Rice has always been a staple diet and with an increasing demographic base globally, absolute demand and consumption of rice will only rise each year. Outside India, the Middle East remains a dominant market and lifting of sanctions from Iran will lead to strong volumes. Demand is also picking up in the US, Europe, and Australia as they explore new palates. Changing lifestyles, increasing brand awareness, and higher cultivation that ensures steady supply, are boosting basmati growth.

Demand for basmati rice has seen a CAGR of 15% in the past five years driven by growth in the domestic and exports markets. We expect this momentum to continue. With a rise in incomes and a shift in consumer preference to branded rice, we expect domestic demand to remain strong. In basmati exports, India has taken away a substantial share from Pakistan – its only competitor – due to superior quality and higher production. This coupled with low inventory, shift in acreage, and rising demand is likely to lead to either stable or higher realisations over the medium term. With lower stock cost, margins should rise, driving the overall profit growth. Despite being in the B2C segment, due to strong underlying growth and decent return ratios, sector valuations remain attractive.

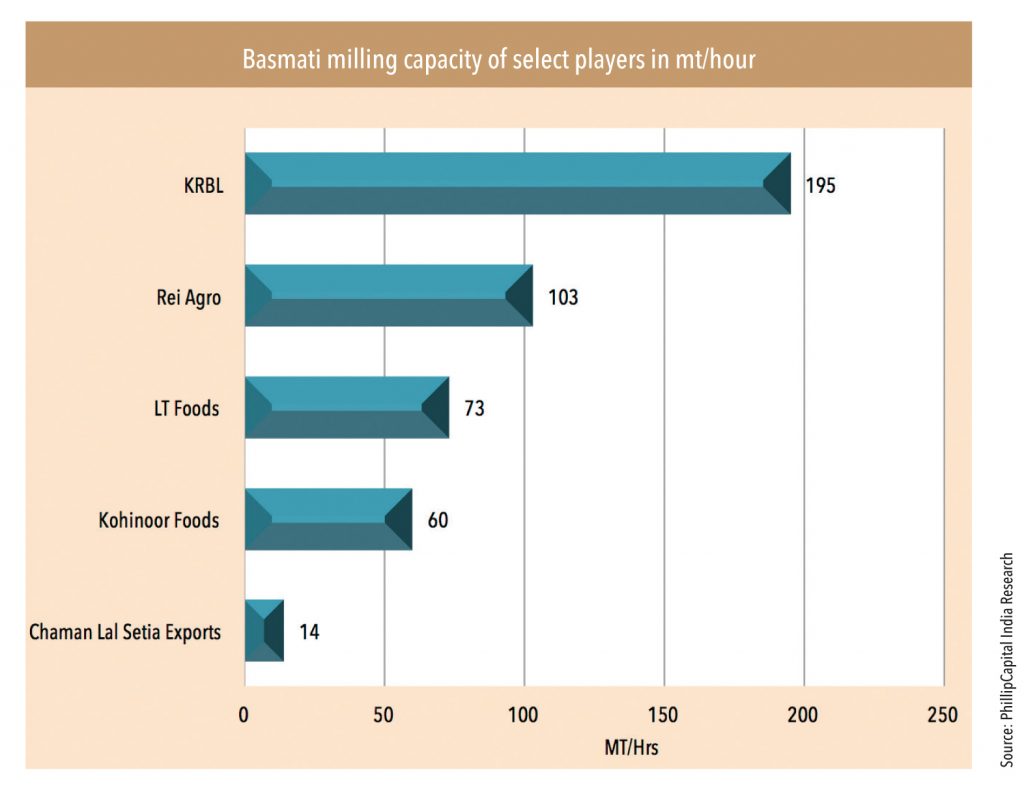

Chaman Lal Setia Export: It is one of the older rice millers and exporters of basmati rice. They have modern processing units in Karnal, Amristrar, and Delhi and a corporate office in New Delhi. Mr Chaman Lal Setia is the CMD. The company has a milling capacity of 14mt/hour and its flagship brand is Maharani. In FY15, it earned a revenue/EBITDA/PAT of Rs. 5.08bn/388mn/195mn with FY10-15 CAGRs of 32%/31%/34%. The company pays about 10% of its profit in dividends and is a listed company with a market cap of Rs. 2.5bn, trading at an FY16 PE of 11x.

Kohinoor Foods: The company has a portfolio of food products ranging from basmati rice, ready-to-eat products, cooking sauces and pastes, spices, seasonings, and frozen food. It has expanded its product basket to ghee, paneer (Indian cottage cheese), ready mixes, namkeens, sweets, premium biscuits and cookies. It has a milling capacity of 50mt/hour and its key brands are Kohinoor Authentic, Kohinoor Extra Long, and Kohinoor Silver. In 2011, McCormick, US, snapped up domestic marketing rights of Kohinoor brands and in 2013 Al Dahra LLC of UAE acquired a 20% stake in the company with a view of long-term food security. It earns revenues of Rs. 12bn, of which Rs. 7bn are from exports. Its financials have been quite volatile and revenue growth was a sluggish 6% in FY11-15. The company has not paid any dividend in the past three years. Its market cap is Rs. 1.5bn.

KRBL: KRBL is India’s largest exporter of branded basmati rice and owns the largest rice milling capacities in the country. Its rice brands include India Gate, Train, Al Wisam, Doon and Nurjahan (contributing 95% of total revenues). Its flagship brand – India Gate – contributes 55-60% of total revenue while non-basmati rice (mostly private labels) contributes 3%. KRBL derives 40% of its revenues from exports — 30% from the Middle East, and 10% from the rest of the world. It also wishes to penetrate the Chinese and Russian markets in the near future. KRBL has maintained excellent financials vs. peers with revenue/EBITDA/PAT CAGR of 19%/21%/25%: in FY10-15. The company has been steadily increasing its dividend payouts – FY15 payout was 14%. It trades at an FY16 PER of 15x.

LT Foods: This company offers branded basmati rice, value-added staples, and organic food. Its brands Royal and Daawat are #1 and #2 in the US and India respectively. While basmati rice remains its core proposition, its vision is to emerge a global specialty food company. In FY15, it earned a revenue/EBITDA/PAT of Rs. 18bn/1.6bn/307mn translating to CAGRs of 22%/20%/17% in FY10-15. The listed company has been consistently paying dividends of 15-17%. Its market cap is Rs. 6.5bn and it trades at an FY16 PER of 8x.

Topline growth has been healthy, but margins have suffered due to MTM losses on inventory

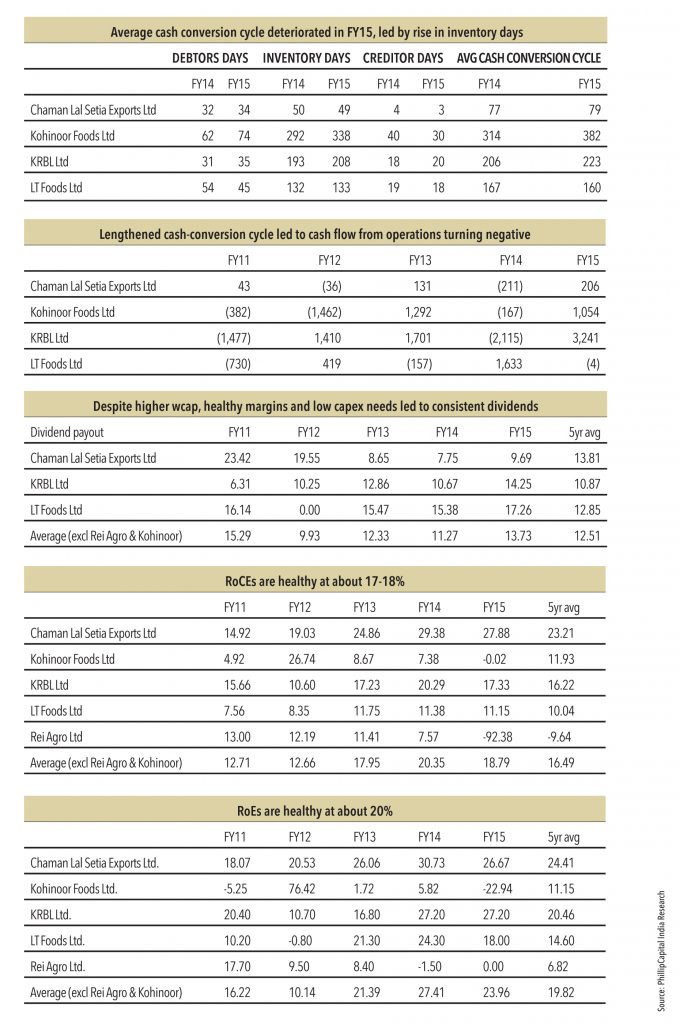

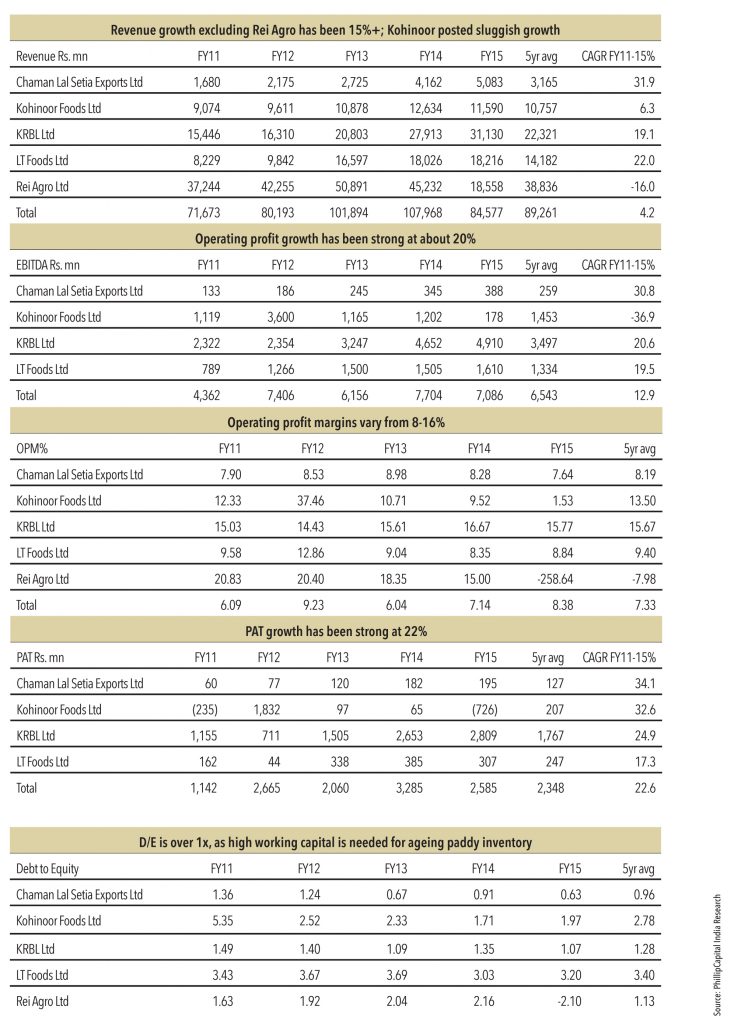

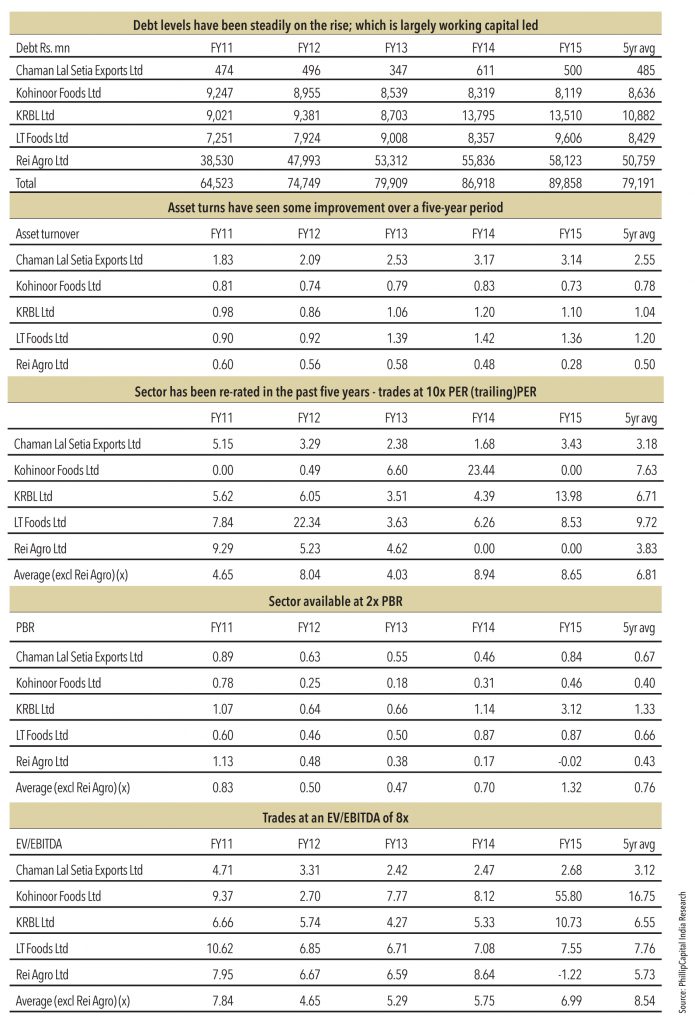

A bottom-up calculation of the four large listed players (Chaman Lal Setia, Kohinoor, KRBL, and LT Foods) shows a topline growth of 18% in FY11-15; including REI Agro, it is just about 4%. The five large listed players account for Rs. 100bn in revenues – a fourth of the industry’s revenues (domestic + exports). Performance was divergent – players such as KRBL (leader in the segment) and LT Foods saw strong topline CAGR of 19% and 22% respectively. Kohinoor Foods revenue growth has been rather sluggish at 6%.

Operating profit growth for the industry was relatively slow at 13% (excluding Rei Agro) perhaps due to franchise expansion and mtm losses on huge paddy/rice inventory. LT Foods’s OPM margins slipped to 9%, but KRBL’s and Chaman Lal’s were steady at 16% and 8% respectively.

Working capital remains a challenge for some players

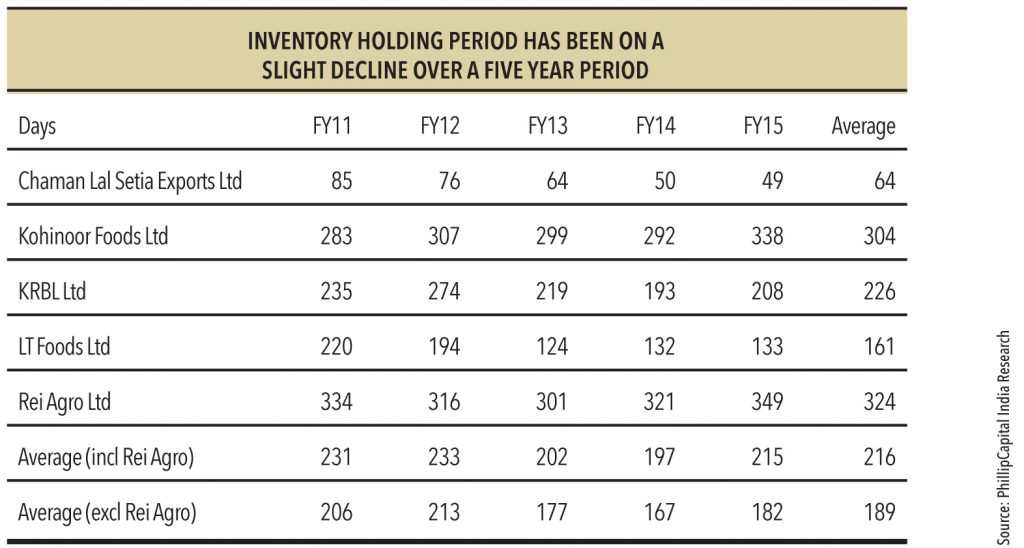

Working capital needs are high in staples trading/milling companies. Ageing is necessary to ensure higher recovery of head rice, reduce the proportion of broken rice while processing, removing moisture, and increasing the aroma. Both paddy and rice are aged, though there is a limit to the effectiveness of ageing paddy beyond six months. Rice can be aged for longer periods and rice aged beyond a year has a price premium, but remains a niche product. Ageing results in high working capital requirements.Indian banks have generally been liberal in financing these working capital requirements. The financing standards have been very low and credit has been easily available. The result has been that most processors had purchased more paddy than was necessary, which in turn had resulted in high inventory holding periods. However, the data points to a gradual decline (of 24 days) in FY11-15.

Players now realize that there is minimal benefit in holding excess paddy inventory. The reason is that all ‘aged’ paddy no matter the vintage (in terms of harvest year) is almost priced the same. Consequently, if paddy is stored for more than a year, then its value is determined by the next year’s paddy prices. Players such as Kohinoor Foods and Rei Agro are holding excess inventory and could see significant inventory writeoffs going by the current low prices of basmati paddy prices.

The recovery rate is the amount of rice that can be milled from a given quantity of paddy. Industry producers are consistently recovering 65% of the paddy for milling. By-product production (husk at ~20% and bran at 9%) is fairly standard across the industry. All processors have access to the latest and improved technologies in processing and storage and therefore there are limited competitive advantages in recovery.

Balance sheet issues are likely to be crucial

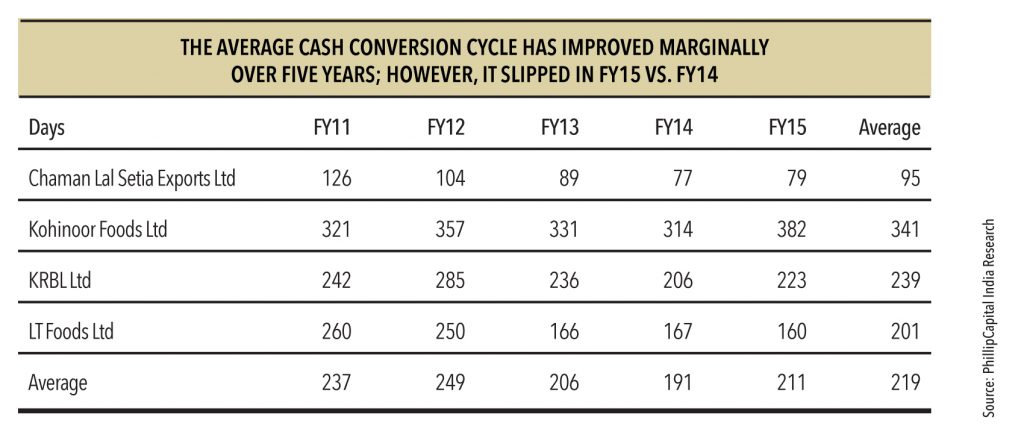

The third continued bad season is likely to put pressure on companies with higher receivable days. A marginal jump in these days suggests a slower secondary offtake than primary sales. As a result, companies are facing pressure from both inventory and receivables. Therefore, sales growth needs to be seen in conjugation with WC deterioration for agri-staples companies. KRBL has a high inventory-holding period, so it has a deteriorating cash-conversion cycle.

Weaker cash conversion leads to lower dividend payouts

Given relatively lower capex needs (mostly working capital), most companies (Chaman Lal, KRBL, LT Foods) have announced dividends over the last five years. However, weak cash generation has meant lower dividend payouts, even as KRBL’s improved to 14% in FY15 from 6% in FY11. Most of the players in the space have healthy RoEs of 20-30%. Among best performers are KRBL and Chaman Lal Setia with ~27% RoEs. Low capex intensity and healthy EBITDA margin of 15% enable the sector’s RoEs to be high despite higher WC intensity. However, cash conversion is usually closely watched.

Where do we go from here?

FY16 is likely to be muted for branded basmati players due to a weak demand environment in the domestic market and in exports. On the domestic side, weak monsoons and excess production have put pressure on offtake. Globally, weak weather patterns and low commodity prices have impacted the overall demand. The sharp correction in basmati prices is likely to result in MTM losses on paddy inventory (while incrementally it would be lower in H2FY16). Heightened aggression among local and international players due to a weak season could soften margins. Players with a high brand recall would be able to combat such pressures to a certain extent.

Subscribe to enjoy uninterrupted access