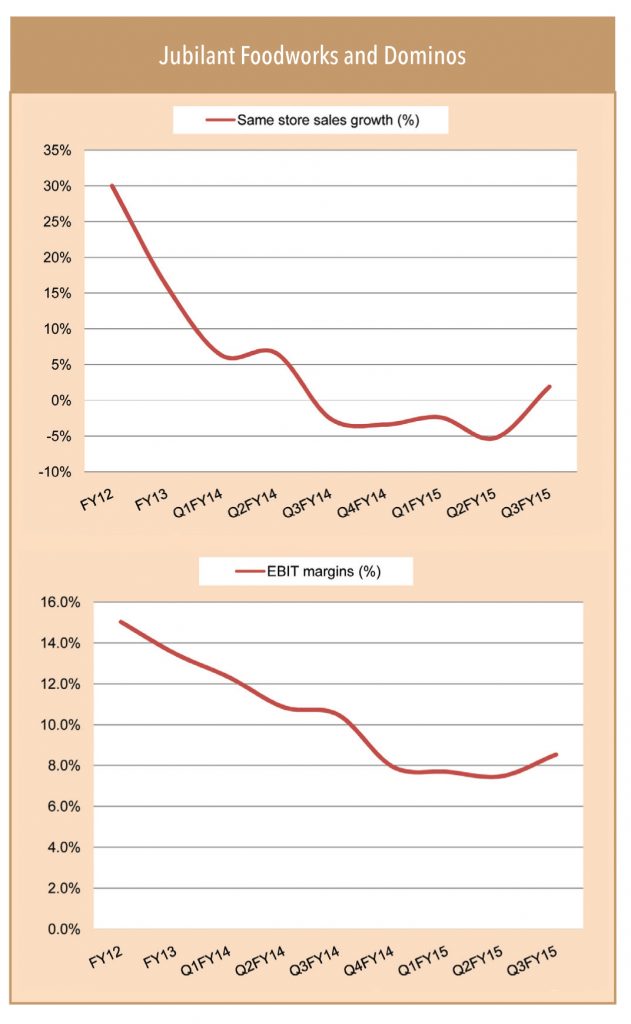

The economic slowdown has hit the Indian restaurant industry hard, with the past one year being especially harsh. Even though the industry has grown, store profitability has been severely dented. Relentless food inflation, rising rentals and labour costs have impacted store-level profitability. This however, has not had a significant impact on store-opening rates, which have accelerated for some companies like Jubilant Foodworks.

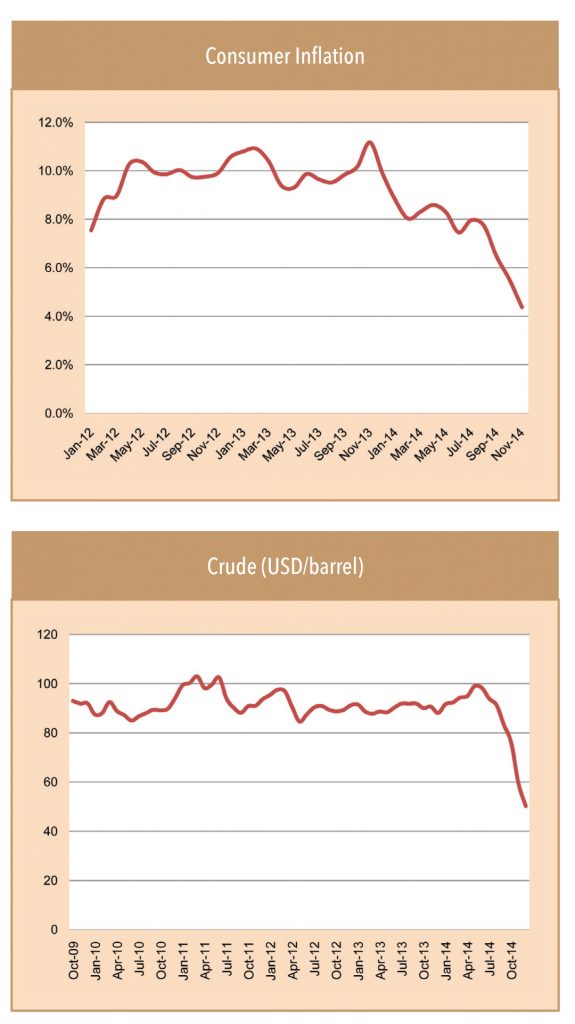

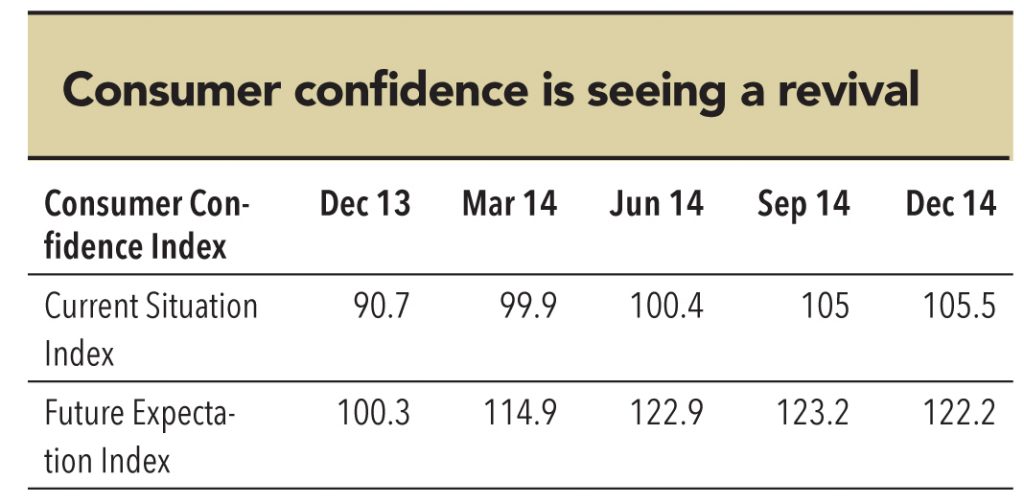

The profitability of major players has been impacted severely by the downturn but it can largely be surmised that the worst is over. One of the greatest windfalls at the start of CY2015 is the simultaneous fall of inflation, crude oil prices and interest rates. The increased disposable income due to such a scenario will highly benefit the food services industry.

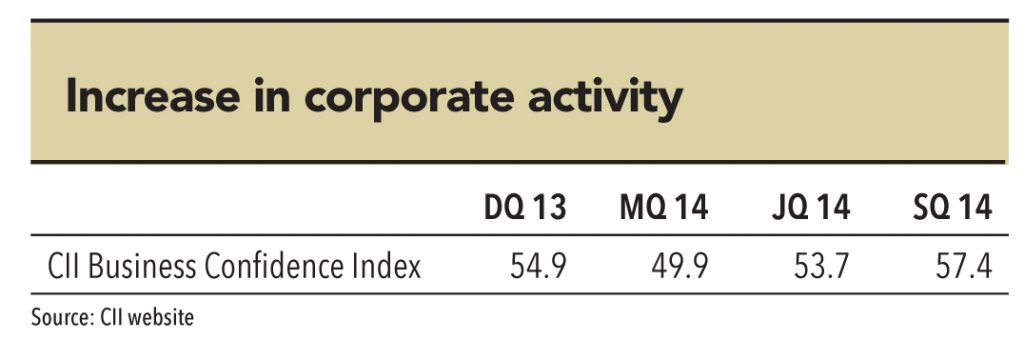

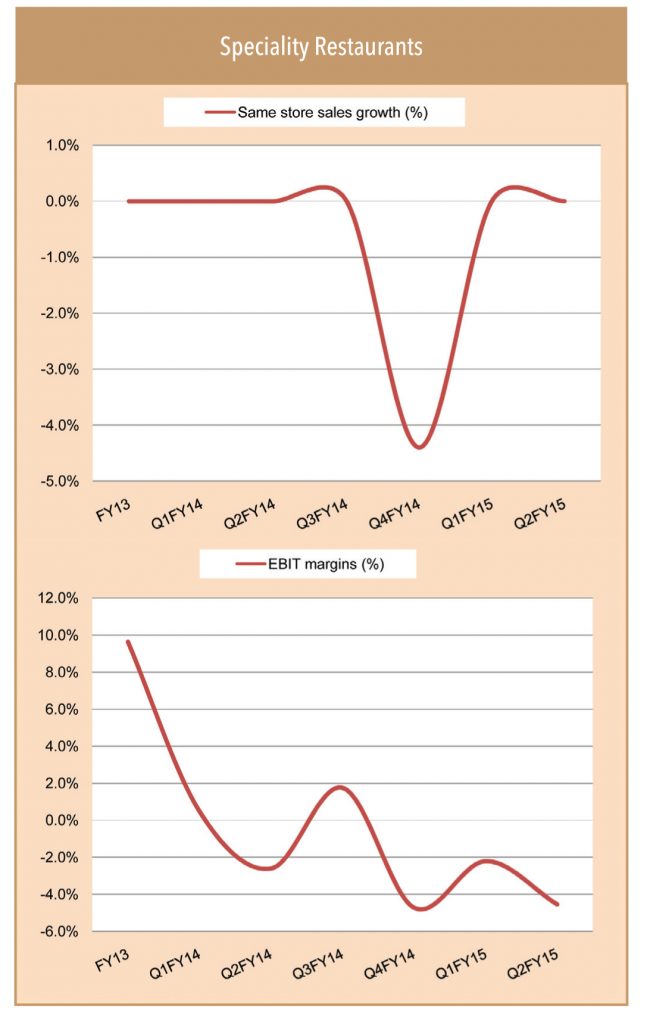

The decline in crude oil prices is a major factor that will boost disposable income. The turnaround of same-store sales depends on the rise in disposable income and growth in real income. A pick-up in industrial and economic activity will be a big boost to the rise in real income as wages will rise and may not necessarily be accompanied by a rise in inflation. A major reason for the stagnation of fine dining over the past few quarters has been the fall in corporate activity leading to a slack business on week days. Mr. Rajesh Mohta, CFO of Speciality Restaurants, believes, “The improvement in corporate activity over the next few quarters will lead to a revival of fine dining. Southern markets like Bangalore have started performing better but most are still significantly below their peak operating performance”.

Brandy and cigars

The lead economic indicators are turning in favour of discretionary consumption. Eating out and ordering will start picking up over the next two quarters. The base is favorable for most chains as they were impacted by a double-dip in same-store sales. Margins have largely bottomed out and an uptick in margins is expected in the forthcoming quarters. The restaurant industry is in a unique position to benefit from pick-up in consumption, leading to revenue traction. This along with a decline in inflation will help to manage the cost structure better. The benefits are expected to translate into significant improvement in margins but the improvement is likely to be protracted.

All discretionary categories will benefit with the uptick in consumption but categories with pent-up demand are generally the first to benefit—these primarily include consumer durables. After consumer durables, small ticket consumer discretionary categories including personal-care products, savories and confectionery benefit. The eating-out industry generally benefits a little later in the cycle as there is no pent-up demand and allocation takes place with a lag after a rise in disposable income. However, some categories see faster pick-up than others. QSR generally sees a faster pick-up in consumption than fine dining. Besides, the best entrenched brands generally rise earlier in the cycle.

In chronological order, our brand picks among listed plays are as follows:

Jubilant Foodworks and Dominos: With 844 restaurants and adding more than 150 outlets a year, Dominos is the best established QSR brand in India. Its unique positioning and disproportionate market share will help to attract a significant share of incremental growth. Good times benefit all players and smaller players sometimes see disproportionate gains. Dunkin, however, needs to improve its brand communication. Dunkin’s turnaround is likely to be protracted and the management guidance indicates a six-year breakeven period.

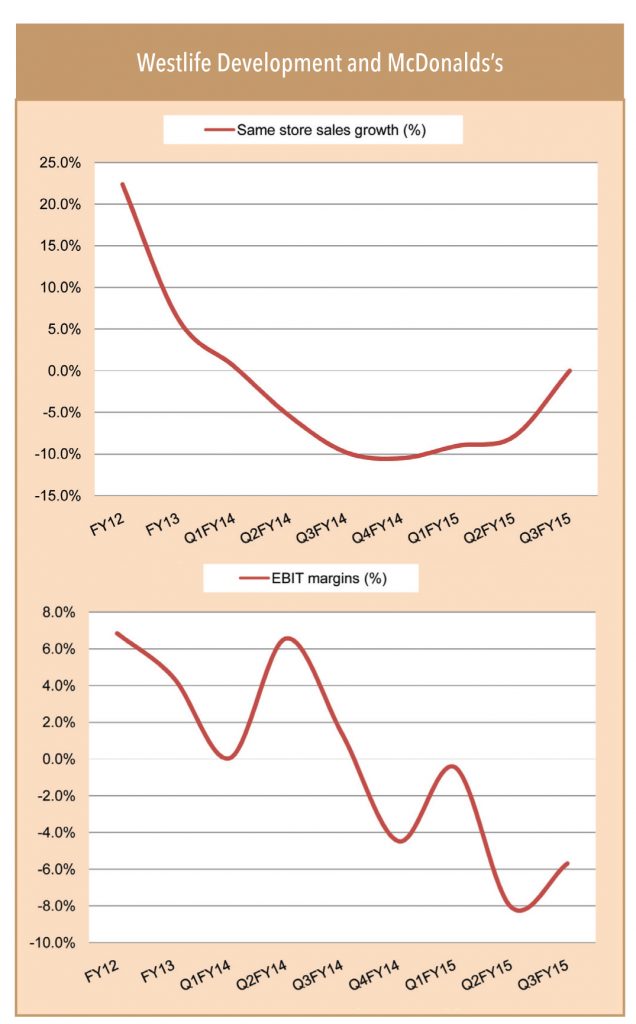

Westlife Development and McDonald’s: McDonald’s

in India has experienced a double dip in same-store sales growth due to the slowdown in economic growth. McDonald’s margin compression has also been quite severe. But with an improvement in same store sales, McDonald’s may see significant improvement

in margins. McDonald’s has also added new product lines and brand extensions, which are yet to deliver to their potential. All these factors indicate that McDonald’s may be a significant beneficiary of the uptick in the economic cycle. However, major changes in global strategy may entail significant investment for franchises, which is a significant risk

Starbucks: With 61 stores and mega store sizes, breakeven will be a challenge. The company is unlikely to break even before 150 stores or at least three years. However, Starbucks has established itself as a quality beverage brand. It will have to enhance its offerings to engage more customers and take a higher share of their wallets. This is a time-consuming process. The medium term will be financially challenging but the company holds out promise.

Speciality Restaurants: Although later in the cycle, Speciality may see the biggest delta as it not only benefits from consumer spending but also from pick-up in corporate activity. Fine dining has huge latent capacity, which will start getting used with a pick-up in consumer activity. With a pick-up in corporate activity not just capacity utilisation improves but spending per cover also picks up. Speciality will see the most significant improvement in margins over the next three years due to operating leverage.

Subscribe to enjoy uninterrupted access