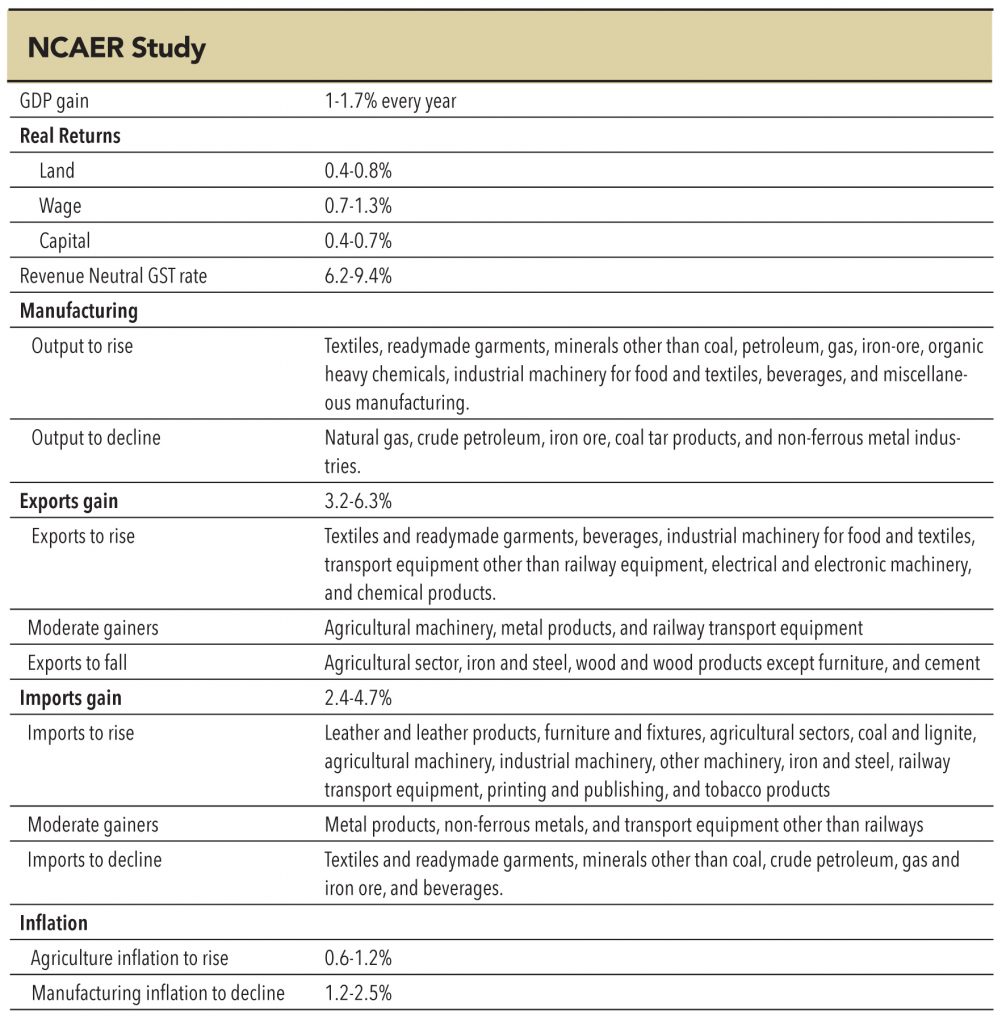

It is widely believed that implementation of GST will have considerable impact on various economic parameters, businesses, and consumers. It is expected to boost corporate profitability, margins, and exports and greater compliance and broader tax base should contribute to added economic growth (NCAER estimate is 1.0-1.7%). GST implementation will link domestic taxation norms to international standards.

Exports: As per the current norms, central indirect taxes (excise + customs) can be set-off while state taxes (like central sales tax, electricity duty, sales tax on petroleum products, mandi tax, entry taxes, octroi, and municipal taxes) are not available for set-off – thus, manufacturer tend to lose as much. Cumulative impact of such un-rebated taxes is between 3-12% of the fob export (depending on the product and its state of origin). Under GST, most of state taxes (along with central taxes) will be reimbursed to the manufacturer and service provider. Under this regime, exports are expected to become tax-free, thereby enhancing the competitiveness of Indian exporters.

Imports: Currently, imported goods are charged a customs duty (12%), landing charges (1% CIF), CVD (0-12%), education cess (3%), and additional CVD (4%). Under GST, all these duties will be subsumed, and SGST and CGST will have to be paid on imported goods and services. Tax benefit will go to the state where goods are supplied/ consumed. Since input tax credit will be available on the taxes paid, it will be revenue neutral for importers.

Fiscal deficit: GST should have a positive impact on fiscal deficit as the government has decided on introducing a revenue-neutral tax. Reduction in tax evasion will have a positive fiscal impact. Higher GDP, boosted by GST implementation, should also stimulate fiscal consolidation. Initially, budget outgo from centre to state will increase in order to duly compensate the states for revenue loss. Once the compensation period ends, fiscal consolidation can be substantial as the centre will not have to share taxes with states, which is the norm currently (28% of the gross tax revenue). Revenue neutral rate recommended for states is 6%; however, it is being advised that states’ GST should be kept at 7% to ensure revenue gains.

Inflation: It is widely accepted and believed by manufacturers and service providers that the entire burden of GST will be passed on to the consumer (in the advent of higher GST rate than the current norm) and businesses will enjoy higher margins. Thus, in a scenario of higher GST, inflation can inch higher. However, with the passage of time, businesses may decide to pass on some of the benefit to end-consumer. Competitive forces should also help in correcting prices.

The current service tax rate is at 12%. If GST is introduced around the current level, inflationary impact will be nil — if it is higher, it will burden the consumer. Another aspect is that service tax coverage will be extended to all services (except a negative list) – this will impact consumers. On goods, total tax (central excise duty and State VAT) comes out to be 25.5% currently. With the introduction of GST, this should decline substantially, thus bringing substantial benefits to consumers.The overall inflationary impact of GST will be based on the rate.

Empirical evidence of GST impact on inflation and GDP in other countries is mixed. Studies have shown that inflation inched higher after the introduction of GST in Australia, Canada, and New Zealand. However, GST or higher inflation did not result in a wage-price spiral. In Canada, CPI increased by 1.5% and GDP dropped by 1.2%. Higher inflationary pressures resulted in higher interest rates, thus creating an additional impact on GDP. These countries have continued to bring in changes to their initial GST structure, based on economic response and impact. Other research work has shown that adverse impact on macro data was primarily due to lack of complete GST implementation. It should be applied to all the goods and services across the board.

Subscribe to enjoy uninterrupted access