In January, one more global fast food chain, the Florida-headquartered Burger King, set up shop in Mumbai, having entered India late last year. That means more choice for consumers and more competition for suppliers. Over the past few years organized players added more than 2,000 restaurants and the industry has built up huge capacity and is looking forward to achhe din (good times). The organised restaurant industry, one of the fastest growing in India, has captured the imagination of global companies, investors and industrialists. The industry is expected to continue its rapid growth with increasing economic prosperity. “Competition helps to grow the market and the entry of more players indicates the market potential,” says Mr. Ravi Gupta, CFO of Jubilant Foodworks.

However, not every enterprise may flourish, as the organized restaurant industry is marked by fast changing consumer preferences and one of the highest mortality rates. Some business models and formats will grow faster than others but some will languish, eating into the pockets of investors and promoters. “Well beaten, ready to rise”, is an in-depth study of the nuances of the Indian restaurant business. It aims to clarify the strengths and weaknesses in emerging business models.

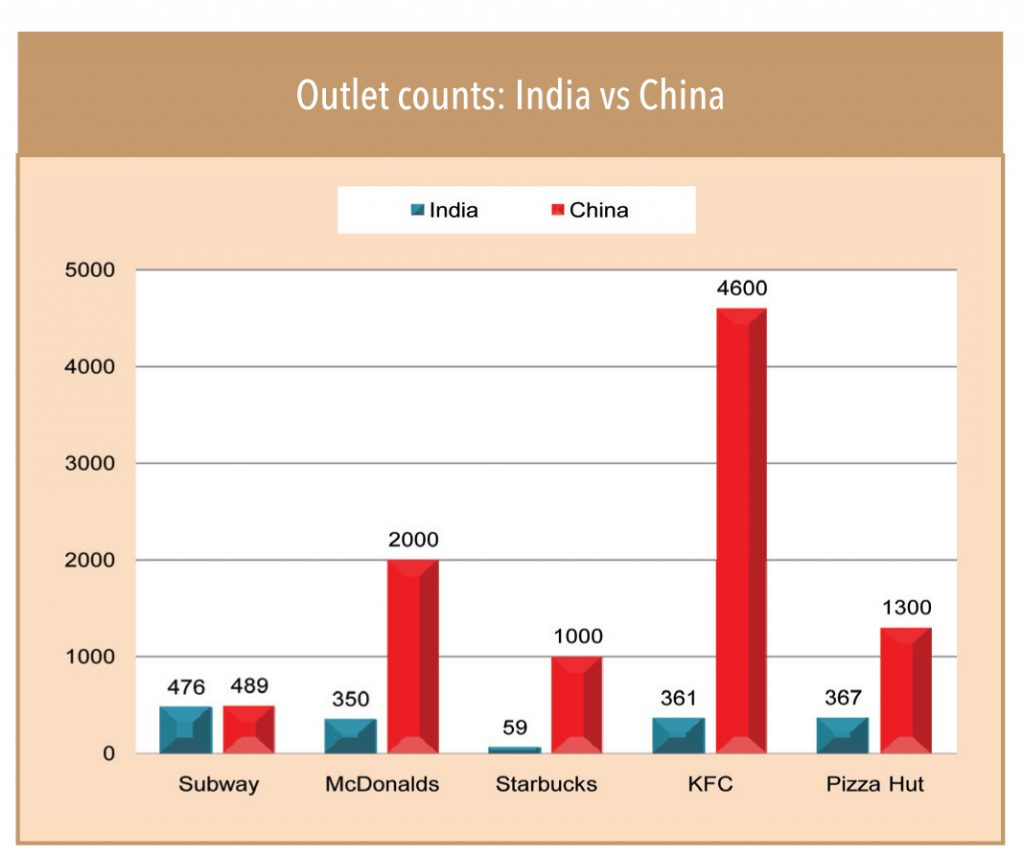

Over the past few years the food services industry, especially in the organized sector, has grown rapidly mainly due to a surge in the middle and upper class populations and the number of double-income couples. The industry growth is expected to continue, in keeping with the growth of the Indian economy. A comparison of India and China with respect to the number of outlets of the top five fast-food chains shows the potential of Indian markets.

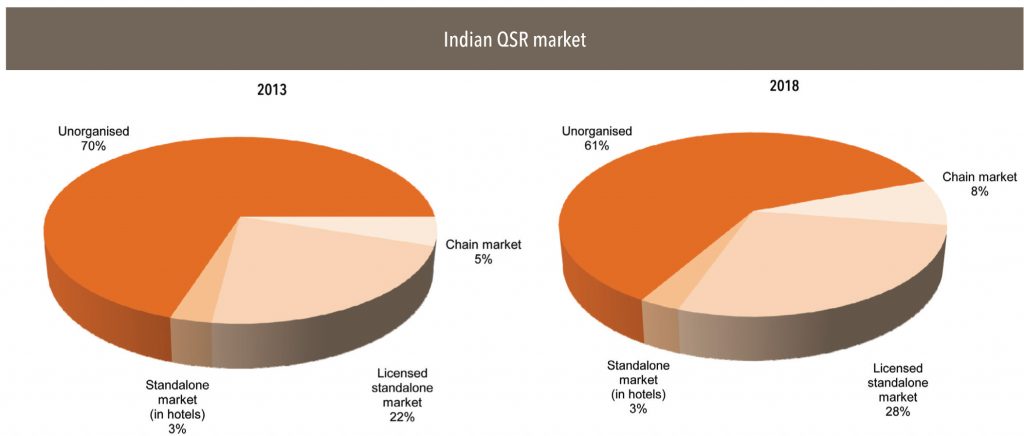

According to an Indian retail and FMCG management consultancy, Technopak, the Indian food services industry is a US$48 bn industry, 70% unorganized and 30% organized. Technopak expects the market to grow to US$78 bn by 2018, a CAGR of 10%, with the organized sector accounting for 39% of the market. The organized market is expected to post 16% CAGR and the unorganized market is expected to post 7.3% CAGR.

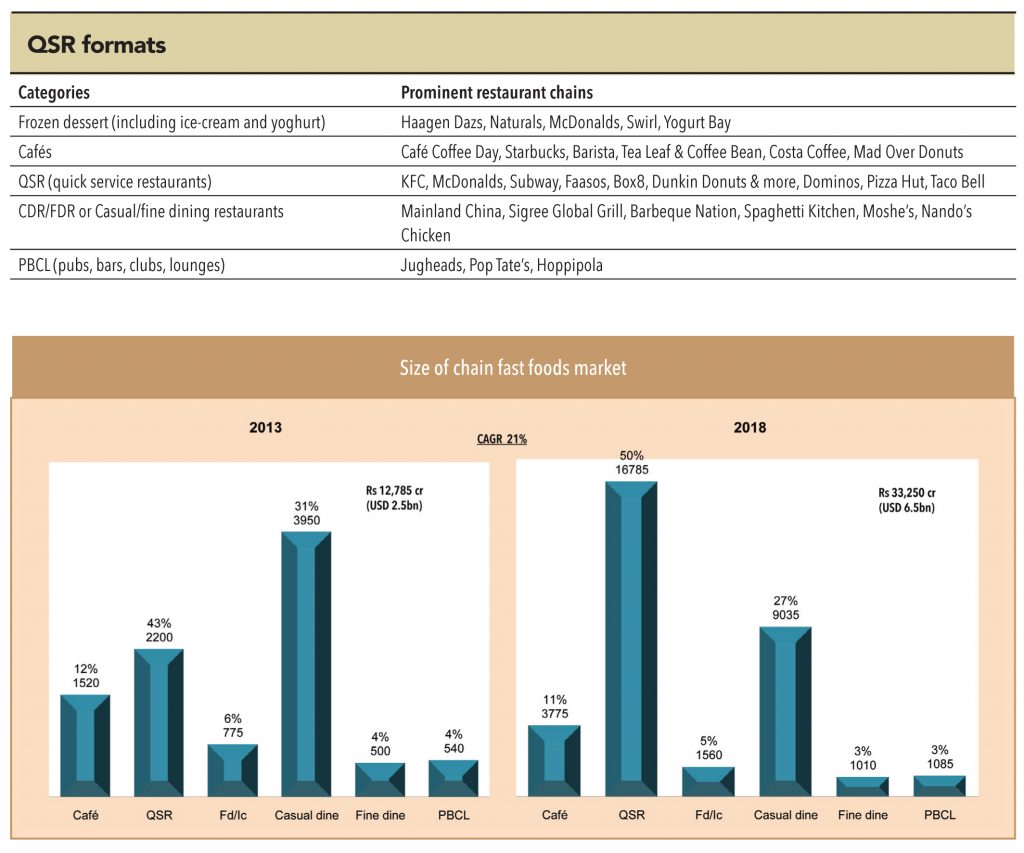

New categories have emerged and each category has a well established international and domestic chain competing fiercely for the consumer’s share of wallet. The Quick Service Restaurant (QSR) and Casual Dining Restaurant (CDR) segments account for over 70% of the share of the organized market. The organised Food Services market is expected to post 18% CAGR over the next few years but the growth could be even higher as more chains enter and discover innovative ways to fulfill customer needs.

Mr. Amit Jatia, Vice Chairman of Westlife Development Limited, franchisee of McDonald’s, on Indian QSR industry.

“The vast Indian middle-class is pressurized by professional commitments, daily commutes, and domestic chores which has resulted in increasing frequency of eating out across urban India. However, the average frequency of about 8-9 times a month in metros like Mumbai is just half of some ASEAN benchmarks of 17-18 times a month. Rising number of Indians are becoming increasingly particular about food hygiene. So even as India’s Informal Eating Out (IEO) market is projected to grow at 11% during 2014, reaching ~USD 107 billion,its QSR component, where we are present, is expected to grow the fastest to ~USD 17 billion at a CAGR of 11-14%. India has significant headroom available when compared globally. India’s QSR segment is only ~16% of the overall IEO market whereas the corresponding proportion is higher in countries like China (24%), Hong Kong (21%) and Singapore (19%). Moreover, the branded component of India’s QSR market is a mere 1% aggregating around 1800 odd stores, which pales in comparison to a demographically similar country like China with 7000 units shared between just two international QSR brands.”

Subscribe to enjoy uninterrupted access