Fin-tech is a short form of financial technology. These kinds of companies, usually start-ups, use software to provide financial

services. Typically, their purpose is to disrupt incumbent

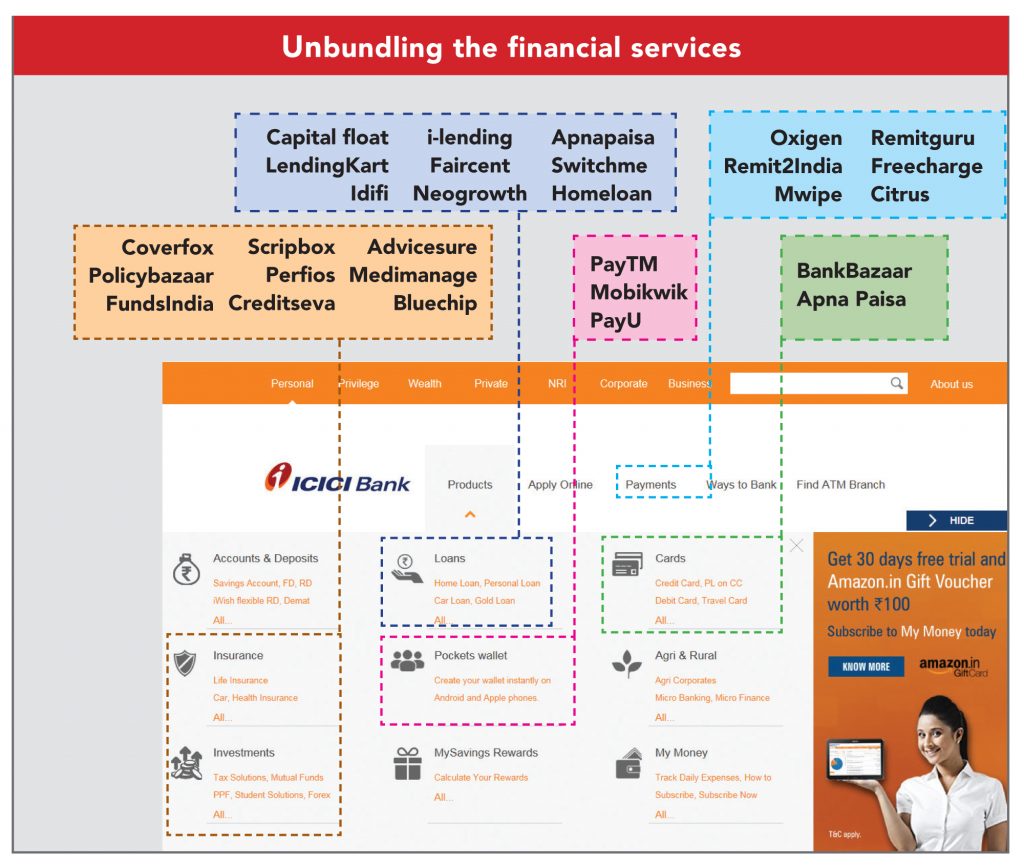

financial systems and corporations that rely less on software. These firms provide specialised services in areas of payment and remittances, lending, personal finance and retail investment, and business infrastructure. The breeding of these companies is a manifestation of strong customer requirements

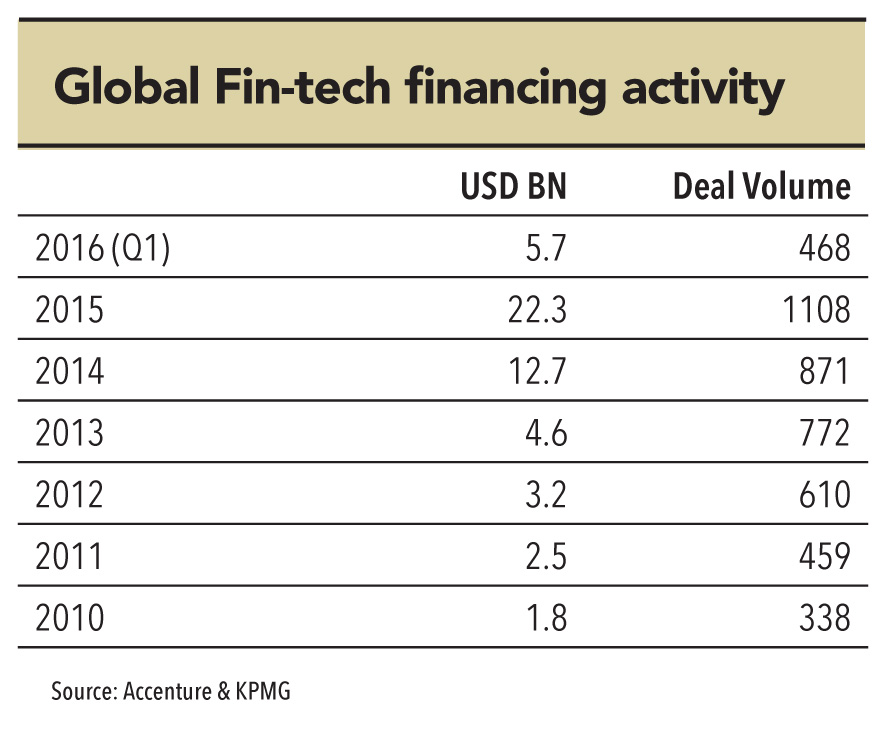

for specialised and customised services. In 2015 worldwide, fin-tech firms received a total financing of US$ 22.3bn while Indian fin-tech companies received US$ 1.6bn.

“The major segments that fin-tech companies have disrupted include mobile payments (PayTM), money transfers(Western Union), loans(Capital Float), and wealth management(Policy Bazar).”

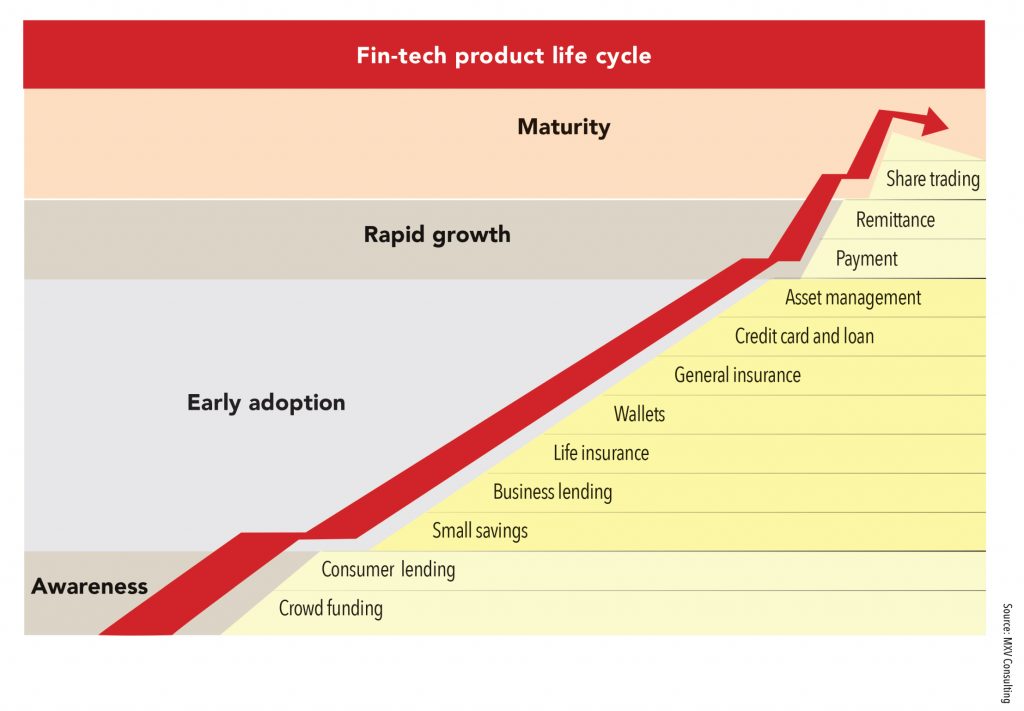

Various financial products offered by fin-tech firms are at different stages of their product life cycles. Concepts such as crowd funding and consumer lending are at a nascent stage. These products would need legitimacy and recognition by the regulator and acceptance by customers. RBI’s recent consultation paper on peer-to-peer lending provides legitimacy to the consumer-lending marketplace model. With increased acceptance by customers, P2P lending could gain traction. Ease of transaction and enhanced customer experience has attracted potential buyers of life insurance and general insurance to fin-tech companies like Policy Bazaar and Bank Bazaar. Payment services of fin-tech companies such as Paytm, PayU, or Citrus are widely used to avail services like cabs, utility bill payments, money transfer, shopping, and movie tickets. Payment and remittance gained wide acceptance among customers due to the ease of use and low transaction costs.

Subscribe to enjoy uninterrupted access