The Lehman crisis is still too fresh to be ignored

Although financiers are optimistic about the government’s efforts in affordable housing finance, they are equally concerned about the rising competition in the space. Gruh Housing Finance, in its FY17 annual report mentions that – “The MCLR-linked lending rates offered by banks resulted in a price war in the market and overall lending rates have come down substantially. The effective rate of interest for customers is less than 3%, an all-time low considering interest subsidy and tax sops. However, this is likely to impact the interest spreads for many players, particularly housing finance companies who are intermediaries and not direct beneficiaries of excess liquidity. While the industry continues to grow at around 16%, albeit at a rate lower than the previous year, the poor offtake in credit has compelled lenders to resort to loan takeovers, which are expected to constitute 20-30% of the incremental disbursements”.

Lending practices of some of the affordable housing players are very aggressive

New entrants in affordable lending need best practices

One financier (who did not wish to be named) said that lending practices of some of the players were too aggressive. These players factor the credit-linked subsidy component into their calculation of loan-to-value (LTV) ratio, which means that in case subsidy is not approved, LTVs can actually end by being more than 100%! Direct selling agents in Mumbai and Gujarat revealed that new entrants in affordable housing are dishing out huge referral fees – ranging from 1.0%-1.5% of the amount disbursed.

Lending in affordable segment characterised by low collection efficiency, high instances of cheque bouncing, and higher operating expense vs. mid-income or high-income segments

Customer profile in affordable lending is characterised by erratic cash flow, economic vulnerability

The customer profile in affordable segment is very vulnerable, characterised by erratic cash flow. Collection efficiency is low and cases of cheque bouncing are as high as 15%. Hence, operating expense in this segment is bound to be high compared with the mid-income or high-income segments. The dynamics of affordable housing are different from the mid-income/high-income housing segments. GV team’s field visit and discussion with various affordable builders and financiers including Xrbia, Karrm Infrastructure, DBS Infra, Nila Infra, Gruh Finance, LIC HF, HDFC, and Aspire Home Finance threw some light on key features of the affordable housing finance segment:

• Cost of customer acquisition is high because of lower ticket sizes. It can range between 1% to 1.5% of the loan size.

• Cancellation rate after property booking is generally high. Given erratic cash flow, unbudgeted expenses could provoke the buyer to cancel the booking.

• Pre-EMI (equated monthly instalment) amount is a key in booking affordable flats. Many prospective buyers fail to rustle up the booking amount (or pre-EMI amount) and have to drop out of buying the property. It is generally believed that faster execution of projects will bring down costs and are hence beneficial to buyers, but some of the builders believe that in the affordable housing, very fast execution may not work as buyers need time to accumulate booking amounts. In most cases, the booking amount is also collected in instalments.

• Due to their poor collection efficiency, servicing costs of affordable housing loans are high vs. mid-income housing loans while operating cost per annum works out to 1% of the loan amount.

• The industry does not have proper history of credit risk involved in the segment. Hence, the adequate pricing of loans is very important.

• The target customers are not well versed with the concept of interest rates. What matters to them is the EMI (equal monthly instalments). These customers are more comfortable with a structure that suits their income flow.

Many prospective buyers of affordable housing fail to come up with the booking amount

Housing companies have mushroomed in the last two years

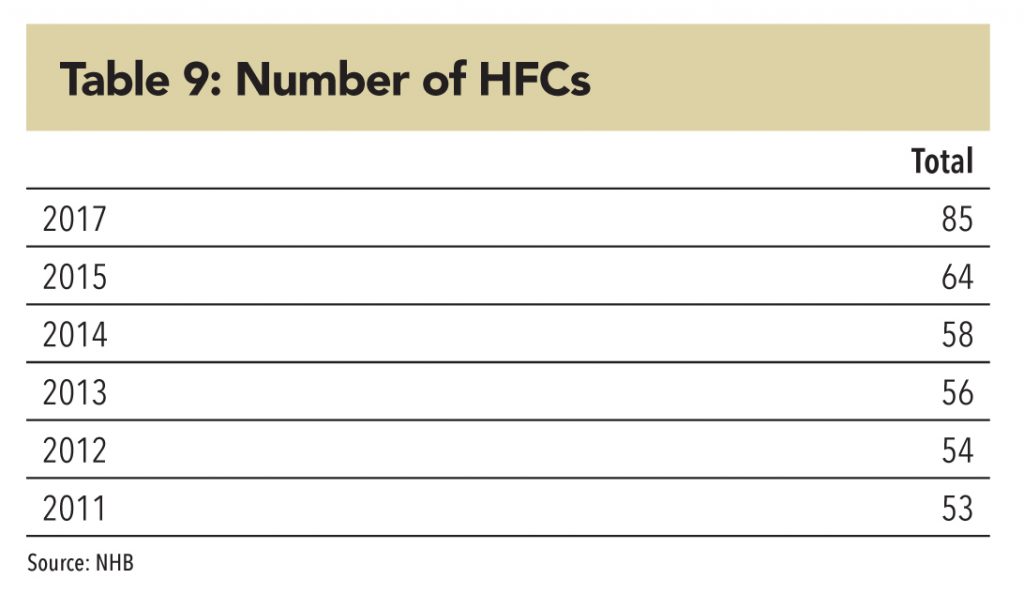

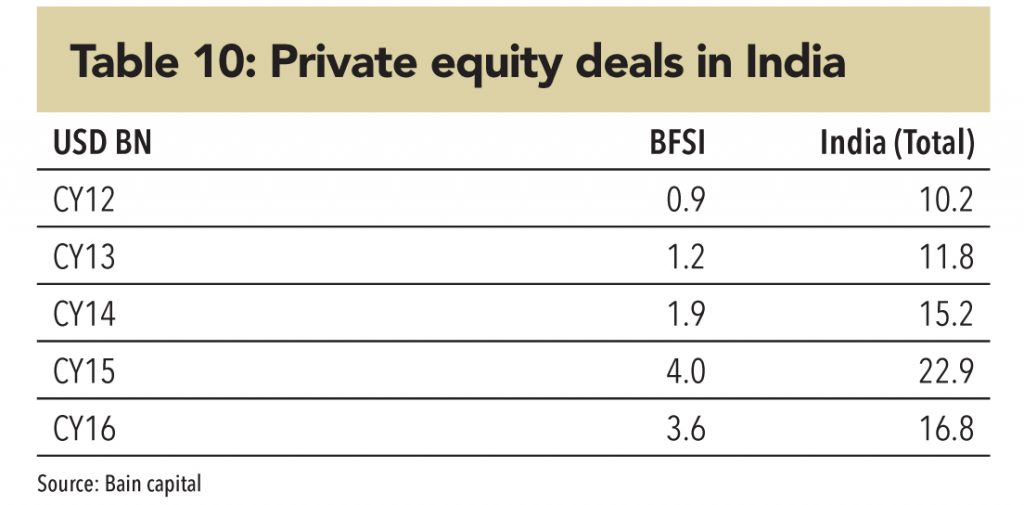

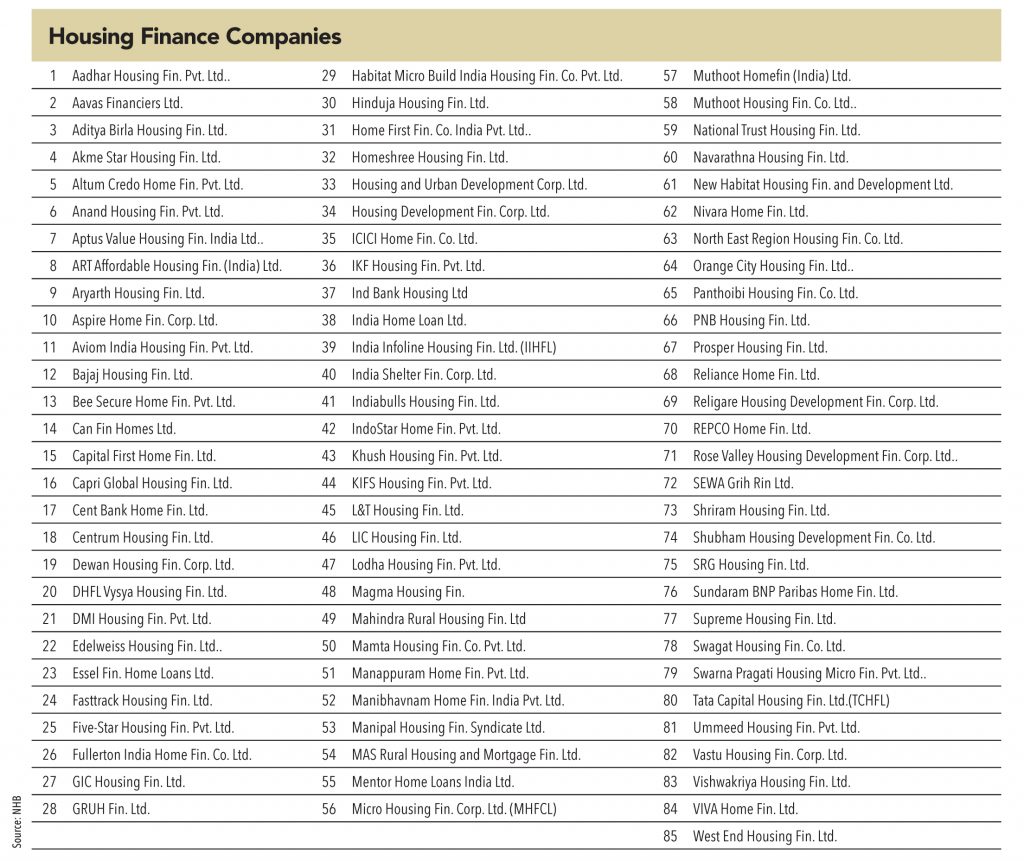

The challenging dynamics of affordable housing finance (high acquisition cost, high operating expenses, and risk of higher credit costs) warrants adequate pricing, but the sudden rise in the number of housing-finance companies is making competition unhealthy. Until 2015, the growth in the number of housing-finance companies was steady (about 10 players added in five years) and totalled 64, but this number increased significantly to 85 in 2017. Industry players view this sudden rise as detrimental. The policy push towards housing has created an enabling environment, which has attracted many new players into this space. These players are often backed by private-equity investments, which have increased manifold into the BFSI sector in the past few years (almost US$ 4bn per annum).

Some undesirable practices have crept in

Some of the housing-finance players are resorting to either unreasonable pricing or going overboard in terms of loan-to-value ratio (LTV). Given heightened competition, at times, the referral fee is high and loan takeover has become a more prevalent practice. GV tried to understand the cost dynamics in the affordable segment with ticket sizes of Rs 1-2mn. In order to maintain internal rate of return (IRR) above the cost of fund, the minimum spread required is between 2.5-3.0%, factoring gross non-performing asset (GNPA) of ~3% and operating cost of 1%. In case of a rise in GNPA beyond 3%,the spread of 2.5-3.0% may not be able to generate an IRR that would cover the cost of funds.

Credit and operating costs need to be adequately priced for long-term healthy viability

The interest rate charged to customers in the segment varies widely between 8.6% and 13%. While a salaried person with a reputed organisation would be charged 8.6%, a person without any income proof could be charged as high as 13%. Are these interest rates unreasonably high or does the risk involved warrant them? Before finding an answer, here are the perspectives of various stakeholders (policy makers, lenders, and borrowers).

Policy makers are in favour of formal loans to lower-income groups at competitive rates

Making loans available to the affordable segment at a reasonable cost is the foremost agenda of policy makers. In order to ensure this, they would always like to make the industry competitive by allowing more players. This has been playing out in the housing-finance industry in the last few years – the numbers of players have increased to 85 from 64.

Borrower’s delight

Borrowers will always prefer easy availability of credit at low cost.Recently, more financiers have positioned themselves in the affordable segment, given higher competition in the mid-income salaried segments. The flow of credit into the affordable segment has improved, with ticket sizes at Rs 1-2mn; there are encouraging flows of credit in the Rs 0.5-1mn ticket size as well.

Financier’s predicament

For housing-finance companies in the affordable segment to flourish in the long run, it is very important that credit costs and other operating costs are adequately priced, so that in a downturn, lenders have enough cushion to absorb losses without stopping the flow of credit to the segment, which actually magnifies the problem and derails the economy. The experience of the banking industry after the Lehman crisis has necessitated the Basel committee to mandate a counter-cyclical provision buffer, so that in a downturn, credit flow does not stop for want of capital. Though competition is necessary, unhealthy competition is dangerous for long-term growth. Some practices – such as high LTVs and predatory pricing – do not adequately factor the risk involved in the segment, especially as this segment does not have a credit history.

For housing-finance co. in the affordable segment to flourish in the long run, it is very important that credit costs and other operating costs are adequately priced

Subscribe to enjoy uninterrupted access