Dr LalPathLabs’ and Thyrocare’s recent successful initial public offerings (with overwhelming response from investors resulting in 33x and 73x oversubscription respectively) has brought Indian diagnostics to the fore as the new healthcare investment destination. The big question is – can diagnostics fulfil investor appetite?

The diagnostic industry has already emerged as the fastest-growing segment of the Indian healthcare industry led by under-penetration of diagnostics services with lower tests per patients, ageing population, changing disease profile to chronic lifestyle-related illnesses, and more importantly, the transition of the Indian industry towards becoming organised. Additionally, this business’s strong capital efficiency (because of higher margins and healthy asset turnover) and its flexibility to expand geographically with minimal capital have captured investors’ desires. However, the limitation of the Indian diagnostics industry as an investment avenue is its relatively smaller base. This issue attempts to make an accurate prognosis of the Indian diagnostics industry.

Diagnostics plays a critical role in healthcare services – in identifying causes and symptoms of various diseases. It saves millions of lives each year by detecting diseases in early stages, helping the doctor offer appropriate and quick treatment. Thus, it curbs the overuse of inappropriate medicines and plays a critical role in the fight against drug-resistant bugs.

Although diagnostics have been an integral part of the healthcare services since a long time, and about 70% of all treatment decisions are based on diagnostics test results, the segment remained unavailable to secondary-market investors until recent IPOs of Dr Lal PathLabs and Thyrocare. The overwhelming response from investors, with 33x over subscription in Dr Lal and over 73x in Thyrocare, brought out diagnostics as the new healthcare investment destination.

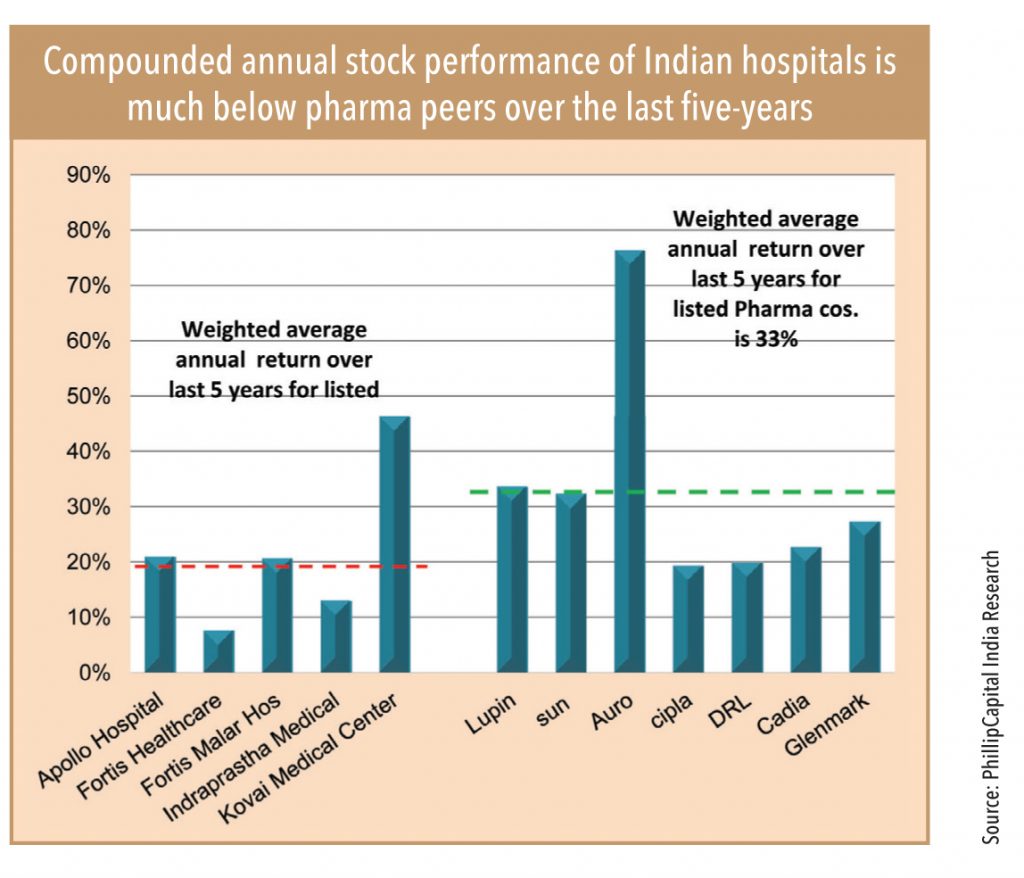

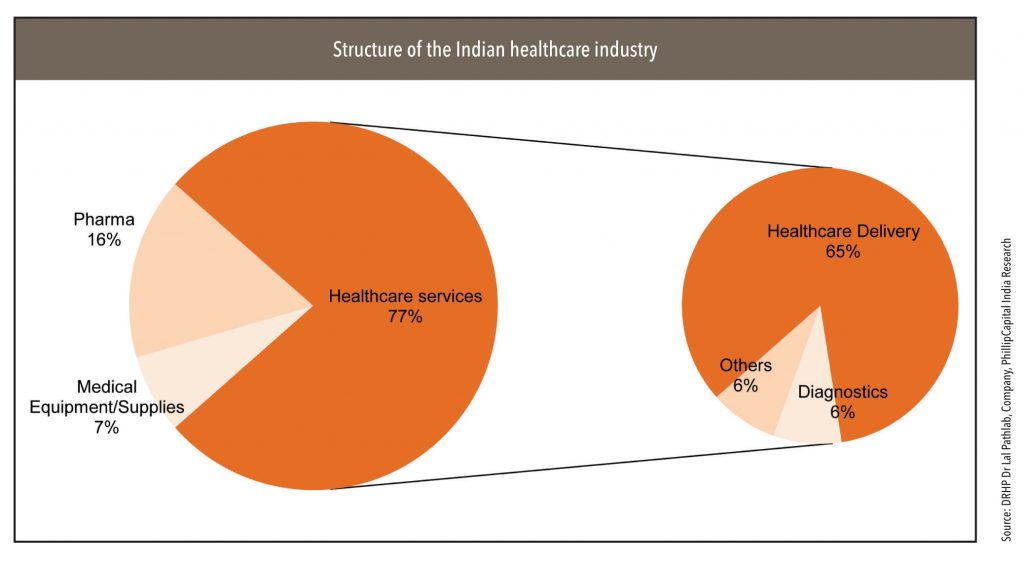

The hospitals business in India has always been considered to hold immense potential given the huge unmet need in Indian healthcare, significant under penetration of healthcare services, and limited number of organised players. However, constrained by the capital-intensive nature of the business, both growth and share-price performance of Indian hospital companies (accounting for +60% of the Indian healthcare industry) have been much below Indian pharmaceuticals (32% of Indian healthcare) over the last five years. Can diagnostics (~6% of Indian healthcare) step in to fulfil investment appetite?

Key growth drivers for the Indian diagnostics market

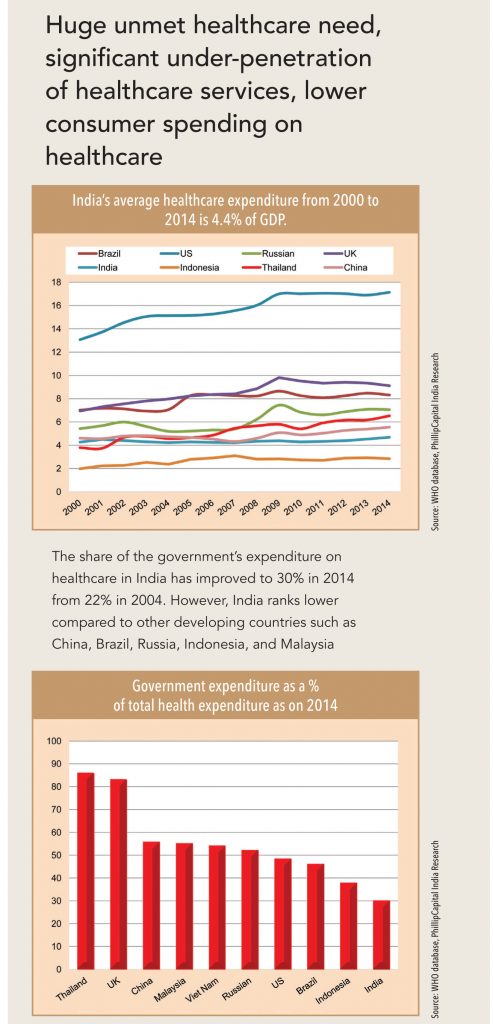

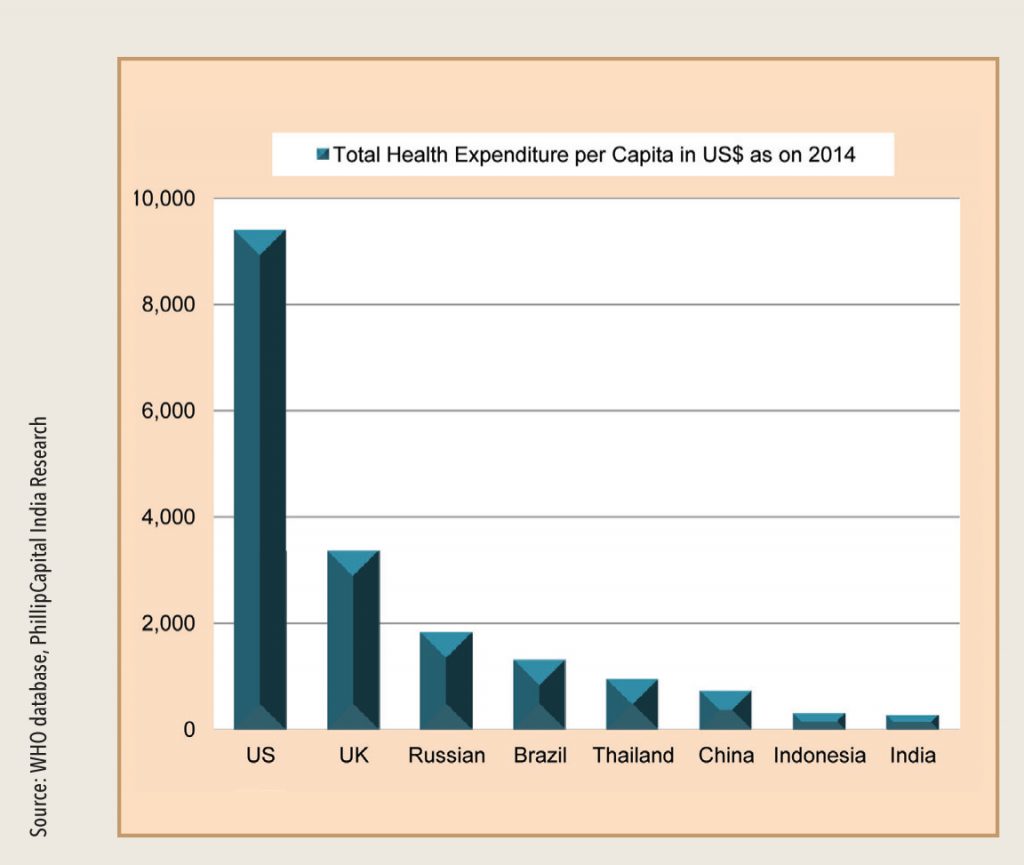

India’s per capita total expenditure on healthcare is too low compared to advanced markets and even vs. comparable markets such as Brazil, Indonesia, Thailand, and Russia

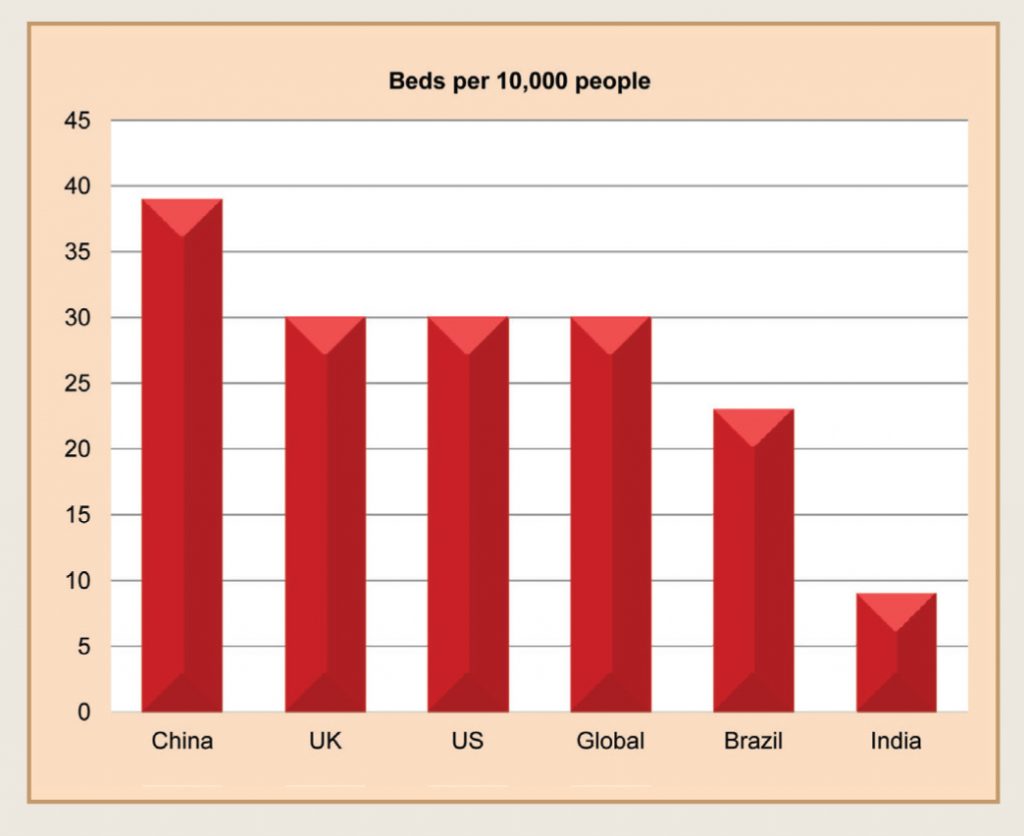

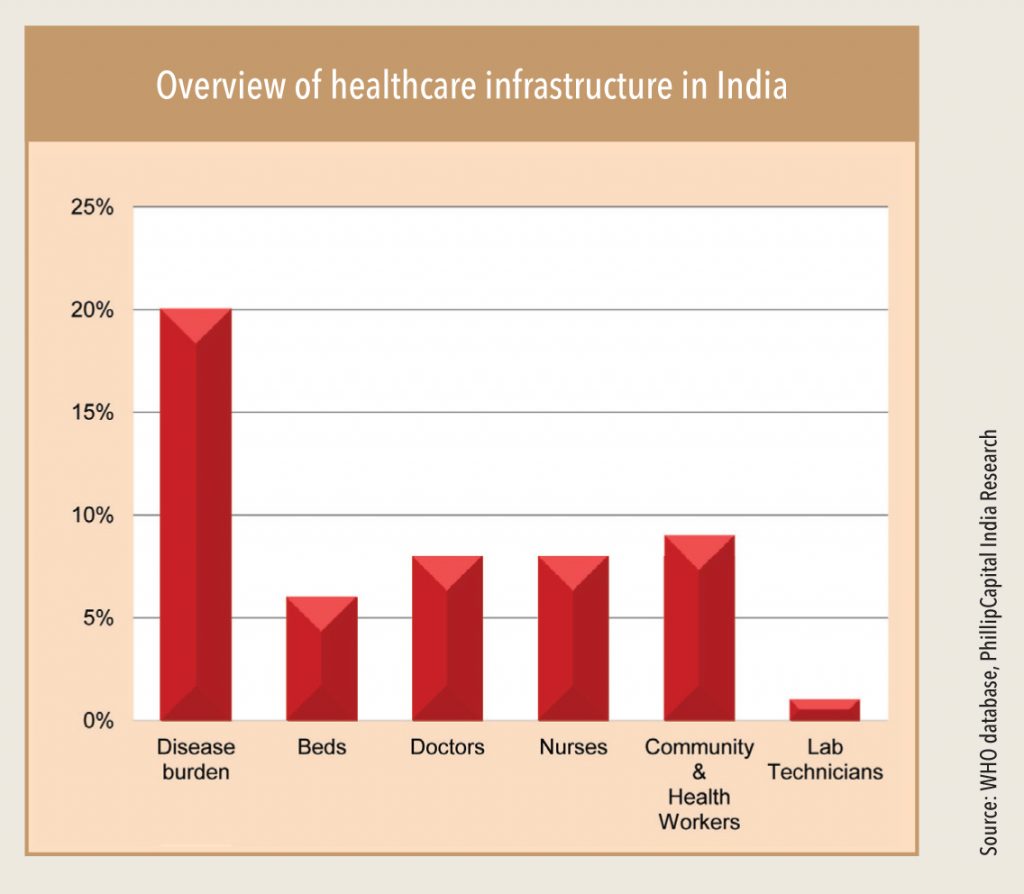

India’s share in the global disease burden is 20%, while its share of healthcare infrastructure is much lower with only 6% of global hospital beds and 8% share of doctors and nursing staff

India lags behind other developed and emerging economies in healthcare infrastructure

The gap remains substantial, with only nine beds per 10,000 people, significantly lower than the other countries and the global median of 30 beds per 10,000 people

Subscribe to enjoy uninterrupted access