D-Mart – On the right path

Supermarket model with focus on value and sustainable expansion

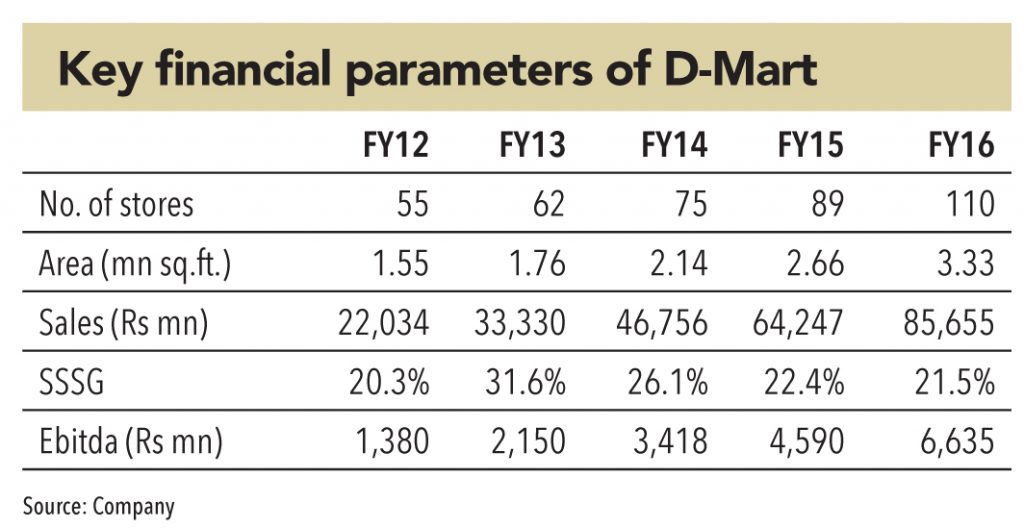

D-Mart was started by India’s legendary investor-turned-entrepreneur Radhakishan Damani in 2003. It is now a major retail chain in India with 118 stores, 87 of which are located in the western Indian states of Maharashtra and Gujarat. Through a strategy called EDLP (everyday low prices), which is also followed by Wal-Mart, D-Mart has created a niche for itself in the modern retail space in India. Customers value it for its relatively low pricing across all major product categories, the whole year round. Because of its strong value focus and ability to offer lowest prices to consumers, its sales CAGR in FY12-16 was high at 40% to Rs 86bn.

While being a leader in brick and mortar retail, the company has its share of admirers in the ecommerce world too. In a recent email to the employees of Indian e-commerce giant Snapdeal, its founder Kunal Bahl asked the employees to follow the example of D-Mart in how to run the business. He reckoned that D-Mart’s focus on unit-level profitability and core audience helped it to deliver phenomenal results. He also remarked that unlike other retail companies, which prioritise expansion over profitability, D-Mart succeeded by doing just the opposite.

Right mix of global retail giants Walmart and Costco

D-Mart is one of the few retail chains in India that has been able to crack the secret of profitability and sustainability in a business model in Indian retail. It operates large-format stores (about 30,000 sq. ft.) and like Wal-Mart, prefers to own the stores or rent them on very long-term leases. However, unlike Wal-Mart, it does not offer an expansive array of brands in each category. Instead, like Costco, it offers a very limited product assortment of fast-selling SKUs, which helps it to keep a tight control on inventory and increase inventory turns.

Growth, but not at the cost of worsening financials

D-Mart has a very conservative policy on new store openings and prioritises sustainability and profitability over scale. It opens 70% of new stores in existing geographies and is very cautious about entering new geographies. This has helped it to have a better understanding of its customers and catchment areas, and to fine-tune its sales strategy. Because of D-Mart’s focus on operating cost control and tight inventory management, its last four-year EBITDA/PAT CAGR was 48%/52% to touch Rs 6.6/3.2bn. Its focus on sustainability has helped it to maintain working capital, debt/equity, and return ratios at healthy levels.

D-Mart is present only in 45 cities in India, and if it is able to maintain its focus on sustainable and profitable growth, it can cover 250-300 cities in the long term – thereby increasing its store count, sales, and profits exponentially. At a market capitalisation of Rs 45bn, it is the most expensive listed retail chains in India. It is likely to grow significantly larger in the long term if it continues to pursue the right strategies

Like Walmart, D-Mart offers low prices every day, and prefers to own stores or rent them on a long-term lease. Like Costco, D-Mart offers a limited product assortment and keeps inventory under control

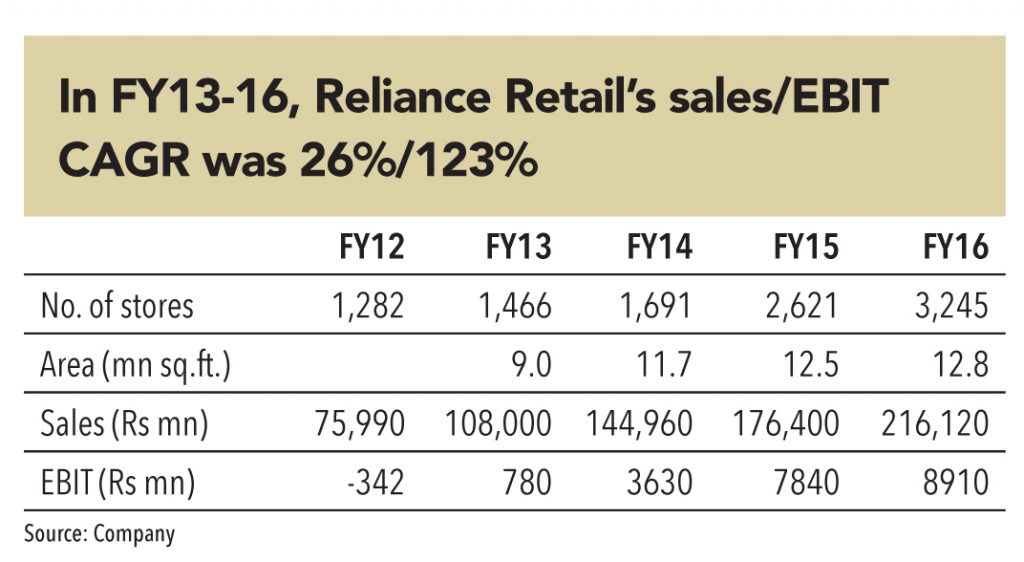

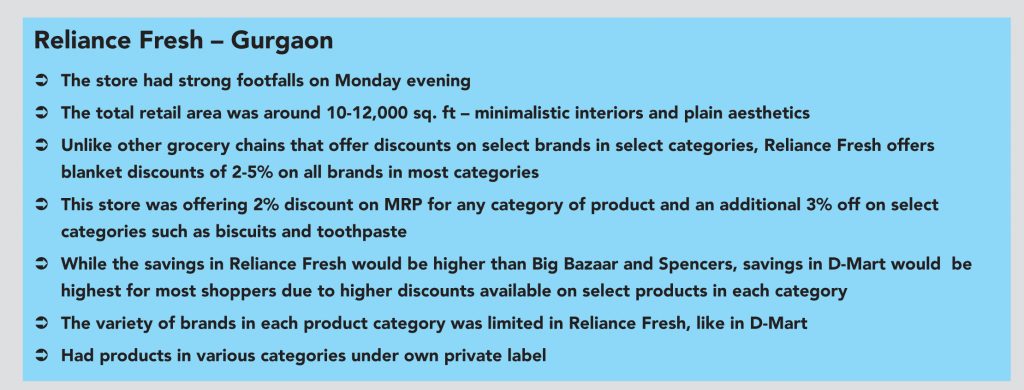

With a network of 3,553 outlets across 686 cities and a pan-India retail footprint of over 13.25mn sq. ft, Reliance Retail is India’s largest retail company. Reliance Fresh, started in 2006, is Reliance Retail’s supermarket grocery chain. It operates around 500 stores (average area 5,000-10,000 sq. ft.) across 80 cities in India. It is positioned on freshness and savings with the core promise of Fresh Hamesha, Available Hamesha, and Savings Hamesha (Hamesha = Always). Unlike other grocery chains, which offer discounts on certain brands of products in certain categories, Reliance Fresh offers blanket discounts of 2-5% on all brands within most categories.

Reliance Retail also includes chains like Reliance Market (cash-and-carry; 37 cities with 2.5mn members), Reliance Digital (electronics; 1,900 stores), Reliance Trends (fashion; 320 stores in 177 cities), Reliance Footprint (footwear), and Reliance Jewels (jewellery; 50 stores in 36 cities).

Unlike other grocery chains, which offer discounts on certain brands of products in certain categories, Reliance Fresh offers blanket discounts of 2-5% on all brands within most categories

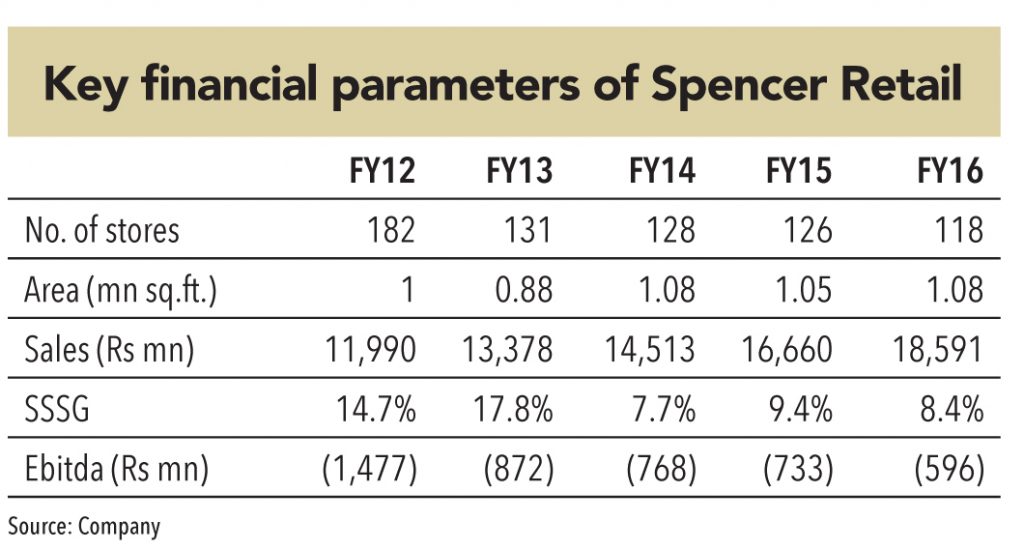

Spencer Retail, part of RP Sanjiv Goenka Group, is a major Indian multi-format retail chain with 120 stores including 37 hyper-stores in over 35 cities in south and north India. Spencer’s hypermarkets are some of the most expansive retail stores in the country with the area of many outlets in excess of 25,000 sq. ft. Unlike D-Mart, which has a limited product assortment, Spencer’s hypermarkets offer one of the widest assortment of brands – this is one of the key differentiators for Spencers according to its website. It also has smaller-format stores under Spencer Supermarkets (17) with per store area of 3,000-5,000 sq. ft. and Spencer Dailies (68) with per-store area of less than 3,000 sq. ft.

During FY12-16, same-store sales for Spencers grew annually by 11% and total sales grew by 11%. However, the chain is still not profitable; it reported a loss of Rs 530mn at the EBITDA level in FY16.

Spencer’s hypermarkets are some of the most expansive retail stores in the country with a very wide product assortment

Future Retail is one of the most prominent and oldest retail companies in India and operates through its chains Big Bazaar, Easy Day, Food Bazaar, and others. Big Bazaar is India’s largest hypermarket chain with 231 outlets and a total area of 9.8mn sq. ft., across 124 cities. Big Bazaar is a multi-category large-format chain with a typical store size of 30,000-40,000 sq. ft. Future Retail also operates other smaller formats like Easy Day (neighbourhood stores chain) with 379 outlets across 128 cities, FBB (a fashion chain) – 54 standalone stores, Foodhall – 6 stores, ezone – 87 stores, and HomeTown – 37 stores.

While Future Group was one of the first movers in the Indian retail space through its chains Pantaloons and Big Bazaar, it faced skyrocketing debt due to aggressive expansion and capital misallocation. As a result, it hived off Pantaloons and sold it to Aditya Birla group in 2012. During FY12-16, its SSSG CAGR was 7.2% annually for its value retail portfolio (Big Bazaar and Food Bazaar).

Big Bazaar is India’s largest hypermarket chain with 231 outlets

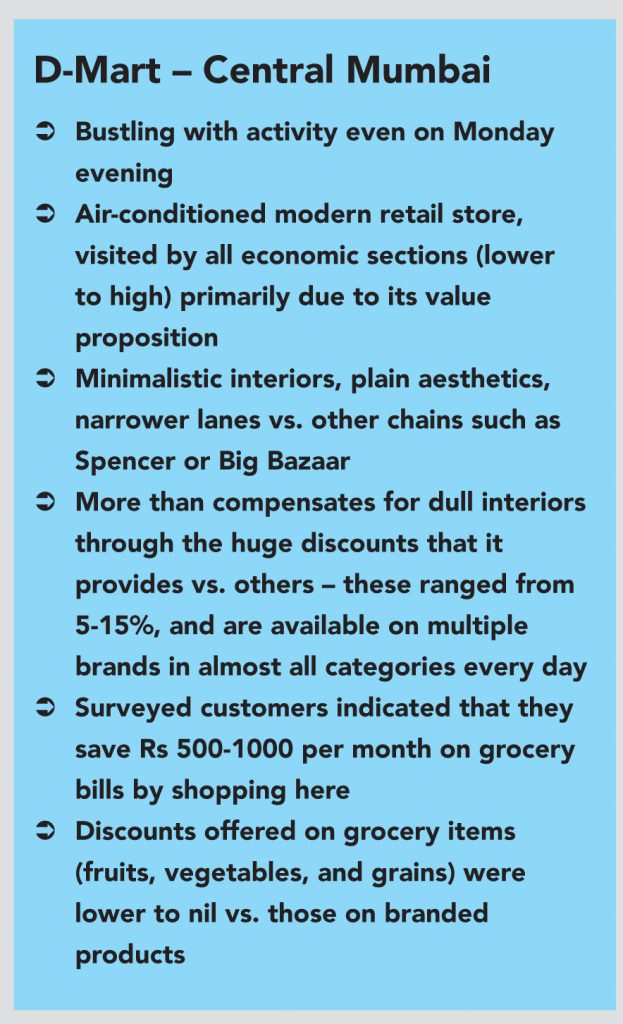

GROUND VIEW GOES SHOPPING

GV talked to a shopper Mr Kadam about why he shops at D-Mart. He said, “I stay at Kanjurmarg East but travel every week to this store in Kanjurmarg West as it offers the lowest prices for all my grocery needs and helps me save around Rs 1000 per month. I even know of some shopkeepers in my area who buy goods for sale from D-Mart.”

GV asked one of the storekeepers Miss Rathi about why consumers buy from Big Bazaar and not from nearby grocery outlets. She said, “People come to malls (Big Bazaar) for variety. It offers a huge range of brands, cheap ones as well as expensive ones, and young salaried people shop 15 days to 1 month worth of groceries in one go here.”

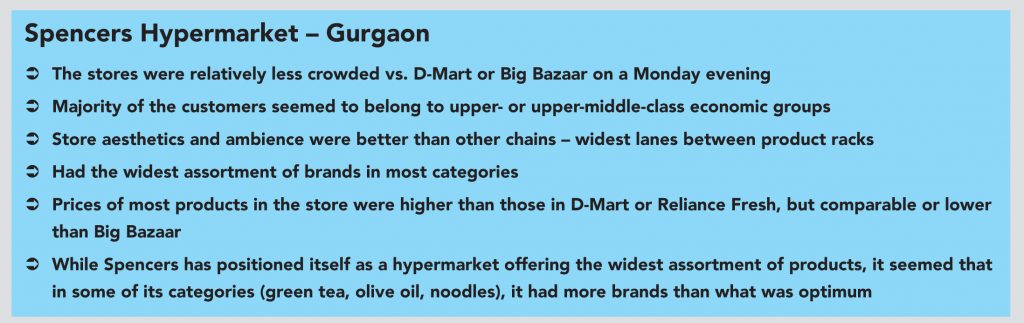

When asked what differentiates Spencers, the store manager said, “Our hypermarkets are positioned on range and variety. People come to our stores for the quality, price, and exotic brands of products – they will not find these in other stores. We also offer discounts on various product categories, which helps customers save money.”

“Reliance Fresh stores are known for the quality of fruits, grains, and vegetables, and the guaranteed savings on MRP on each and every product” – Mr Ritwik, Store Salesman, Reliance Fresh, Gurgaon

D-Mart and Reliance Fresh best poised to succeed, Big Bazaar needs to work on value proposition, Spencers Hypermarkets needs to work on efficiencies

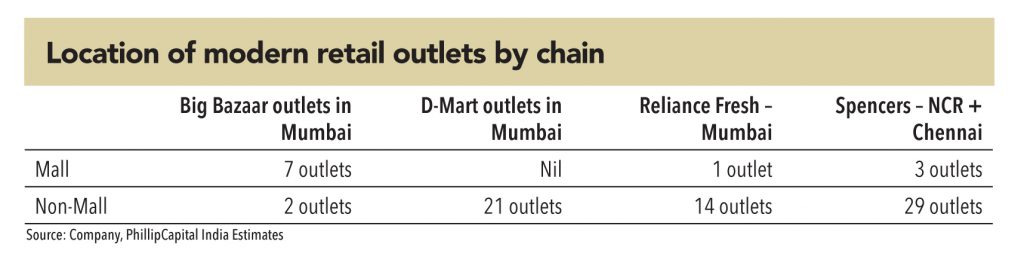

D-Mart’s business model seems best poised for sustainable and profitable growth. It offers lowest prices on most product categories (which leads to higher footfalls and sales), does not operate in expensive locations such as malls or downtown areas of cities (which saves costs), and has tight control on inventory due to limited product assortment (which helps to reduce working-capital needs).

Like D-Mart, Reliance Fresh offers low prices, rarely operates in malls, and has a limited product assortment. While its financial details are not available publicly, we believe that Reliance Fresh’s business model is sound and the chain can grow sustainably by continuing to control inventory days and operating costs, and not undertaking very aggressive expansions.

While Big Bazaar outlets offer a wide product assortment and the convenience of one-stop shopping for all daily needs, it may lose footfalls to other retail chains due to its inability to offer effective savings to customers on a daily basis.

Spencers Hypermarkets seems to have scope to reduce both costs and inventory. These stores are slightly ahead of time – more expansive (area) and expensive (aesthetics) than optimum. Also, the number of brands available at Spencers Hypermarkets may be more than what is optimum.

Quick takeaways:

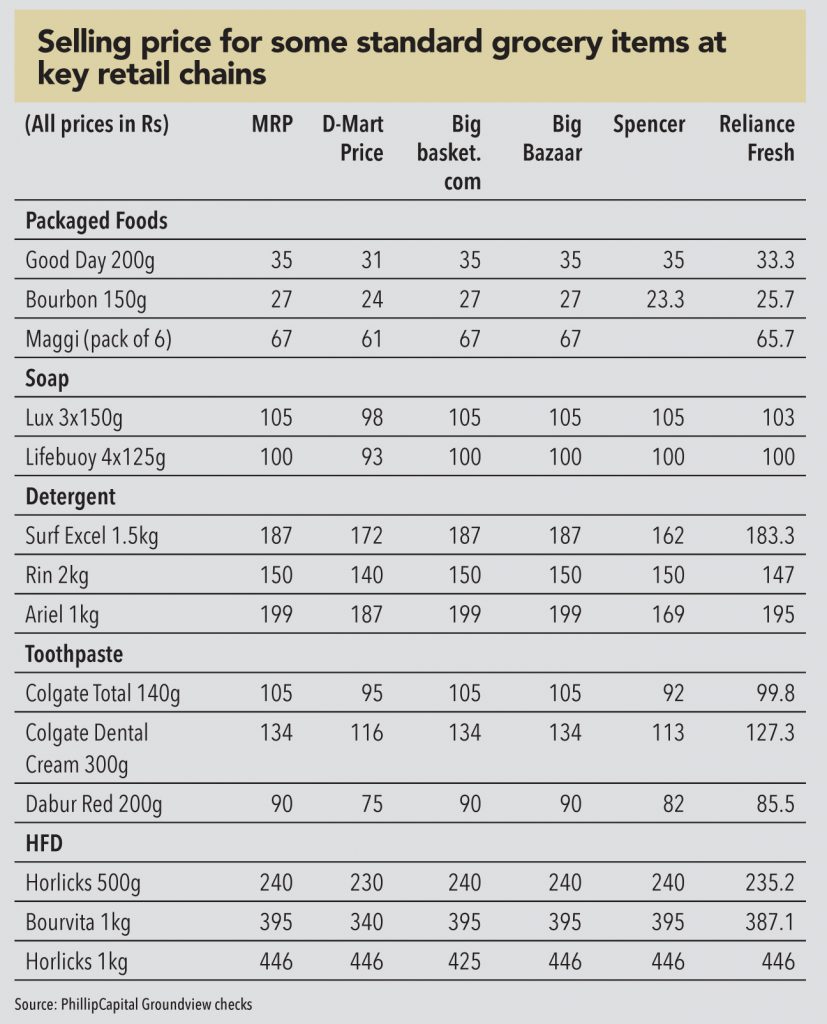

Price: D-Mart offers the lowest prices for most branded products, followed by Reliance Fresh, followed by Big Bazaar/Spencers. A price-conscious customer will prefer D-Mart over other stores in the same locality.

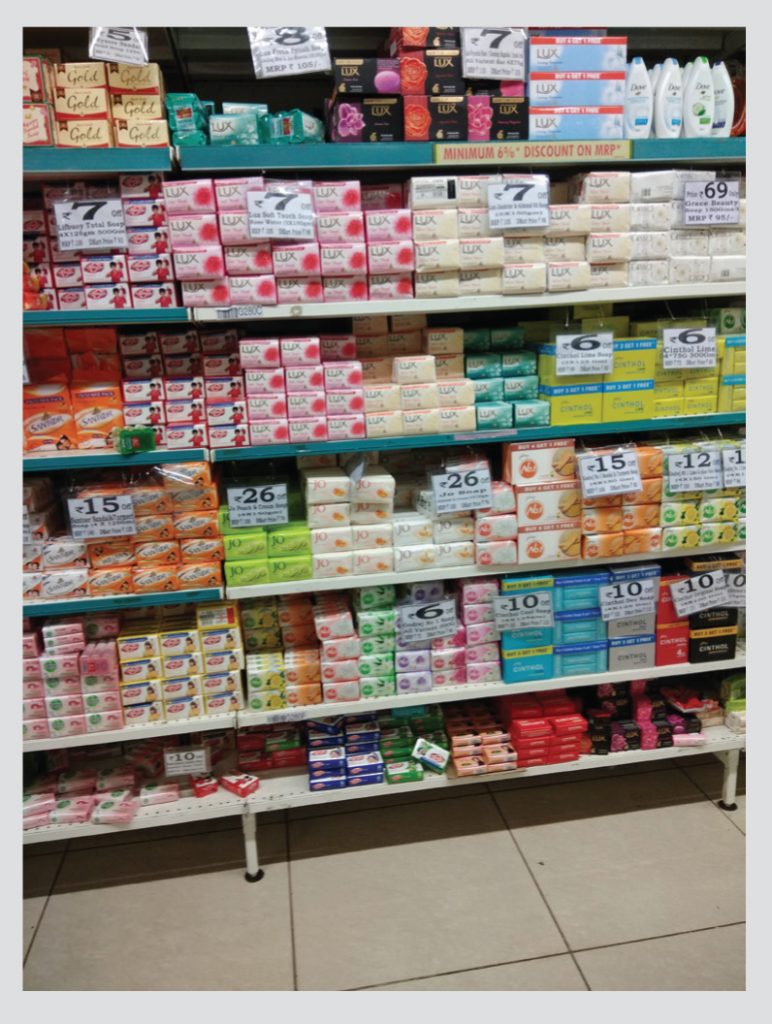

Product assortment: Spencers Hypermarkets, followed by Big Bazaar, offers a wider assortment of brands compared to D-Mart and Reliance Fresh.

Store size: Spencers and Big Bazaar have larger store sizes, followed by D-Mart, followed by Reliance Fresh.

Store aesthetics: Spencers Hypermarkets, followed by Big Bazaar, have higher focus on aesthetics and ambience compared to D-Mart and Reliance Fresh.

Footfalls: D-Mart had the highest footfalls, followed by Big Bazaar/Reliance Fresh, followed by Spencers.

Store location: Most stores of Big Bazaar and Spencer Hypermarkets were in malls, which have higher rentals. Some stores of Reliance Fresh were in malls. No D-Mart stores are in malls; they are always standalone buildings

Subscribe to enjoy uninterrupted access