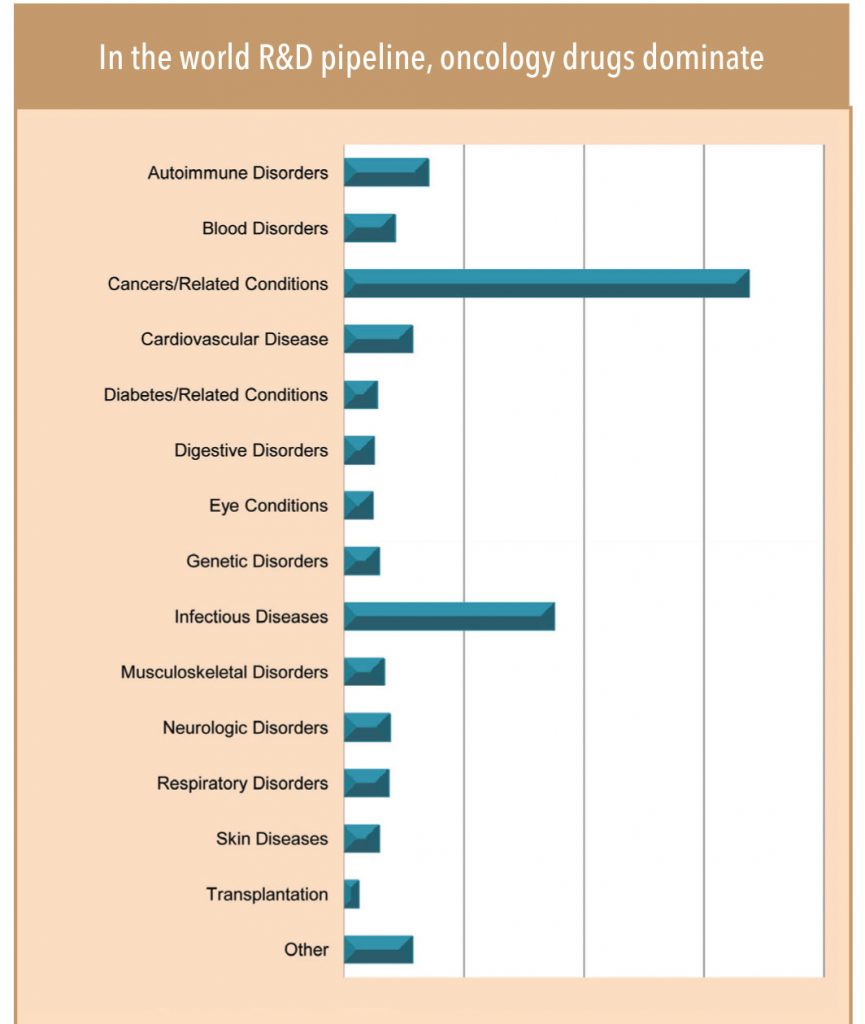

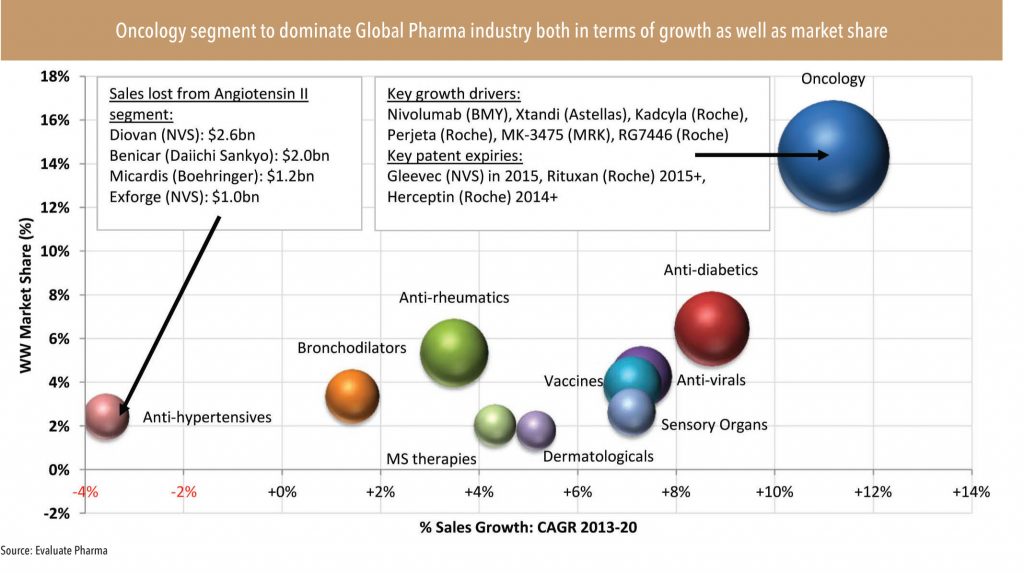

• Across the world, the largest R&D pipeline is in the field of oncology — this provides more growth visibility for the segment. Oncolgy holds the largest innovation pipeline (with about 550 molecules, of which a large share, 338, are biologics molecules) implying huge generic opportunity in the medium to longterm.

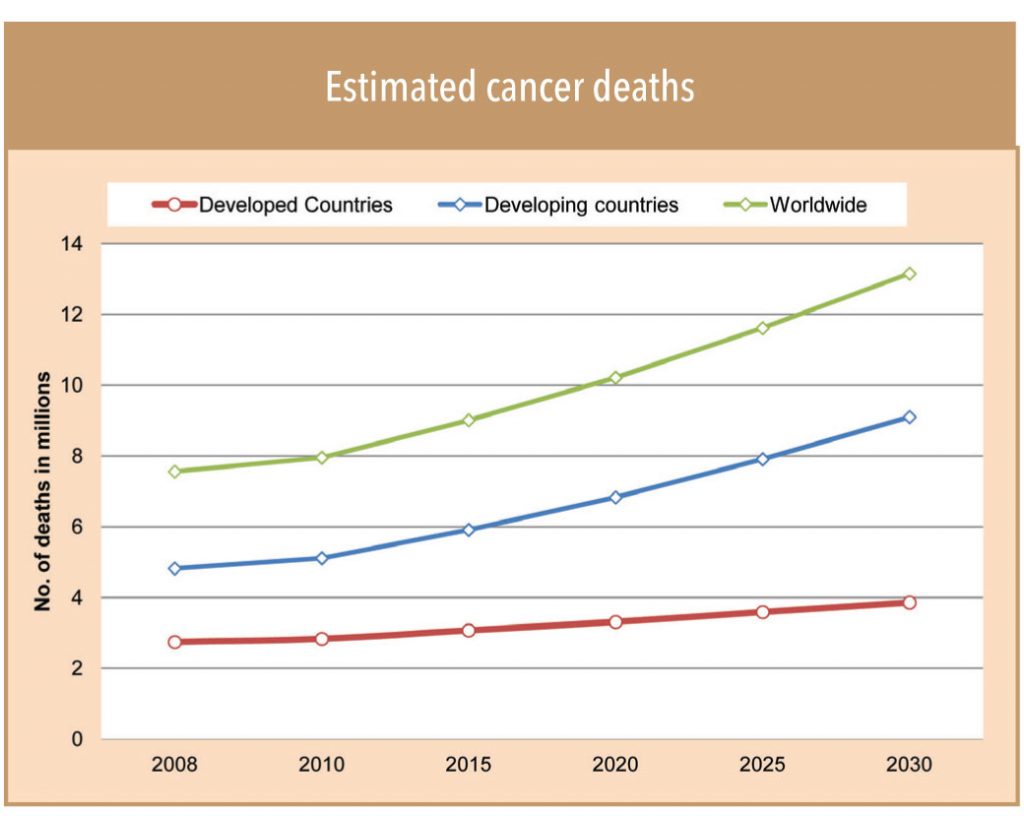

• It is not just the domestic opportunity — the export opportunity to emerging markets (with a sale potential of about US$20bn and an annual growth of 12-15%) holds big potential for Indian peers. Like India, incidence of cancer is rising in emerging marketsdue to a variety of reasons and many of these markets face similar challenges such as lack of access to information, prevention, early detection, and treatment. According to the International Agency for Research on Cancer, the death toll in emerging markets will jump up to 6.8mn in 2020 from 5.3mn in 2012 — at a much higher rate than the developed world. In just another 10 more years, that is by 2030, they are expected to touch 9mn.

While the oncology business opportunity in the emerging market is large and lucrative, these markets have developed their own regulatory protocols,which become key challenges for product registration. To overcome this, Indian peers such as Natco, Biocon, and Intas Pharma, have forged alliances with local players to deal with regulators and penetrate these markets.

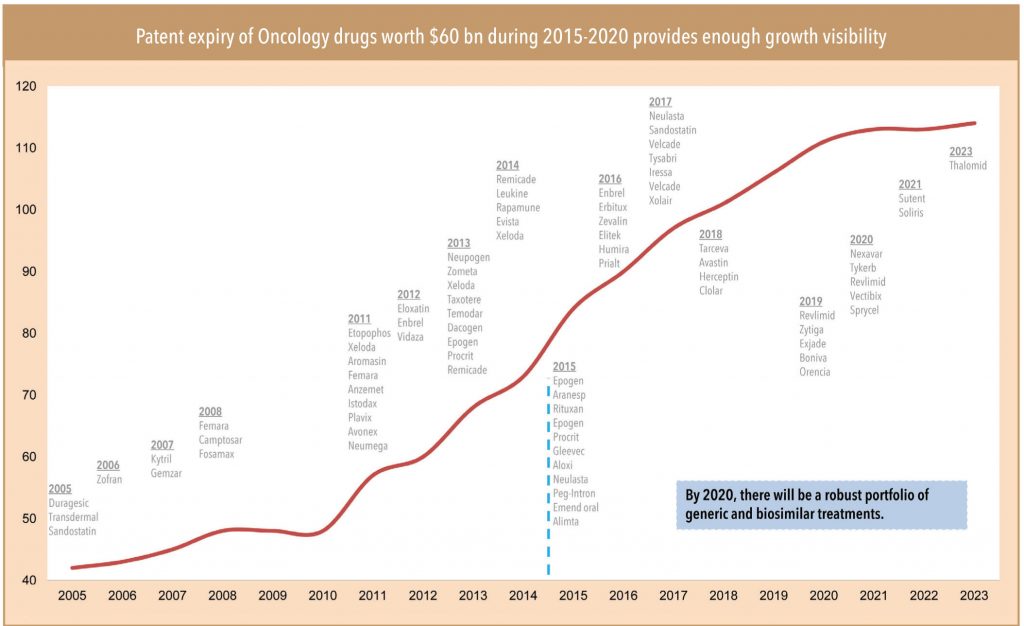

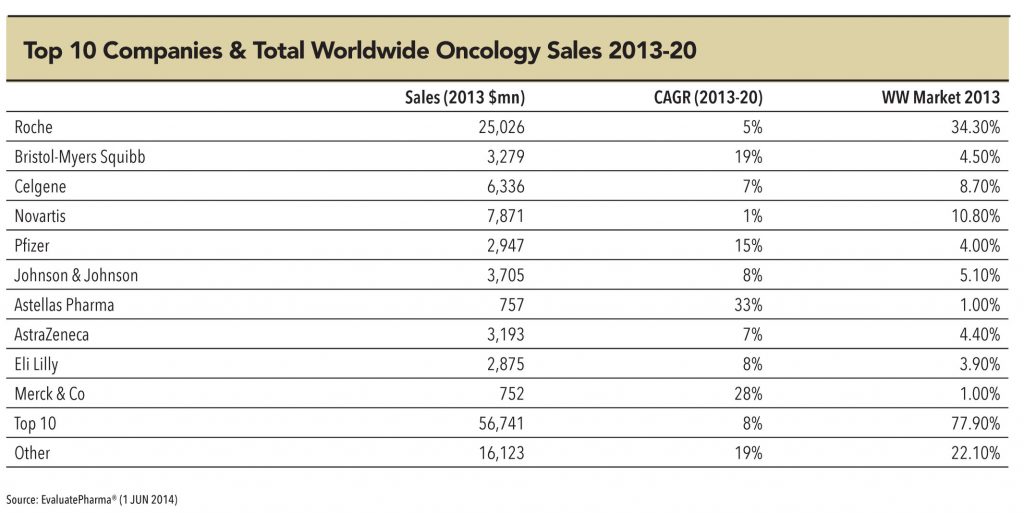

The patents of a series of oncology molecules (with annual sales of about US$60bn) in advanced markets such as the US and EU will expire in the next 5-6years (over 2015-2020) — this provides enough growth visibility for players such as Dr Reddy, Sun Pharma, Biocon, and Natco.

• The rising dominance of biologic/targeted therapy products in the upcoming innovative drug pipeline as well as drugs approaching patent expiry indicates a larger growth opportunity in the biologic/biosimilar space. In fact, of the total 550 oncology molecules in the global R&D pipeline over 60% (i.e. 338) belong to biologics. Biologics also account for over 70% of the total patent generalisation opportunity of US$60bn in oncology over 2015-2020.

Dr Reddy, with its basket of traditional small-molecule oncology ANDA fillings for the US oncology market and a pipeline of biosimilar cancer drugs in alliance with Merck Serono, is best-placed to make use of the upcoming opportunity in the oncologyspace, in traditional and new drugs. Similarly, Biocon, with an advanced pipeline of biosimilar cancer drugs in alliance with Mylan, and strong biologic R&D and manufacturing capability is well-placed to capture the biosimilar-led oncology opportunity across the world.

Subscribe to enjoy uninterrupted access