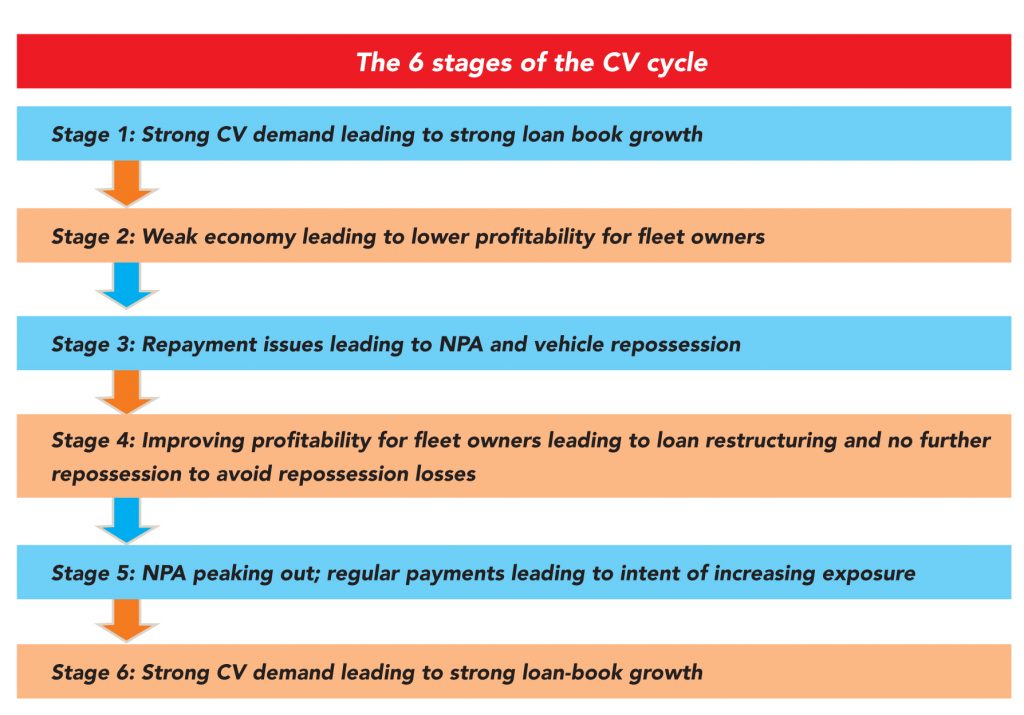

CV financers have started becoming cautiously optimistic about India’s CV cycle, but believe that a material growth in CV sales is still a while away. While none of them was sanguine about demand in the short term, they were quite optimistic over a 2-3-year period, based on improving profitability for fleet owners after diesel price cuts and an expectation of uptick in freight rates. While the CV financers’ portfolios continue to be stressed, there are early signs of stability after the diesel price cuts in the past few months, which have led to improving cash flows for small fleet owners. In a 6-stage cycle, financers are currently at stage 4 — therefore it will be a while before there is a strong pick up in CV demand.

Truck repossession trends: Selective and not very fruitful in the current environment

CV financers said that vehicle repossession has seen a significant slowdown in the past 2-3 months. While this by itself is a positive signal, digging deeper reveals a different picture. The slowdown in repossession is actually because of losses on vehicle repossession and the inability of financers to resell the vehicles. Since profitability has recently improved for smaller truck operators, financers are not resorting to repossession. They hope that with improving profitability they will be able to recover their loans over a period — therefore, they would wait rather than incurring losses on repossession. Financers are resorting to repossessing vehicles only in the case of intentional default.

A subdued second-hand vehicles market with low prices and rising inventory is making it incrementally difficult to repossess vehicles. This case is more prominent for vehicles that are upto two-years old. 25-30% depreciation in value during initial years leads to a significant hit on the books of these financers. One financer said that out of the 2,000 vehicles a month that he was repossessing, he could sell only 1,700, therefore, he stopped repossessing vehicles 3 months ago. His current inventory is at around 8,500 vehicles.

To circumvent the NPA norms and avoid repossession,financiers are currently allowing their customers to miss an EMI in a quarter or once in six months in cases where repayment miss is more due to economic factors rather than intentional.

Discounts impacting second-hand prices, accentuating financiers’ problem

Increasing discounts offered by OEMs to boost sales have significantly impacted the second-hand vehicle prices. This has further accentuated the problems for financers who had to take a haircut on the loans provided while selling repossessed vehicles. Discounts offered by OEMs have seen the prices for second-hand vehicles trade at significantly lower levels. The current offer for a 3-year-old 25-tonne vehicle is around Rs 900,000, 25% lower than the historical normal of Rs 1.2mn. Current low prices will become the new norm,given that discounts are here to stay

NPAs nearing peak; should stabilise soon

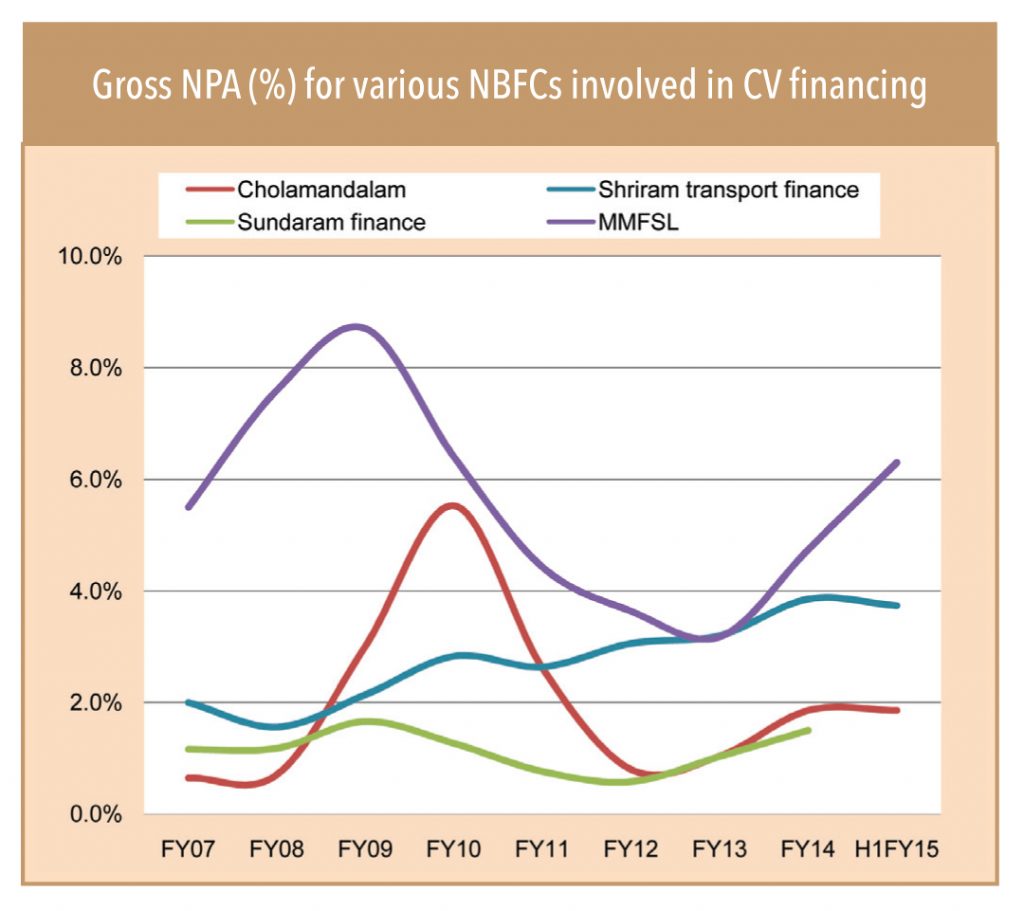

Banks and NBFCs engaged in CV financing indicate that they have a 5-10% NPA level in the segment. These levels are close to peak, given the improving operating environment for small truck owners. However, the new provisioning norms introduced for NBFCs could see NPAs move up further in the short term.

Nevertheless, NPA levels should peak in the coming 6 months for various institutions before stabilising and eventually starting a downward trend. Willingness to lend aggressively to the sector will help propel CV numbers; however, this will happen only over the next 12-18 months.

Subscribe to enjoy uninterrupted access