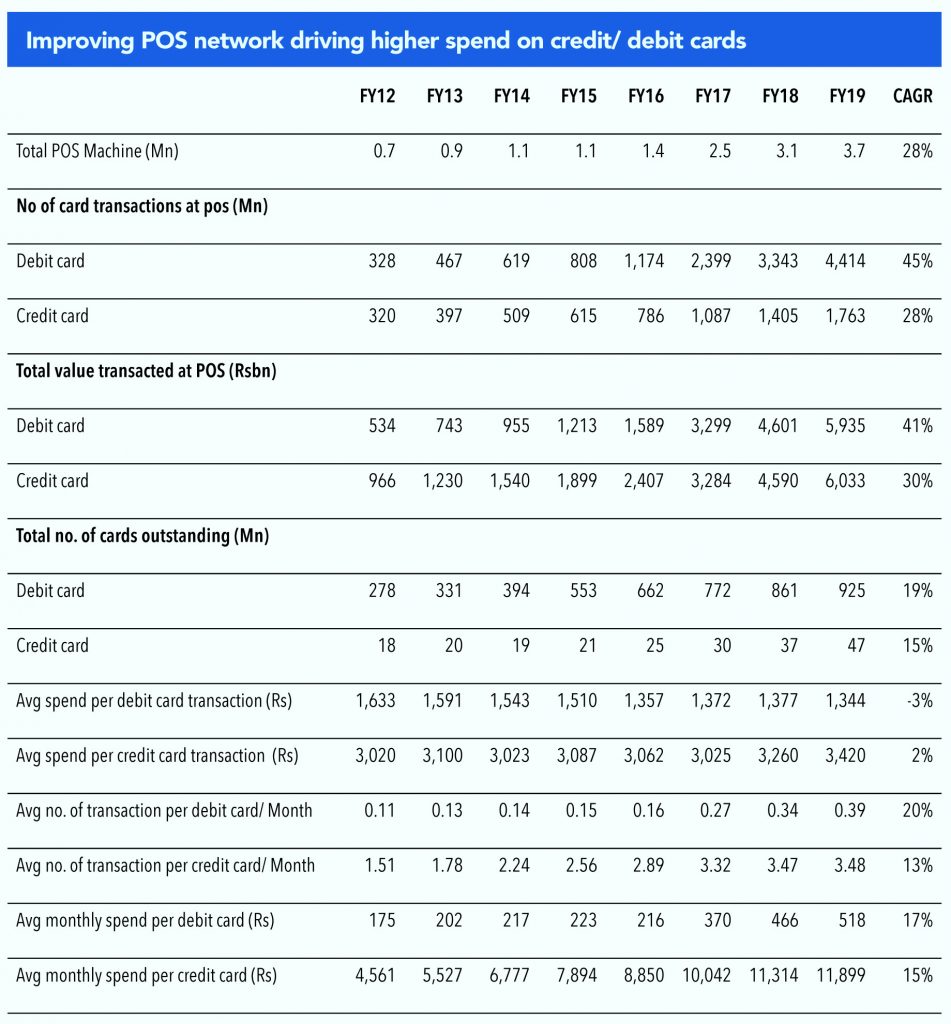

While POS penetration has improved, it still remains one of the lowest globally. The CAGR of the number of POS machines was a robust 28% over FY12-19 – to 3.7mn from 0.7mn. Nevertheless, penetration still remained one of the lowest globally. India has just 3,000 machines per million population. In contrast, Brazil has c.35,000 terminals per million people and China and Russia have c.45,000. A closer look at India’s data shows that 70% of the country’s POS terminals are installed by just five banks, who happen to have large credit-card portfolios.

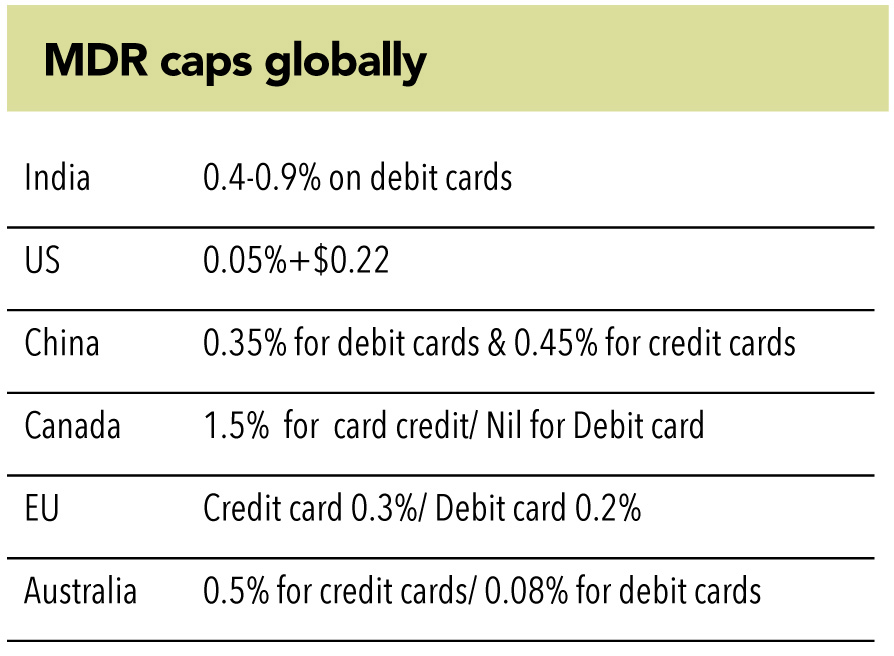

Typically, banks charge 2.0-2.5% per transaction for credit cards. For debit cards, the RBI has capped the MDR (Merchant Discount Rate) at 0.4% for smaller merchants and 0.9% for larger merchants. The problem lies in how MDR is shared between banks that issue the card and banks that accept the payment. For credit cards, the issuing bank gets c.1.8% of the MDR. For debit-card transactions, the issuing banks make 0.5-0.75% of the MDR fee. Not surprisingly, for banks it is less profitable to install POS machines as a larger share of the MDR fee is taken by the card-issuing banks.

The merchant discount rate (MDR) is charged to a merchant or dealer for payment-processing services on debit or credit card transactions. The acquiring bank (which installs the POS machines) collects MDR from the merchant and pays an interchange (I) fee to the card-issuing bank and a network fee (N) to the card scheme. The MDR basically compensates for the following: (1) the bank issuing the card (by paying an interchange fee), (2) the bank which puts up the swiping machine (Point-of-Sale or PoS terminal), (3) and network fee to network providers (such as Mastercard or Visa) for their services. MDR charges are usually shared in a pre-agreed proportion between these parties.

A point-of-sale or POS terminal is a hardware system used to process card payments at retail and other merchant locations. These terminals process payments of debit and credit cards by reading the magnetic strip or chip on cards to check for sufficient funds to transfer to the merchant. POS terminals also record and generate a payment receipt for transactions.

In India, the RBI specifies the maximum MDR charges that can be levied on every card transaction. The interchange is usually enabled by the card scheme, which assures revenue for the card-issuing bank. This incentivises the issuing bank to keep issuing more cards, and to spend on marketing and loyalty programs so that cardholders use cards frequently. The MDR fee is traditionally market determined, and is a contract between the acquiring bank and the merchant, based on the merchant’s volumes, risk, and infrastructure needs.

The Merchant Discount Rate (MDR) for debit and credit cards used to be similar in India until 2012. However, since then, the RBI has reduced MDR fee on debit cards to encourage the use of debit cards, especially at smaller merchants and service providers and locations. This move is encouraging all categories and types of merchants to deploy card-acceptance infrastructure and also facilitate acceptance of small value transactions. Further, in the case of the acquiring banks, a certain element of guarantee on the Return on Investment (ROI) is required for deepening the card acceptance infrastructure. A lower MDR with the expected increase in transaction volume because of network effects would result in a reasonable ROI for acquiring banks. The MDR fee paid by merchants on credit card was around 1.7% vs. 0.6% for debit cards in FY19.

Interaction with MBOs (multi brand outlets) and retailers suggest that with large private and PSU banks now rolling out zero-cost EMI schemes even on debit cards (these, until a few months ago, was available only on credit cards and Bajaj Finance EMI Cards), more customers are now able to avail of zero-cost EMI, provided they pass through banks’ filtering processes. While there are 47mn operational credit cards in the system, debit-card numbers are significantly higher at 925mn.

Banks that GV spoke to said that not all debit card holders are eligible for EMIs; this facility is based on credit profile. Nevertheless, even if 35% of debit card holders have a suitable credit profile, the number will be large – as high as 4x-5x of the present credit-card base. Moreover, retailers also feel that debit cards will take market share from existing EMI cards and credit cards, because using a debit card is much more convenient and there are no hassles of remembering the monthly bill payment date – the EMI is deducted from the savings account directly.

Abhishek, who is working with a bank, recently bought a LG washing machine on his debit card from a multi-brand outlet. He had two options – his HDFC Bank Debit Card or HDFC Bank Credit Card. He chose his debit card. He said, “Cost will remain the same in both modes of payment, but the debit card is much more convenient. I don’t need to worry about monthly bills as I keep a minimum balance of Rs 25-30,000 in my savings account. In credit card there is a risk of huge late payment fees and interest charges if I forget to pay the monthly bill on time.”

Pine Labs POS offer EMI scheme activation at the merchant outlet; a service earlier not available

• Pine Labs offers a single point of contact for activation of EMIs across multiple issuers, subvention collection, and settlement.

• It offers no-cost convenient EMIs, cashback offers, and discounts directly at the point of sale.

• Has a tie up with 19 card issuers with 40mn+ customers.

• Also, it offers first-of-its-kind EMIs on debit cards.

Subscribe to enjoy uninterrupted access