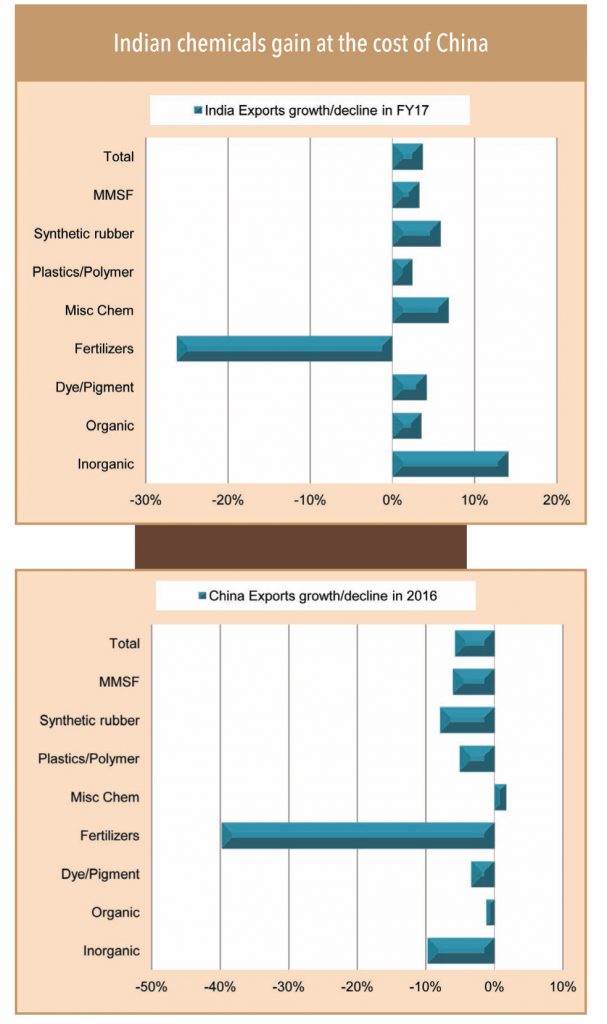

While changing national priorities towards environment safety have constrained the growth/outlook of China’s chemicals industry, it adds to the sheen of the Indian chemicals industry that has historically been driven by domestic consumption. India’s strategic positioning as the best alternate source/manufacturing hub for chemicals in the world is propelled by the following: (1) India is showing the fastest economic growth in the world, (2) it is the second-largest consumer market after China, (3) it has a large young and educated work force, (4) it has low-cost advantages, (5) it has a supportive policy environment, and (6) its quality of infrastructure is improving. This trend is visible in Indian chemicals’ export growth (excluding pharma) of +4% to US$ 31bn in FY17 (while China’s was -6%).

A similar trend is visible across all key broad categories of chemicals, except for agrochemicals in which both India and China saw sharp declines in exports due to a weak demand situation. Indian export of inorganic chemicals grew 14% yoy in FY17 (vs. a 10% decline by China) followed by 8% growth in synthetic rubber (vs. an 8% fall by China), and 4% rise in dyes and pigments (vs. 3% fall by China).

FY17 (after China’s environment policy implementation) was the first year to show such a diverse exports growth trend between India and China, which showcases the Indian chemicals gain at the cost of China scenario of Indian chemicals’ gain at the cost of China’s policy-bound loss. The Indian chemicals industry is receiving a much larger and longer window of export opportunity given the recent known aggression of Chinese policy makers towards environment protection, a recent finding of non-compliance by over 50% of chemicals manufacturers in China, and stricter Chinese government directives for shutting polluting industries or relocating them to a distant industrial belt (this is mandatory over next five years).

GV visited China recently and met SOEs (State-Owned Enterprise), MNCs, local private manufacturers, and chemicals distributors (local as well as global) – and they all pointed at the priority that the chemicals segments receive in China.

Dr Kai, a chemicals expert based in China, said, “Driven by its largest import demand of semiconductors, integrated circuits, and printed circuit boards (worth about US$ 250bn, i.e., 15% of China’s import and the leading import category), electronic chemicals is a top priority segment for China. Similarly, going by the electric vehicle revolution in China and other parts of the world, relevant specialty chemicals, such as lithium ion, would be an area of focus”. He also believes that fluorochemicals (mainly for agro and pharma applications) and organosillicon compounds (largely used in manufacturing construction chemicals such as sealants, caulks, adhesives, coatings, etc.) are considered important segments for the Chinese industry.

Dr HU, an ex-professor of chemicals in Zhejiang University and current founder of Zheda Panaco Chemical Company, said, “Agrochemicals is not a focus area for the Chinese government, as it expects to reduce the application of agrochemicals in the country and it does not find much scope of value addition in the segment. Agrochemicals is a high-volume segment with high water effluent and less profit”.

Mr Hongjun Li, GM – International Trade, Xingfa Chemical Group (one of the leading manufacturers of glyphosate in the world) said, “China manufactured about 80% of the world’s technical-grade agrochemicals production, but the changing priority of the country towards environment safety and policy restrictions have, of late, curtailed the scale of agrochemicals production in the country. Going ahead, China’s focus will remain around complex/value-added technical-grade products as well as seeds, but the low-end generic agrochemicals and fertilisers will see a sequential downturn.

On fluorochemicals, Dr Hu believes that abundant cheap input material is China’s key strength, and application of flurochemicals in agrochemicals remains a growth factor, rather than pharmaceutical application. He believes that the dye and dye intermediates segment is a mature one with high pollution and less profitability; hence, it is an ignored space for China.

Mr Jan Kriebaum had similar thoughts about the dyes industry, but said that pigments (in the colour segment) are likely to see consolidation, resulting in the emergence of stronger and larger players. MNCs can benefit. He believes leather chemicals and packaging materials are non-preferred segments in China due to their pollution potential.

Mr Lex Huang, GM, Zhejiang Chemicals Import & Export Corporation, a state-owned enterprise, said, “Agrochemicals is going through a phase of consolidation, with larger players growing and smaller being eliminated. The dye-stuff segment is seeing very tight supply and a high price situation due to the shutdown of many manufacturing plants. On the other hand, pigments are still believed to be an important area in China, and companies in this segment are upgrading themselves to cope up with the environment policy requirements.” He highlighted that more fluoro-compounds are seeing increased application rather than chloro or bromo compounds, indicating better growth visibility for fluorochemicals.

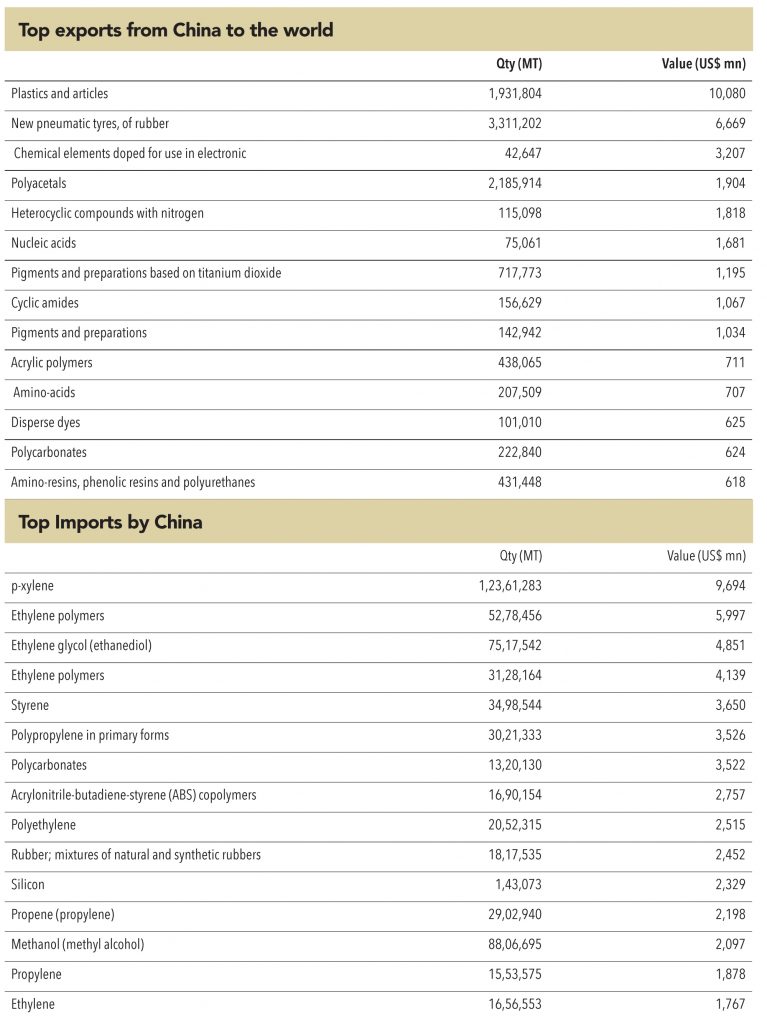

Since China is the leading global market/manufacturer for chemicals, its priority chemicals areas can be taken as future growth areas for any chemicals manufacturer globally, including Indian manufacturers. However, in such segments, China can pose tough competition for others. On the other hand, the segments that China ignores could prove to be areas of opportunity for India, given that China’s manufacturing is in the middle of ‘rationalisation’.

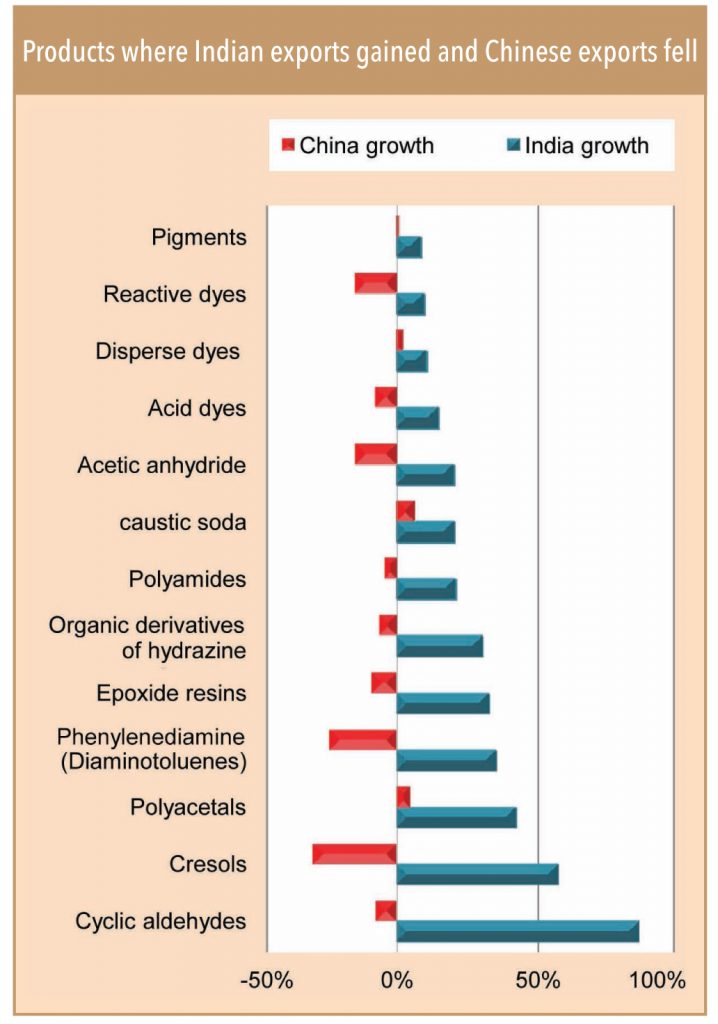

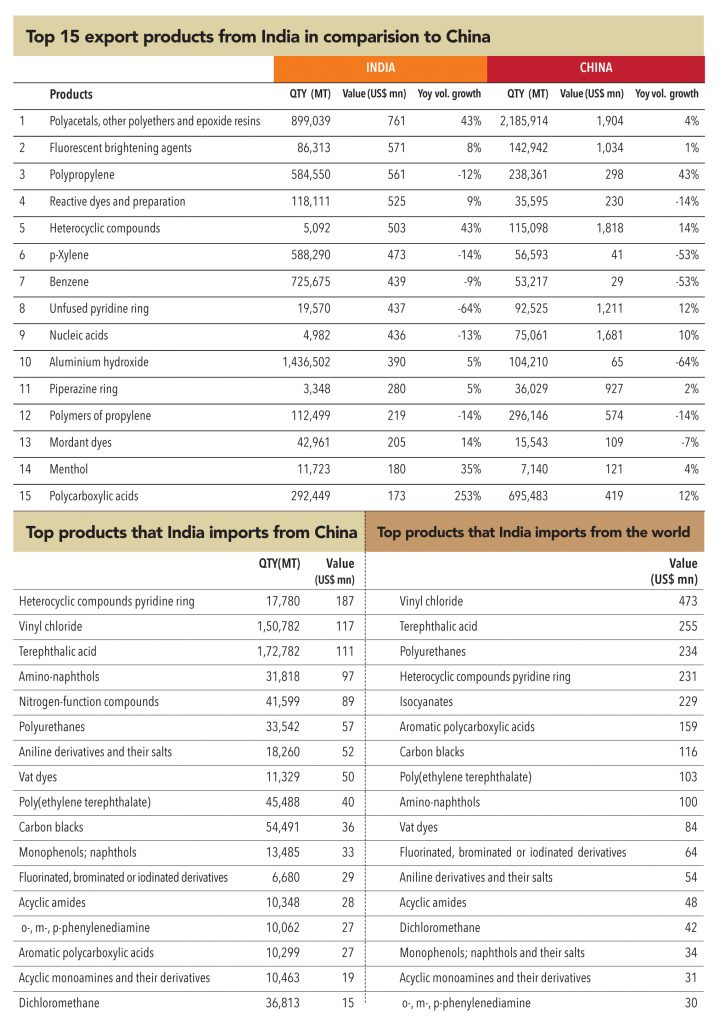

Although weakening Chinese chemicals exports (after the implementation of its stricter environmental policy in January 2015) offers a huge exports opportunity for India, chemicals exports by both India and China saw a decline in 2015, primarily due to the sharp correction in crude prices. However, in 2016, Indian chemicals exports gained while China continued falling. Hence, a critical analysis of Indian top-50 chemicals export products in comparison with Chinese exports provides a better insight about the future growth areas for the Indian chemicals industry.

Products where Indian exports gained in 2016 (with falling Chinese exports) include: Polyacetals, polyethylene terephthalate, phenylenediamine, polyamides, reactive dyes, and pigments.

Amongst these, polyacetals (one of the leading export products, an engineering plastic) has seen a robust growth of 47%/28% volume/value in 2016 and the growth momentum continued in 2017. Chinese exports of polyacetals have seen moderate volume growth of 4%, but there was a 7% decline in value terms in 2016. Key players such as DSM Engineering Plastics, BASF India, Bhansali Engineering Polymers, and Gujarat Flurochemicals will benefit from a Chinese slowdown soon. Players such as Atul should benefit from a conducive trend in cresol and epoxy, but vat dyes might see tough competition.

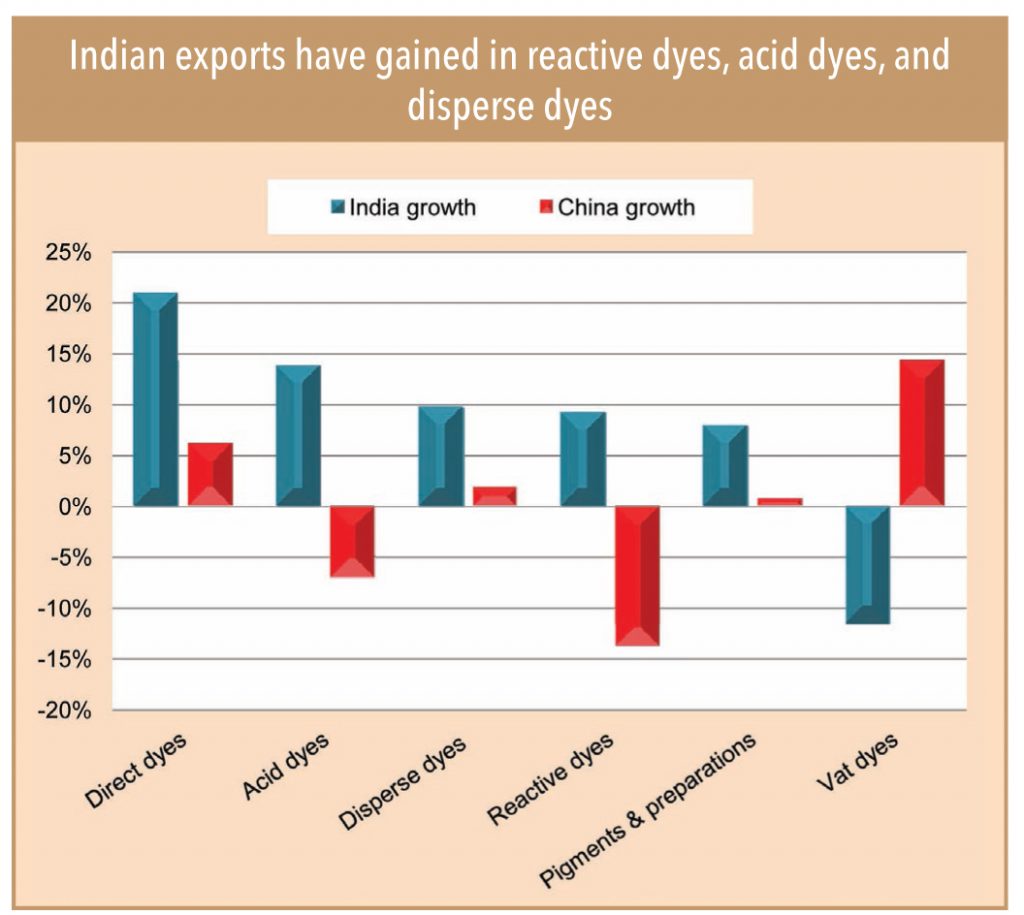

Within colours, India has broadly been holding a strong position in the global market, along with China. Last year, Indian exports in reactive dyes, acid dyes, and disperse dyes gained, as Chinese pollution restrictions took a heavy toll on these segments; this trend is likely to continue. On the other hand, in pigments, while India gained vs. China, the Chinese industry is going through a consolidation and upgradation phase (as it looks at the scope of value addition). However, both India and China will have a leadership position in pigments.

Key Indian players in dyes: Bodal Chemicals, Kiri Industries, Shree Pushkar, Akshar Chem

Key Indian players in pigments: Sudarshan Chemicals, Clariant, Poddar Pigment

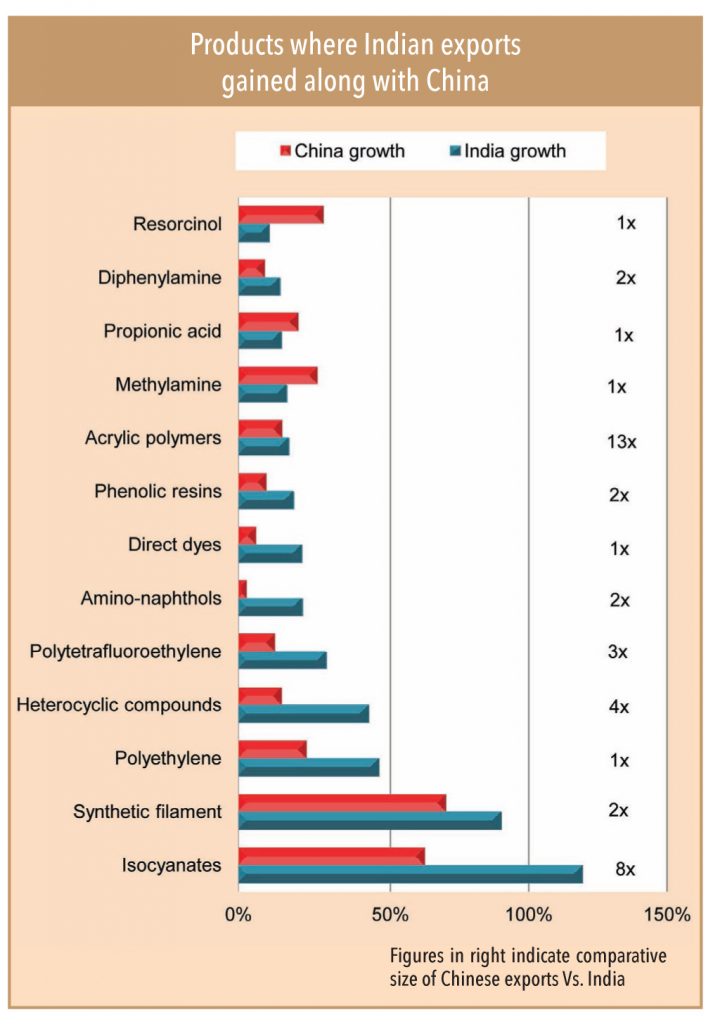

Products where Indian exports gained along with China, but where China has significant scale In some chemicals, both India and China gained in terms of global trade last year. These include acrylic polymers, isocyanates, heterocyclic compounds, polytetrafluoroethylene, amino-naphthols, and phenolic resins. In these product categories, China currently operates at a much larger scale than India. Rationalisation in such product areas (due to pollution control by China) could prove to be a key growth opportunity for Indian players.

Import substitution can be a long-term value growth driver

Like exports opportunity, the import substitution theme has always been a key criterion for any new project in the Indian chemicals industry. Few ‘import-substitution’ based projects by Indian peers include – the recent mega phenol project by Deepak Nitrite, few benzene derivatives and a recent diversification project into nitrotoluene by Aarti Industries, and the butyle phenol and upcoming para amino phenol (PAP) project by Vinati Organics.

Ms Vinati Saraf Mutreja, Executive Director, Vinati Organics, had similar thoughts on its upcoming para amino phenol (PAP) project. She explained, “India’s heavy dependency on Chinese imported PAP was certainly a criteria for us to invest about Rs 5.50bn in this project, and we were even confident on the superior/cost-effective, clean and green, and sustainable process that we developed, compared to Chinese peers. Now, the structural upward shift in operating costs are there due to factors like mandatory effluent treatment, spike in employee cost, and multi-fold energy cost, which definitely provide an additional natural support for our upcoming largest project in PAP”.

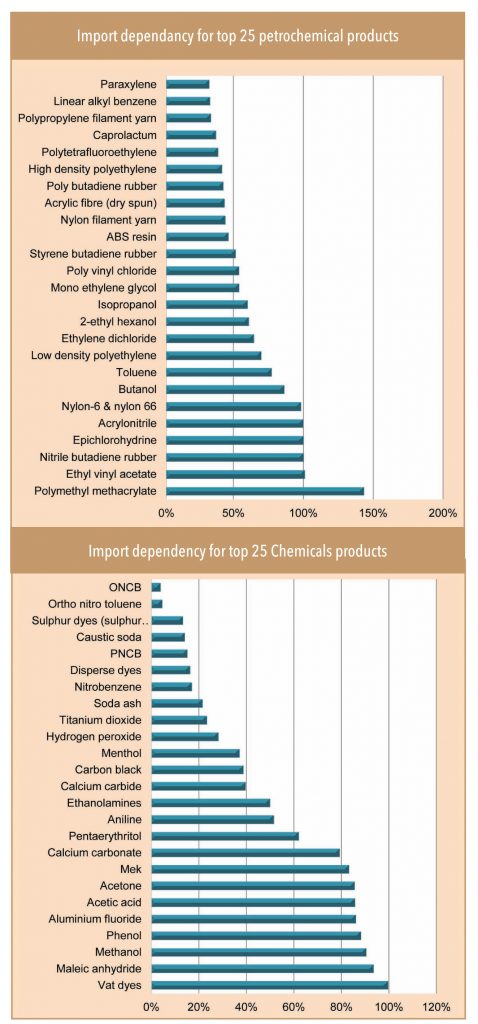

While India has a surplus trade in specialty chemicals, which has grown in double digits over the last few years, the country is still dependent largely on imports of various chemicals such as vat dyes, aniline, nitrobenzene, phenol, acetone, toluene derivatives, carbon black, and caustic soda. Amongst these, India is dependent on China mainly for vat dyes, aniline, and carbon black.

In addition, India has always been a net importer of petrochemicals to meet its feed stock requirement. With the rising exports of specialty chemicals, the import dependency has consistently increased over the years. The main import-dependent products include – polymethyl methacrylate, ethyl vinyl acetate, butadiene rubber, acrylonitrile, and poly vinyl chloride (PVC). Amongst petrochemicals, PVC seems the only Chinadependent product; otherwise, the non- China import is high in petrochemicals.

Subscribe to enjoy uninterrupted access