For this, it is important to understand the difference between a bank and a NBFC’s zero-cost scheme

Loan from Bajaj Finance

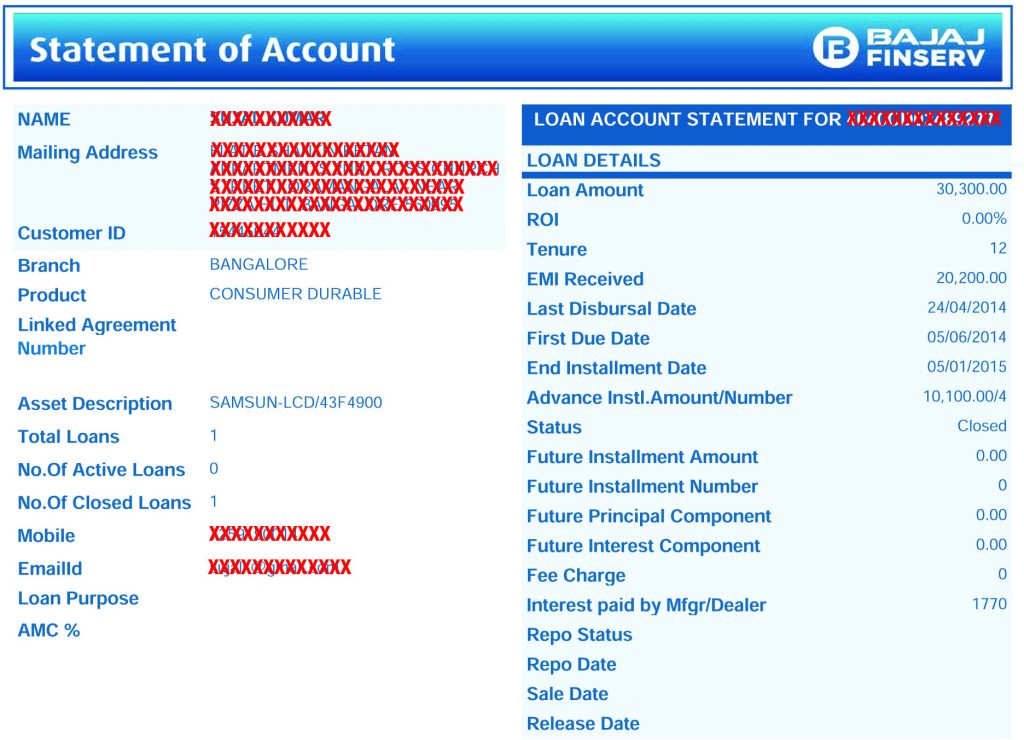

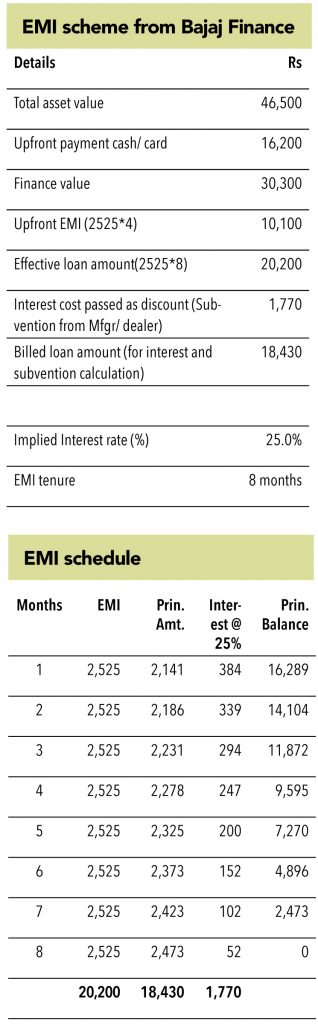

• Sumit, a salaried person working with a bank, buys a Samsung TV from a multi-brand retail chain on zero-cost EMI from Bajaj Finance.

• The price of the product is Rs 46,500. He makes a 35% down payment of Rs 16,200 and opts for 4 upfront EMIs that total Rs 10,100 (Rs 2,525*4). The remaining amount, Rs 20,200, (what is left after reducing Rs 16,200 + Rs 10,100 from the product price of Rs 46,500) is distributed over eight EMIs. He also had to incur some processing fee.

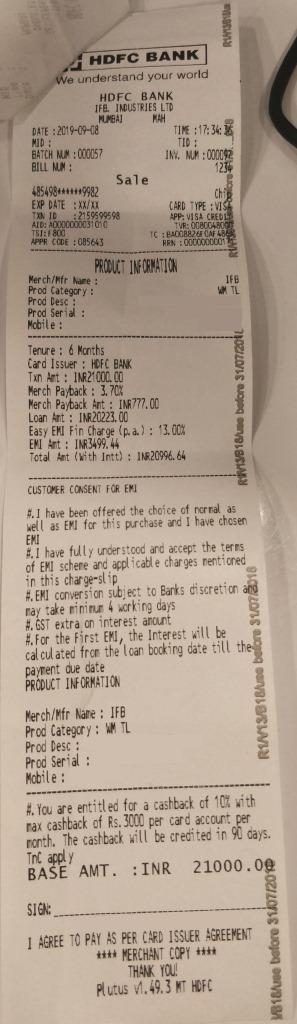

• Satish bought a top-load washing machine from an exclusive IFB outlet.

• The product price was Rs 21,000, and he was given option of zero-cost EMI from both Bajaj Finance and HDFC Bank.

• He choose The HDFC Bank Credit Card zero-cost EMI scheme, and swiped his card at the merchant’s POS machine.

• Incidentally, this POS machine is from a company called Pine Labs-Plutus – the only one that provides all banks with the EMI option at the merchant outlet.

• To start Satish’s EMI, the merchant selected HDFC BANK ZERO COST EMI SCHEME with a 6-months tenure at the POS machine itself.

• The merchant immediately received Rs 21,000 less 1.2% MDR fee) in his account.

• The bank blocked Satish’s credit-card limit by the loan amount of Rs 20,223 (Rs 21,000 les Rs 777 (Interest), which is 20,223).

• The bank converted the loan amount into an EMI scheme in two days, and the first EMI was deducted two days after the transaction.

• The Brand (IFB) paid the subvention amount of Rs777 (interest amount) to Pine Labs, which paid it back to the respective bank from which the EMI was taken.

Jab Miya bibi razi to kya kar lega kazi. This age old Indian saying (which loosely translates to – when the bride and groom are ready, how can the priest object) fits this scenario perfectly. When brands and customer want to go with banks, what good would it do for NBFCs to object?

One of the leading consumer-durables companies revealed that 30% of its turnover is sold on finance (paper finance + card). Of this financed book, 85% is from Bajaj Finance. It said that with the current subvention cost structures of NBFCs, it may cap the financed book at 40% of its turnover, as beyond this, this would start having a significant negative effect on the company’s margins. However, if this consumer durables company were to shift its business to banks, it could achieve 50-60% finance penetration in the same subvention budget. While it is aggressive – it has tied up with banks such as HDFC and ICICI already – it finds the limited presence of banks in dealerships in smaller cities a challenge. While HDFC Bank has become aggressive in the last 5-6 months, its presence is still significantly lower than Bajaj Finance’s.

When customers go with banks for their consumer finance needs, they get better offers as compared to NBFCs. Most banks run cash-back offers, which Bajaj Finance very rarely offers, because it is the sole lender at many dealership points in smaller cities. One of the leading consumer durables companies said that its share of bank finance has increased to 25% in metros vs. just 5% a year ago.

• As far back as 2001, RBI had issued a circular that directed banks to end the practice of offering 0% EMI schemes for purchasing consumer durables. Banks were not allowed to charge interest on purchases of consumer durables at below their benchmark prime lending rates (BPLR). Later, from July 2010, banks moved on to the base-rate system; they were not allowed to lend below the base rate.

• While banks followed the guidelines in letter, the spirit was missing. In 0% EMI schemes offered on credit card outstanding, the interest element was often camouflaged and passed on to customer in the form of a processing fee. Similarly, some banks were loading expenses incurred in sourcing the loan (such as DSA commissions) in the applicable RoI charged on the product.

• In this, the RBI said that banks should refrain from offering low / zero percent interest rates on consumer durable advances to borrowers through adjustments of discounts available from manufacturers / dealers of consumer goods, since such loan schemes lack transparency in operations and distort the pricing mechanism of loan products. Also, these products do not provide a clear picture to customers about the applicable interest rates.

• It asked banks not to promote such schemes by releasing advertisements in different newspapers and media indicating that they are promoting / financing consumers under such schemes. They should also refrain from linking their names in any form / manner with any incentive-based advertisement where clarity regarding interest rate is absent.

• As a result of these guidelines, banks stopped adjusting discounts received from manufacturers/ dealers in the interest rate. Moreover, they became transparent in disclosing the interest rates charged and the subvention amount received from brands. However, as these guidelines are applicable only to banks, NBFCs are free to not disclose interest rates and the subvention amount. HDFC Bank discloses all information about interest rate charged, loan amount, merchant payback and tenure. Banks aren’t keeping grey areas or hiding anything from customers. They are abiding by all guidelines on these type of loans. So presently, the RBI does not have any objection to the current way in which zero-cost EMI schemes are offered by banks. In fact, banks hope that to create a level playing field, the regulator will extend these guidelines on to NBFCs as well. If this happens, even NBFCs will have to disclose all details such as interest rate, subvention amount, etc.

Subscribe to enjoy uninterrupted access