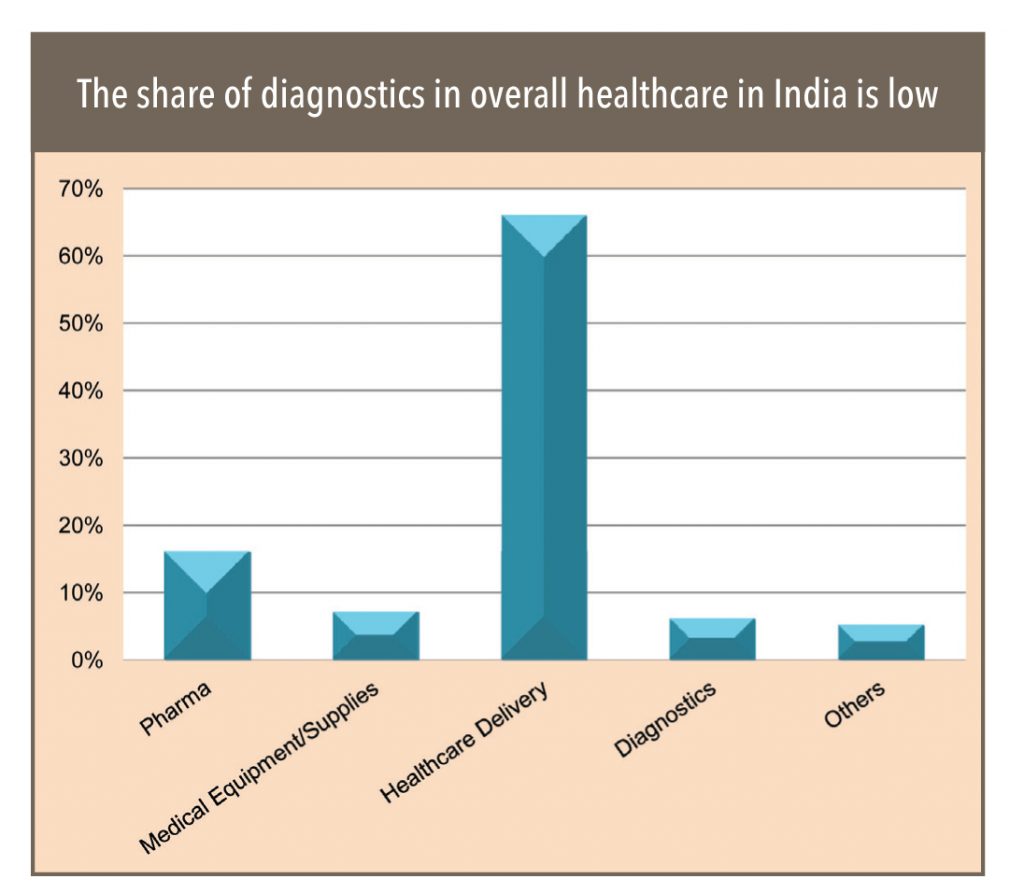

The Indian healthcare industry (represented by healthcare services, pharmaceuticals, and medical equipment) is estimated at about US$ 100bn as of FY15. Diagnostic services (a small part of healthcare services)

contributes about US$ 6bn – representing 6% of the overall Indian healthcare industry.

Like the Indian healthcare delivery

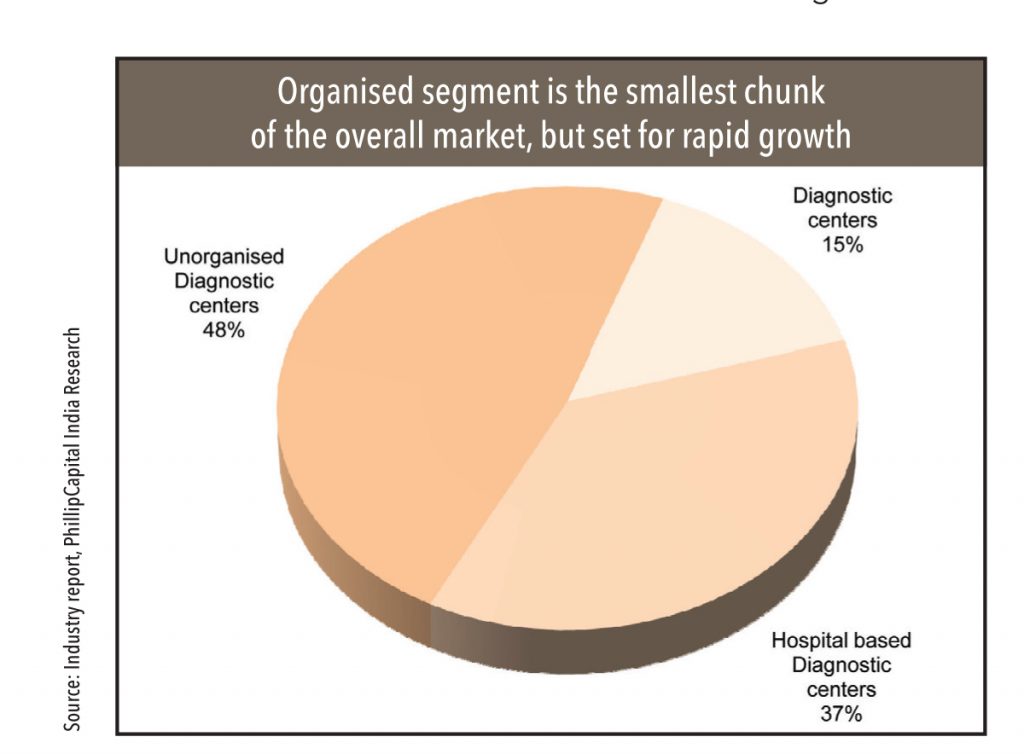

industry (hospitals), the diagnostic market is highly fragmented and dominated by unorganised players, which hold about 85% market share. Just like in the hospitals segment, the organised dizagnostic market is controlled by a few pan-India chains – SRL laboratories (SRL Labs), Dr Lal PathLabs (Dr Lal), Thyrocare Technologies (Thyrocare), and Metropolis Laboratories. In terms of growth, the diagnostic industry has outpaced the hospital market over the last five years with annualised compounded growth of 16% vs. 11% for hospitals. Within the diagnostic segment, the organised pan-India chains delivered compounded annual growth of over 20% vs. industry growth of 16%.

Factors that will drive future growth for the Indian diagnostic industry

The segment, constrained by under penetration and comparatively lower tests per patients so far, will see accelerated growth led by:

Although diagnostics plays a vital role in the spectrum of Indian healthcare delivery services (by identifying the root cause and ensuring that the patient gets appropriate treatment), its share in overall healthcare spends is lower

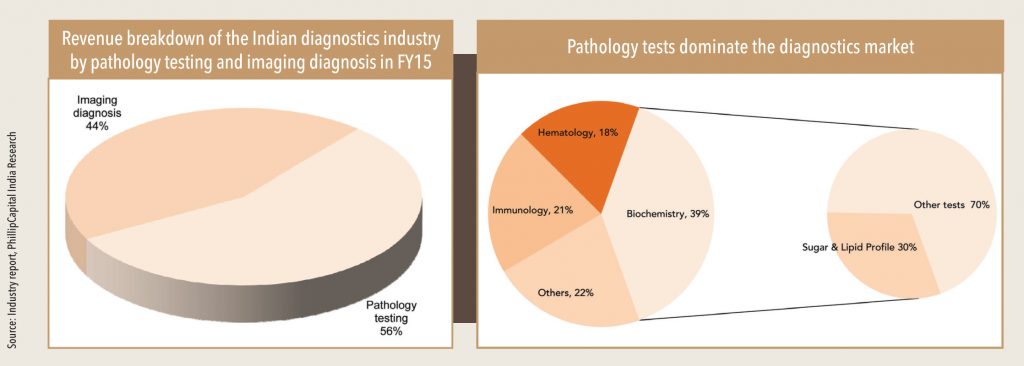

Based on the nature of diagnosis practices and facilities, diagnostic services can broadly be divided into pathology and radiology. While pathology tests involves laboratory analysis of bodily fluids such as blood and urine as well as tissues, radiology uses a variety of imaging techniques such as X-ray,

ultrasound, computed tomography (CT),nuclear medicine including positron emission tomography (PET), and magnetic resonance imaging (MRI) to diagnose and/or treat diseases.

Since pathology is the first-line of diagnosis for many diseases and provides a wider coverage of tests, it dominates the Indian diagnostics market with about 56% revenue market share. On the other hand, radiology is still out of reach for a large mass of the Indian population, as the cost of imaging diagnostic services is often more expensive than pathology testing.

Pathology tests are further categorised into biochemistry, immunology, haematology and molecular pathology. As per industry sources, biochemistry tests (covering blood sugar, lipid profile) hold a dominant share of ~39% within the pathology segment, followed by immunology (deals with an organism’s immune response to a certain disease) and hematology (deals with diseases of blood cells, tissues, bone marrow, lymph nodes, thymus, and spleen). In biochemistry, blood sugar and lipid profile tests have a dominant share and these two types of tests contribute ~30% of overall revenues from biochemistry testing.

Dr Vivek Jain, Director of P.H.Medicals Centre says, “The share of biochemistry tests for smaller labs is as high as 70-80% followed by hematology tests, which account for over 20% share. This is due to the cabality/focus on these tests and their practice to outsource the high-end tests to bigger laboratories. In case of medium to large labs, the share of immunology is over 40%.”

He believes that molecular tests in India are still in a nascent stage and largely catered to by select large diagnostic chains. However, he foresees relatively faster growth in molecular tests ahead.

Industry size: Debatable?

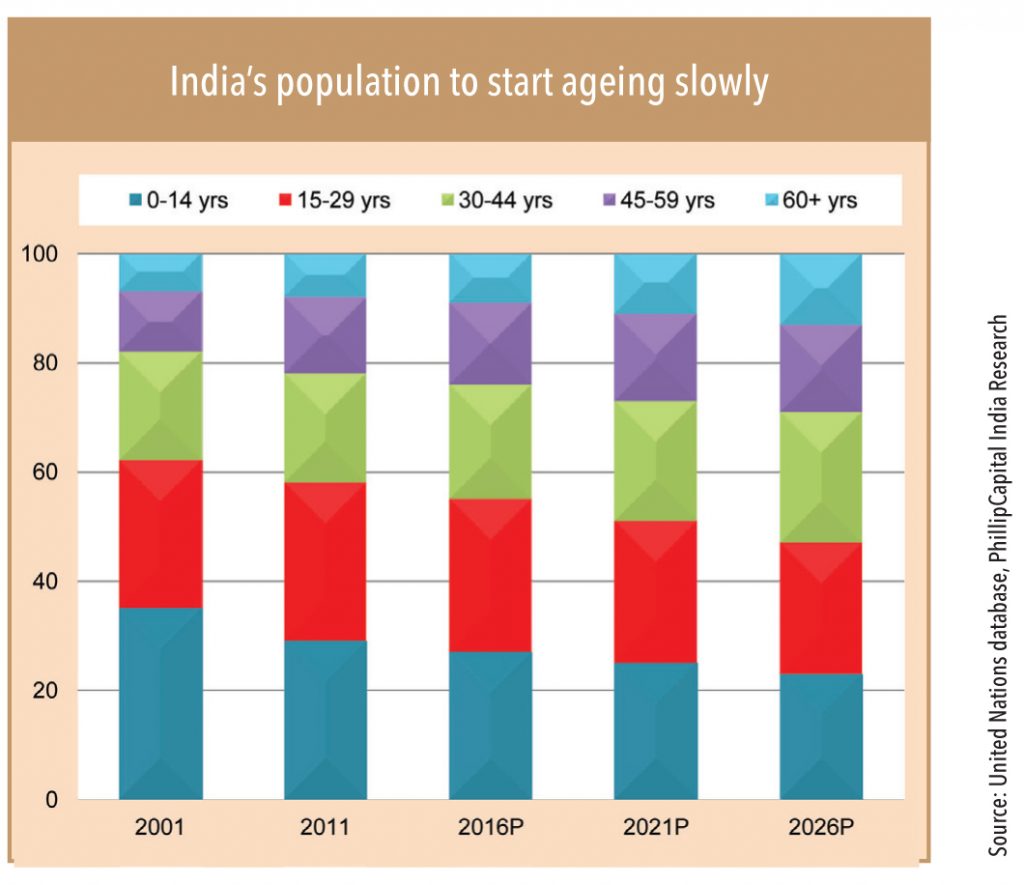

Various industry studies peg domestic diagnostics industry CAGR at 15-17% to potentially reach US$ 9bn by FY18. However, Dr A Velumani, CMD of Thyrocare Technologies holds a very different opinion. He says, “The market size (of ~US$ 6bn for the Indian diagnostics market) is grossly under-reported – this is because our country lacks any system of documentation for diagnostics or healthcare services, which is largely catered to by the unorganised sector. Similarly, reported growth of 15-17% seems low, considering that India’s demographic is shifting towards a higher age from a predominantly younger one.”

He believes the ground realities for the Indian diagnostics industry suggest accelerated growth. While the annual per capita spend in the US on diagnostics is around US$ 100, it is about US$ 6 in India, implying significant scope for growth, led by increasing income levels. India is still a young country with an average age of around 25 years; the need for diagnostics services grows with age. So, as India’s average demographic begins ageing, its diagnostics market should see 20-25% growth over the next 20 years.

Prime Minister Shri Narendra Modi’s government initiatives – which aim to provide all Indian citizens with free drugs, diagnostics, and insurance cover ( to treat serious ailments under the National Health Assurance Mission) should provide adequate volume growth to Indian diagnostics. Improving healthcare services at affordable rates are turning India into one of the leading destinations for ‘healthcare tourism’ – this also enhances the value-growth visibility for Indian diagnostic services.

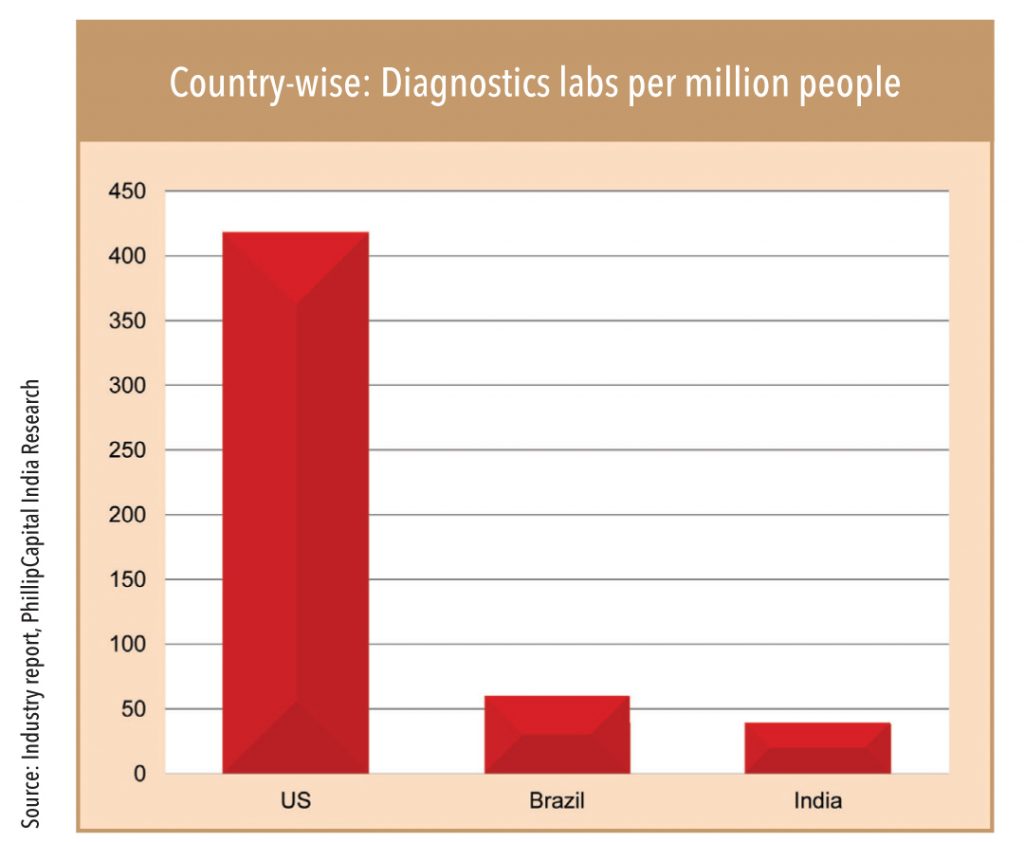

Under-penetration and under-utilisation of diagnostics labs in India makes growth outlook robust

Like unmet healthcare infrastructure in India, diagnostics infrastructure is considerably low compared to both advanced and emerging markets. India’s 39 diagnostics labs per million people (compared to US’ 418 labs and Brazil’s 60), shows the level of under-penetration. Significantly lower number of tests per patients in India compared to other markets indicates tremendous scope for growth. In fact, the average no of test per patients in India is 2-3 against 11 tests performed per patient in the US and seven tests in comparable country like Brazil.

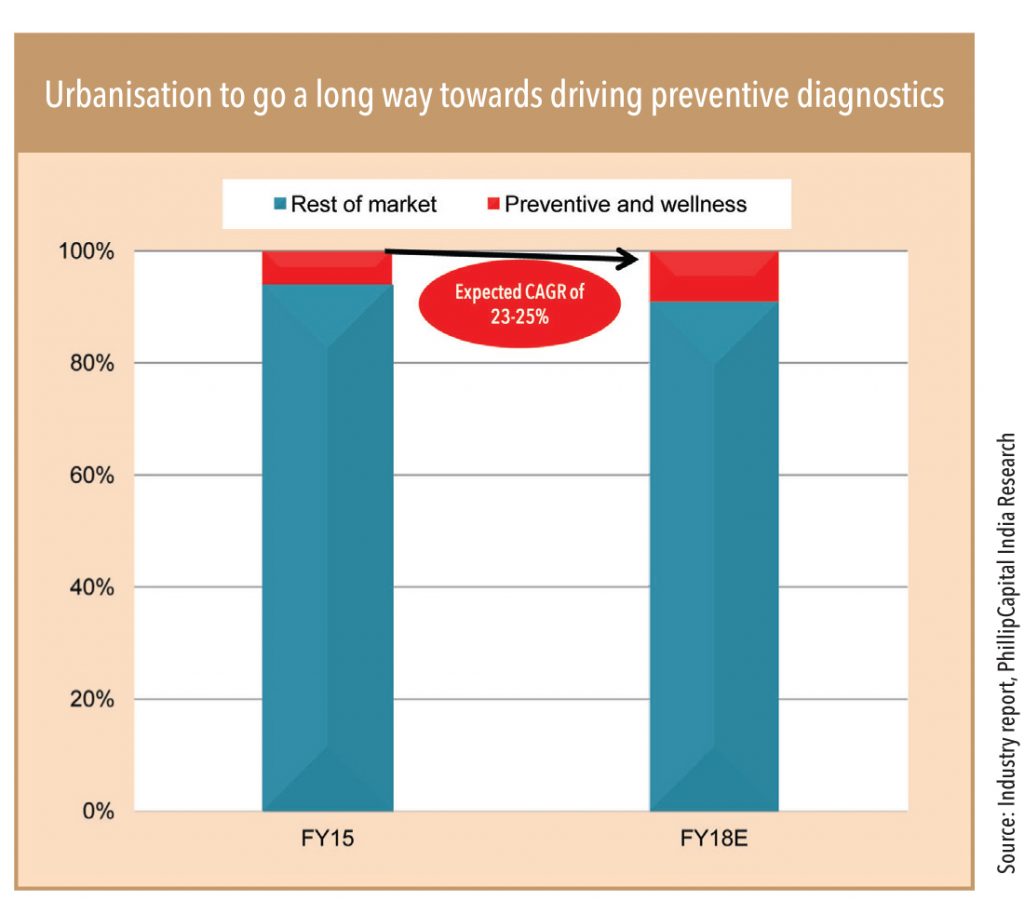

Preventive diagnostics is likely to see robust 23-25% CAGR over the next few years

Rapid progression of wellness/preventive tests makes diagnostics the fastest-growing segment

Steady progress of the Indian economy and consequent rising income levels and urbanisation have played a vital role in creating awareness towards health and wellness. The strategic focus of organised diagnostics chains toward preventive and wellness test packages (to optimise costs through scale) created a revolution of sorts in the preventive diagnostics market, particularly in urban areas. As per the 2016 World Population Reference Bureau, India’s urban population accounts for just 33% of its total, compared to 78% in the developed world and 54% in developing countries. Moreover, rising number of tie-ups with diagnostics chains from large companies (preventive checks for employees) and insurance companies (‘medi-claim’ plans), coupled with possible faster urbanisation, provide robust growth visibility for diagnostics.

Shift towards organised diagnostics places diagnostics chains in a better position

Although diagnostics was initially an integral part of hospital services, the unorganised segment gradually captured a leading share of the domestic market, supported by weak regulatory environment and low entry barriers. In recent years, pan-India chains with national and international accreditations, have gained momentum. Increasing awareness about healthcare and quality diagnosis, and changing treatment practice of doctors towards evidence-based prescription has supported the organised chain. Despite that, organised chains account for just 15% of the overall diagnostics market. The share of diagnostic chains is likely to see a 22% CAGR in the near future and gradually grab market share from the unorganised segment.

Additionally, the increasing practice of outsourcing of diagnostic services by hospitals will further boost the growth of the organised diagnostic sector. In fact, diagnostics had (so far) been considered an inherent part of the hospital business, but new management strategies look at this as ‘non-core’, hence believe it should be outsourced. Since diagnostics is a business of scale, in-house laboratories are a costly proposition for hospitals. Such changing practice by hospitals will boost the growth momentum of the Indian diagnostics industry further

Aging population should ensure long-term volume growth

India is still a young country with an average age of around 25 years and the need for diagnostic services grows with age. As the demography ages (over the next couple of decades), the Indian diagnostics market will see accelerated volume growth.As per United Nations’ world population statistics, Indian population >60 years is likely to grow by about +40% over the next ten years. As per industry sources, seniors aged 60+ require nearly 12 lab tests per year compared to about three for the 18-44 age group. This aging population should continue to provide incremental testing volume for several years to come.

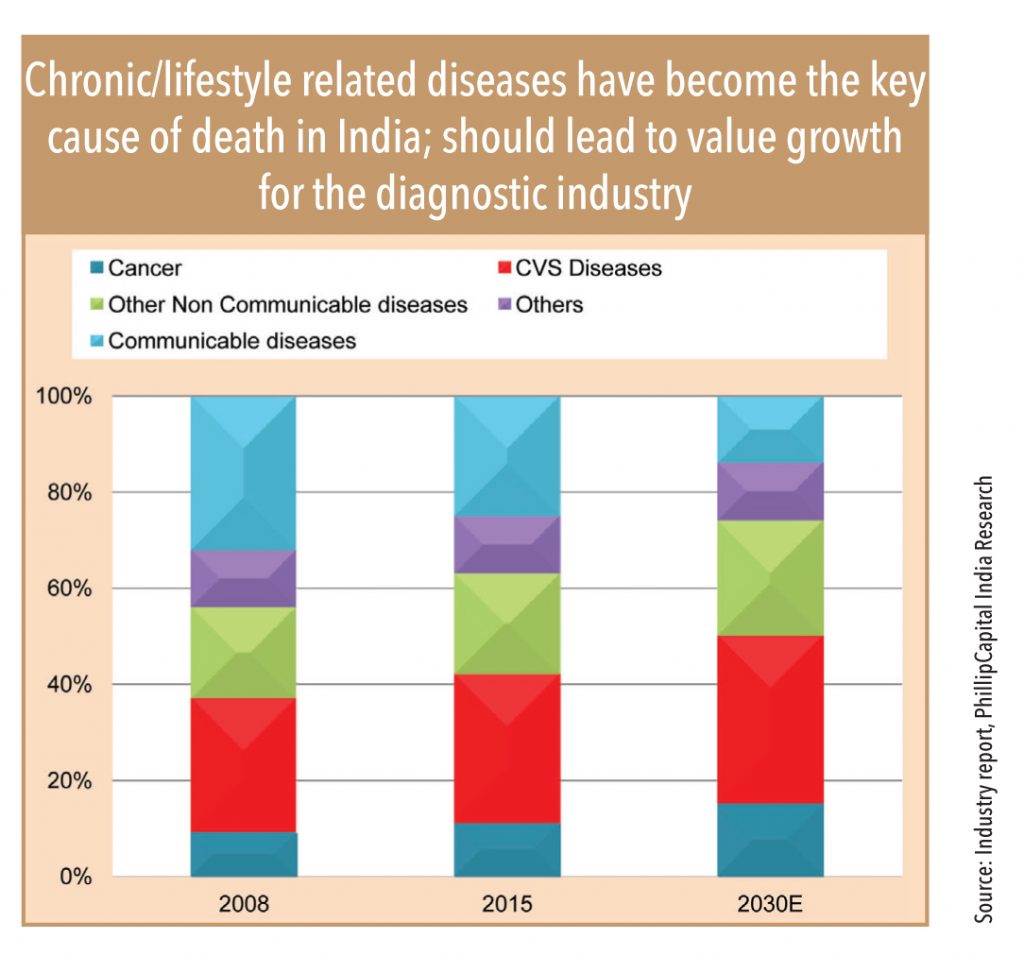

Changing disease profile (to lifestyle diseases) will lead value growth

With improving per-capita income, lifestyle-related illnesses have been increasing rapidly in India over the last few years. To be specific, diseases such as cancer, cardiovascular diseases, and diabetes are seeing a steady rise and these are likely to increase both – the number of required high-end tests and tests per patient. Ultimately, this changing disease profile will lead to volume and value growth of Indian diagnostics.

Subscribe to enjoy uninterrupted access