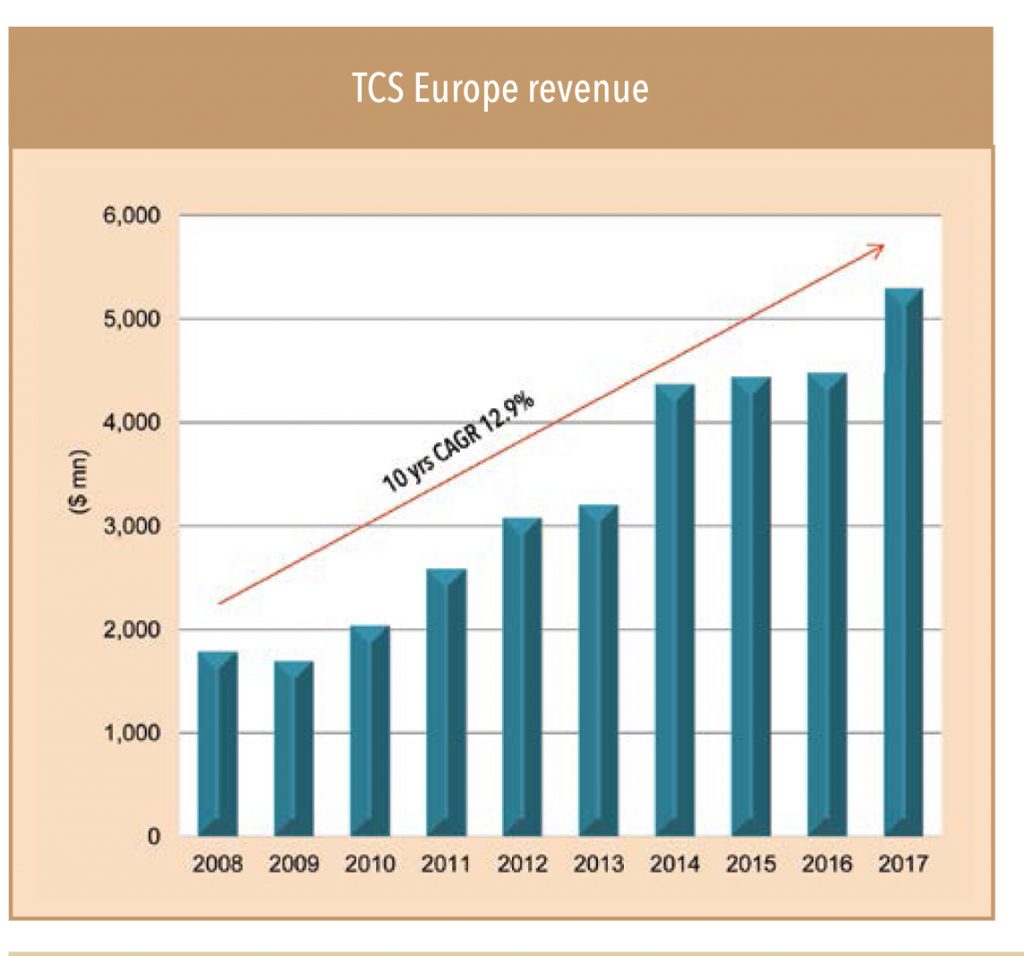

TCS has had a remarkable run in Europe over the last decade. From US$ 1.5bn in revenue from the region in 2008, the company now generates over US$ 5bn. Over the last few years, the company has not only cemented its place as a leader in the region, but has also established a reputation of being a highly professional and customer friendly vendor – ready to help the client in whatever manner it can. Its capabilities in the region are considered at par with Accenture and other global vendors, and most clients are either working with or want to work with TCS as their vendor.

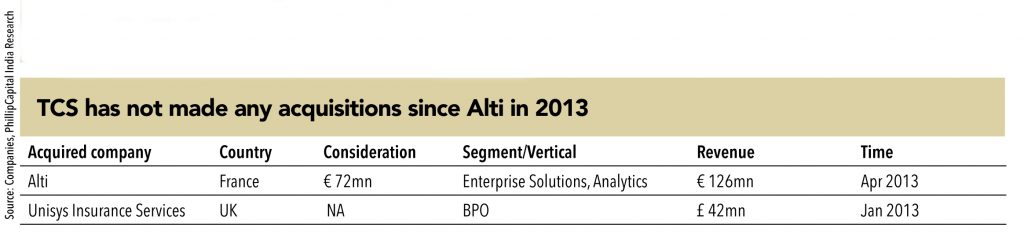

TCS started its European business with operations in the UK by initially securing government contracts. It then gradually expanded to private clients. Its strong capabilities in the BFSI space helped it spread its footprint into Switzerland and Scandinavia, and its manufacturing prowess helped it in France and Germany. Notably, TCS expanded its operations in Europe almost completely organically – making just one small acquisitions (Alti, France, 2013, € 126mn revenues) along the way.

A very interesting detail that surfaced from interactions with various clients in the European region was how TCS had ‘graduated’ from a low-cost offshore vendor to one perceived as being able to be a ‘strategic partner’. A decade ago, most clients would classify IBM and Accenture as tier-1 vendors and TCS/Infosys/Wipro/Capgemini at tier-2. Today, almost ALL clients put TCS and Accenture at par as tier-1, which is a remarkable elevation in TCS’ perception.

Every single client lauded TCS for its professionalism and customer connect, and the manner in which it is always ready to travel that extra mile to help its clients. Conversely, the perception about Accenture and IBM is that they ‘walk with their MSAs in their back pocket’, jumping to charge clients for anything outside the MSA’s scope. Infosys/Capgemini and other European vendors remain distant third choices for almost all clients for outsourcing.

Going forward, TCS is likely to further strengthen its position in the European region based on its all-round capabilities, digital prowess, and superior customer perception. Some of the large deals that it recently won (Marks & Spencer, Lloyd, Prudential) are testimony to its growing influence in the region.

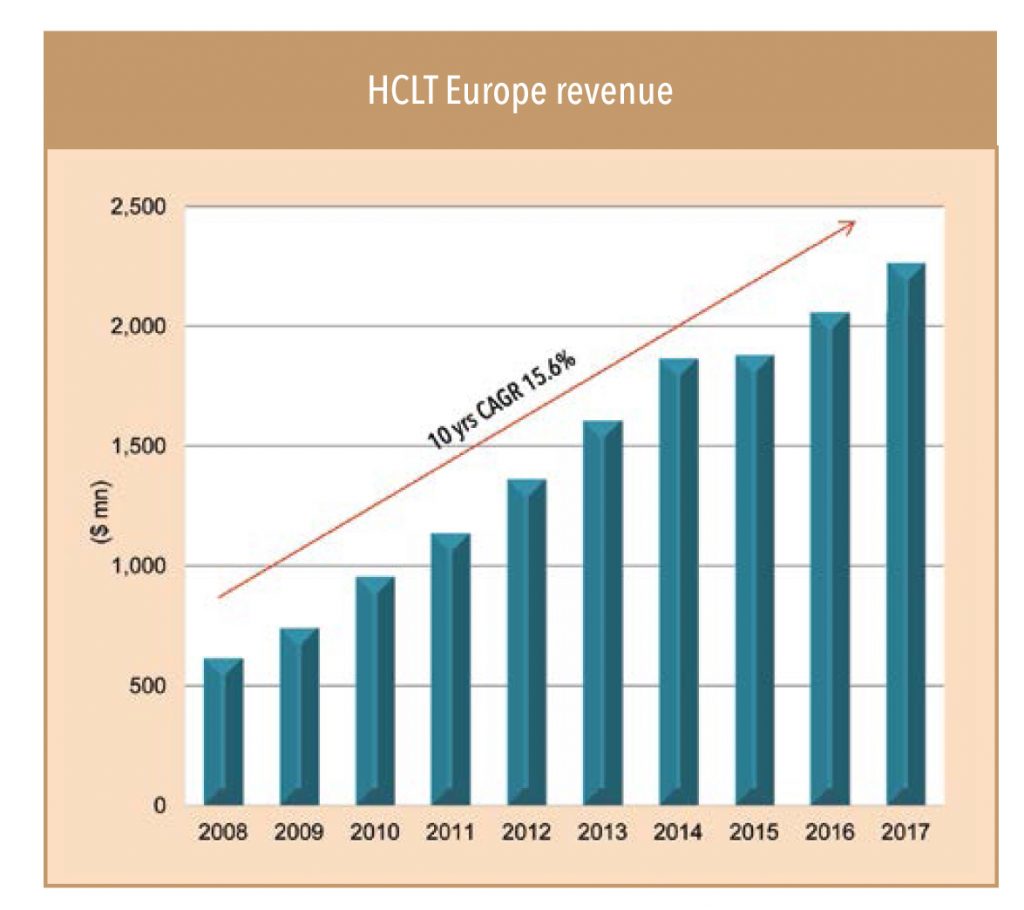

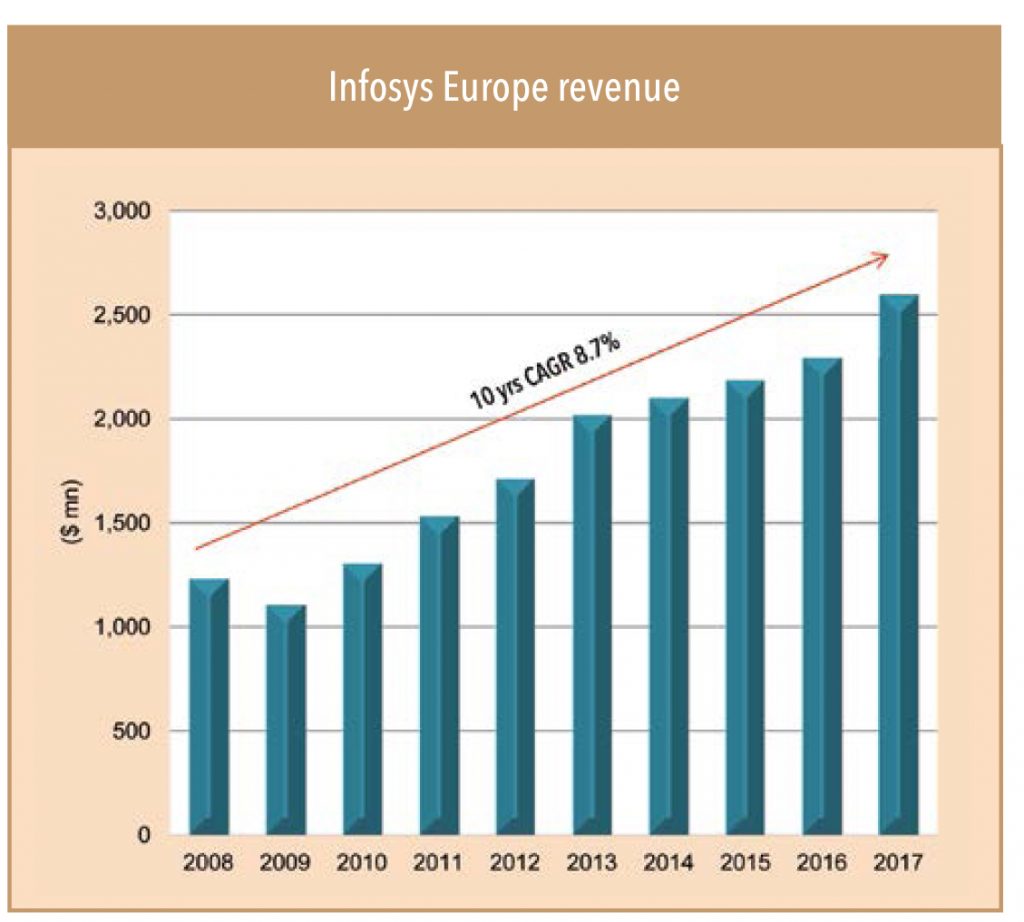

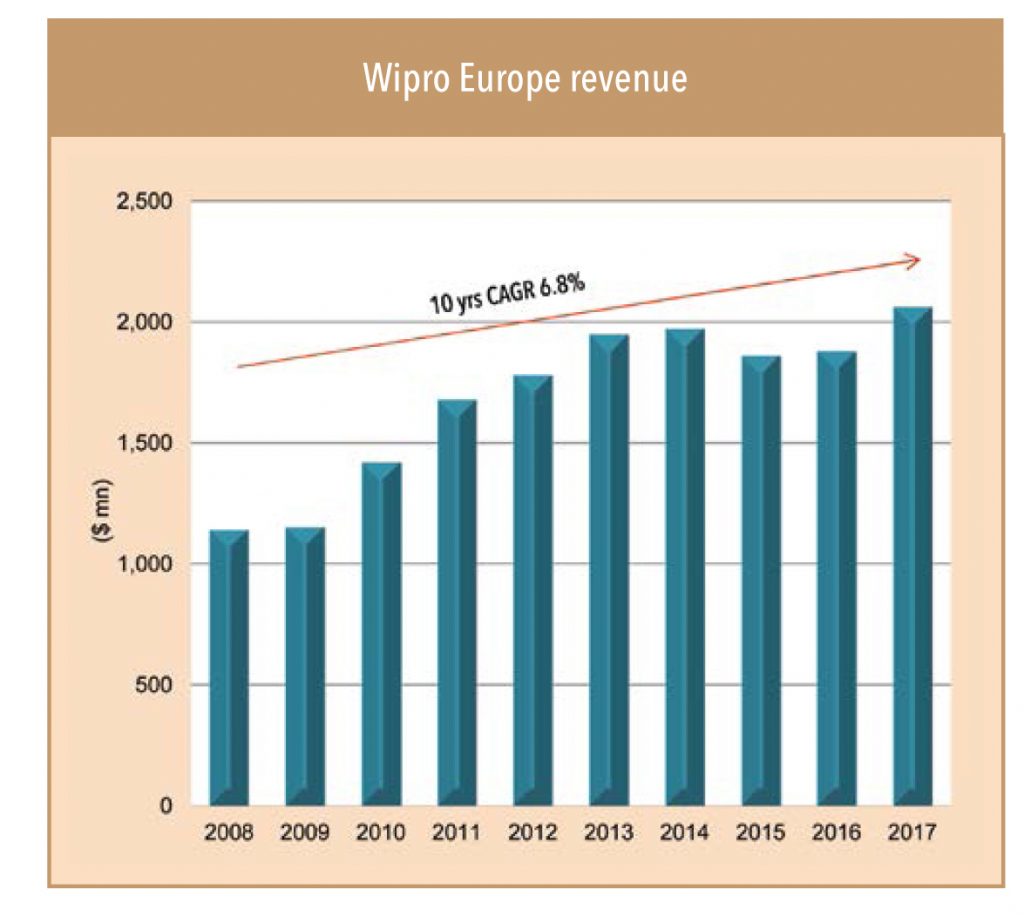

HCL Tech in Europe, surprisingly, has exceeded everybody’s expectations and performed much better than ALL other Indian peers (including TCS). Over the last decade, its revenues from Europe have quadrupled from € 600mn to € 2.3bn – a CAGR of 15.6%. In comparison, TCS’ CAGR was 13%, while Infosys/Wipro clocked 8.7%/6.8%. All along, it captured market share from local European vendors such as Capgemini and Atos, and global behemoths such as IBM.

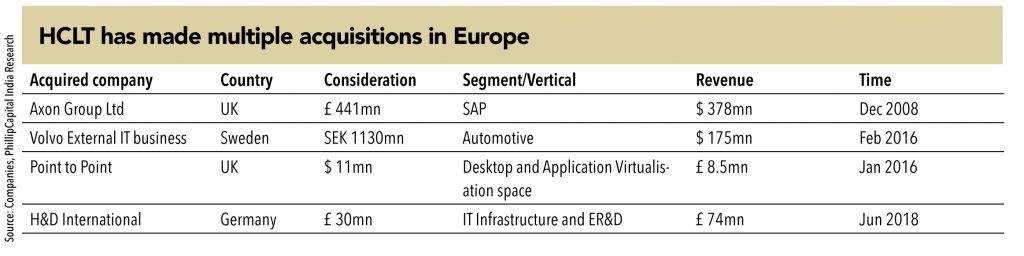

HCLT’s growth in Europe was driven by its expertise in IMS. The company cleverly used this relatively ‘low-end’ offering to get a foot in the door with the ‘reluctant to outsource’ clients in this region. Just like TCS, it first established its presence in the UK, and then expanded into Scandinavia and other European countries.

A key reason for HCLT’s strong growth in Europe (and US) over the last decade was its capture of market share in the IMS business, especially from IBM. A large number of IMS contracts came up for renewal between 2005 and 2015 across Europe. Most clients were not satisfied with the services provided by the incumbent (especially IBM); they thought they were being charged excessively for a relatively low-end job. While reluctant to the idea of outsourcing, European companies were relatively comfortable testing waters with outsourcing this ‘low-end low-risk’ work of infrastructure management. HCLT grabbed the opportunity with both hands, and expanded its clientele through this route. Upselling ADM and other outsourcing services still remained a mountain too steep for it to climb.

However, going forward, HCLT appears to be in a slightly precarious situation in Europe. Its expansion, driven by its IMS prowess, is now under threat with cloud services providing an even cheaper and more efficient alternative to IMS contracts. Moreover, since it was never able to establish any formidable presence in the ADM or enterprise application space, the future looks uncertain for the company. While it continues to do well in the ERD space, and is currently the third largest ERD vendor in the world (behind European counterparts Altran and Alten), its ERD expertise is unlikely to help it to salvage or expand its standing in the regular outsourcing domains of ADM/Enterprise/IMS.

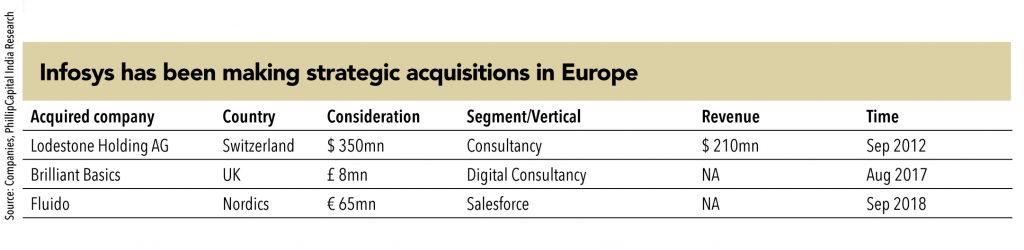

Infosys, too, has had a commendable run in Europe over the last decade. From less than US$ 1.2bn revenue from the region in 2008, the company now generates US$ 2.6bn from the region – a CAGR of 8.7%, second only to TCS and HCLT in the region. It has been able to successfully leverage the brand equity it created from starting as almost a garage enterprise by four engineers to its current form as a professional multi-billion-dollar multi-national company.

Infosys established its presence in the European region based on its success with US-based clients. Its first few clients in the EU were primarily multinational companies with English speaking management. It built up from there, entering UK, Switzerland, Germany, and Scandinavian countries. It has been particularly successful in manufacturing and retail segments, delivering enterprise application and ADM solutions.

However, interactions with multiple clients showed serious concerns among existing and potential clients about the stability of Infosys’ management. Over the last four years, the top management has witnessed high level of instability – with the company getting its fourth CEO in four years. Over this period, it has lost scores of senior management people and its attrition level remains alarmingly high at 22%. Most companies seemed impressed with what Infosys has achieved in Europe, and its delivery capabilities, but remain concerned about the top-management’s stability and fear that this would negatively affect delivery.

Also, while most investors/analysts tend to compare Infosys with TCS, putting them on similar terms, we noticed that NONE of the clients reciprocate this feeling. ALL clients preferred TCS (along with Accenture) while Infosys came in a distant second (or third, in some cases). In early 2000s, Infosys appeared to be within catching distance of TCS, with the gap between the two – both in terms of size and perception – continuously narrowing. However, the turmoil of the last half decade has widened the gap, perhaps more than it ever was.

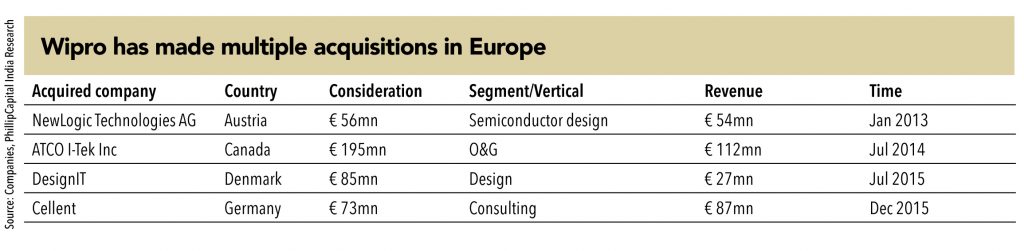

Wipro has had a phenomenal run in Europe over the last decade, although on a smaller base, even after accounting for its lacklustre performance in the last five years. From US$ 1bn revenue from the region in 2008, the company now generates US$ 2bn – a CAGR of 6.8%. However, over the last five years, it has struggled, clocking a CAGR of only 3.2%, which is in line with its toil in other geographies.

Wipro followed a rather unconventional route for its Europe expansion – the inorganic one. Through 2008-17, the company acquired three companies in the region – an offshoot of the ‘string of pearls’ strategy. This strategy helped the company break the language and cultural barriers in Germany and Scandinavian countries.

However, in terms of capabilities, most clients consider Wipro relatively behind other Indian and local European vendors. Multiple clients currently working with Wipro were not satisfied with the level of delivery and capabilities. Those not currently working with Wipro did not show any proclivity towards working with it.

Most clients pointed to Wipro’s overall relatively weaker delivery capabilities. However, its capabilities in the ERD space were considered to be at par with the best, and in this domain, clients remained quite content with its performance.

Going forward, Wipro might struggle to maintain its growth momentum in Europe. Its perception – about having weak delivery capabilities – is likely to inhibit its growth, aiding other vendors to grab larger market share. Even its recent acquisition of Celent hasn’t played out well for the company due to integration issues.

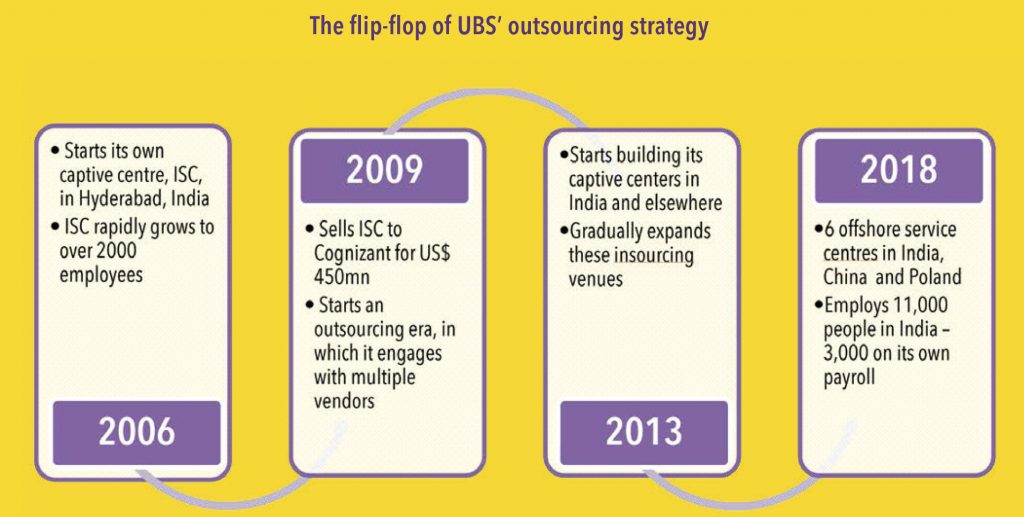

UBS remains a key BFSI client for almost all IT vendors across the world. It has been, by far, one of the largest and most diversified clients for the outsourcing industry. It has had a long and interesting history of outsourcing.

• UBS started its own captive, ISC (Indian Service Centre), in Hyderabad in 2006 – which rapidly grew to 2000 employees, providing services which were not yet commercially available in the market then.

• Later, as a shift in strategy to “BUY” rather than “BUILD” it sold the ISC to Cognizant in 2009, for US$ 450mn.

• The sale marked the start of the next stage in the development of the UBS offshoring and outsourcing strategy – where it engaged it various vendors across the world.

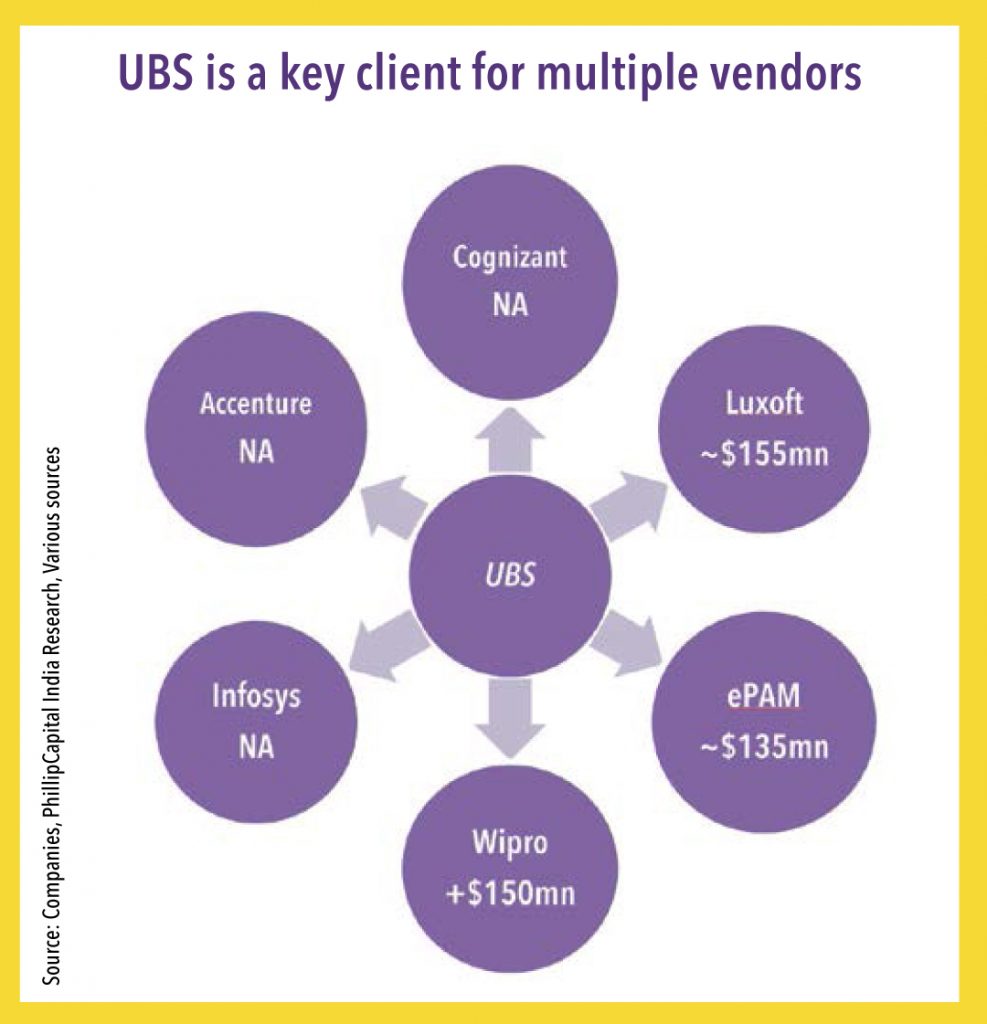

• Today, UBS, has multiple IT outsourcing vendors on its rolls – Accenture, Cognizant, Infosys, Wipro, HCL Tech, Luxoft and ePAM.

• In 2013, it quietly began building up its own capacity in India and elsewhere. Today, 11,000 people work for UBS in India – with 8,000 employed through external providers, and 3000 on its own payrolls.

Current scenario

UBS remains a key account for many vendors. For Wipro and Luxoft, it is one of their top clients – while it contributes a substantial share of revenues for Cognizant and ePAM. Accenture and Infosys too, derive decent share of their BFSI revenues from UBS.

• Luxoft: UBS contributes ~18% of revenues for Luxoft – though the revenue has been coming down over the past 10 quarters, as a result of UBS focussing on more insourcing.

• ePAM: UBS contributes ~10% of revenues for ePAM, which has declined from over 13% in 2016. Last year, UBS extended a $300mn contract with ePAM.

• Wipro: UBS contributes less than 3% of revenues for Wipro, and is one of its top accounts. It has been largely stable (with slight growth) over the last 10 quarters.

Insourcing – an opportunity and a threat

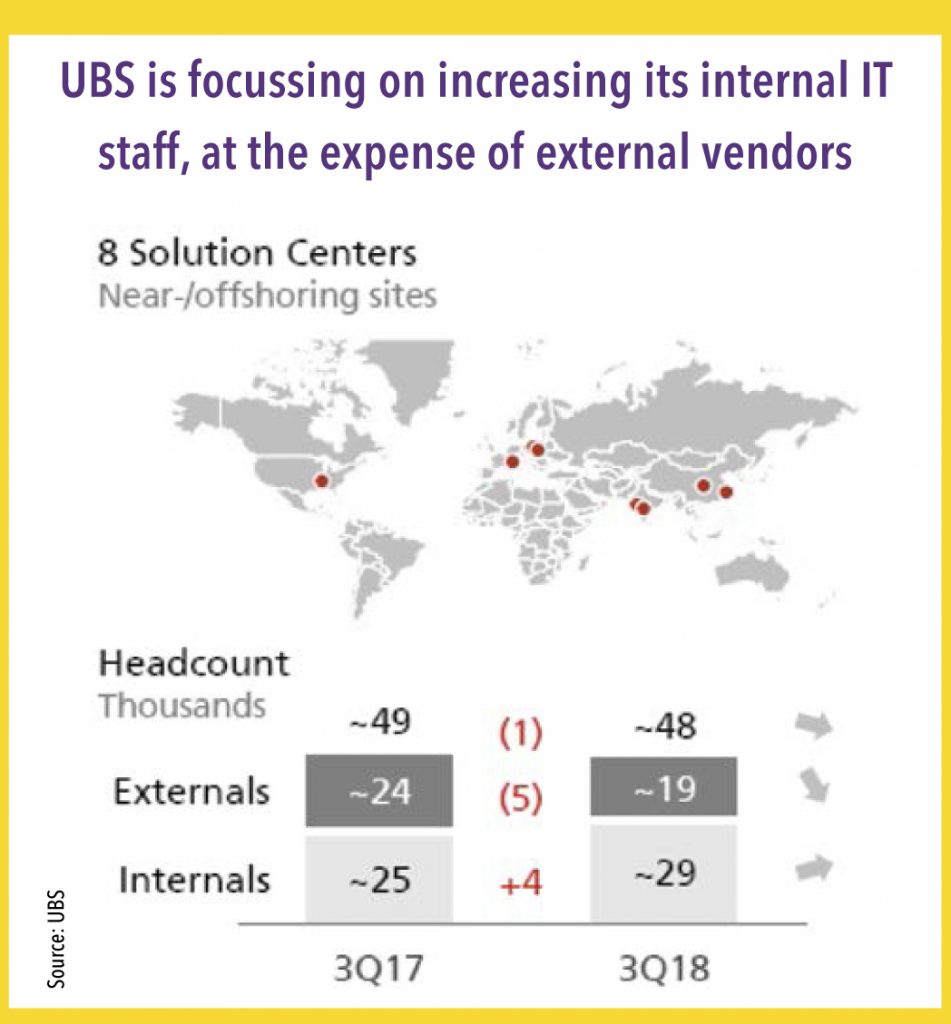

In October 2018, UBS reported a 7% jump in its staff count to 63,684 people, from 59,470 a year ago. This was a results of it expanding its captive centres in Mumbai/Pune, which UBS wants to use as global insourcing hubs.

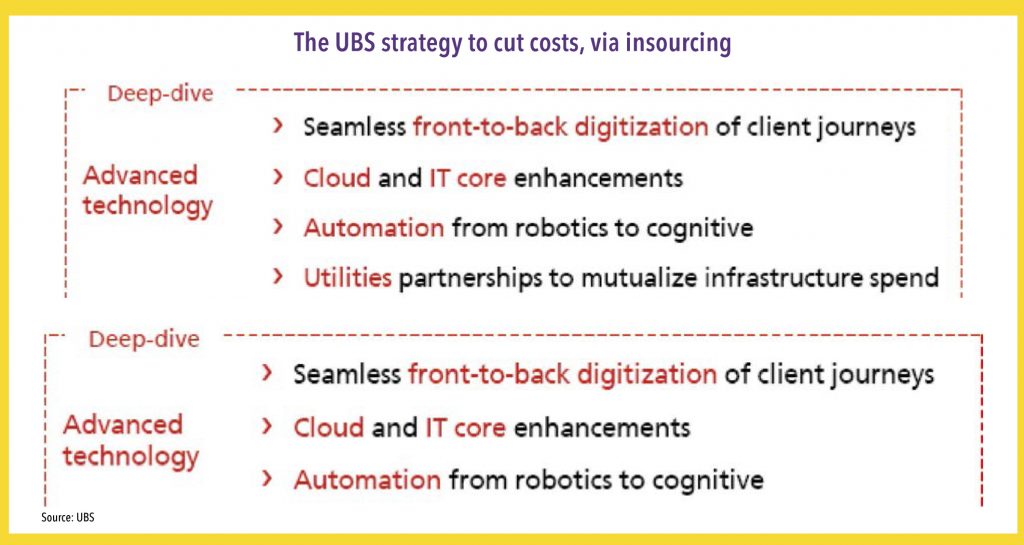

UBS aims to keep 60% of its IT services in-house – as compared to almost 70% currently outsourced to third-party vendors. The company has witnessed this U-turn in its outsourcing strategy, on two counts:

• Expanding its captive centers is one of its largest levers for cost reduction – a strategic pillar of its corporate transformation plan.

• The management believes that the typical business processes outsourced ten years ago like data inputting can be digitized or automated. With the speed of digitization picking up, classic IT services providers (like Wipro, Cognizant etc) are struggling to keep up with this speed.

For UBS, at €8.9bn, the ‘Corporate Center–Services’ make up roughly one third of its overall Group costs. Over the next three years, the management aims to reduce these costs by€800mn – as stated in their Oct-18 call with investors. Key points about their outsourcing strategy over the next three years:

• Today, more than 30% of UBS’s staff is offshored. And it intends to continue to shift further activities from high-cost to low-cost locations, using its own offshore and nearshore shared services centers.

• With the opening of a second site in Pune this year, it now operates 6 offshore service centers in India, China and Poland; and 2 nearshore centers in Switzerland and the US.

• For its outsourced services, it continues to consolidate third party vendor locations from 35 as of last year to only 9 by 2020. This will both reduce costs and will improve risk management.

• It is internalizing selected activities currently performed by external providers to enable higher productivity, lower costs, and to build critical in-house knowledge. Over the last 12 months it has increased internal staff by 4,000. The majority were hired into its offshore centers in India. This increase was more than offset by a reduction in external headcount, leading to an overall decline of roughly 1,000.

• It intends to further reduce the external headcount, through automation of processes – specifically in Operations and IT.

• It has reduced vendors by 45% since 2013 and aims to push this above 50% over the next two years. In addition, it has recently implemented new measures to further tighten its interna demand management. “To say it in very simple terms: We will buy less, cheaper and smarter.”

• Automation is expected to be a key driver for cost efficiency. It already has 700 robots in production, and intends to increase it to ~1,000 by year-end.

While UBS insourcing strategy intends to cuts vendor revenues, it represents a strategic bet on India. The company and its management realize India’s tactical significance, with the huge pool of engineers, mathematicians, statisticians, physicists, and other highly-qualified science and technology graduates. As a result, India’s importance as a delivery / innovation center, for UBS, is definitely increasing.

Indian vendors need to move up the value curve here, and try to capture the revenue pie, currently taken-up by Luxoft (US$ 155mn) and ePAM (US$ 135mn) – both of them being higher priced than Indian vendors.

However, if other banks start copying UBS’s strategy, it can be a threat to Indian IT services vendors. Bulk of the IT business will move into captives – the remaining (higher value work) will shift to vendors with capability to deliver this higher value work.

Subscribe to enjoy uninterrupted access