The demand drivers in north and west India remain wedding and events

The investment is in style and design

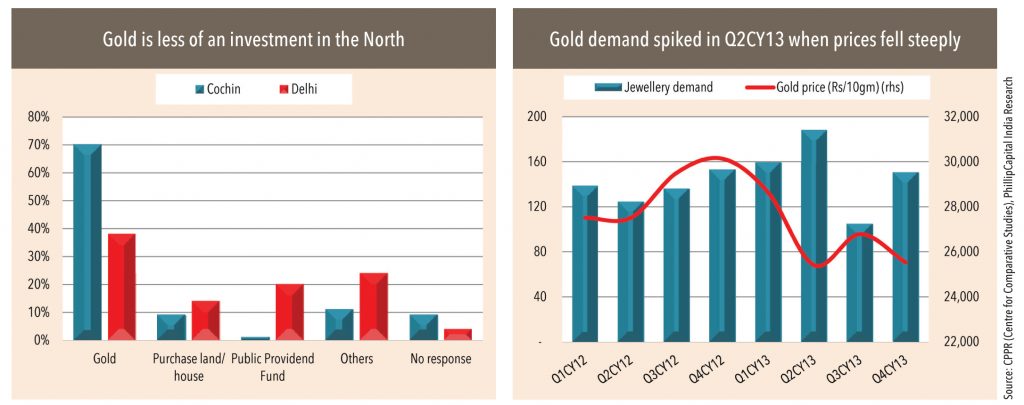

More than investment, the north Indian jewelry market is driven and motivated by end use, design, and style. Diamond jewelry comprises a larger share of the market — north is India’s largest diamond jewelry market with a share of around 40%.

Mr. Sanjeev Bhatia, CFO, PC Jewellers succinctly describes the market, “In the north, the average buyer’s implicit motive seems to be driven by fashion rather than investment.” He goes on to add that, “Share of diamond jewelry is significantly high in the North. The sale of gold coins and bars is low. Gold coins and bars account for only 3-4% of PC Jewellers’ turnover”. Another interesting data, which validates this, is that recycled gold for jewelers in north is much lower than that in the south (40%). Jewelry out of recycled gold is on an average at only 10% for PC Jewellers. This is largely attributable to the preference for diamond and designer jewelry, where making charges are higher, and the accessory mindset of the consumer,whereas lower sale of coins means lower recycling.

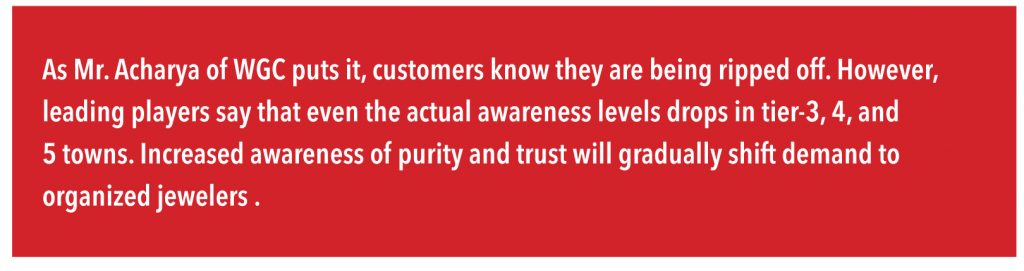

Gold is purchased closer to weddings and ‘occasions’ and in the form of jewelry and coins. Coins and bars are used for gifting purposes during marriages. The biggest festival for gold coins purchases in the north is Dhanteras. However, when prices fell in Q1FY14, people across India including in the north bought gold six months before Dhanteras, which is quite unlike typical north Indian behavior. The average ticket size for gold consumption here is around 17gms says one leading jeweler.

Interestingly, diamond purchases also spike during ‘occasions’. One of the leading diamond players explains, “Karva Chaut is very big for diamonds. Women coax their husbands into buying diamond rings and sets as a reward for fasting.”

The popularity of deposit and loyalty schemes is naturally low as the purchase of jewelry is not planned too much in advance. Most players use the deposit schemes as a means to draw customers into the store. It is positioned to help a housewife make small ticket purchases.

The wedding party starts late and continues longer

Here, 70% of the market is driven by weddings and ‘occasions’ related to weddings such as engagements, mehandi, sangeet ceremonies and cocktail parties, says Mr. Bhatia. People in the north buy wedding jewelry closer to the wedding date, to match with their wedding trousseau such as lehenga, etc.

Kundan and minakar are the two popular varieties of north Indian jewelry. They have been inspired from the designs and craftwork of Mughals and reflect the Mughal dynasty. A leading diamond player explains, “Uncut diamonds such as polkis is very popular in the North. We wouldn’t be able to sell these in South where ruby jewelry is more popular.”

The average gold consumed during a North wedding is around 100 gm and diamonds is around 3 carats.

In search of purity

In the north, purity still remains an unaddressed issue. “80% of North Indian jewelry market is unorganized. Unlike the south where there are prominent players such as GRT or PC Chandra in the East, north doesn’t have major organized players like us,” says Mr. Sanjeev Bhatia, CFO, PC Jewellers.

“80% of North Indian jewelry market is unorganized. Unlike the south where there are prominent players such as GRT or PC Chandra in the East, north doesn’t have major organized players like us,”

-says Mr. Sanjeev Bhatia, CFO, PC Jewellers.

Though buyers are aware of trust and purity issues, they continue to patronize the unorganized market as the price points there are lower and it suits their budget. As Mr. Acharya of WGC puts it, customers know they are being ripped off. However, leading players say that even the actual awareness levels drops in tier-3, 4, and 5 towns. Increased awareness of purity and trust will gradually shift demand to organized jewelers .

In the absence of large regional players, Titan’s Tanishq has spearheaded the agenda of purity and under-karatage. However, standardization/certification of purity still remains an issue.

“Design is not for philosophy it’s for life.” Issey Miyake

Demand is shifting from unorganized players to organized ones as branded players also offer higher variety and range. While explaining the north-Indian buyer Mr. Bhatia says, “For the north Indian customers, design and diamonds-size matter more.” As the buyer places design and studded jewelry as a priority over gold as an investment, she is willing to pay the higher making charges that these entail. Buyers are aware of making charges, but they are more aware of designs. Bhatia believes that customers enter a PC Jewellers store for the variety and range it offers.

A north Indian customer is fickle minded says a person associated with a niche pan-India jeweler — “A customer doesn’t have loyalty to any particular store and will jump shops if there is a better design elsewhere.”

The market is thus relatively complex with a larger share of unorganized players, lower degree of fair trade practice (for purity), and with customers who are focused on design and fashion and are fickle minded.

Subscribe to enjoy uninterrupted access