Will the investor community continue to ignore the Indian specialty chemicals sector, with a market size of about US$ 25bn? This industry has already delivered healthy 13% CAGR (next only to China and Korea) over the last decade. India has emerged as the fastest-growing specialty chemicals market fuelled by sturdy domestic demand with strong economic growth, a large population, and rise in per-capita income. A simultaneous reduction in input costs, due to the sharp correction in crude prices, enhanced the earning efficiency of the industry, which relies on imported inputs. Moreover, softening of Chinese chemical exports, with environmental issues leading to a shut down and relocation of 1000+ chemical plants, adds zing to India’s specialty chemicals exports potential for the next couple of years. Additionally, the Indian government’s ‘Make-in-India’ initiatives in addressing the old hurdles of the industry, with enhanced focus on R&D and the rapid flow of FDI into the sector indicates value growth in the domestic specialty-chemicals industry. This issue takes an in-depth look into the rising tide that will float all speciality-chemicals boats.

Chemicals are now an integral part of human life due to their numerous applications that help improve the quality of life — these include breakthrough innovations enabling pure drinking water, faster medical treatment, stronger homes, and greener fuels. The chemicals industry is critical for the economic development of any country, as it caters to the needs of various industries.

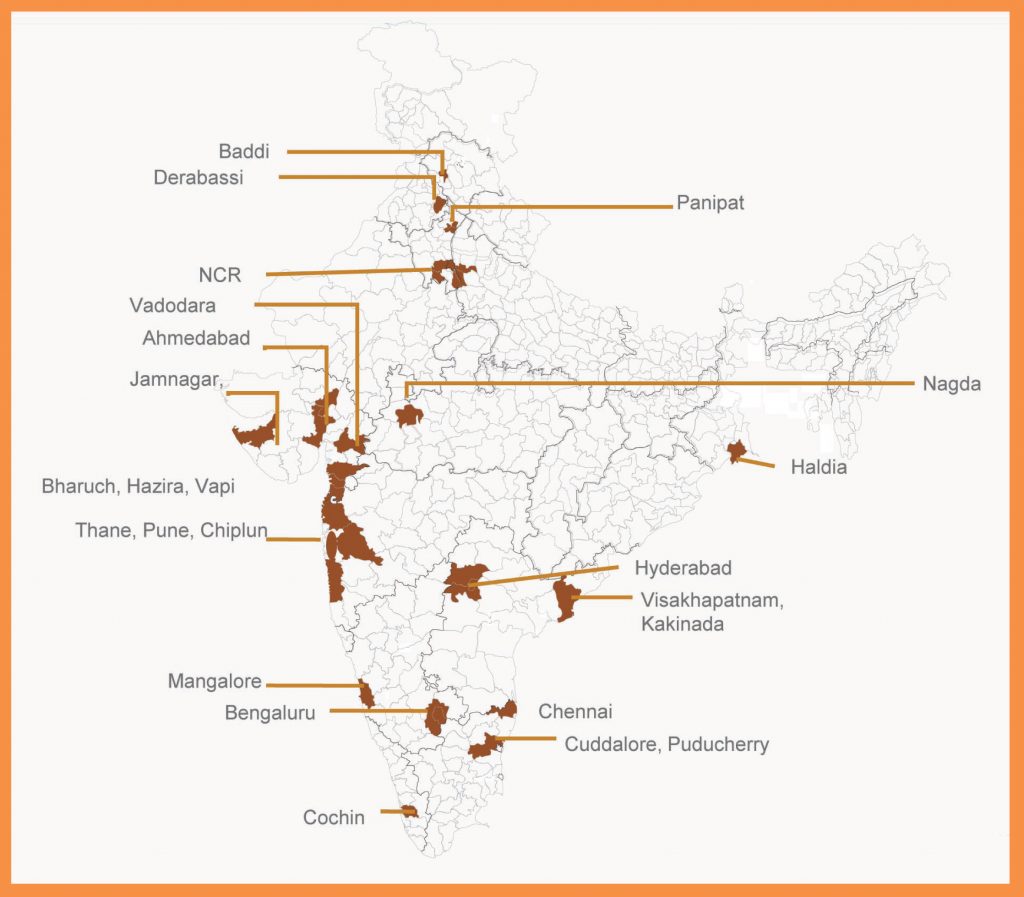

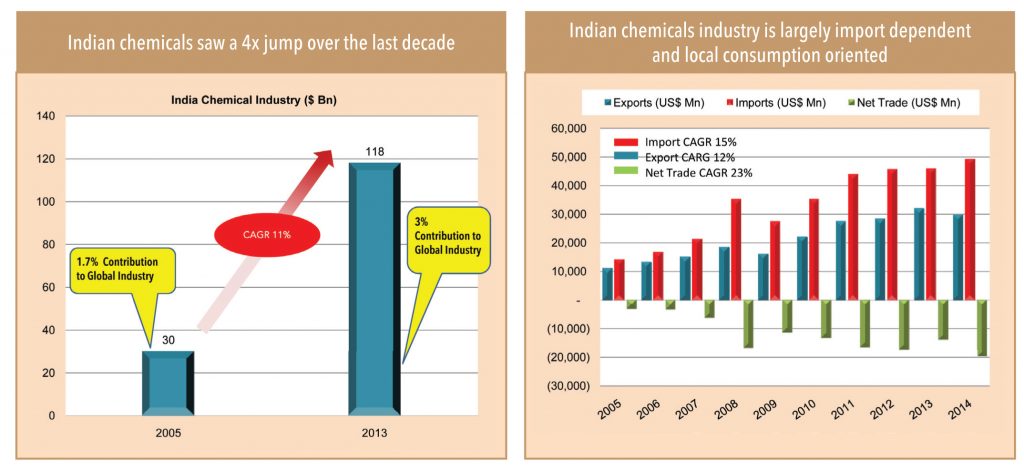

In India, the industry facilitated the country’s march from being an agrarian economy to an industrial one, and provided huge employment opportunities.It is a significant contributor to India’s economic development. While it is one of India’s oldest industries, it has evolved to a mature core industry from a low-growth regulated one. Over the last decade, India’s chemicals industry grew rapidly (4x, average annual growth of 17%) to touch US$ 127bn in 2014. This industry accounts for 16% of India’s manufacturing, 2.5% of GDP, and 9% of exports. Robust demand for chemicals was fuelled by strong economic growth, large population, and rise in per-capita income. As a result of strong domestic demand and Asia’s increasing contribution to the global chemicals industry, India has emerged as one of the ‘focus destinations’ of companies worldwide.

However, while the Indian chemicals industry’s standalone progress has been great, it does not compare well on a global scale — it still holds only ~4% global market share and is yet to enter the league of international chemicals manufacturers.

While India’s chemicals market grew rapidly over the last decade led by increasing demand, capacity creation remain muted — therefore, rising domestic demand was fed by ever-increasing imports, which saw a 15% CAGR. In fact, manufacturing capacity saw muted growth of 3.5% over the last eight years. However, thanks to increasing focus on value-added specialty chemicals, average annual growth in chemicals exports was 12% while it was 9% for chemicals exports volumes.

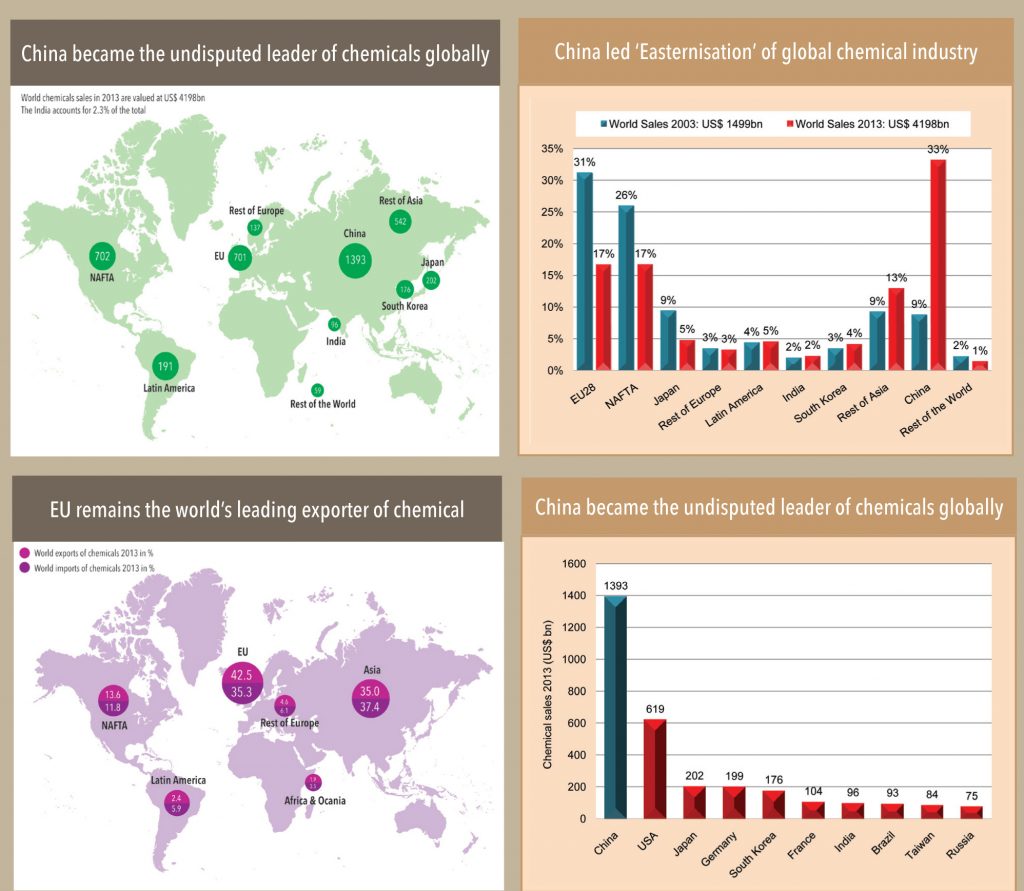

The world chemicals industry saw steady progress to US$ 4.20tn in 2013 from US$ 1.50tn in 2003, reflecting an average annual growth of about ~11%. It was largely driven by China, where chemicals sales swelled rapidly at 27% CAGR to US$ 1.39tn in 2013 from US$ 131bn in 2003. Primarily led by Chinese progress, the centre of the world’s chemical industry saw ‘easternisation’ during the last decade — the share of emerging Asian markets such as China, South Korea, India, and rest of Asia, saw their combined chemicals market share increasing to 53% in 2013 from 23% in 2003. During the same period, China led the chemical sales growth at 27% CAGR, followed by South Korea and India at 13% each, and the rest of Asia (excluding Japan) at 15%.

By contrast, annual chemicals sales by developed markets like North America, European Union, and Japan remain muted at 2-4%. Europe, the traditional leader of the world’s chemicals industry, gradually lost its top spot to China. However, even as European countries lost their traditional leadership in terms of market size, they still maintained their leadership in terms of exports of chemicals, accounting for 43% of global chemicals exports. While Europe’s technological advantage remained its key strength, rising energy and feedstock prices proved to be its Achilles’ heel, especially compared to the oil and gas-rich Middle East and the United States.

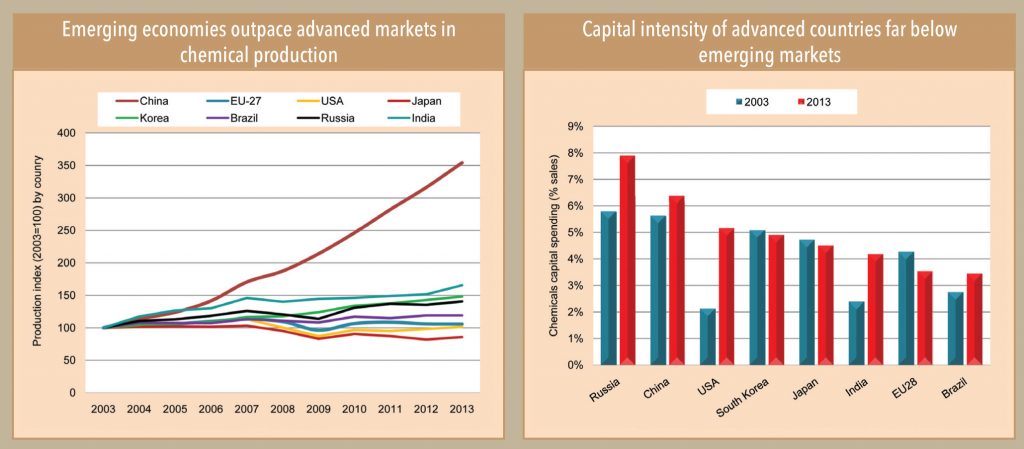

While the global chemicals market shifted to the emerging Asian regions from the developed western world, production of chemicals saw ‘easternisation’ in the last decade. Production in China saw a healthy average annual growth of 14% in 2003-13, followed by other emerging economies such as India at 5%, Korea at 4%, Russia at 3.5%, and Brazil at 2%. While the developed world’s industrial competitiveness (particularly in Europe) came under pressure due to an ageing population and strict environmental/health/climate regulations, the emerging world gained from cost-effective manufacturing, rising chemical demand led by relatively higher economic expansion, and population growth.

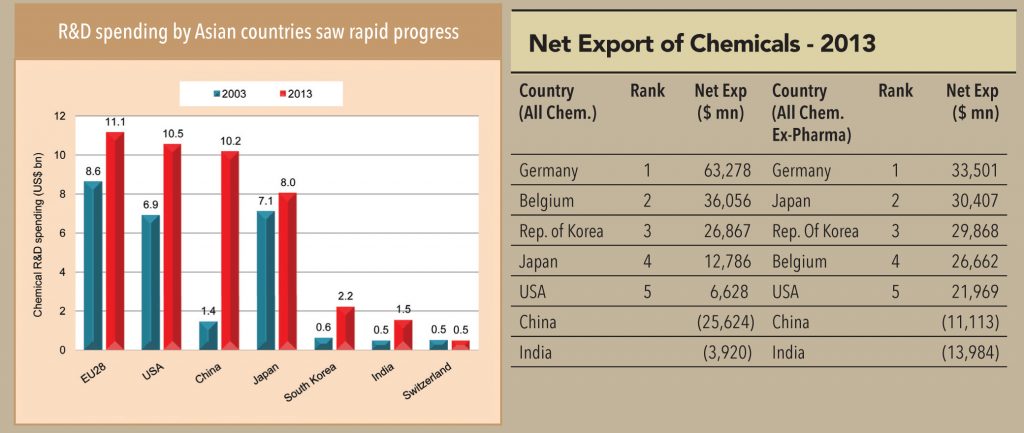

Improving chemical production in the emerging markets has already been well complemented by rising capital-spend intensity (as a % of sales). Additionally, steadily growing R&D spending in chemicals by emerging countries suggests continued outperformance over the developed world.

Although China and USA are large global chemical markets, Germany leads in terms of net chemical exports, followed by Belgium, Korea, and Japan. China and India are net importers of chemicals. China’s net import in 2013 was US$ 25.6bn for all chemicals and US$ 11.1bn for chemicals excluding pharma — this implies that China’s dependency on imported pharma products is much more than chemicals.On the contrary, India’s pharmaceutical exports are stronger compared to its chemicals exports.

Subscribe to enjoy uninterrupted access