Ground View undertook case studies across three segments of the defence industry – defence PSU, private sector, and MNC.

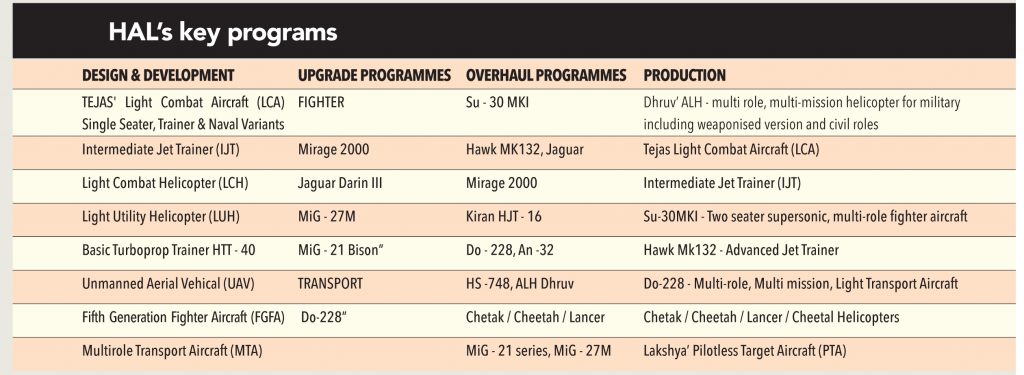

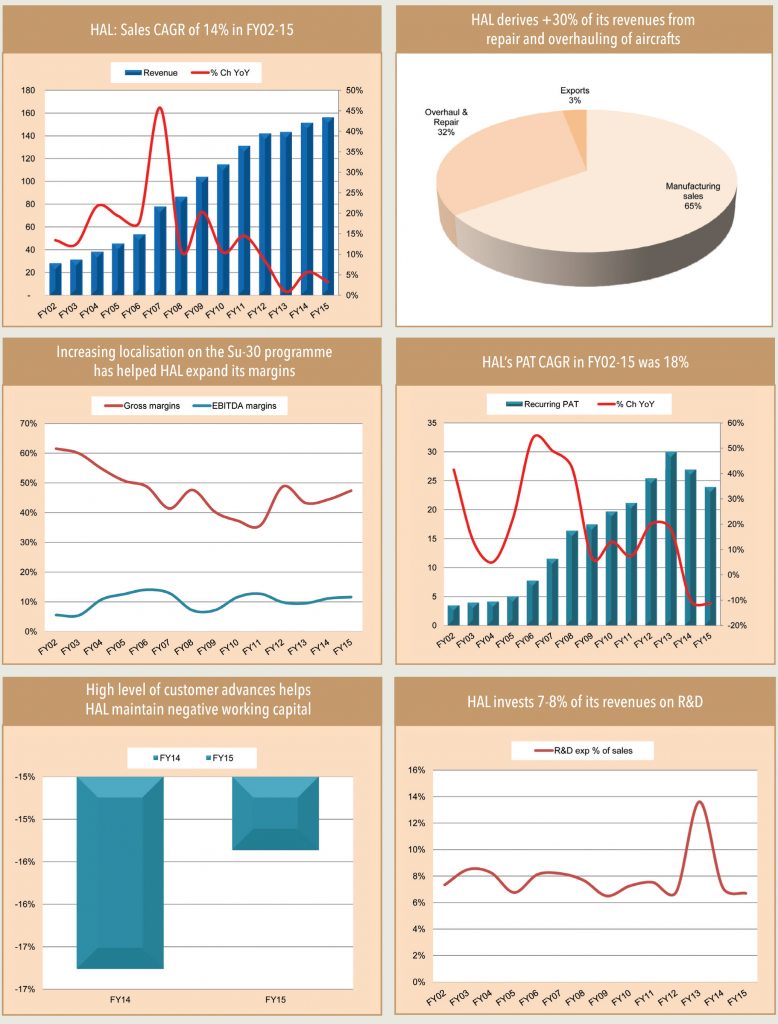

1.Defence PSUs – Hindustan Aeronautics (HAL): HAL will be a beneficiary of the government’s focus to manufacture complex aircrafts indigenously. Over the past 15 years, HAL has developed outsourcing capabilities, allowing it to migrate from a mere assembler of aircrafts to a co-developer, and now a prime OEM.

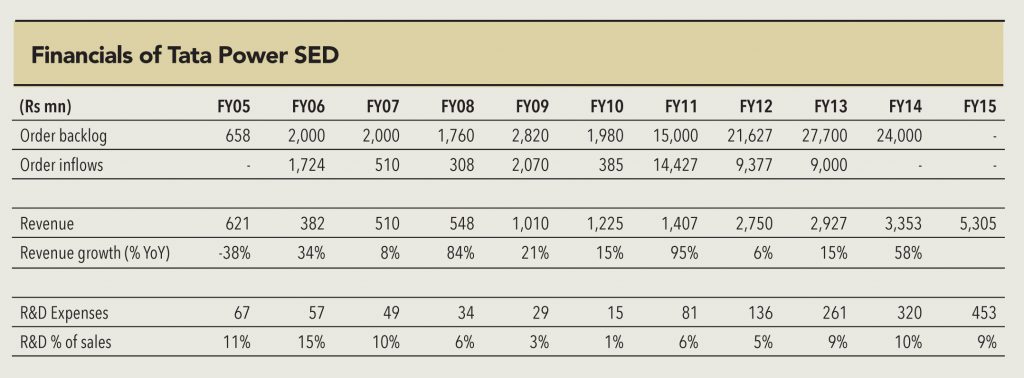

2.Private sector – Tata Power SED: Tata Power‘s four-decade-old Strategic Electronics Division is a leading sub-system supplier to the Indian armed forces. However, over the next five years, this division should transform into a system integrator with marquee projects such as howitzer guns and control and communication projects such as Tactical Communication System and Battlefield Management System.

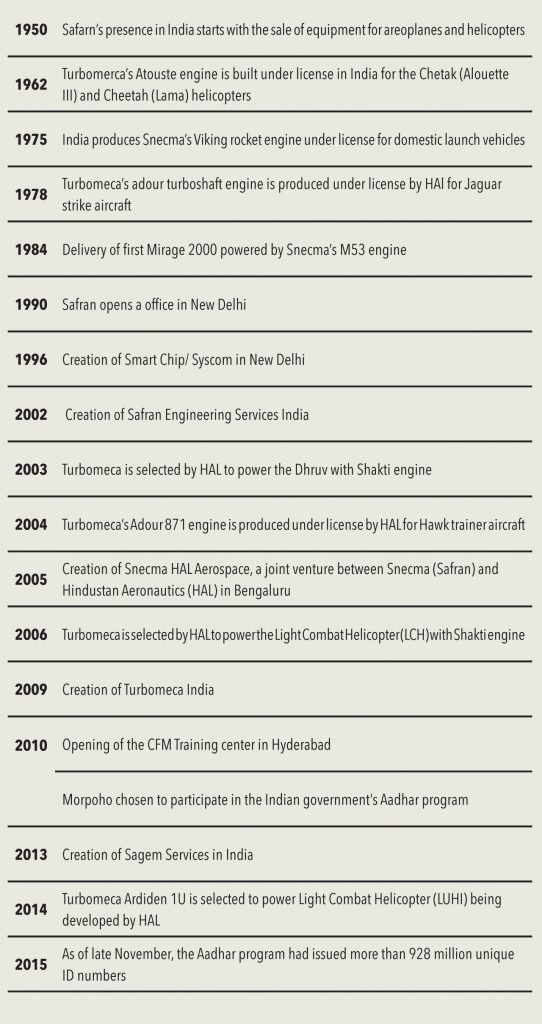

3.MNC – Safran India: Safran (France) has been present in India for more than 60 years. In the 1950s, it started off by selling equipment for airplanes and helicopters, followed by major sub-components for Jaguar and Mirage aircrafts in 1970-1980. In 2004, engines for the Hawk Trainer were manufactured by HAL under license; similarly, in 2006, Safran Helicopter Engines (a subsidiary of Safran), was selected to co-develop and co-manufacture engines for HAL’s Advanced Light Helicopter (ALH). Safran will be a key beneficiary of future fighter aircraft and helicopter programmes adopted by India – such as Rafale and Kamov 226.

Ground View met with the management of the company and visited its aircraft-manufacturing complex in Nasik, not only to understand HAL’s journey, but also its future strategies in a policy environment that is skewed towards the private sector.

What does it do?

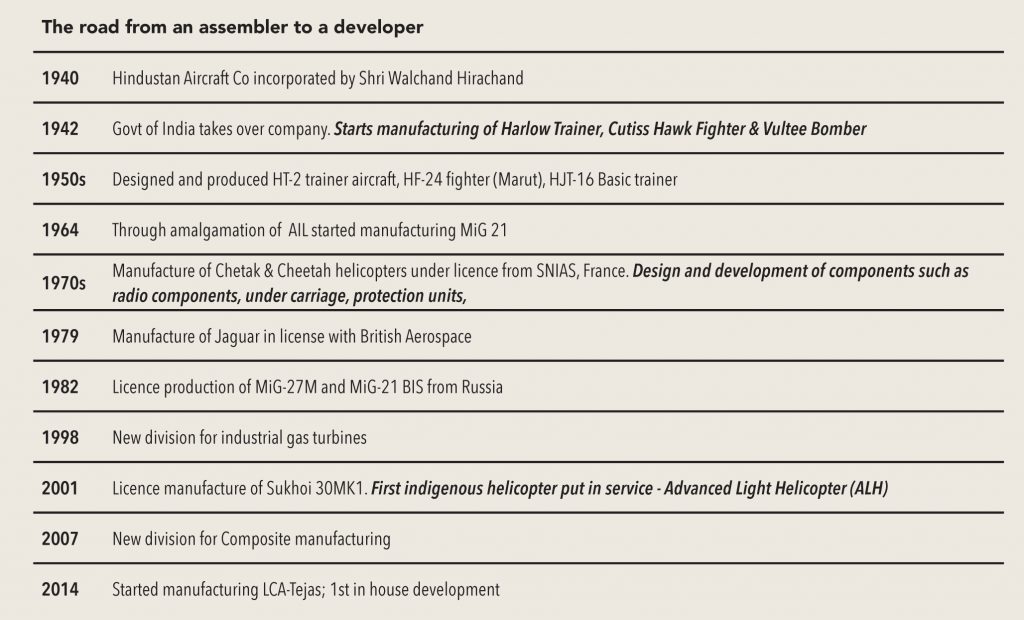

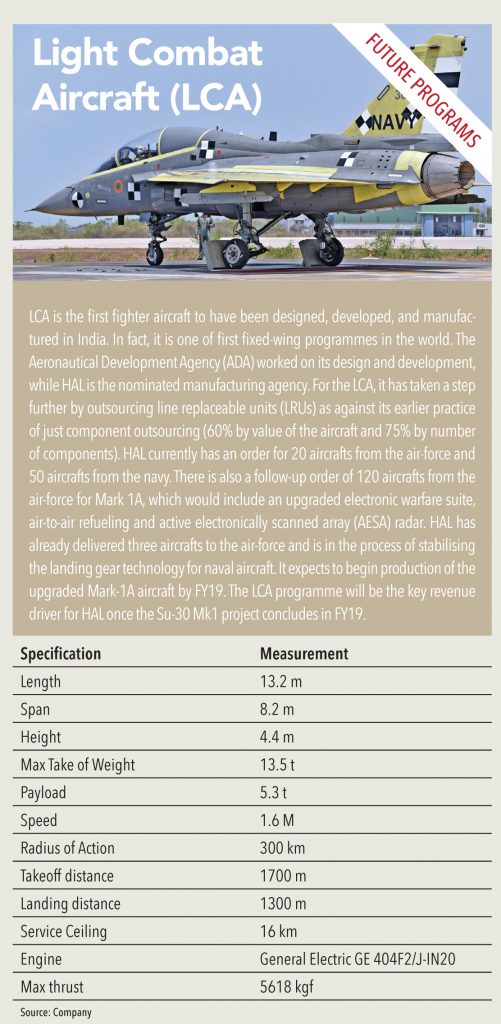

HAL is India’s premier government-owned defence aircraft manufacturer. Over 75 years, it graduated from being an assembler of aircrafts (in 1940s with Harlow PC 5A), to a joint developer (in 2000 with Sukhoi-30 Mk1). It is now an independent design and manufacturing OEM (in 2014 with LCA), which has enabled it to increase its know-how from trainer aircrafts to fighter aircrafts and attach helicopters. HAL has produced over 3,800 aircraft and over 4,500 engines, including 15 types of indigenous designs. It is also a leading example of vendor development and outsourcing of key processes in the defence sector.

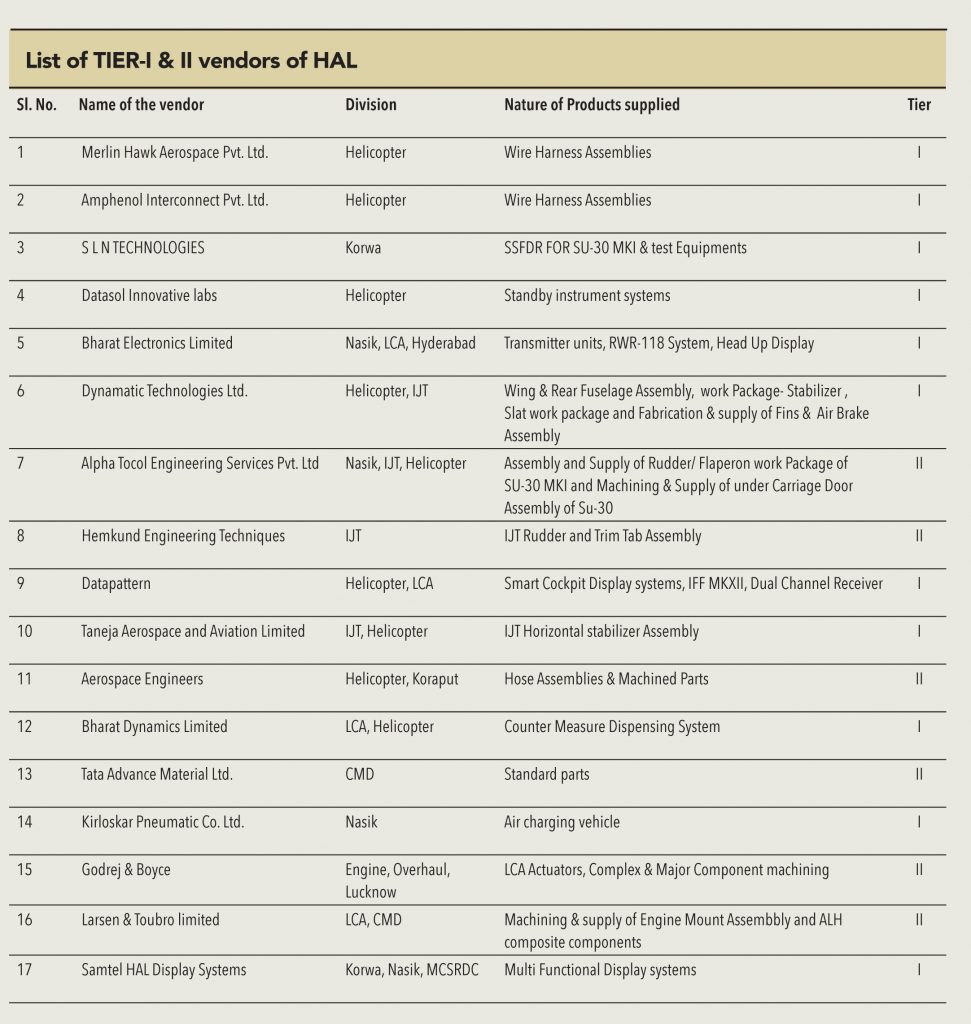

Outsourcing has been a key to HAL’s success

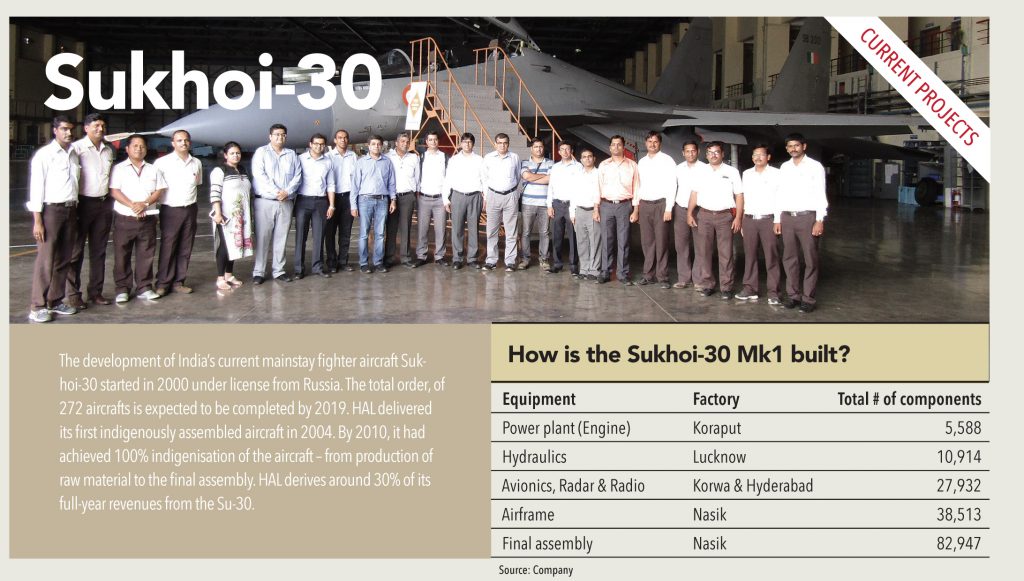

The world over, aircraft manufacturers such as Boeing and Airbus are mainly integrators and do not build the plane themselves. 40,000+ components go into larger fighter aircrafts such as Sukhoi-30 (Su-30) while 20,000-25,000 components are involved in making a helicopter.Hence, it is impractical for OEMs to manufacture all components in-house. Before the 2000-10, HAL had developed in-house capabilities for critical equipment such as forgings, aero structures, empennages, and engine parts – as the Indian industry was not mature enough to manufacture aeronautical-grade components.However, with the Sukhoi program, this changed – and the company adopted the outsourcing model. In case of Su-30, HAL outsources 37% to domestic vendors and imports 40% from its Russian and other foreign counterparts. HAL is now outsourcing module assemblies starting with the LCA, which is a step up from merely outsourcing component manufacturing.

Unlikely to face competition from the private sector in the near term

Unlike other defence PSUs, which could potentially face existential risks in the next five years due to private sector competition, HAL is on more firm ground. Two reasons why it will probably not face tough competition:

1) The private sector lacks the capability to manage complex supply chains for aircrafts.

2) Since the volumes are limited globally, there are not more than 4-5 OEM’s.

Key challenges

• Lack of continuity of programs: One of the major issues faced by HAL is the lack of continuity of projects. Given the prolonged period taken by the dispensation, and delays related to manufacturing an aircraft, the risk of technology obsolescence leads HAL’s clients to place only limited quantity of orders. Since HAL has to invest in setting up a dedicated manufacturing and assembly line for each product, the cost is prohibitive and the returns are low.

• Bulk ordering required to provide for revenue

growth visibility: As the average lead time to manufacture a aircraft/helicopters is 24-36 months, visibility of orders is a must. A break in between orders, will require HAL to restart its assembly line all over again leading to time lost to ramp up production back to the original levels.

Ground view met with the management of Tata Power SED (SED) as it emerges to be one of key beneficiaries of the growing investments in the sector. SED increased its presence to becoming an OEM for howitzer, armoured vehicles, and complex control command and communication projects from being a sub-system supplier for missile, submarine, and electronic warfare programmes.

History

For close to four decades, The Tata Power Company Limited through its Strategic Engineering Division (Tata Power SED) has been a leading private-sector player in the indigenous design, development, production, integration, supply and life-cycle support of mission critical defence systems of strategic importance. During this period, the division has partnered the Ministry of Defence (MoD), the armed forces, DPSUs, and DRDO in the development & supply of state-of-the-art systems and emerged as a prime contractor to MoD for indigenous defence production when it secured orders for Pinaka Multi Barrel Rocket Launcher, Akash Army Launcher and Integrated Electronic Warfare System for the Indian Army and for the Akash Air Force Launcher, COTS-based Automatic Data Handling System for Air Defence and Modernisation of Airfield Infrastructure (MAFI) for the Indian Air Force.

Product portfolio of Tata Power SED

Future growth prospects

Four projects that will most likely transform SED into a system integrator

Tactical Communication Systems (TCS): In consortium with L&T and HCL, SED is bidding for the US$ 2.5bn TCS project. TCS is a communication system that the army will use under offensive terrain. This project will make progress as Ministry of Defence is expected to release funds for the prototype in FY17. The prototype building and approval will take 24-30 months and the final order is expected to be awarded by FY21. SED’s consortium is competing with Bharat Electronics in this project.

Battlefield Management System (BMS): The BMS consists of a wireless network that links digital devices carried by combat soldiers, interlinking them, their commanders, and a range of battlefield sensors. This provides a common battle picture to each individual. Software Defined Radio (SDR) is the key technology for this project – SED has technology tie ups with global companies such as Rockwell Collins, RNS, and Thales to source the SDR. In a consortium with L&T, SED is bidding for this US$ 6bn project. Here also it competes with Bharat Electronics. Order for the prototype building for BMS is expected in FY18.

Mounted gun howitzer programme: The management expects the RFP for the Rs 160bn project, which envisages manufacturing of 814 howitzer guns mounted on an all-terrain truck, to be published in 2HFY17, after which it will take at least 36 months for the final order to be placed. In this project, SED competes with Bharat Forge-Elbit (Israel) and L&T-Nextar (France).

Optronics: Optronics offers the most near-term order opportunity for SED. The company has recently been qualified to manufacture hand held thermal imagers (HHTIs). This will also allow SED to compete in orders for passive night-vision devices (PNVDs), which until now was a nominated area for Bharat Electronics. India is expected to procure US$ 4bn (Rs 300bn) of PNVDs over the next five years.

Management expects both TCS and BMS final orders to be awarded by FY21-22

Ground view met with the management of Safran India, a multinational company with French origins. Globally, Safran (parent company) is a leader in helicopter turbine engines, commercial aircraft engines, helicopter flight controls, and landing gears. Safran should be one of the few MNC defence companies that stands to benefit from local manufacturing capabilities, particularly in helicopter engines.

History of Safran in India

Safran has been present in India for the more than 60 years. In the 1950s it started off by sale of equipment for airplanes and helicopters, followed by major sub components for Jaguar and Mirage aircrafts in 1970-1980. In 2004, HAL made engines for the Hawk trainer under license; similarly, in 2006 Safran Helicopter Engines (subsidiary of Safran) was selected to co-develop and co-manufacture engines for HAL’s Advanced Light Helicopter (ALH).

What does it do currently?

Like its parent, Safran India operates across three segments viz. defence, commercial aerospace, and security. It has 2,500 employees – the highest in any country in Asia. Currently, Safran uses India as an engineering centre and also has three manufacturing units for CFM engine parts, smart cards, and co-manufactures engines for ALH with HAL.

Commercial aerospace:

Safran is global leader in engines for commercial aircrafts. CFM international, a JV of Safran Aircraft Engines and GE, has sold more than 700 engines in India. In addition, Safran is also a leader in landing gears, wheels, carbon brakes, and electrical wiring interconnection systems for aircrafts. This segment remains a majority contributor to revenues for the company in India.

Defence:

The key product that Safran supplies/develops/jointly manufactures in this segment is the helicopter engine for HAL. Through its subsidiary, Safran Electronics & Defence, is also a leading supplier of avionics such as navigation systems, flight control systems, and optronics.

Security:

With more than 1,500 employees, security is one of Safran’s main businesses in India. The group is a key partner for the government’s Aadhaar scheme. Safran also operates South Asia’s largest smart card manufacturing facility in India. Baggage screening is another solution that Safran provides in this segment. Delhi, Mumbai, and Bangalore airports use Safran’s computer tomography screening solutions.

Where does Safran stand on developing local manufacturing capabilities?

Safran currently has three operational manufacturing plants: (1) CFM engine parts, (2) smart cards, and (3) a plant with HAL to manufacture the Shakti engines for ALH. Going forward, even as the company does not have any concrete plans to set up new facilities, it would look at investing in sub-assemblies for future projects such as Rafale aircraft and Kamov 226.

Future growth prospect

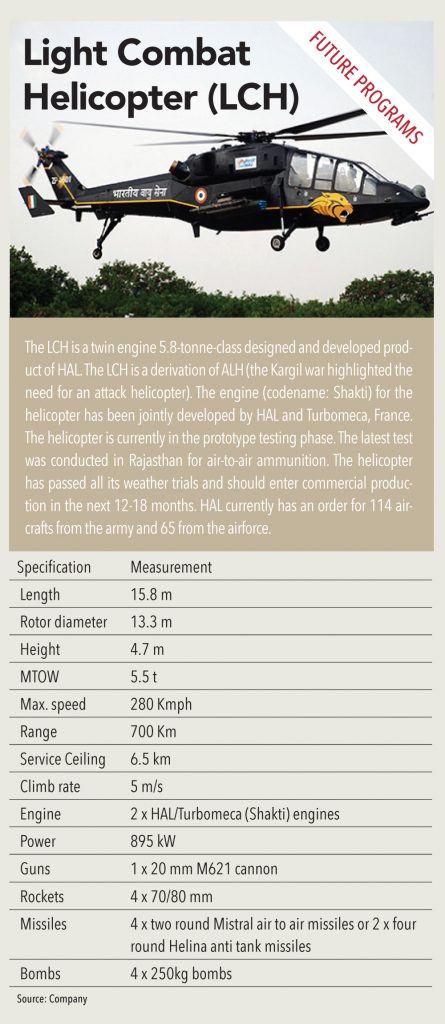

• Light combat helicopter: The LCH will use the Shakti engine that Safran jointly manufactures with HAL. HAL has orders to manufacture ~180 helicopters (65 for the air-force and 114 for the army). This would necessitate a requirement of 350+ engines and spares. HAL expects the final operational clearance for this project in FY17 followed by a commercial order in FY18. In addition, HAL also expects to export the LCH to South East Asian countries.

• Rafale fighter aircraft: India proposes to buy 36 aircrafts from Rafale, France, with an option to buy another 36. Safran supplies components that account for 1/3rd of the value of the aircraft. Safran supplies the twin engines (M88) while its other subsidiaries provide power transmission systems, accessory gearbox, and full authority digital engine controls. However, it is still not clear what role Safran India will play in this project.

• Kamov Ka 226 helicopter: In 2015, India entered into an arrangement with Russia to locally manufacture the Ka 226 helicopters. Initially, 200 helicopters will be manufactured by HAL. Safran Helicopter Engines supply the engines for this helicopter.

• Repair and overhaul opportunity: In the near term, the management of Safran India also believes that repair and overhaul of ALH provides revenue visibility. Safran has previously been part of the Mirage overhaul programme.

Subscribe to enjoy uninterrupted access