The Mango Man’s (Aam Aadmi’s) Capex

“Chaan aahe na? (nice, isn’t it?),” enquired Dr Dnyandeo Patil of his under-construction retirement home in Zombadi village, Chiplun (Ratnagiri district of Maharashtra). He is in the process of outfitting the interior of his 4,000 sq. ft. house (mansion by Mumbai standards) with polished and glazed vitrified tiles (PGVT) and the terrace and walkway with unglazed porcelain tiles. At Rs 60-70/sq. ft., this is no cheap spend! The winner – a brand of tiles that belonged to an unlisted, but reputed Gujarat-based player. For the GV team, this conspicuously lavish household capex in rural India turned a routine trip to purchase the famous ‘Ratnagiri hapus (alphonso)’ into an intriguing fact-finding mission about the status of the ceramic tiles industry.

Insatiable curiosity led the intrepid GV team to the supplier of these tiles – Mr Malani of M/S Malani & Sons. “Abhi toh PGVT tiles sabse zyaada chalte hai, finish aur variety bahut acha hai(today PGVT tiles are in vogue, the finish and choice of products is unmatched),” he said. Better durability and lower costs of installation compared to other forms of flooring were also compelling factors as far as cost-sensitive but quality conscious rural customers are concerned.Further into the conversation, he casually revealed that his enterprise had an annual turnover in excess of Rs 75mn, with a sizeable chunk from unlisted brands!

Which led to the following questions – Is this a flash in the pan limited to the cash-cropping and wealthy, Konkan belt or a nationwide phenomenon? Are unlisted Indian brands (from the famed town of Morbi) really that good?

What followed was an extensive road trip and meetings with listed and unlisted companies, interviews with dealers and architects, and interesting conversations with end users – which resulted in this GV on the Indian tiles industry.

Despite the sluggishness of the Indian economy, particularly the real-estate construction space, the domestic tile industry continues to grow at 12-15% per annum. Driven by individual construction in hinterlands and government spending on the social sector, the Indian ceramic tile industry achieved a size of ~Rs 250bn and 760mn square meters (msm) in CY15.

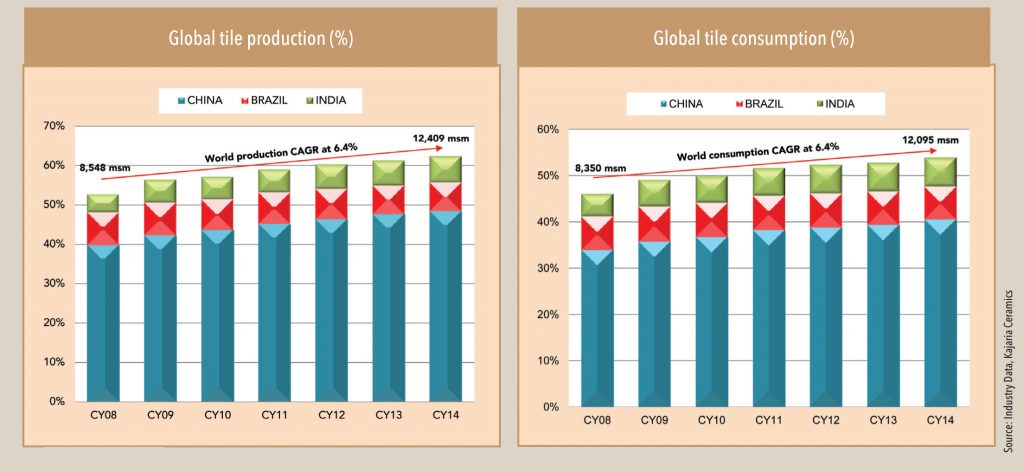

India is the third-largest tiles market in the world, accounting for about 7% of global production. A cursory glance at the production and consumption statistics reveals some interesting details – while global tiles production CAGR over CY08-14 was 6.4%, the Indian industry’s was 13%. During the same period, the domestic rate of growth in production overtook China’s 10% and Brazil’s 4%.

In the same period on the consumption front, India’s appetite

for tiles has seen a CAGR of 11%, indicating increasing exports. As with demand, growth in domestic consumption outpaced China’s 10% and Brazil’s 6%

Subscribe to enjoy uninterrupted access