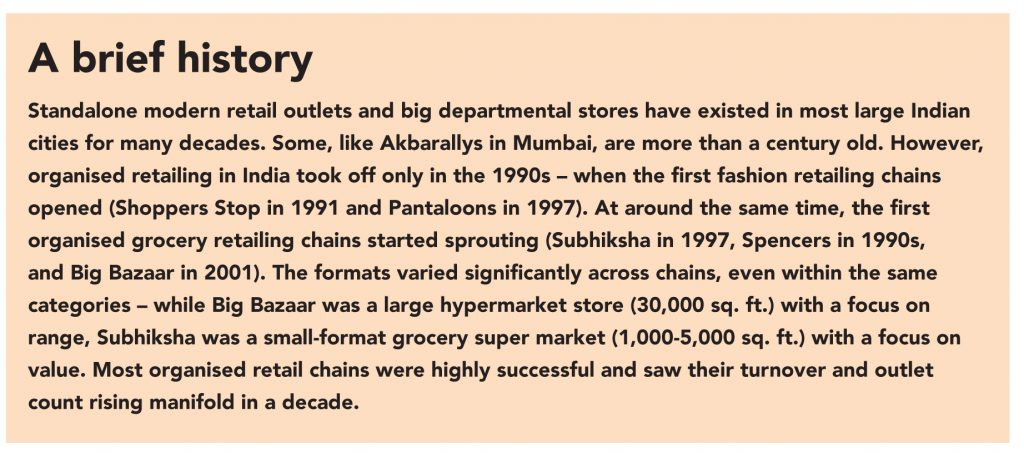

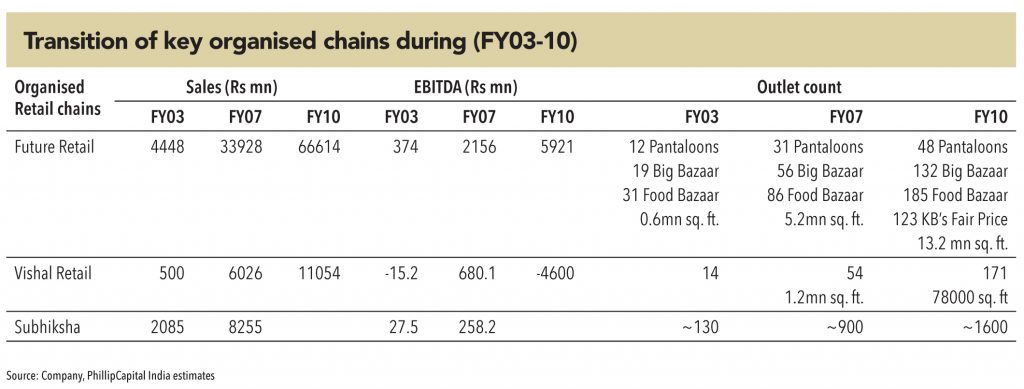

This period saw very strong growth in footfalls and sales for most organised retail chains in India. For most, growth was driven by a strong focus on the front-end of their business, i.e., the consumer-facing aspect. Most of these retailers offered significant discounts to customers and were able to generate healthy footfalls and sales based on their value proposition. Subhiksha, a prominent grocery chain, offered average discounts of 8% on various grocery categories. In spite of this, most retailers made satisfactory operating margins due to cost control and economies of scale in procurement. While the free-cash flow was still negative for most, it was not a big concern due to the small business size and manageable debt levels. Consensus expectations of exponential future growth for many retailers led to their stock prices delivering phenomenal returns during that time.

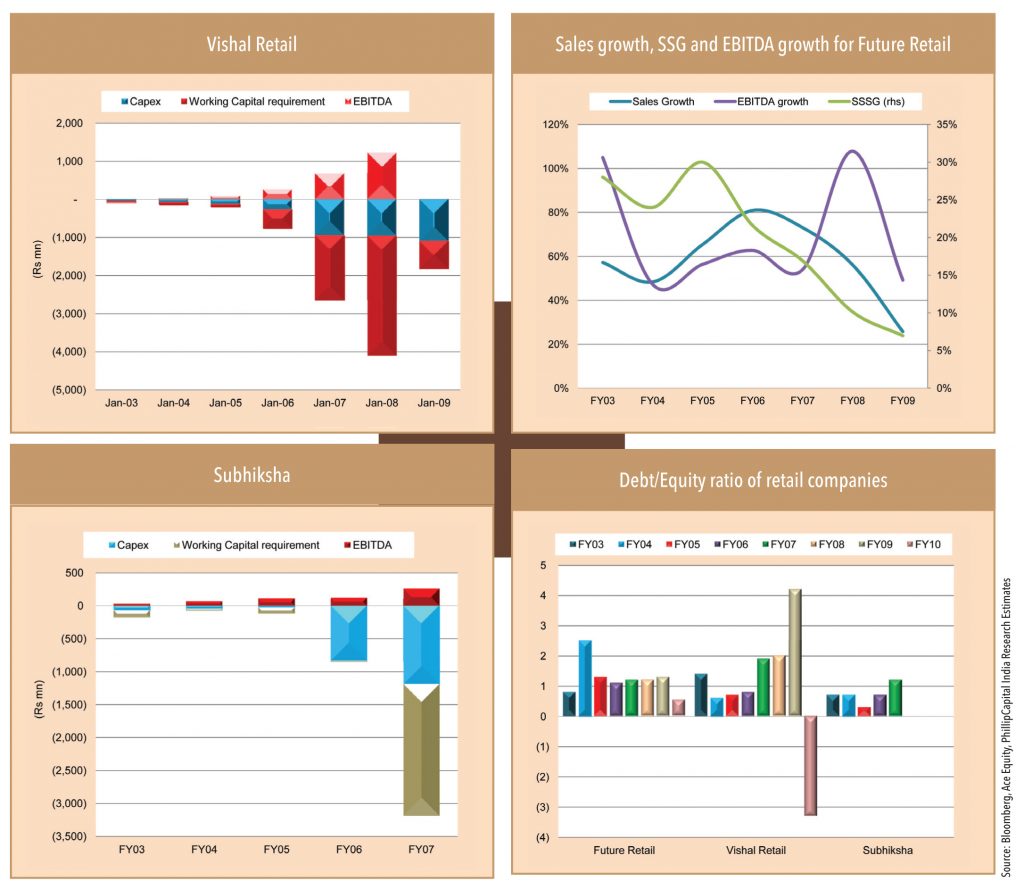

While a strong focus on the front-end helped achieve significant growth in footfalls and same-store sales for organised retail chains in India, a lack of focus on the back-end proved disastrous for them as they engaged in aggressive expansion plans in 2007-10. Most, overconfident due to the growth they saw in 2000-07, more than doubled their store count in 2007-10 through debt without improving systems and processes. In spite of strong growth in sales in 2007-09, ever-increasing inventory levels and unmanageable debt forced retailers such as Vishal Retail and Subhiksha to default on loan payments and shut shop in 2009. Future Retail’s Pantaloon chain, marred by skyrocketing debt levels, was sold to the Aditya Birla Group in 2012.

In spite of their strong growth in sales in 2007-09, for major retailers of that time, ever-increasing inventory and unmanageable debt derailed their growth story completely

So what went wrong?

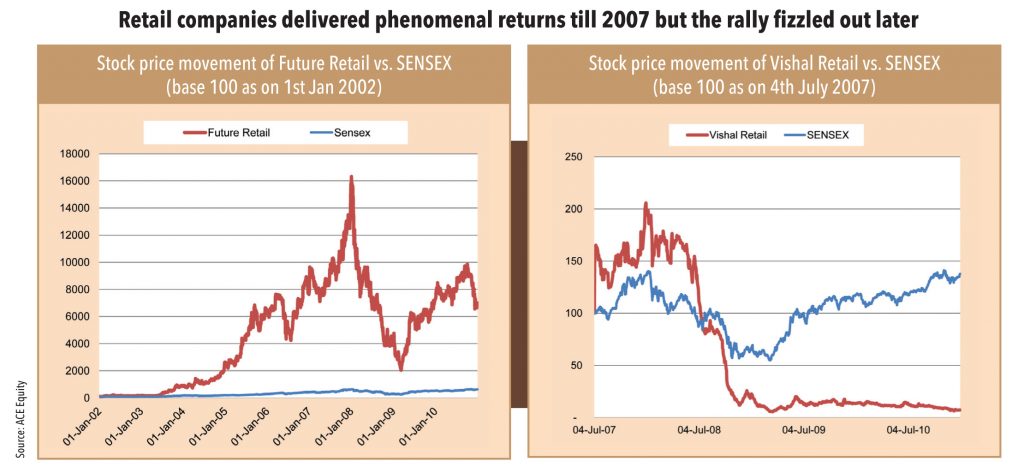

Organised Indian retailers bit off more than they could chew: Significant growth in sales in 2002-07 emboldened Indian retail companies to pursue very aggressive growth strategies. Kishore Biyani-led Future Group increased Big Bazaar/Pantaloons outlets by 100%/40% in FY07-09. Similarly, Subhiksha more than tripled its outlet count to 1600 in FY07-09, and Vishal Retail also expanded aggressively. While SSSG and operating margins remained strong during the period, EBITDA generated was far lower than that required to fuel capex or meet working-capital requirements. This pushed companies into a debt spiral.

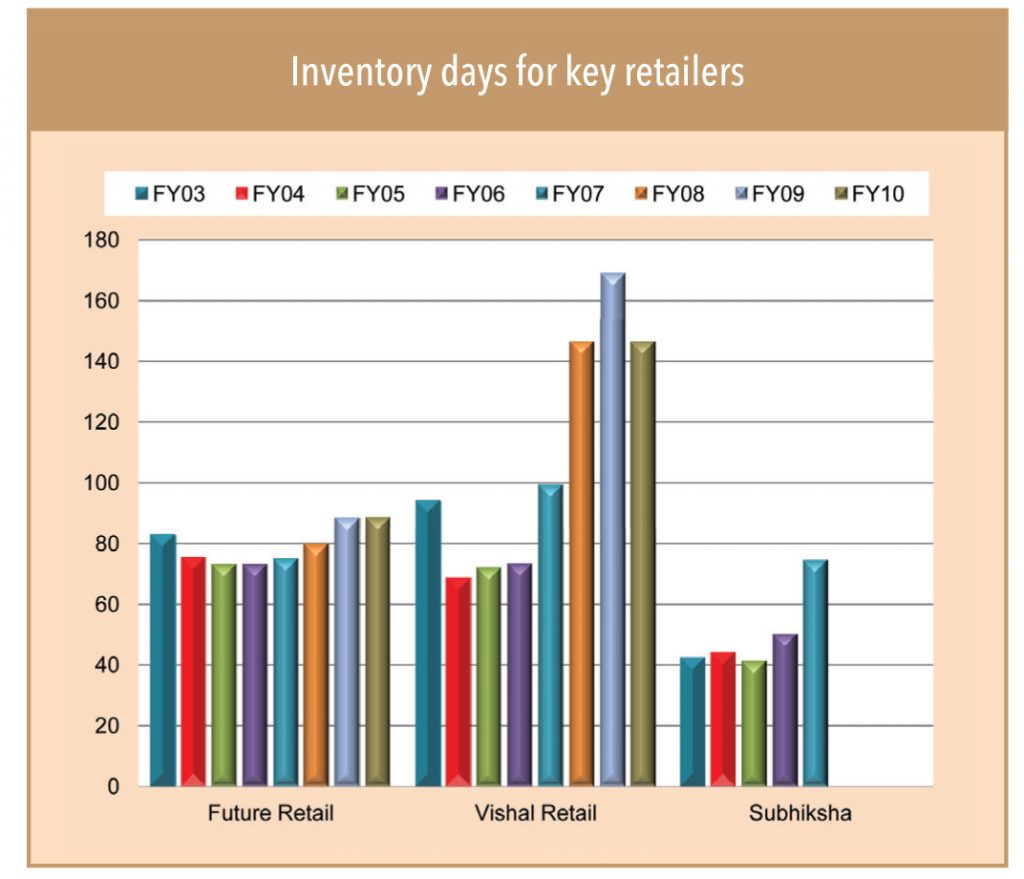

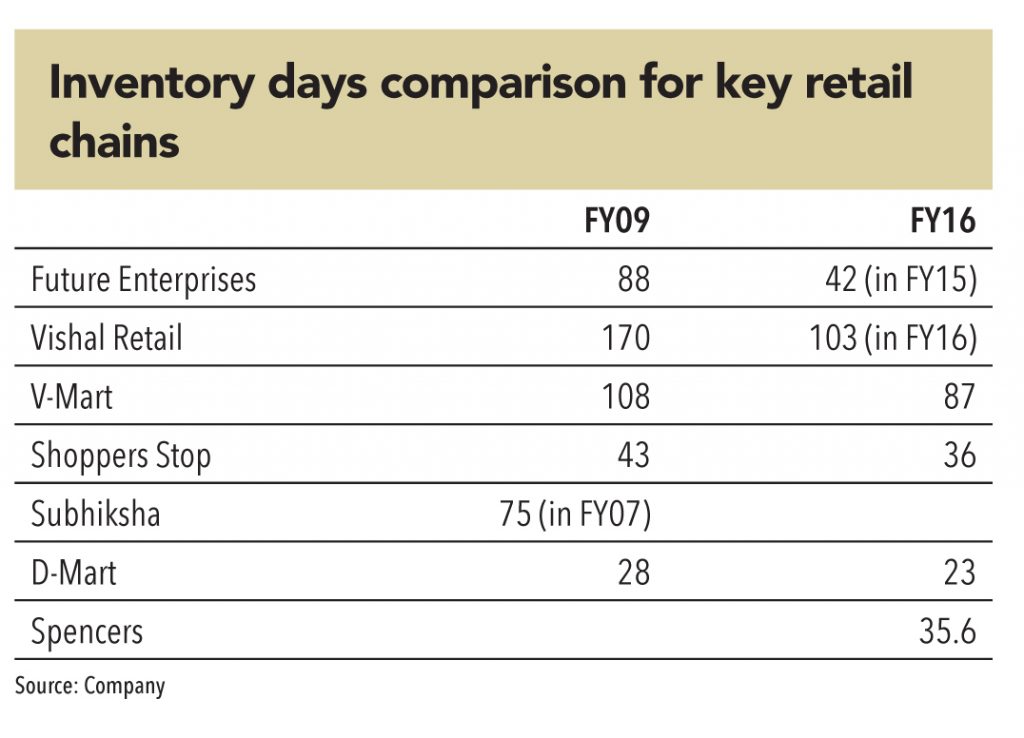

Expansion over efficiency spelled disaster: For most companies, expansion accelerated from 2007, despite a weak understanding of inventory management – this led to significant increases in inventory levels. For Vishal Retail, inventory days increased to 169 in FY09 from an average 70 in 2004-06. These increases led to drastically higher working capital requirements, which forced companies further into debt. Due to rising debt levels, companies had to increase cost controls to up their margins, which meant lower discounts at their outlets. This led to an even more pile up of undesirable inventory, which ultimately led to defaults.

Lessons from the past

The Indian organised retail landscape has taken a decisive turn since 2011 after Shubhiksha’s bankruptcy and sell-offs of Vishal Retail and Pantaloons chains. Current organised retail players in India have learnt from mistakes – their own and those committed by their peers. They are more focused on sustainability and profitability. The business models have become more agile and can withstand shocks better.

Slow and steady wins the race

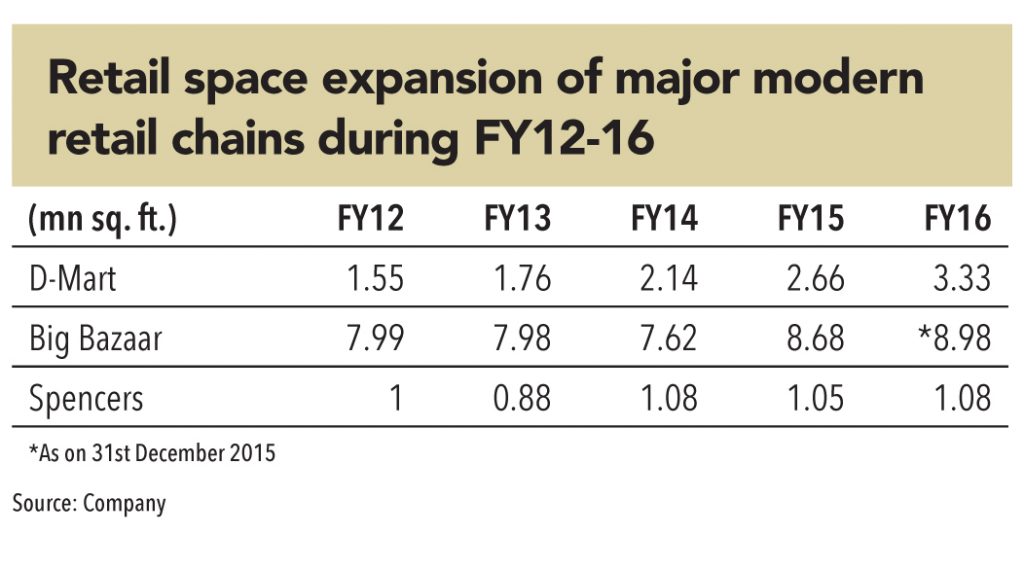

Most present Indian retail chains increase retail space by only around 10-15% annually vs. the 50-100% increases seen in the furious growth period of 2007-10. V2 Retail vs. Vishal Retail is a great example of this evolved approach. Mr Ram Chandra Agarwal, founder of Vishal Retail, launched V2 Retail after the distress sale of his chain Vishal Retail in 2012. V2 Retail works with a very different strategy vs. Vishal Retail. It operates stores of about 10,000 sq. ft. and adds 60,000-70,000 sq. ft. annually. In comparison, Vishal Retail operated 18,000 sq. ft. stores and used to add 1mn sq. ft. of retail space annually during its heydays in 2007-09.

Current Indian organised retailers have begun to place a huge emphasis on sustainability and profitability over scale

Using technology for leaner operations

Currently, most organised retail chains operate at significantly lower inventory levels vs. that in 2007-10. They exert control over their inventory levels by focusing on product assortment, avoiding illiquid products, ordering fast-moving products, and minimising inventory build-up through various corrective actions such as stock returns, discount sales, and shifting inventory to other stores.

In the last decade, IT systems have played a key role in significantly improving inventory management. Most companies now operate their entire supply chain using advanced IT systems. For example, D-Mart uses IT systems for procurement, sales, and inventory management. The IT systems help it to identify and quickly react to changes in customer preferences by adjusting products available, brands carried, stock levels, and pricing in each of its stores, and effectively monitoring and managing the performance of each store.

Indian organised retail has finally started maturing

The Indian organised retail industry is in a far more sustainable and mature phase than it was a decade ago. While current investors may not expect the exponential growth and phenomenal stock returns from incumbent organised retailers (as seen a decade ago), they will be far more confident about the quality of growth and sustainability of business models, at least for a few of the present retailers. In the modern retail space, some chains (such as D-Mart) have been able to develop retail models that are profitable and sustainable, and have been able to recreate the same success in each new store that they open.

Successful retailers will be able to (justifiably) command a significant valuation premium

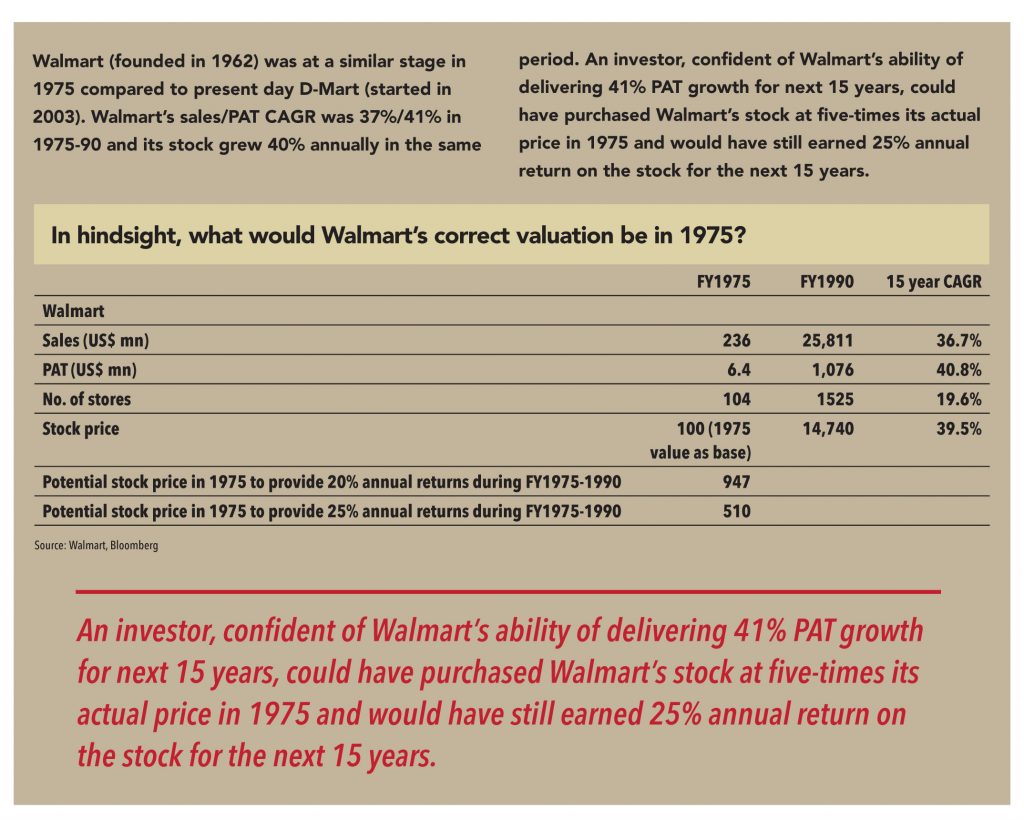

While the story of modern retail in India has just about started, there is huge scope for growth through market-share gains from unorganised retailers. Successful retailers that have the ability to successfully copy-paste their models in their new stores, will see exponential levels of (sustainable and profitable) growth and will be highly valued by investors.

Subscribe to enjoy uninterrupted access