Both central and state governments have been consistently announcing infrastructure development projects for NER. Numerous comments by bureaucrats, ministers, business leaders, local entrepreneurs, distributors, and channel partners suggest robust infrastructure initiatives in NER are underway, which will ultimately trigger growth for cement consumption. Initiatives on infrastructure development in the region look positive with growth likely across all infrastructure verticals including railways, roads, ports, inland waterways, airports, and hydropower. NER also remains a focus area for PM Modi – he has announced several initiatives. Any project in this region will have a material impact its growth because the base is too low. Here are a few details:

Housing:

Given that NER is an earthquake-sensitive region,most houses are made of material other than concrete – such as bamboo, mud, and bricks – they are typically called ‘Assam-type houses’.

Census data shows that only about 3% of houses in Assam (NER’s largest state) are concrete with concrete roofs; 11% (nearly 700,000) are classified as not liveable. This suggests huge potential housing demand in the long term. Even if we consider rehabilitation of these non-liveable houses and their conversion into concrete (of say 200 sq. ft. area), the potential is 3.5mn tonnes of incremental cement demand. Considering the long-term potential of conversion of 6mn houses to concrete the overall potential for cement is as high as 30mn tonnes (assuming only 200 sq. ft. houses).

While theoretically these numbers look attractive,the conversion to concrete is going to be a very long-term process. However, even if just 500,000 tonnes p.a. of cement is consumed from the houses that are supposed to convert to concrete, it will translate into +8% cement demand growth in NER.

NER is essentially hilly terrain – so it is amazing to see that most of the highways are good quality. In certain areas, the roads are even better than our metros. Transport minister Nitin Gadkari recently announced a 10,000km road network for NER at a cost of Rs500bn. Though road projects typically do not consume large quantities of cement, because of NER’s rough and hilly terrain, cement consumption here is likely to be higher. Due to frequent landslides, cement consumption will also include RCC culverts, curves, bridges, and road borders. For every 1,000km two-lane road, the benchmark consumption is about 1mn tonnes of cement. Theoretically, this will translate to 10mn tonnes of demand, assuming 100% cemented roads. However, even if 20% of this network is cemented, it will translate into 2mn tonnes of incremental cement demand and will boost demand CAGR by +10% over the next few years. Going by the announcements made by central and NER’s state governments, expectations of huge road project development in NER seem realistic.

The governments (central and state) intend to:

• Connect all state capitals in NER with improved/ upgraded national highways

• Provide connectivity to all district headquarters through improved state roads

• Improve connectivity with neighbouring countries

• Provide road connectivity to backward and remote areas of NER

• Improve some of the important roads of strategic importance within NER

Specific emphasis on development of roads in Arunachal Pradesh

Arunachal Pradesh has the lowest density of roads among NERstates. It shares over 1000km of sensitive border with China and Myanmar and has vast potential for hydropower generation.Considering this, the trans-Arunachal highway network of about 900km needs to be upgraded urgently. This will also lead to material demand for cement.

Urgent need to improve bridges in NER

NER consistently suffers from lack of inter-regional connectivity. There has been consistent demand to provide increased connectivity between north and south Assam by constructing bridges on the river Brahmaputra at various locations such as (1) north and south Guwahati, (2) Jorhat and north Lakhimpur via Majuli, (3) Dhola and Sadia, and (4) Dhubri to Phulbari in Meghalaya.

Roads in NER will be a key driver for cement demand. The base of cement consumption in NER is so low that any material demand from such projects will look significant. Due to the nature of the terrain, road projects could lead to higher cement consumption. Mr Gadkari seems committed to building quality infrastructure in NER. This region may generate higher cement demand from road projects vs. other parts of India, at least in the medium term.

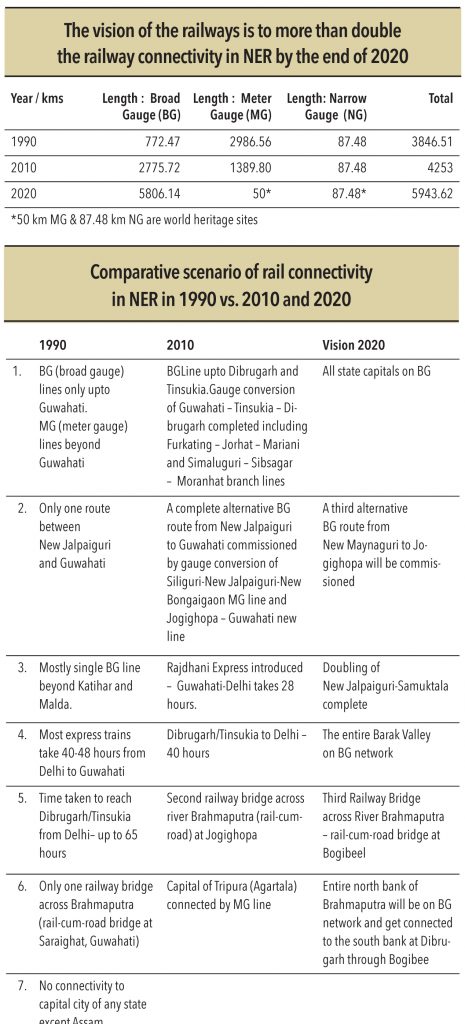

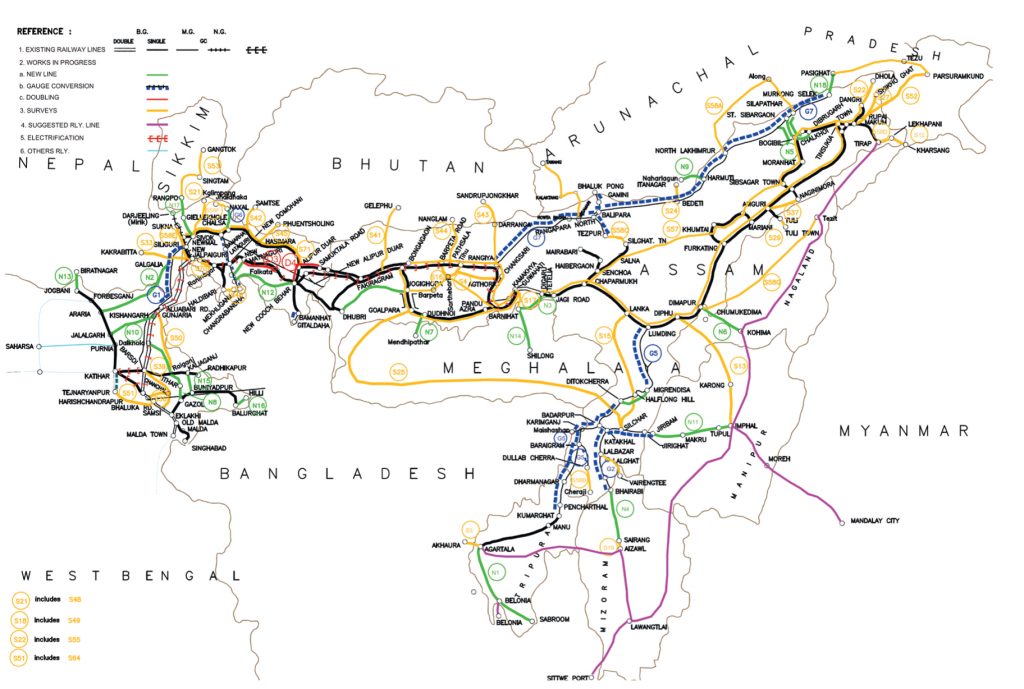

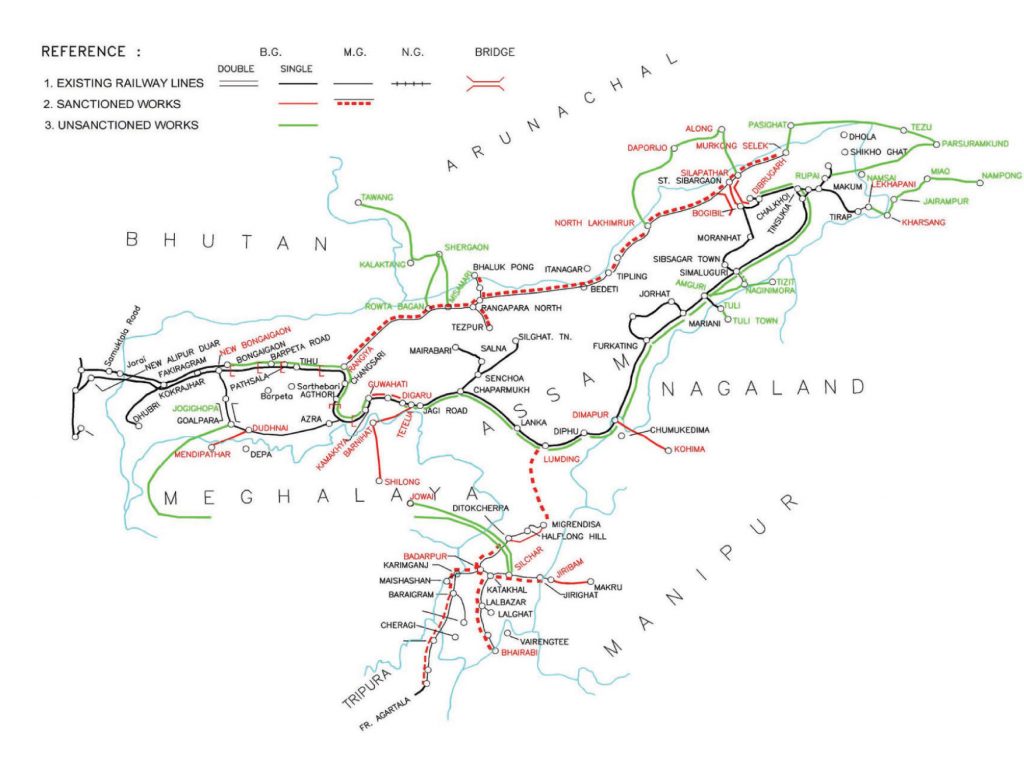

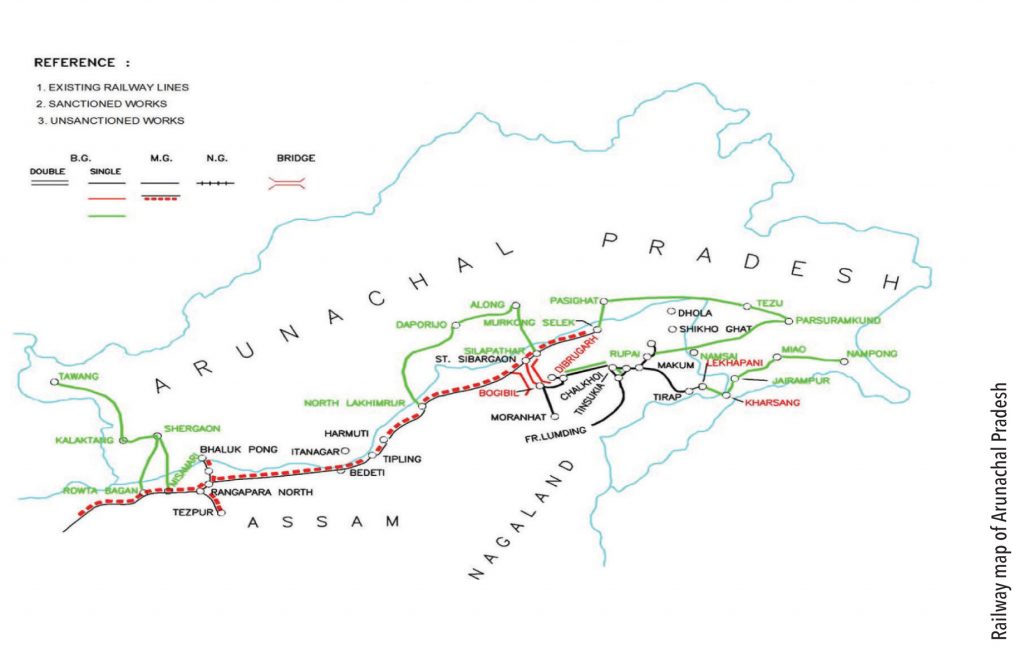

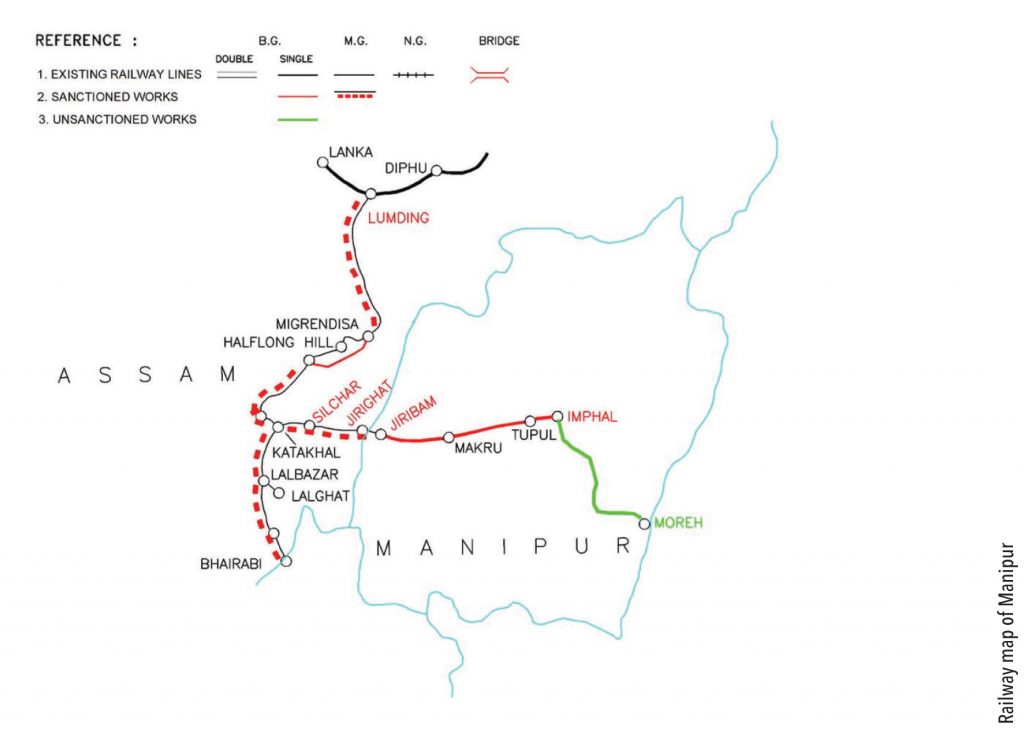

Central and state governments have ambitious plans to improve rail connectivity in NER. Though this may not lead to huge demand (railway projects do not tend to consume high quantities of cement vs. road projects), any material increase in demand is positive for the industry due to the low base. Development of rail network will mean facilitation of trade and commerce in this region, addressing one of the major problems for long-term growth – poor connectivity.

The vision of the railways is to more than double the railway connectivity in NER by the end of 2020

Connectivity issues in NER will be significantly addressed with improving railway connectivity. A significant boost to trade and commerce is likely, though it is difficult to quantify demand for cement. Improving railway connectivity will bring a structural long-term change in the economics of doing business in NER. This will be more of a longer term positive rather than an immediate positive for the cement industry.

Air connectivity to NER is also under revival. Guwahati remains the only major commercial hub, which is quite well connected to the rest of India. Apart from Guwahati, air connectivity to NER is poor or below average. Though the average number of departures per week has improved to nearly 500 from 226 in 2001, there is tremendous scope to improve air connectivity to the region.

DoNER has listed the following reasons for a revival and upgradation of air connectivity in NER.

1.Terrain makes air connectivity not just an option for travel, but an absolute necessity.

2.Road and railways are highly capital intensive. Development of air infrastructure is lesser so.

3.Improvement in air connectivity will help NER gear up on agriculture, tourism, and services.

4.Improved air connectivity will also facilitate movement of perishable agro commodities. More so, quick and reliable movement of cargo is necessary to find markets within and outside NER for such commodities.

5.Cities such as Shillong can be developed as educational hubs in the longer term and improved air connectivity will facilitate this initiative.

6.NER remains threatened by natural disasters. Improving air connectivity will mean better evacuation mechanism for patients during natural disasters.

7.Improving air connectivity also has strategic reasons – to protect NER from international threats and opening up the region, especially to the ASEAN countries.

There are 11 operational airports in NER, 12 non-operational airfields, and three greenfield projects are under evaluation or execution. For the time being, revival of existing airports remains a priority and major new greenfield announcements may not happen. Governments are already considering developmental plans for non-operational airports in Arunachal Pradesh, Tripura, and Meghalaya. Ground View’s checks also suggest that around five airfields are being developed in Arunachal Pradesh, especially as an Air Force base. All these developments will definitely add to the cement demand in the region. However, more importantly, upgradation and revival of air connectivity to NER will significantly help it to attract investment and will be structurally positive in the long term.

Among infrastructure projects, the cement-consumption intensity in hydropower projects is the highest. For every 1000MW of a hydropower project, the consumption of cement is ~1.5mn tonnes. A hydropower project has the potential to consume 10,000-15,000 (~200,000-300,000 bags) of cement per day of construction.

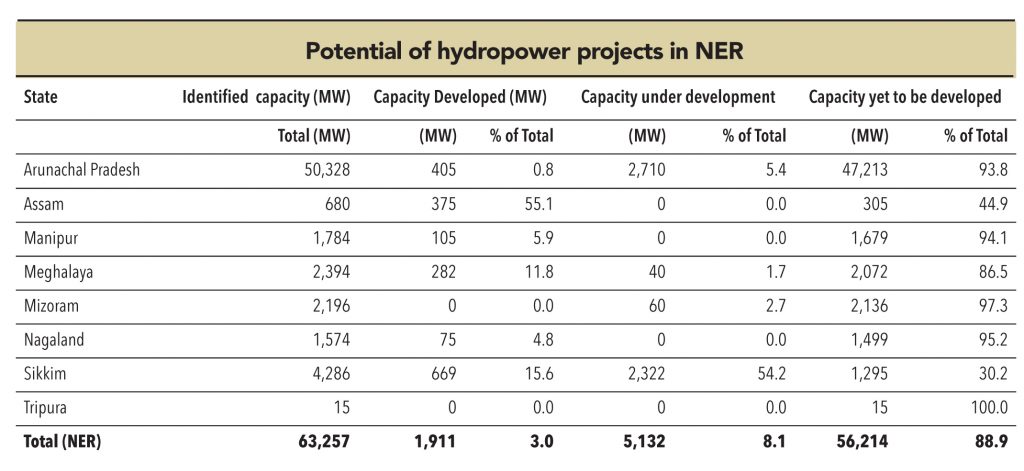

Across the country, NER has the maximumpotential for hydropower capacities and most of this is in Arunachal Pradesh. The table below highlights the potential for development.

In NER, 89% of hydropower projects are yet to be developed. If they are implemented, they will lead to a whopping cement consumption of ~90mn tonnes.

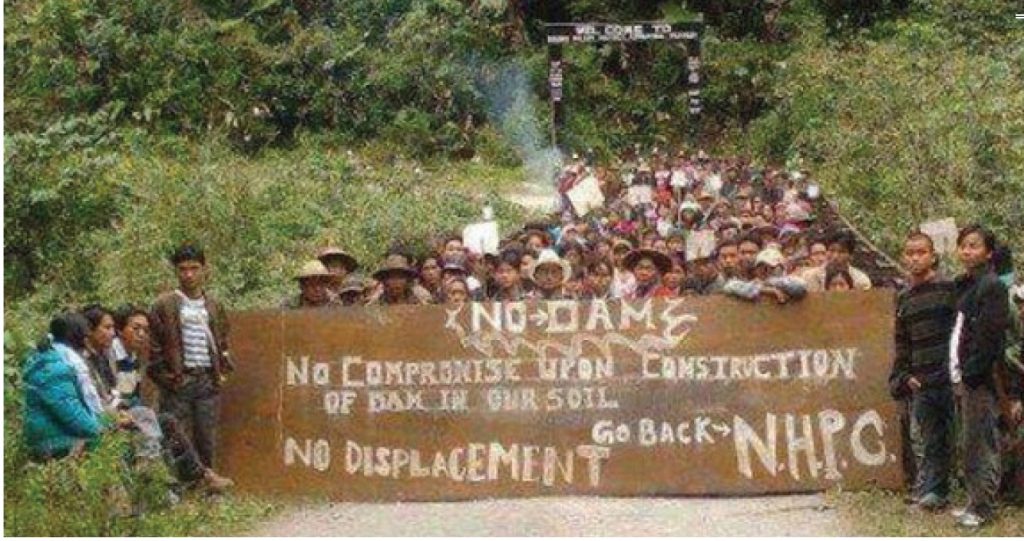

However, interactions with few developers constructing these hydropower plants suggest numerous bottlenecks such as:

• Non-availability / delay in environment and / or forest clearance

• Delay in private land acquisition

• Inter-state disputes

• Law and order / militancy problems

• Provision of resettlement and rehabilitation of the population dislocated because of such projects.

• Non-provision of employment for project-affected families

• Concerns regard the protection of aquatic lif

The region is unlikely to see huge activity in hydropower in the near term. However, even if say 5% of the proposed or identified projects are executed in the medium term, it will boost cement demand significantly. The long-term potential remains exciting.

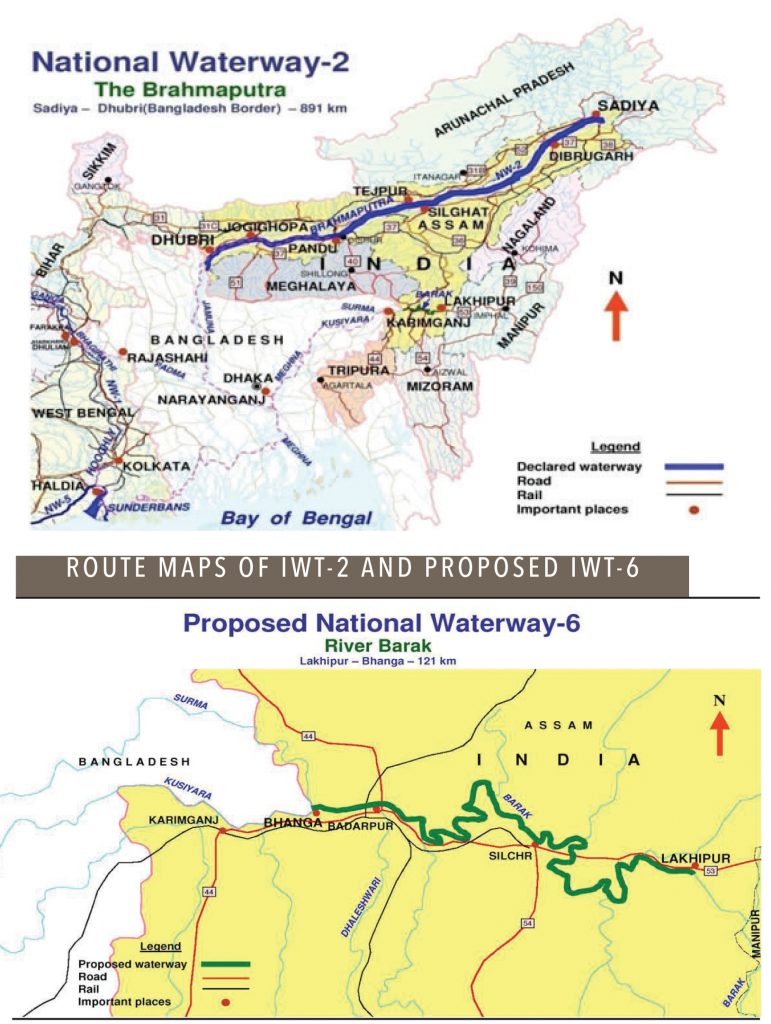

India has about 14,500km of navigable and potentially navigable waterways of which around 55% are used regularly. NER’s inland waterways are classified as National Waterway 2. This route is established since September 1988 across the Sadiya-Dhubri stretch of the Brahmaputra River and is the second-largest inland waterway of the country at 891km –a 121km stretch of the Barak River is already under consideration as NW6.

NER has identified a 1,566km stretch of tributaries of the Brahmaputra and Barak rivers as state waterways (feeder routes). Kaladan multi-nodal transport project will also provide alternate route through Myanmar to NER. Moreover, river Brahmaputra offers immense scope for development of river cruise and eco-tourism in NER.

Development of these waterways will significantly boost internal transportation within NER and will emerge as an economical logistic support for the transportation of cement, which should eventually positively impact development of infrastructure in remote areas of NER.Though difficult to quantify, development of the new proposed feeders will consume significant quantities of cement.

Subscribe to enjoy uninterrupted access