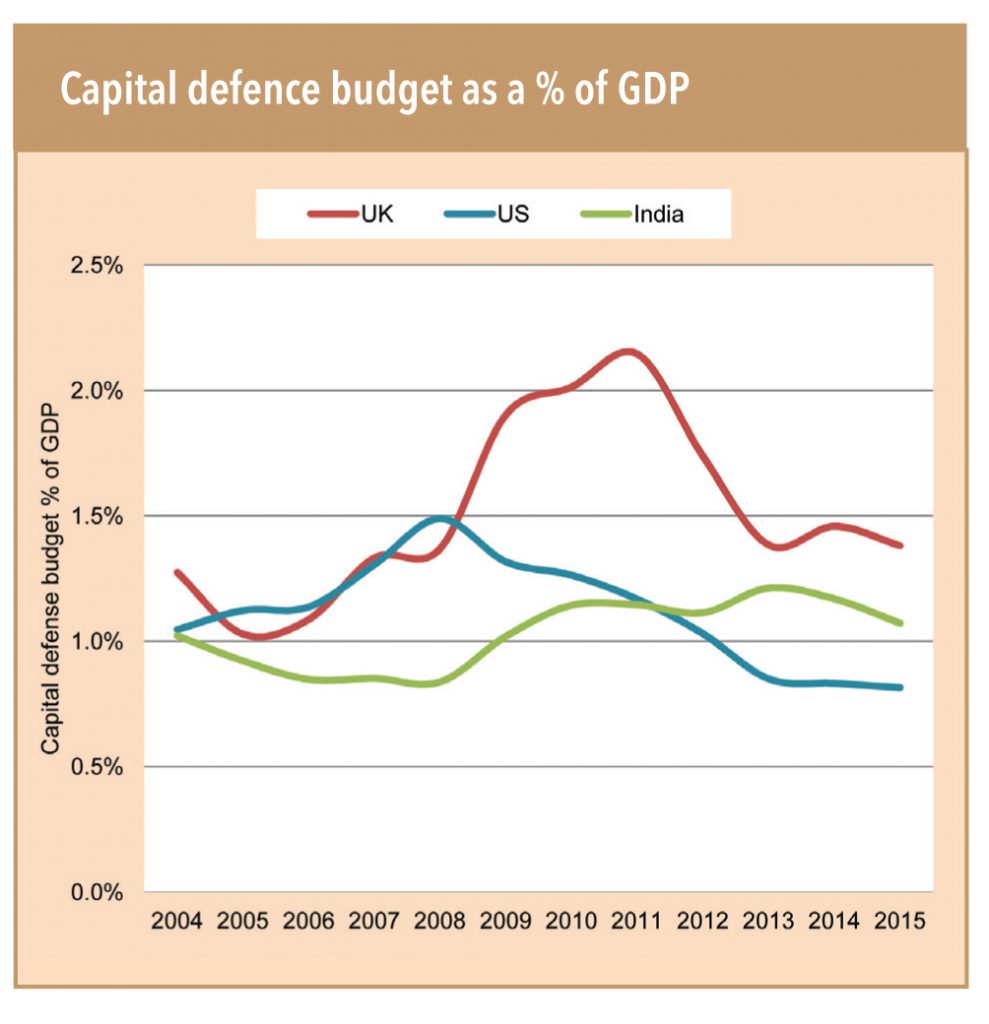

India’s capital expenditure as % of GDP is now in line with global averages

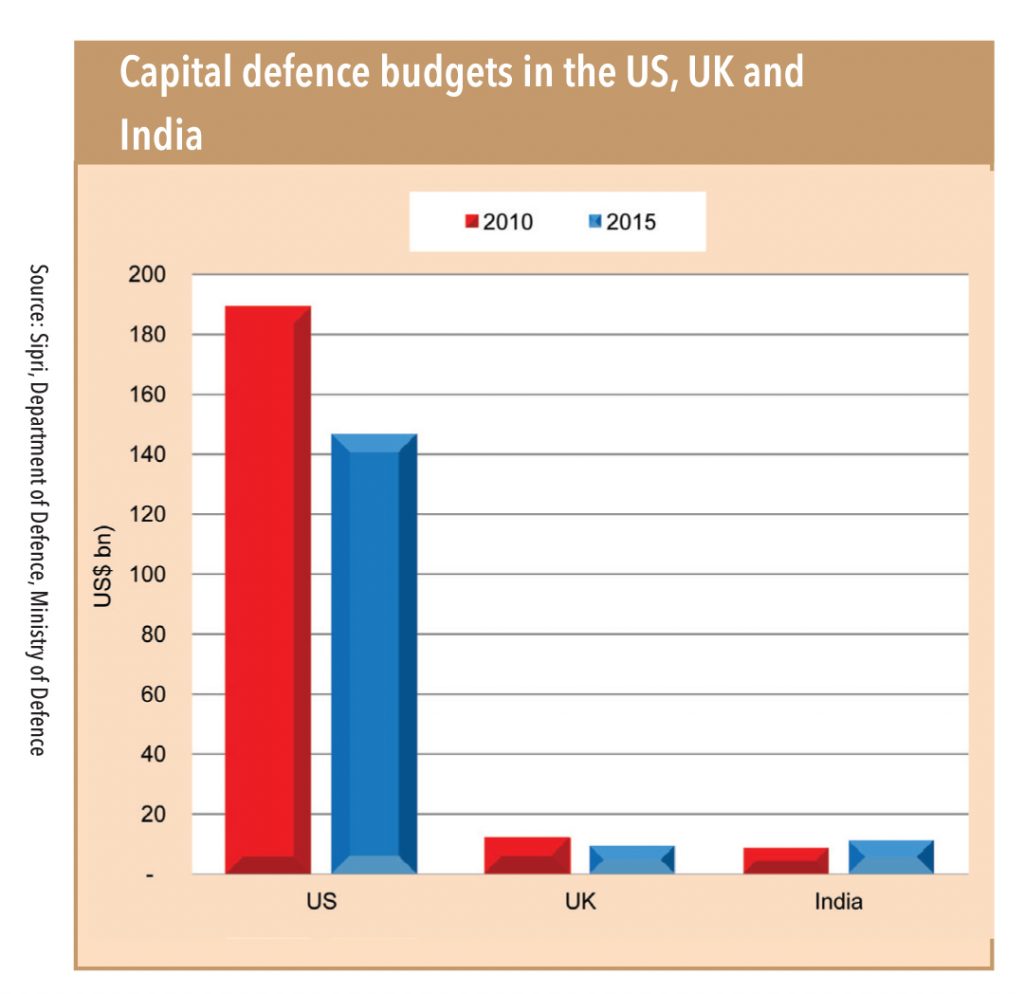

Capital defence budgets in developed nations such as North America (US) and United Kingdom (UK) are falling in the past five years. UK’s capital budget has shrunk by 25% (2010-15), while US’ is down 22%; in the same period, India’s spending has increased by 30%. Consequently, India now spends 1.1% of its GDP on defence (capital expenditure ex-land and construction), which is higher than the US (0.8%) and largely in line with that of UK (1.4%).

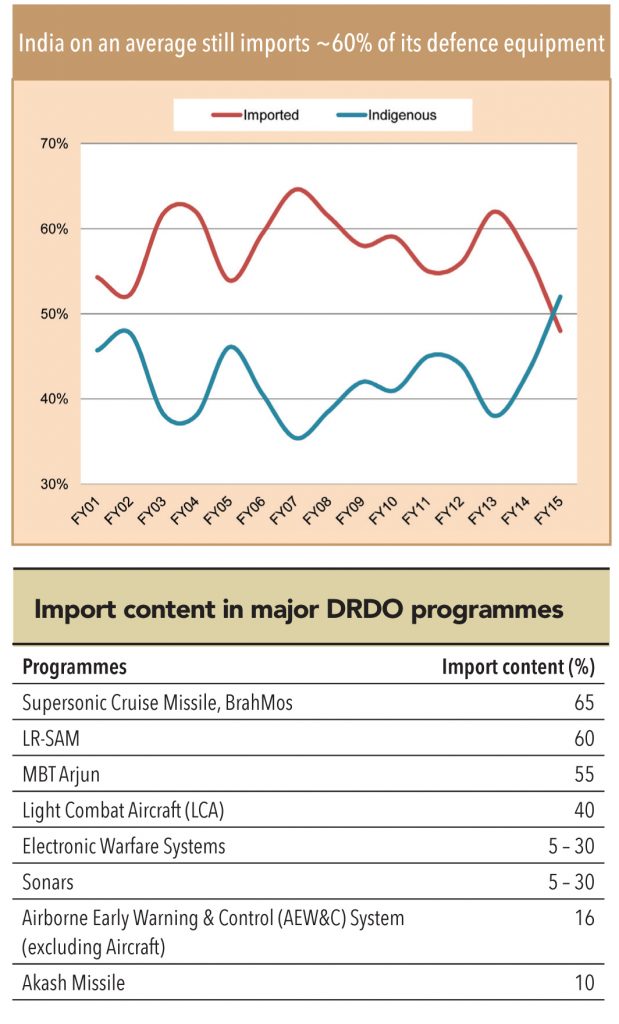

India’s spend on defence (as % of GDP) is higher than the US and approaching UK’s threshold but, India imports ~60% of its defence equipment

Despite the impetus on indigenisation by various DPPs in the past ten years, India continues to rely on imports of defence equipment. Almost 60% of the annual capital budget is towards imports. Key reasons for high imports – India’ defence PSUs lack the expertise to manufacture complex systems and private sector participation is nascent. Major projects such as BrahMos, LCA, Long Range Surface to Air Missile (LRSAM) have an import content of 40-65%.

Recent policy initiatives are conducive towards increased local participation

In order to correct this anomaly, the current government has taken steps towards changes to procurement procedures – by introducing new category IDDM, revision of the defence products

list, issuing industrial licenses to the private sector, and relaxing FDI norms.

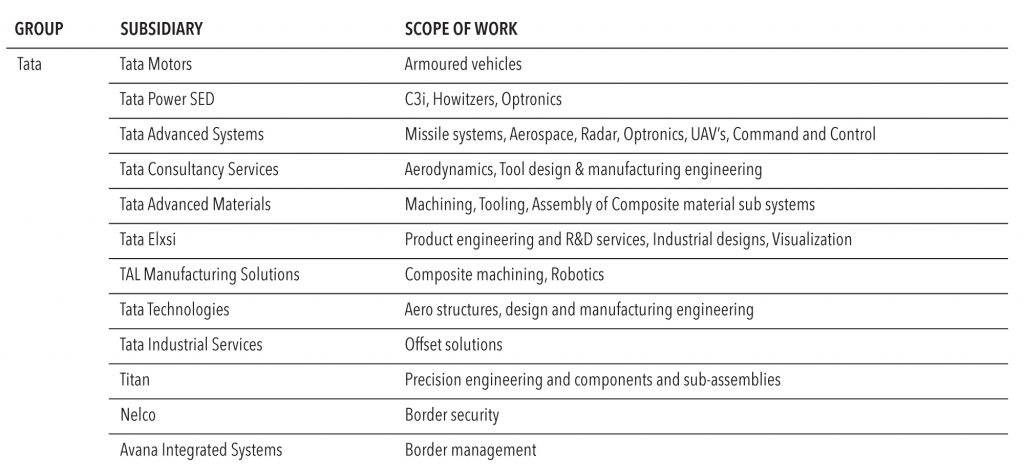

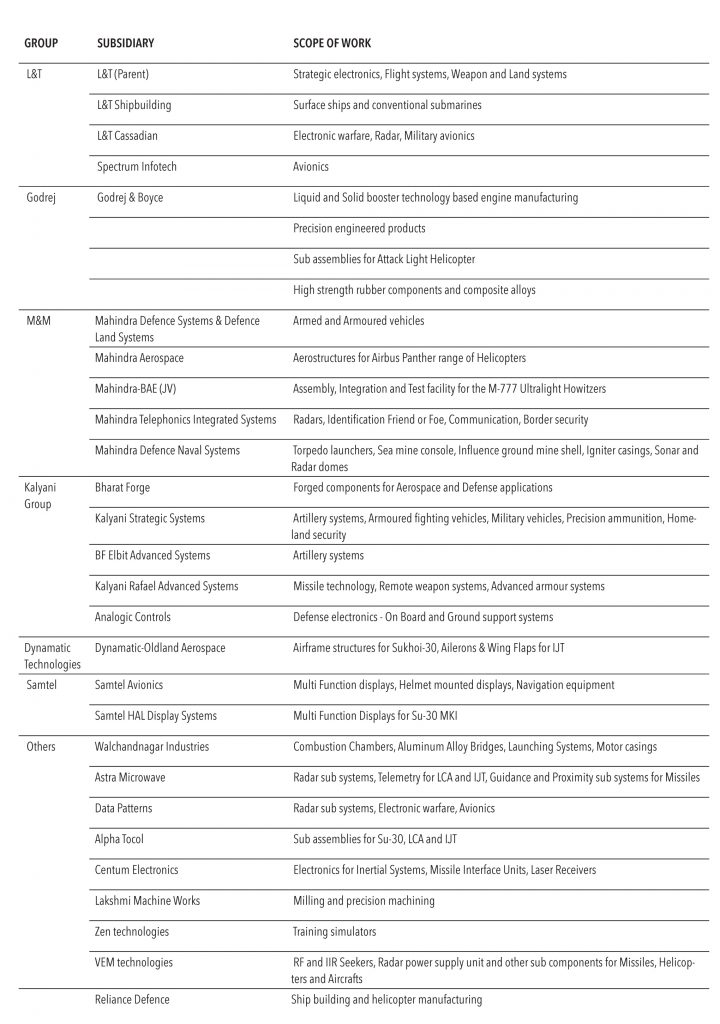

Group-wise exposure

In the parlance of the global defence supply-chain, India’s private sector companies manufacturing sub-components and sub-systems for local defence PSUs or global majors can be classified as tier-2 and tier-3 vendors. Only select companies (such as L&T, Tata Advanced Systems, Dynamatic Technologies, and Data Patterns) are tier-1 vendors. The natural line of progression would be for tier-1 vendors to graduate and become system integrators of prime OEMs, which design and develop complex systems,while tier-2/3 vendors can increase their capability to become tier-1 vendors.

Within private sector groups, Tata, L&T, Godrej, Bharat Forge, and Mahindra have developed competencies across multiple segments of the defence sector.

Subscribe to enjoy uninterrupted access