In a freewheeling interaction with Ground Zero, Mr. Sisir Pillai, Chief Strategy Officer – Digi Cable, talks about the implementation of cable TV digitisation in India, the pitfalls, and the challenges that the television content distribution industry faces. (Views are personal)

Digi Cable is a large, independent, unlisted, multi-system operator (MSO) with operations spread across western, northern, and eastern Indian states. Mr. Sisir Pillai has been with Digi Cable since 2007 and has close to 25 years of experience in cable television, broadcasting, marketing and advertising sales. He has been associated with the cable television industry since its inception and has worked with most major MSOs. On the broadcasting front, his experience spans channel distribution and placement with Zee Turner, CNBC TV18, ETC Network, and Sahara.

Here are excerpts of the interaction:

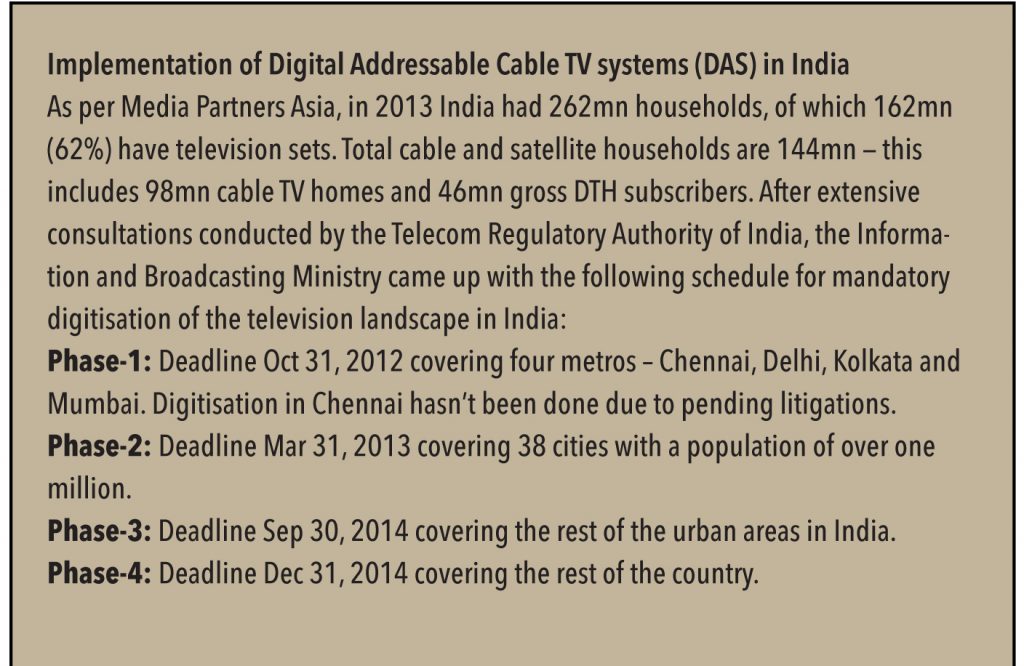

The Indian television industry has immense potential as it is one of the largest cable television markets in the world (Next only to China) and is today the fastest growing cable and pay TV Market. The addressable market size is estimated at about 100mn cable homes out of a total TV market of about 160 Mn (and still growing). The annual subscription revenue generated today at an ARPU of say INR 200/- per subscriber, per month is ~Rs 230bn. India’s pay TV ARPU is among the lowest in the world, but when compared with the number of channels offered at this ARPU it makes for a very dismal picture. Following extensive regulatory consultations, India embarked on a journey of digitisation in 2012.

Digitisation in India began on a very promising note as large MSOs who run cable TV networks deployed digital set top boxes (STBs) at a very rapid pace to meet the regulatory deadlines of Analog Sunset. What we have witnessed is probably the world’s fastest deployment of over 25 mn STB’s, completed in just about 14 to 15 months period (deployment started sometime in Jan. 2012 and by March 2013, more than 25 Mn STB were deployed in 42 markets).

Kudos to the ministry, the regulator and all the stake holders, viz, broadcasters, MSO’s, last mile owners (LMO’s) and the consumers who together worked to achieve this feat.While any change in a business ecosystem is very slow and gradual process (it is believed the conversion to Digital from Analog even in a mature market like the US has taken ~8 to 10 years) we could have seen better compliance, if all the stakeholders would have put in some more effort.

Speed-to-market was probably one of the biggest reasons for most of the challenges that the industry experienced in digitization. Broadly, one can summarize the challenges experienced as:

Implementation challenge: to change the mindset of all stakeholders who are conditioned to 20 years of analog television culture; funding & investment challenges; technology challenge; regulatory & legal challenges & finally the consumer challenge: changing consumer mindset to accept and adopt the digital ecosystem.

As a result, STB deployments were done haphazardly and therefore inventory management and tracking of STB’s remains a challenge – this means that the capital deployed on the ground cannot be tracked or managed efficiently.Addressability a key feature and requirement of DAS was never implemented from day-one, resulting in STB’s getting entitlements without the consumer having to pay for the services.

Packaging, if implemented effectively would have resulted in lower broadcaster payouts for the MSO’s and optimisation of subscription revenues, but till date we are yet to see this take-off. RIO’s – Reference interconnect offers which would have been one of the foundations of creating a basic legal agreement/understanding between the various stakeholders (whether between the Broadcaster and the MSO or between the MSO and the LMO’s and the filling of the Subscriber/customer application form, SAF/CAF) was never effectively implemented, resulting in arbitrary deals.

Billing, which in DAS was expected to ensure a completely transparent regime in managing services and payments has instead become a major problem area. This is despite the fact that both the conditional access system (CAS) and the subscriber management system (SMS) are housed at the MSO’s headend (or in the cloud). On-the-ground collections from consumers are done by the LMO’s and the MSO is not privy to this payment information.

Packaging is again very critical to the business of MSO’s in DAS. In a country like India with such diverse demographics and varying consumer preferences, it is very important to work on multiple packages rather than offer just a few packages with most consumers being offered a standard package with almost all channels. As mentioned earlier, by not offering the right packaging, MSO’s are paying more to the broadcasters and at the same time unable to generate more revenue from consumers.

(know your customer through SAF and Package application form, PAF) which should ideally contain a complete demographic and psychographic profile of each and every consumer household. MSO’s have either got incomplete or fictitious subscriber information and are unable to formulate the right services at the optimum price points to enable them generate commensurate subscription income.

MSOs need to revamp their systems and processes to ensure they’ve the correct information on the number of STB’s issued to their LMO’s and that which is active in the system (Cable TV in India is still unidirectional and this poses a challenge in understanding the exact number of active subscribers), get all the RIOs fully documented and deposited with the regulator, enforce packaging and start billing consumers. This will be key to the short-term success of the business.

In the medium term, the business will have to migrate from a unidirectiona to a bi-directional system which will enable delivery of content and services in a non-linear fashion.

The long-term perspective would be to invest in upgrading the infrastructure at the last mile to ensure delivery of both digital cable services and broadband services over the same pipe and to become the medium of choice for delivery of content & services, any-time, any-place to multiple access devices in multiple formats.

The regulator alongwith the ministry has done a commendable job in ushering in phase 1 & 2 of DAS; now I would love to see the regulator play the role of a mentor ensuring a more level playing for the various stakeholders especially those investing capital in digitization.

The regulator should look to evolve a retail pricing mechanism (where broadcasters have the freedom to decide on the retail price – the regulator should however work on fixing a maximum and minimum retail price wherein on cannot provide more than 15 to 20% discount) and strive towards working an acceptable revenue sharing formula between the stakeholders and work towards greater transparency. The regulator could further streamline channel distributors/aggregators addressing vertical/horizontal ownership challenges which need to be regulated.

From a medium to long terms perspective, regulations should help the industry transition from unidirectional to bi-directional signal transmission, facilitate non-linear delivery of services and help in offering both broadband and cable TV services over the same pipe.

Phase 3 & 4 presents an immense opportunity as there are estimated 75 to 80mn homes that still needs to be digitised, but having said this the bitter experience in implementation in phases 1 and 2 has made the large MSOs cautious in entering into this market.

However, I must also point out that the market structure in phases 3 and 4 is far more conducive for investment as there is limited competition; players who operate in these markets don’t have the economies of scale nor the expertise to invest, operate and manage the digital infrastructure.

Despite the challenges, the Indian television industry has immense monetisation potential as viewer preferences are changing. Gone are the days when television was just a family entertainer. The MSO industry needs to gear up for non-linear content delivery, multiple device viewing, and high-speed broadband needs of consumers.

Immense investments need to be made in conversion of one-way cable TV lines to two-way and installation of servers/equipments. The quantum of investment could be as much as Rs 10,000-20,000/subscriber, but this is a one-time spend.

If leveraged appropriately, this investment can be justified in the following manner — customer ARPUs from content need to increase from Rs 200-300 to Rs 500-600 per month. This coupled with high-speed broadband access for Rs 500-600 per month implies a total ARPU of Rs 1,000/month. Even if the MSO parts with 50% of the customer ARPU with the LMO, viz. Rs 500/month, pay content providers a net amount of Rs 100/month (vis-a-vis a negligible amount right now due to carriage) and bandwidth charges of Rs 100/month, an MSO is able to retain Rs 300/month. This implies that such an investment has a 3-year payback for an MSO, while the infrastructural investment is for life.

The business prospects are immense, but work needs to be done on the ground, in overcoming implementation challenges and lastly, not to mention getting the right funding to tap into growth.

Subscribe to enjoy uninterrupted access