India has a large need-based housing shortage, as estimated by the technical group. However, the government’s priority is to address demand-based shortage first. Policy makers’ initiatives involve increasing supply by providing fiscal sops to builders, reducing costs by providing extra FSI or by making land available at a reasonable cost, and increasing affordability for buyers. Given the huge demand-based shortage, affordable housing is a good way for policy makers to revive the economy and insulating it to an extent from global slowdowns. In this issue, GV looks at the efficacy of the government policies towards affordable housing and tries to get a holistic perspective by interacting with various stakeholders including financiers, policy makers, builders, and end users (buyers).

Satyanand Kadam works as a mechanic in a motor-repairing shop in Ghatkopar, in central Mumbai. He has spent 20 years of his life winding copper wire and living in dilapidated housing conditions. He supports a family of three with an income of Rs 22-25,000 per month and rents a shanty in one of Mumbai’s numerous slums. Since most properties in Mumbai are not below Rs 1mn, until recently, Satyanand could never hope to own an apartment. Of his total monthly income, he spends Rs 10-12,000 on food and about Rs 5-6,000 on rent. Even a Rs-1mn property would result in a monthly instalment of approximately Rs 9,000 after factoring in a ‘margin’ amount of Rs 100,000-150,000 – making it nigh impossible for people like Satyanand. But something has changed steadily in the last few years.

The magic of the CLSS scheme

Like Cinderella’s fairy godmother, in comes the government swishing the magic wand of its credit-linked subsidy scheme (CLSS) under its ‘housing for all mission 2022’. The CLSS provides borrowers with a one-time interest subvention of Rs 270,000.

The CLSS scheme has provided a big boost to lots of prospective buyers with ticket sizes of less than Rs 2mn

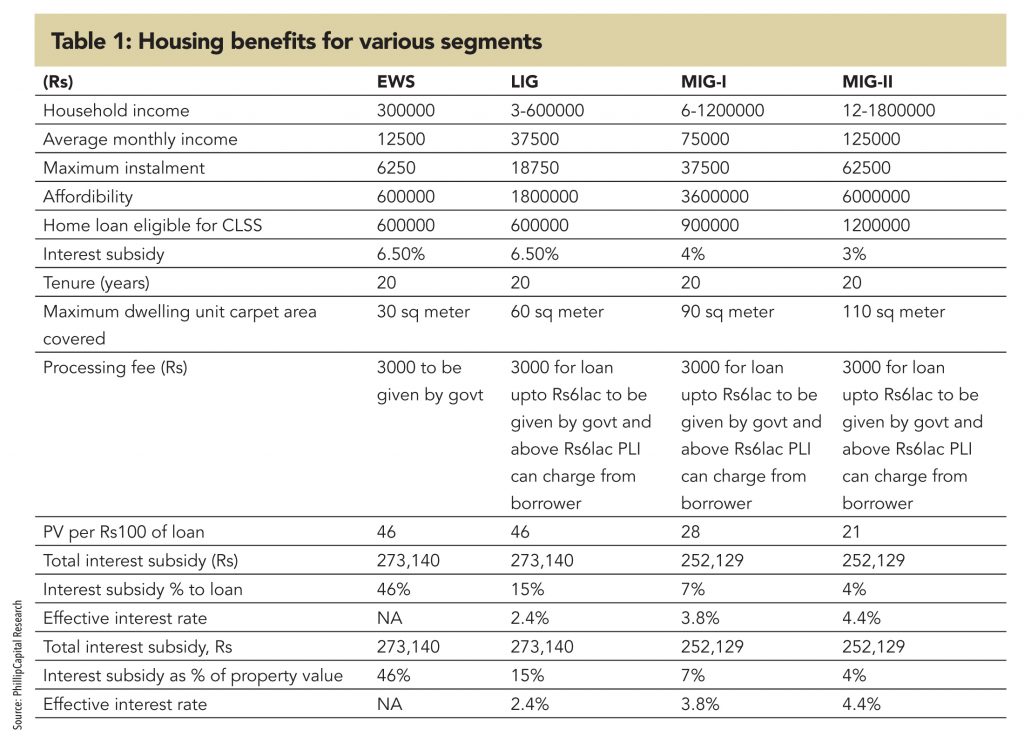

The credit-linked subsidy meaningfully improves the affordability of prospective properties (please refer to table 1) for the economically weaker section (EWS) and low-income group (LIG). With the help of CLSS, the house, which Satyanand could ill afford until recently, becomes 27% cheaper. Consequently, his EMI falls to Rs 6,300 from Rs 9,000. The CLSS scheme has provided a big boost to lots of prospective buyers with ticket sizes of less than Rs 2mn.

Most affordable projects have homes starting from Rs 0.9mn up to Rs 2mn. These projects usually come up on the outskirts of cities and provide amenities

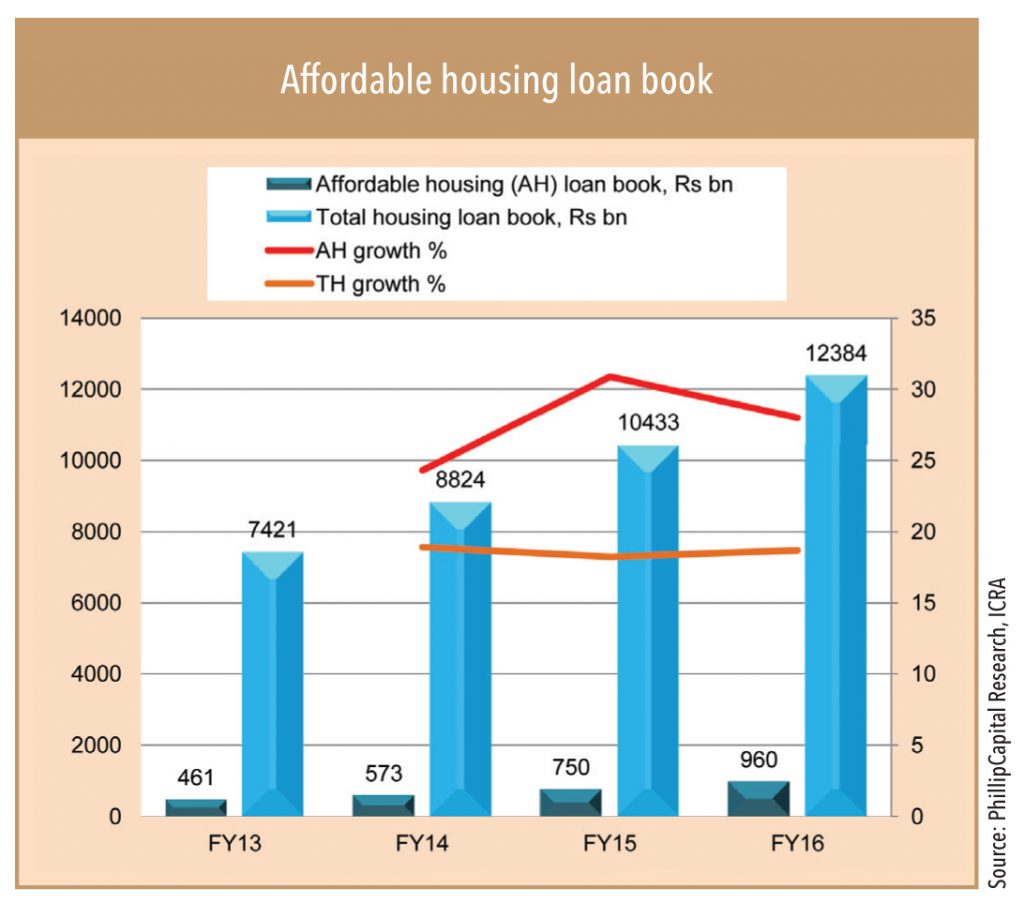

Affordable segment (financing and construction) gaining momentum

The government’s thrust has made affordable-housing a vibrant segment. Currently, real-estate developers, in collaboration with financiers provide faster and hassle-free loan-processing facilities to prospective buyers. In its field visits, Ground View’s team saw developers and financiers providing housing loans even without income documents. For example, Xrbia has a ‘no document’ scheme, where buyers need not submit any income documents. Any prospective buyer with the following details can walk away with a home loan provided she has – (1) no default in home, auto, personal loan, (2) completes home / office verification successfully, (3) personal discussion, and (4) KYC and 12-month bank statements.

However, for these schemes, the interest rate charged is usually higher – for example, Xrbia charges 11.9%. HDFC has a similar product, where it charges about 13% interest. Likewise, Karrm Infrastructure (a Mumbai-based affordable-housing builder with a portfolio under development of 15,000 units) provides buyers with loans and options of various insurance plans such as the option of an annuity-based insurance plan (which is added to the cost of the house), were the annuity is reinvested and a lump sum amount is paid on closure of the loan. The insurance scheme provides comfort to financiers and acts as an incentive to the buyer for timely repayment of EMI.

There is no data on an all-India basis to quantify the progress made by private builders, but GV team’s survey in Maharashtra and Gujarat suggests that encouraging progress has been made on the supply side

Most affordable projects have homes starting from Rs 0.9mn up to Rs 2mn. Given the high cost of land within city limits, these projects usually come up on the outskirts of cities and provide amenities such as schools, medical centres, market places, and play areas. These basic amenities are essential to convince buyers to shift to the outskirts, which more often than not entails quite a bit of work-related travelling. Buyers are usually willing to travel more if the housing schemes provide safety, security, hygiene, and amenities. In one of Karrm Infrastructure’s completed project, the GV team visited a school affiliated to Maharashtra state board. Amenities, such as reputable schools for children is one of the main basis for people to shift to locations on the outskirts of cities.

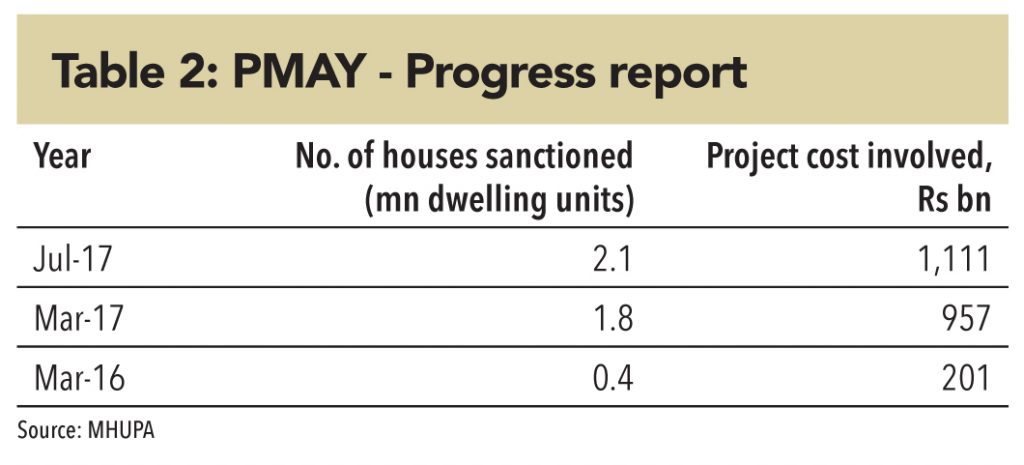

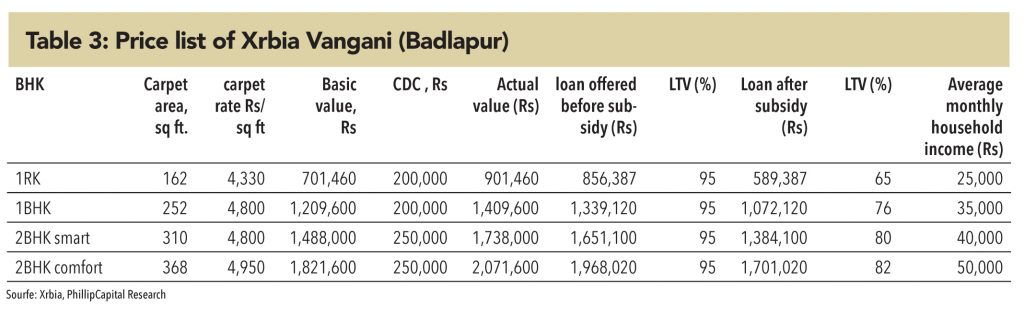

PMAY – HFA by 2022 has gained momentum in FY17 with the sanction of government-approved projects growing rapidly. The total houses sanctioned under various government projects increased by more than 3x to 2.1mn units, involving a total investment of Rs 1tn. Similarly, projects by private builders in the affordable segment have also seen significant traction. There is no data on an all-India basis to quantify the progress made by private builders, but GV team’s survey in Maharashtra and Gujarat suggests that encouraging progress has been made on the supply side. The outskirts of mega cities such as Mumbai have witnessed massive projects in areas such as Badlapur, Shahpur, Neral, and Vangani – along Mumbai’s central railway line. Similarly, affordable projects are visible in Virar and Dahanu Road along the western side. A patch of 25km in Vastral (a city and a municipality in Ahmedabad district in the Indian state of Gujarat) is home to more than 250 affordable housing projects.

The buyers’ profiles

Monthly household incomes of buyers of these projects ranges between Rs 25,000 and Rs 50,000. Families with monthly incomes of Rs 22,000-25,000 would typically look for homes with a ticket size of about Rs 800,000, while those with higher monthly incomes of Rs 30,000-35,000 usually peruse properties worth Rs 1.5mn. Families with even higher monthly incomes (Rs 45,000-50,000) usually look at properties worth about Rs 2mn.

The customer profile in the income bracket Rs 25,000-50,000 varies between salaried and self-employed, usually 50:50. Salaried people are private company employees, government employees, or semi-government employees. In households seeking out affordable housing, usually, there are two or more earning members – in most cases, husband and wife are both gainfully employed. Therefore, builders and financial institutions have made co-ownership (husband-wife) mandatory, in order to avail government subsidy.

The demand for housing in the affordable segment has increased in cities due to a large migrant population

The nature of the demand – EWS, LIG, migrants to cities

The demand for housing in the affordable segment has increased in cities due to a large migrant population. The demand is higher in cities with more industrial belts such as Mumbai, Ahmedabad, Pune, Nasik, Surat, Indore, Coimbatore, and Chennai. Migrant workers who have settled in those areas for a while, want their families to come and live with them. A reasonable part of the demand in the low-ticket segment comes from such migrant workers.

The report by The Technical Urban Group (TG-12), constituted by the Ministry of Housing and Urban Poverty Alleviation, pegs almost 96% of the housing shortage from the EWS and LIG segments. As per the government of India’s latest definitions, EWS constitutes households with an annual income of up to Rs 300,000 and LIG as those with Rs 300,000-600,000. As a thumb rule, affordability is calculated at four times the annual income. Considering the shortfall, houses worth Rs 500,000 to Rs 2mn have always been in demand in urban centres. This demand has grown with the government of India’s subsidy scheme, which has increased affordability in a meaningful manner.

96% of the housing shortage is from the EWS and LIG segments

Lenders’ profiles and practices: Paradoxically costly

Many formal lending institutes provide loans above Rs 1mn, but very few provide loans between Rs 0.5mn and Rs 1mn. As per NHB data, in 2015, only about 15% of loans that were disbursed were in the less than Rs 1mn range. As per Jones Lang LaSalle’s report on affordable housing, “The key issue that deprives people from availing a home loan in the Rs 0.5-1mn bracket is the perceived high risk – apprehensions of loans turning into non-performing assets and uneven payment patterns.” These segments are economically weaker, and live in dilapidated housing conditions without proper sanitation and drinking water. The government is trying to address the issue of housing shortage in the EWS segment in cities by providing grants to dwellers under slum-area-redevelopment schemes in partnership with private builders. However, the pace of growth in addressing the issue of this segment is slow, resulting in a deep housing shortfall.

The interest rate for the affordable segment is high because of high operating expenses (lenders’) and high risk of default (borrowers’)

The lending rate in the affordable segment varies, depending on the customer profile. It starts with 8.6% for a salaried customer with a reputed organisation (can be government or private) to 13% for a self-employed person with no income proof. There are some financiers who even charge 15-16%, but those would be in very few cases. A processing fee of 0.75-1.00% is levied, unlike in the mid-income housing segment, where processing fee is waived by financiers in the wake of increased competition. The processing fee compensates the financier for the cost incurred in acquiring the customer. Cost of acquiring a customer is a referral fee paid to the direct selling agents. The interest rate in affordable segment is high due to factors such as high operating expenses and high risk of default (because of buyers’ erratic cash flow, especially in self-employed segment).

GV has tried to answer these questions in the following sections – Is the affordable segment being overcharged by financiers? Or, is the high interest rate necessary for financiers because of the low ticket value and vulnerability of default, in order to generate a reasonable internal rate of return?

Subscribe to enjoy uninterrupted access