Rahul, an employee in the R&D department of a leading MHCV manufacturer, said: “The MHCV segment is under tremendous pressure when it comes to adhering with BS-6 norms. All the OEMs are on their toes not only because of emission limits but also because they want to ensure low costs. Currently, it looks like we will have to take at least a 15% price hike as 130HP and above trucks would need to use both EGR and SCR, with changes in the driveline and gearbox.” However, the good thing is that fuel efficiency would improve by 10-15% under BS-6, he added, providing these details:

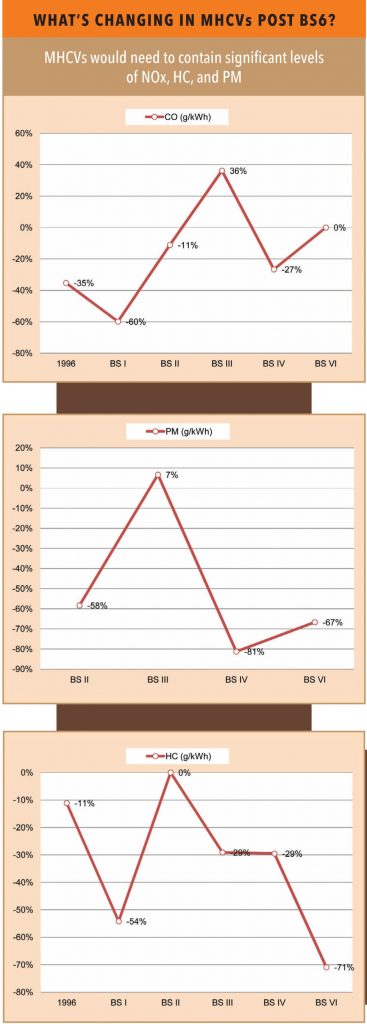

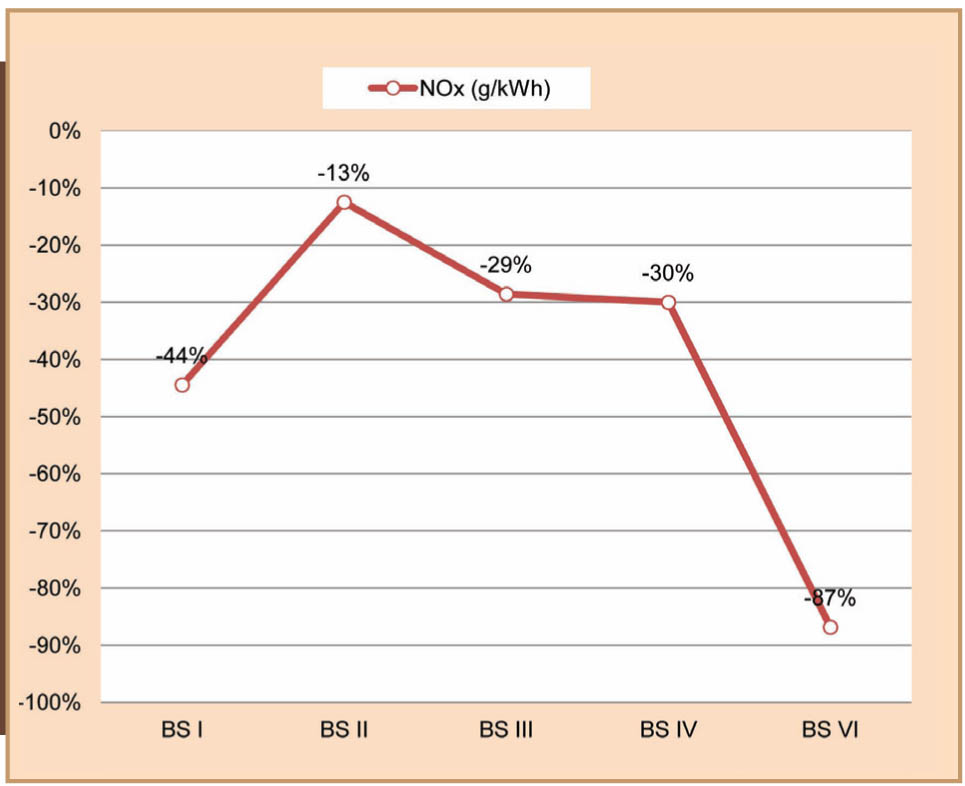

• There is significant tightening in the emission norms of heavy-duty vehicles: NOx limit has to be reduced by c.87% and particle matter by c.67%.

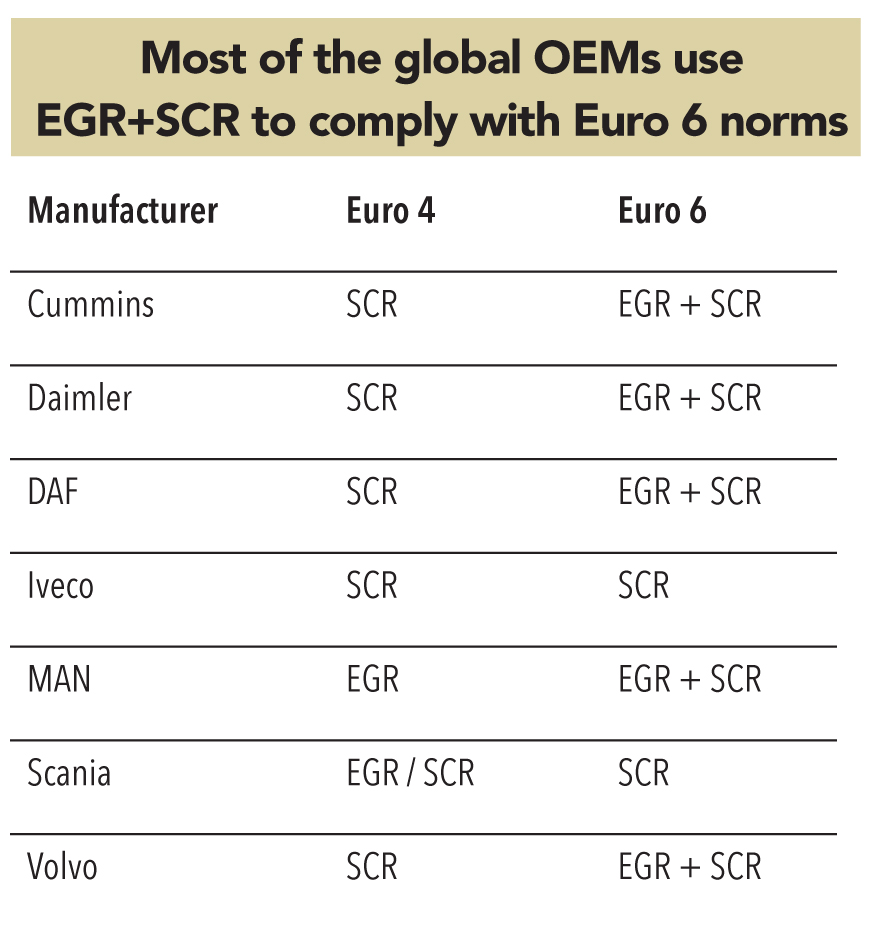

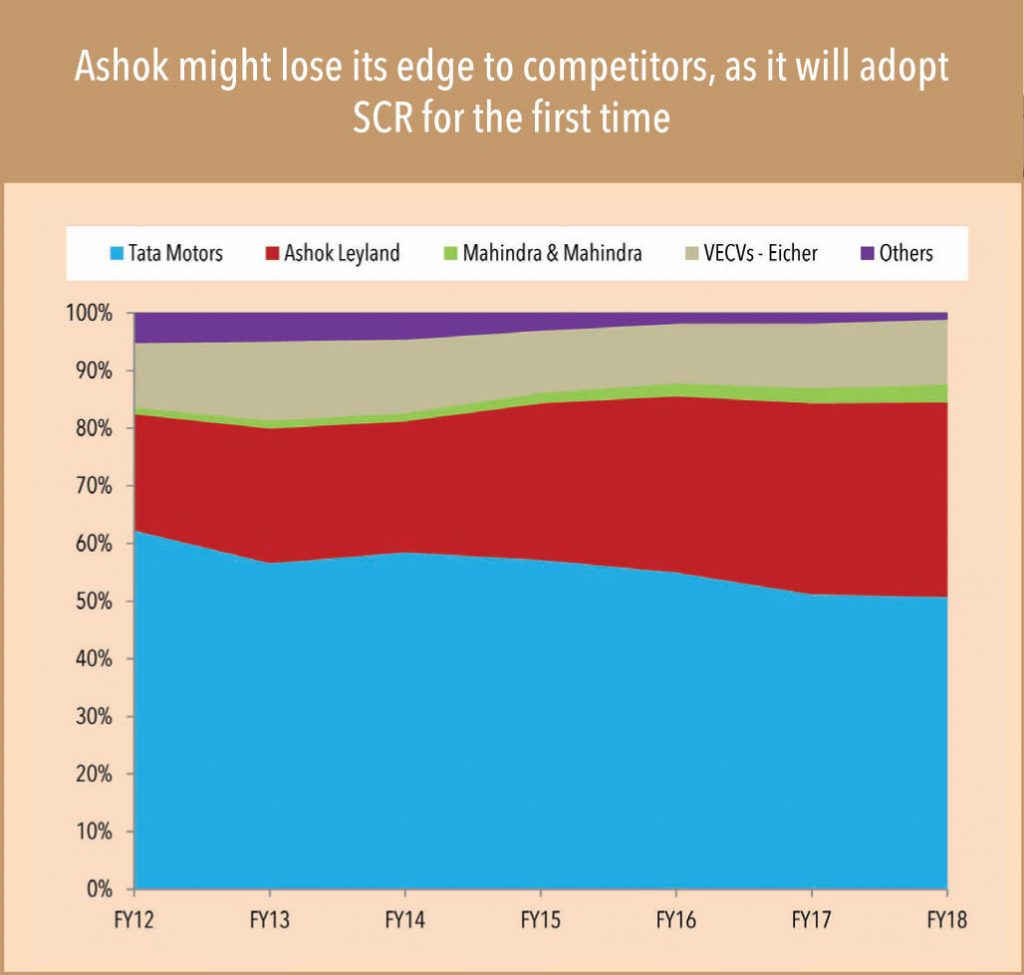

• OEMs Tata motors, Mahindra, Bharat Benz will add EGR technology to their existing SCR technology. Ashok Leyland will add SCR technology along with its iEGR technology. This major change will be complemented by several other changes in the driveline, gearbox, fuel injection systems, and other technological advancements.

• Globally most MHCV OEMs use a combination of both EGR and SCR, as controlling NOx with standalone technology is almost impossible and also creates engine instability.

“Engine modification is a BIG cost to the company, if you need to change anything, now is the time.”

-Rahul, R&D department of an MHCV player

Engine and intake system reforms a major overhaul; electrical to replace mechanical systems

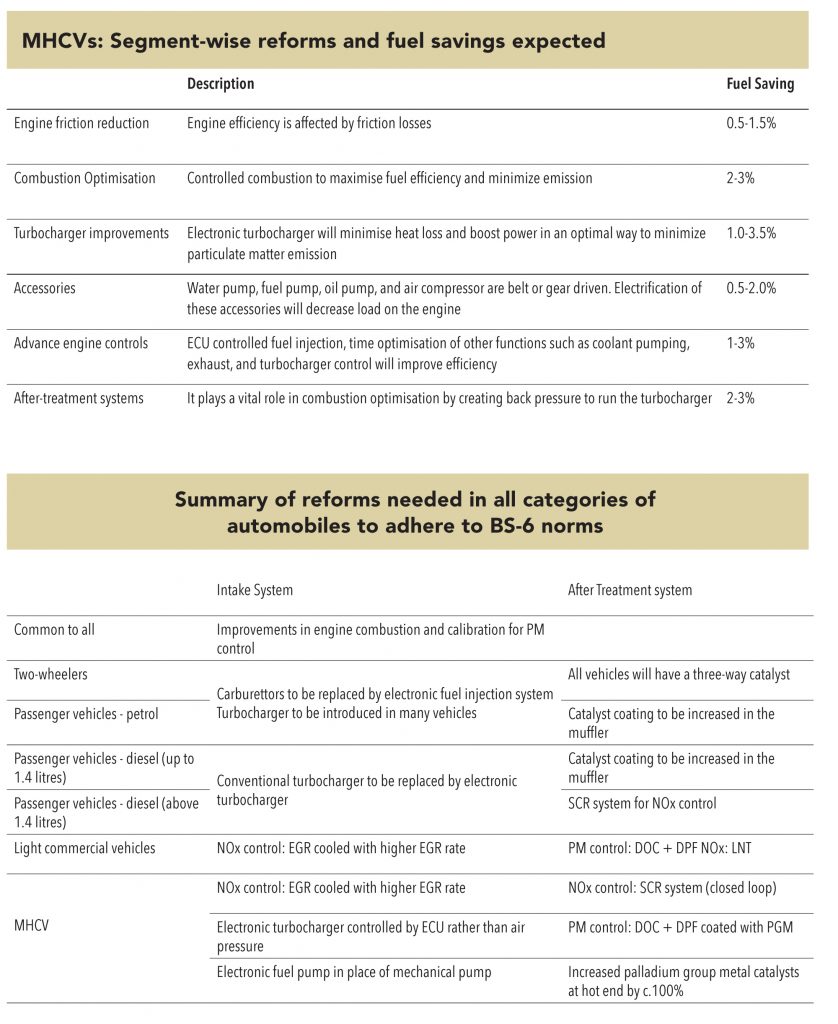

Rahul, the MHCV R&D person says that under BS-6, truck engines will go through a major overhaul across segments, with more usage of centrally controlled functions using ECU. Engine and intake reforms would mainly mean reduction in friction level in engines and more controlled combustion,which in turn would improve efficiency and minimize emission.

Turbo chargers would be upgraded to electronic (currently pneumatic) this would boost power, minimize heat loss, and PM emission. Further, all the accessories/child parts such as water pump, fuel pump, oil pump, and air compressor would be electrified (they were earlier belt or gear driven). All these changes, along with some changes in the gearbox and driveline, would not only help control emission but also improve fuel efficiency by as much as 8 -12%.

Exhaust system changes – SCR to shake hands with EGR

Here are some of the things that will change:

(1) OEMs would have to use both SCR and EGR technologies. It is very difficult to achieve BS-6 level NOx by only using one of these technologies

(2) Fuel injection systems would be upgraded to ECU controlled from pneumatic

(3) Size and ratio of ad-blue tanks would increase

(4) Exhaust will need to be covered with special insulation

(5) DPF would need special PGM coating, LCVs can control NOx by using LNT (lean NOx trap)

(6) Catalyst quantity in the SCR is increased.

OEMs are worried about both things – smooth implementation of technology as well as cost implications. Currently, it appears as if the shift to BS-6 will lead to a 15% hike in prices in the +130HP categories, but this will be along with a 8- 12% improvement in fuel efficiency.

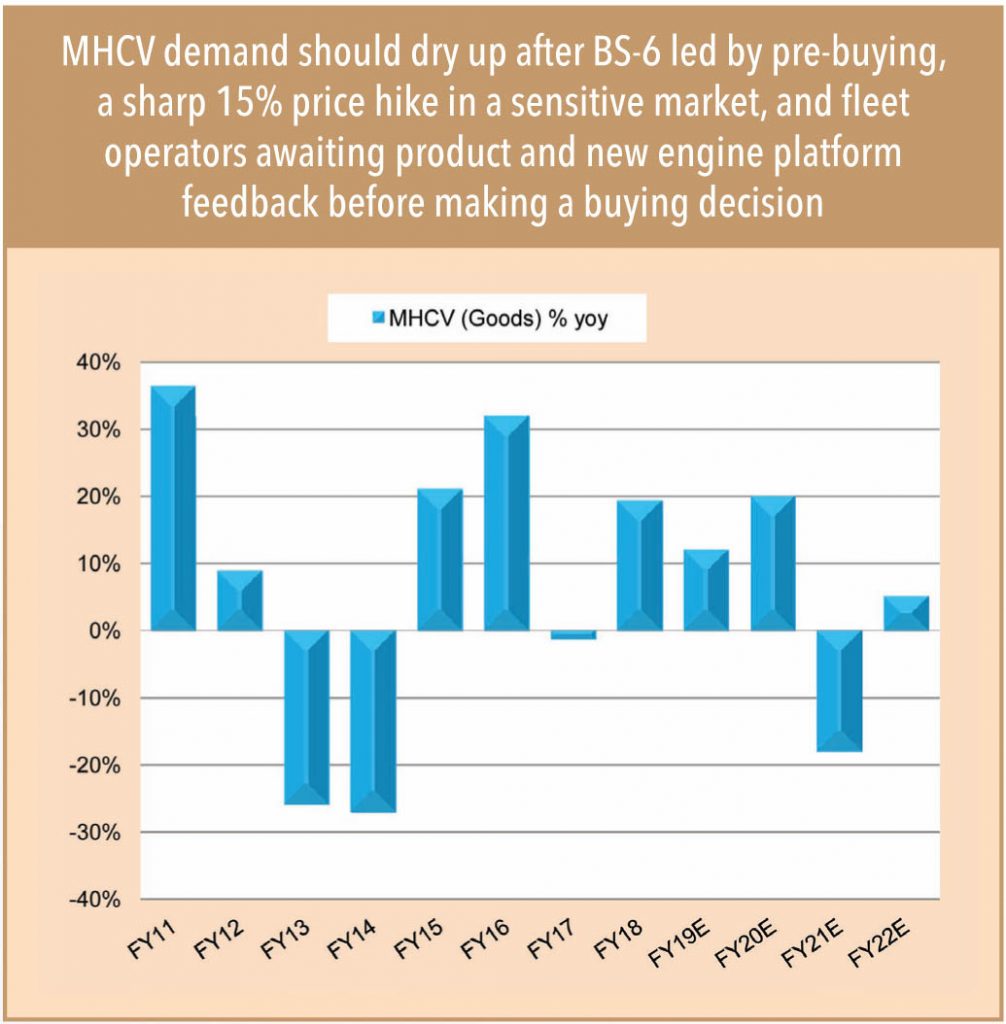

The MHCV sector should see a very strong pre-buying in the run up to the BS-6 shift in FY20, after which demand should dry up led by pre-buying, a sharp 15% price hike in a sensitive market, and fleet operators awaiting product and new engine platform feedback before making a buying decision (which generally takes up to 6-12 months). Ashok might be at a losing end vis-à-vis competitors, as it would adopt SCR for the first time. The price impact on Ashok would be much higher due to its shift from iEGR to SCR. Besides, fleet operators have already used SCR-based platforms of competitors who adopted SCR during the shift to BS4.

Subscribe to enjoy uninterrupted access