Free parking

Even parking is very expensive in most cities in Norway with hourly parking charges upwards of c.NOK 50 per hour (or more than USD 6).

Fuel-cost saving

Tesla offers free supercharging. The fuel cost for a 1,500 km trip in a diesel luxury SUV would have been about NOK 1,800 (USD 220 or INR 15,000 – diesel in Norway costs USD 2 or Rs 140).

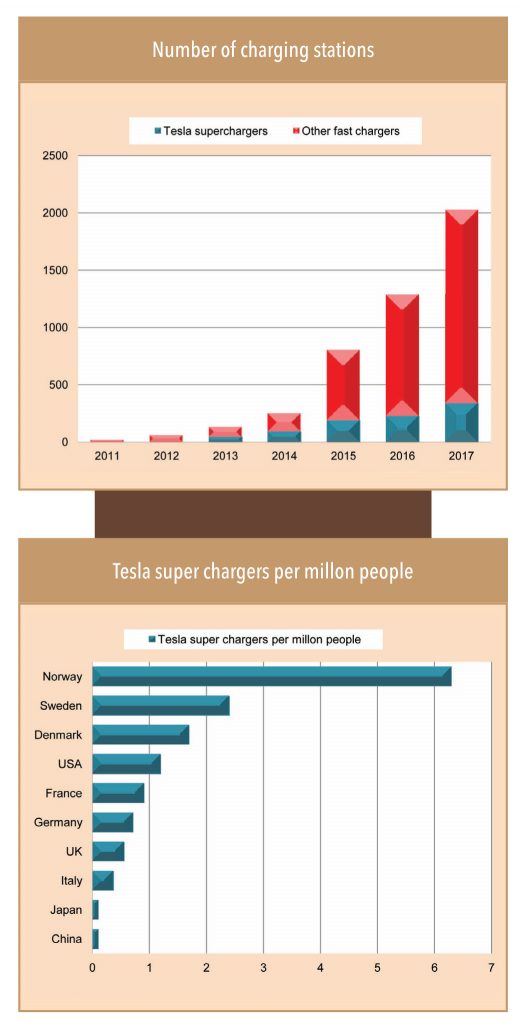

Very vast network of Tesla superchargers

Tesla currently hosts around 400 active superchargers spread across Norway, which are absolutely free – this makes it easy to travel to any part of the country without worrying about access to charging.

Low population and high per-capita income

The reason EVs picked up so rapidly in Norway is its low population density, but more importantly, its high per-capita income at US$ 70,000+/annum. Moreover, there is free healthcare, education, and retirement benefits, which lead to high disposable income for discretionary spends. The country is full of natural beauty and the governments’ concern and the general public’s awareness about preservation and conservation means that almost everybody is willing to invest in EVs.

Nitesh noted in his travelogue that the Tesla Model X with a dozen ultra-sensors, cameras, rock solid drive, ludicrous mode, automatic door opening and ignition, semi-autonomous driving, huge screen and many other features enthralled him. The Jaguar I-Pace lacks most or all of these almost sci-fi features that the Model X has, plus the I-Pace is smaller with a seating capacity of five. In conclusion, while I-Pace is about 12% cheaper than the Modex X, it wouldn’t be fair to compare it with the much larger and futuristic Model X. A more appropriate comparison would be the I-Pace and the Model S (which also has a larger wheelbase). Additionally, Norwegian consumers are reluctant to buy a Jaguar EV because Tesla’s charging infrastructure in the country (offering free charging) is very vast.

EVs is still a long way off for India, given the country’s lower discretionary income and high cost of producing a mass-market BEV (as highlighted earlier, the ex-factory cost of a BEV Ciaz would be nearly Rs 2.5mn). However, electric vehicle adoption could take off in India if battery prices fall faster than anticipated.

Meanwhile, what can Indian OEMs do to be ahead of the curve in case of a BEV revolution in India?

Focus more on infrastructure

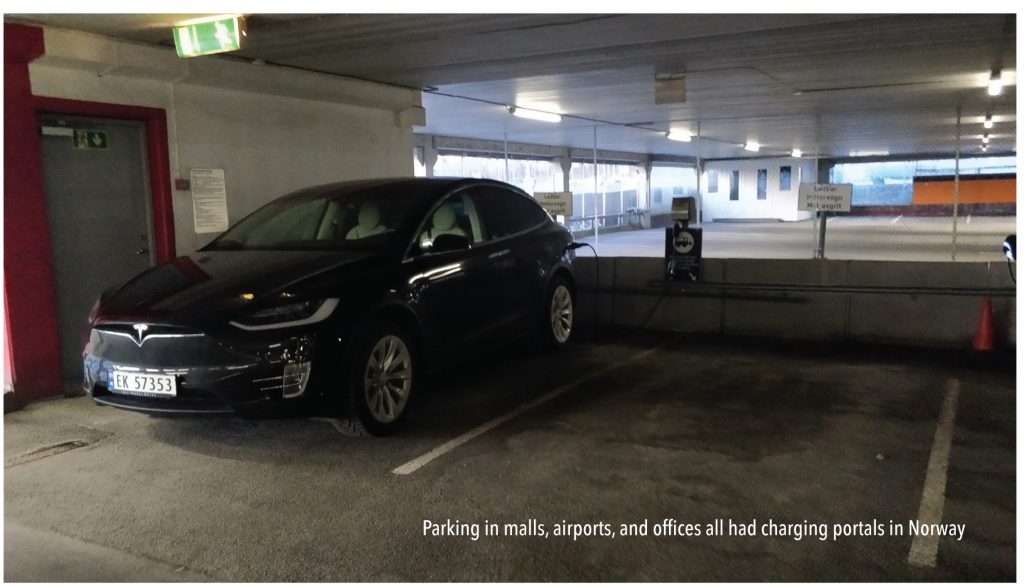

Indian OEMs should focus more on creating charging infrastructure and an ecosystem. Tesla took five years to create such a network of charging stations in Norway, and it is currently so much more ahead than competition that its moat is not easy to breach. OEMs should not only focus on rolling out good affordable electric vehicles, but take steps towards start adding charging infrastructure in mall parking, airports, and hotels. In Norway, for example, there is optimum utilization of parking places.

If OEM’s can offer free charging (like Tesla does) it could considerably reduce total ownership cost and induce rapid adoption. An off-the-cuff idea is that Maruti, M&M, Hero, Bajaj, and TVS have vast dealer networks, which they can use for installing charging stations. This would also provide a strong moat for Indian players, one that would be difficult for foreign OEMs to break, even if they are currently ahead in the global EV race.

Government incentives won’t be a big deal in India

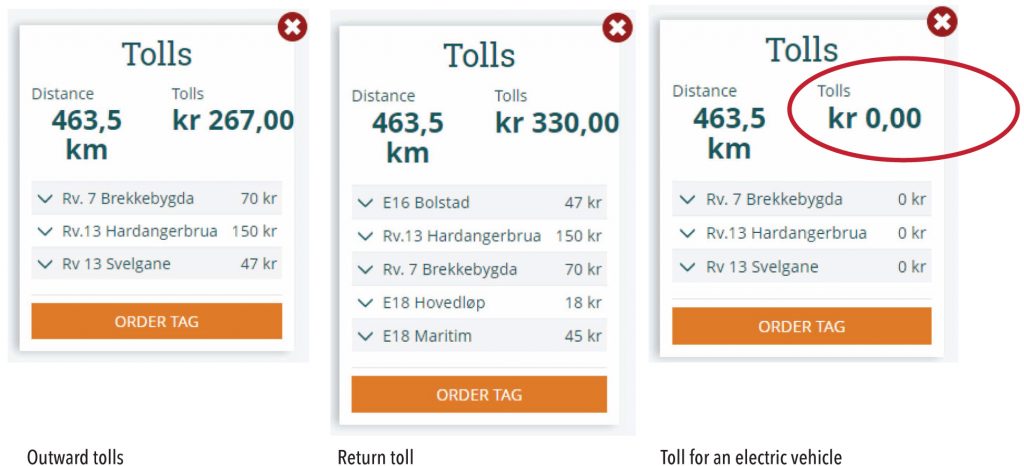

While the Norwegian government uses oil money to subsidize conservation efforts (including EVs), other measures such as free toll and parking prove huge incentives there. In India, they may not be as meaningful as their cost is not extremely high (at least for now). Given the Indian government’s past resistance to offer any major subsidy for electric vehicles, OEMs would have to depend on battery technology and falling battery cell prices for making affordable BEVs.

Subscribe to enjoy uninterrupted access