The concept of the payment bank is unique and offers an opportunity in a huge, untapped market for basic banking services. But the initial journey is expected to be painful due to intense competitiveness and the limited scope of operations. The space is expected to be crowded with different players focusing on the space – not necessarily with an aim of profitability.

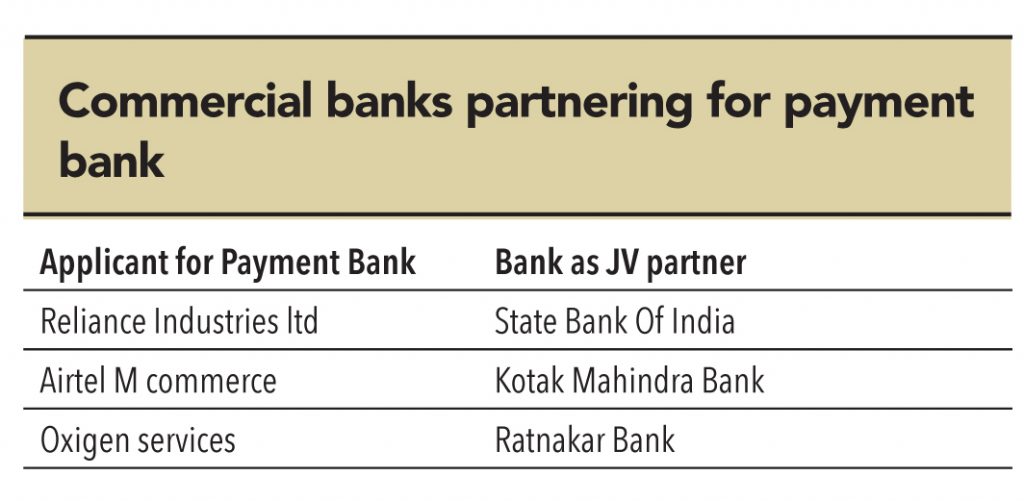

Various banks have partnered with either telecom service providers or pre-paid instrument issuers for payment bank licences (banks can only become an equity partner with maximum equity holding of 30%). Interest is seen across industries like telecom service providers (Airtel, Vodafone, Idea, Reliance Jio); NBFCs (Cholamandalam, Muthoot); business correspondents (Vakrangee) ; IT services (Tech Mahindra), PPIs (Oxygen, Itzcash, GI Technology), India Post etc. Banks like ICICI bank; Axis bank and Yes bank are also in discussions with various applicants for a possible tie up.

Business potential not exciting

The potential market opportunity for payment bank in remittance and cash in – cash outs can be pegged at Rs100bn (domestic remittance market Rs20bn and cash ins – cash outs Rs85bn). The intermediation business would earn a wafer thin margin, which can be anything between 50bps to 100bps based on industry dynamics. The total opportunity for payment banks does not seem too exciting. The moot question remains, than why so many applicant – RBI received 41 application for payment bank license.

Deep pocket players – profitability not the sole motive

Despite a not-so-encouraging market potential for payment banks, interest seems to be immense from deep pocket players like Reliance, SBI, Airtel, Vodafone, Idea and Tech Mahindra etc. The potential opportunity is insignificant for these players in the overall scheme of things. The primary motive for telecom operators can be customer stickiness whereas for PPI issuers and BCs it is a natural upgrading. PPIs and BCs have been facing challenges due to restrictions on cash out at points of sale. Also due to lack of control by sponsor banks in pricing of services by BCs, the scalability of the model has been in question. Banks’ motive in payment bank is to ensure captive customers for loan products and de-congest branch.

Barring PPIs and BCs, where the upgrading to a payment bank is driven by commercial motives, the motive of other participants is to ensure customer stickiness or customer acquisition. In such a scenario, the industry will be impacted by fierce competition.

Subscribe to enjoy uninterrupted access