In August 2016, World Economic Forum, in collaboration with Deloitte, came out with a white paper on “The Future of Financial Infrastructure – How Blockchain can reshape Financial Services.” The study was done to showcase how DLT technology will shape the financial services ecosystem, and its implications on the future of the financial services. Its key findings were:

“Blockchain has the potential to address these limitations of the current processes by modernising and simplifying the traditional ‘siloed’ design of the financial industry infrastructure with a shared fabric of common information” says WEF.

It is named a leader in Gartner’s Hype Cycle for Emerging Technologies. The shift from a centralised technical infrastructure to distributed, ecosystem-enabling platforms is laying the foundations for new business models in payments, digital banking, and financial transaction technologies.

Financial services industry is far ahead in terms of experimenting with newer technologies. Blockchain, with its characteristics of sharing a system of records through consensus and trust, will help financial services firms to transfer assets within their business networks. Blockchain can be disruptive in the sense that – it will replace the traditional ledger system with distributed ledgers, which will lead to newer business models replacing existing hub-and-spoke model with intermediaries.

In banking, key transactions (in processes) revolve around asset ownership. Several layers of data are exchanged between financial institutions through intermediaries in order to complete any transaction. The processes, many a times, become inefficient and expensive. Blockchain, through its distributed ledger technology, promises to resolve all that.

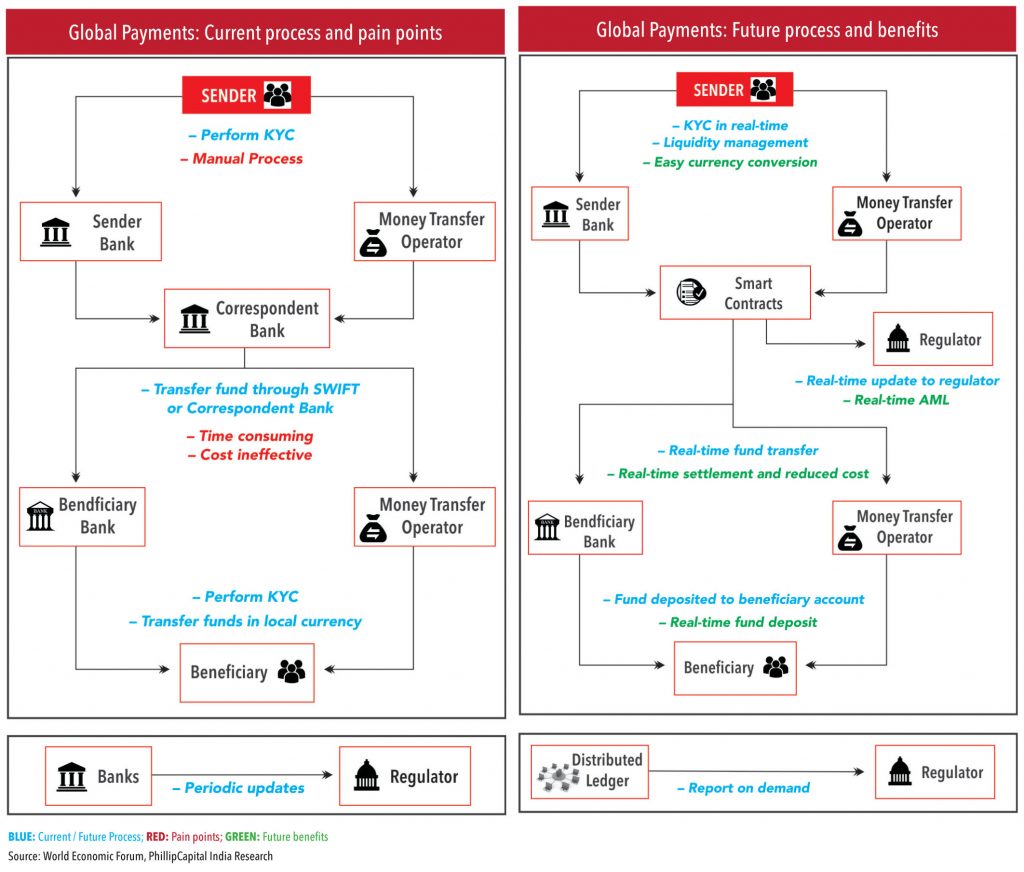

The banking industry is faced with a number of changing demands. International payments are increasing at twice the global GDP growth. In a report in July 2016, consulting firm Accenture PLC estimated that banks process US$ 25-30tn of cross-border payments annually, across 10-15 billion transactions. Financial institutions must have proper infrastructure in place to support ever-increasing transactions. However, due to the limitations in today’s infrastructure, banks process payments in batches, resulting in high processing costs, lengthy settlement times, and a poor customer experience. The use of DLT can solve this problem as it will replace third-party intermediaries, resulting in real-time transactions at less time and cost.

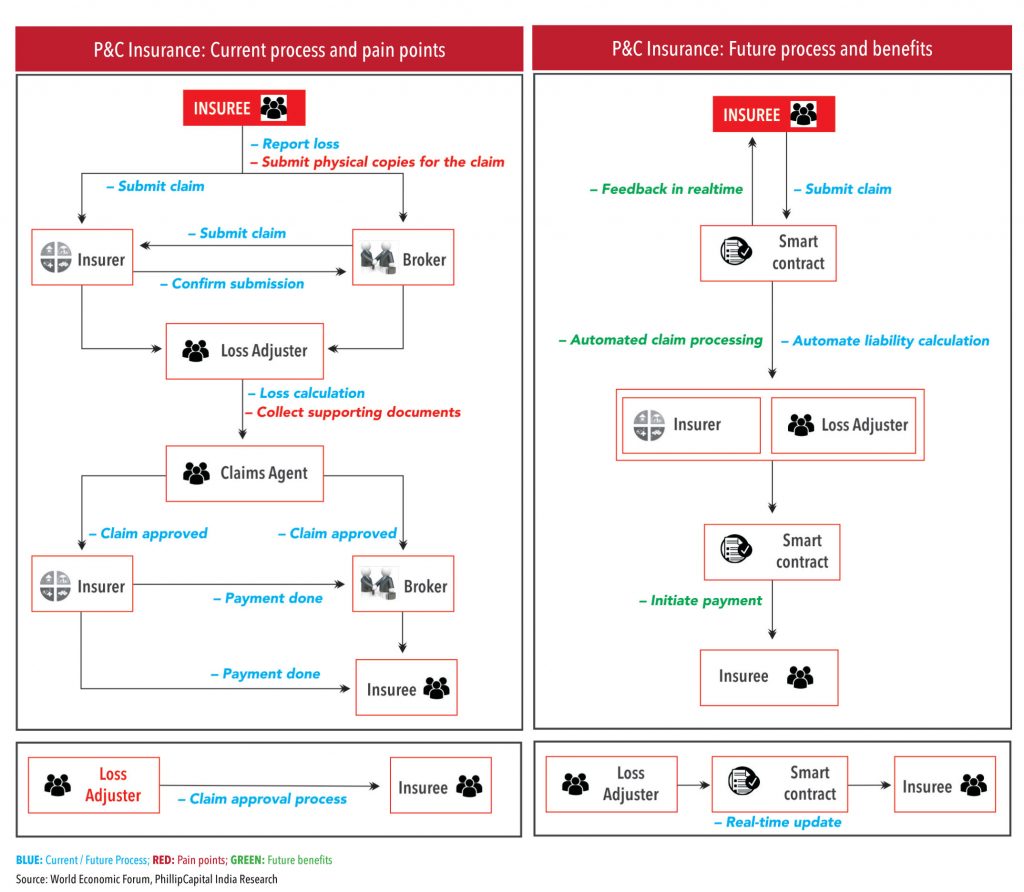

P&C is the second-largest segment of insurance and is expected to generate premiums of US$ 895bn by 2018 (as per a Finaccord 2015 report). However, claim settlement is a major pain point — it costs 11% of annual premiums for P&C insurers. The key growth driver in the market would be the change in customer demographics and economic recovery. The current insurance claims process requires manual collection of data, which is time consuming and also prone to frauds. With the use of DLT, an insurer can obtain the required claim documents, along with the history of the insuree in real-time, hence reducing the claim processing time and also the cost.

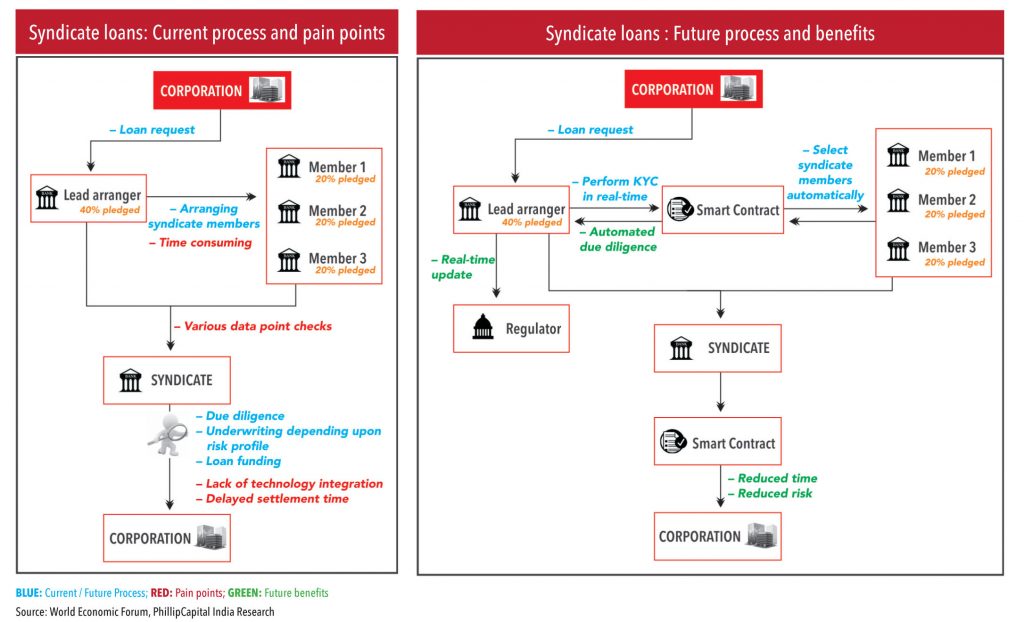

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial or investment banks known as arrangers. Factors such as a large amount to protect capital adequacy ratios, or to diversify risk arising from a single borrower, form the basis of lenders opting for syndicate loans. The US loan market is estimated to be of US$ 1.92tn (as of 2014), with four of the largest financial institutes in the US accounting for more than 50% market share. The process of identifying members for the syndicate is time consuming, and often results in delays in loan approvals. With the use of DLT, the lead arranger can decide for the syndicate members in real-time by using smart contracts.

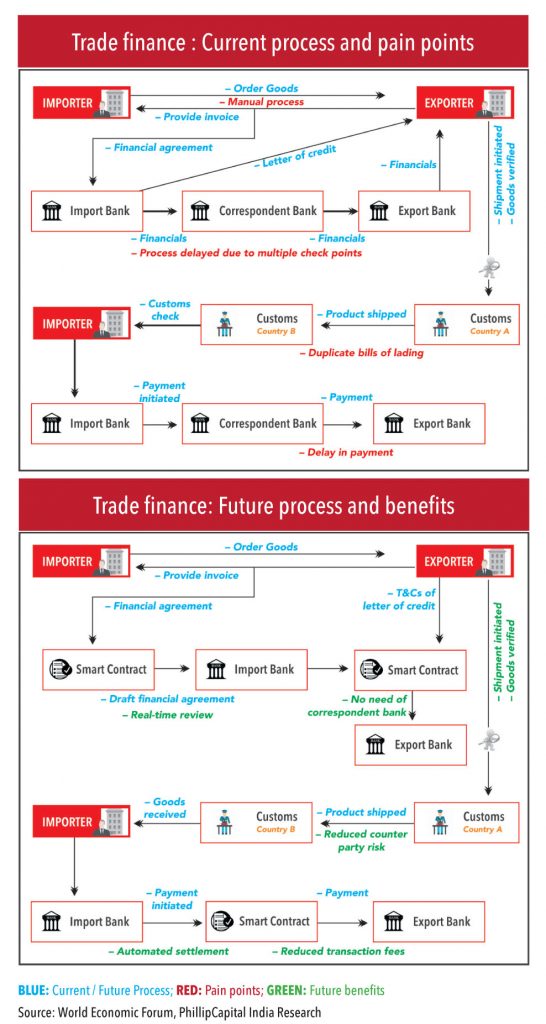

Trade financing helps businesses fund goods or services. It includes lending, issuing letter of credit, export credit, and insurance. Financing has become an integral part of trading with an annual market-size of US$ 10tn (as per World Trade Organization 2015 report).

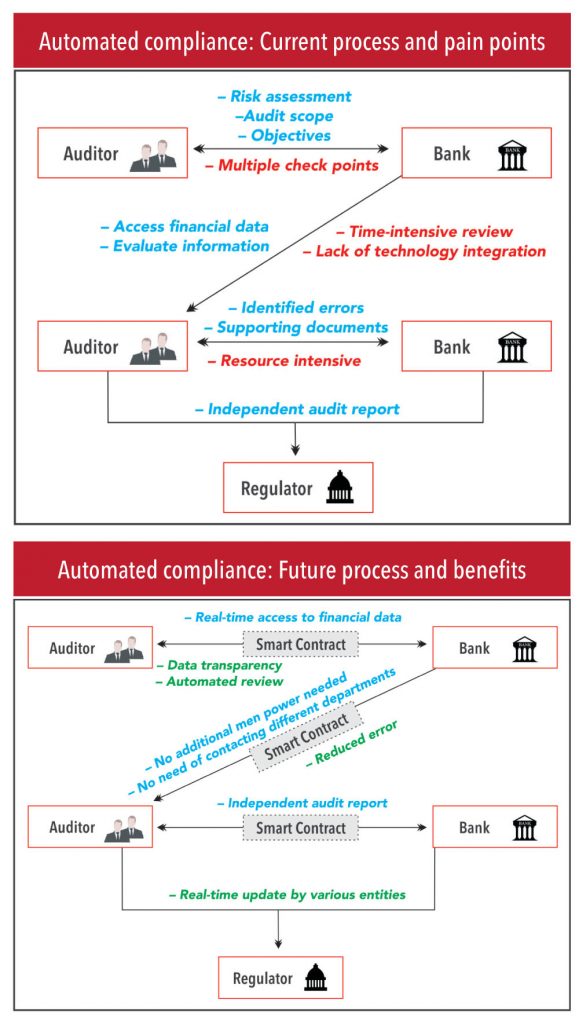

With the increasing use of cross-border and multi-currency transactions, banks find themselves at a centre of all the government regulations regarding certain requirements, restrictions, and guidelines. As per a Financial Times 2015 report, large financial institutions have spent US$ 4bn in compliance related activities in 2014.

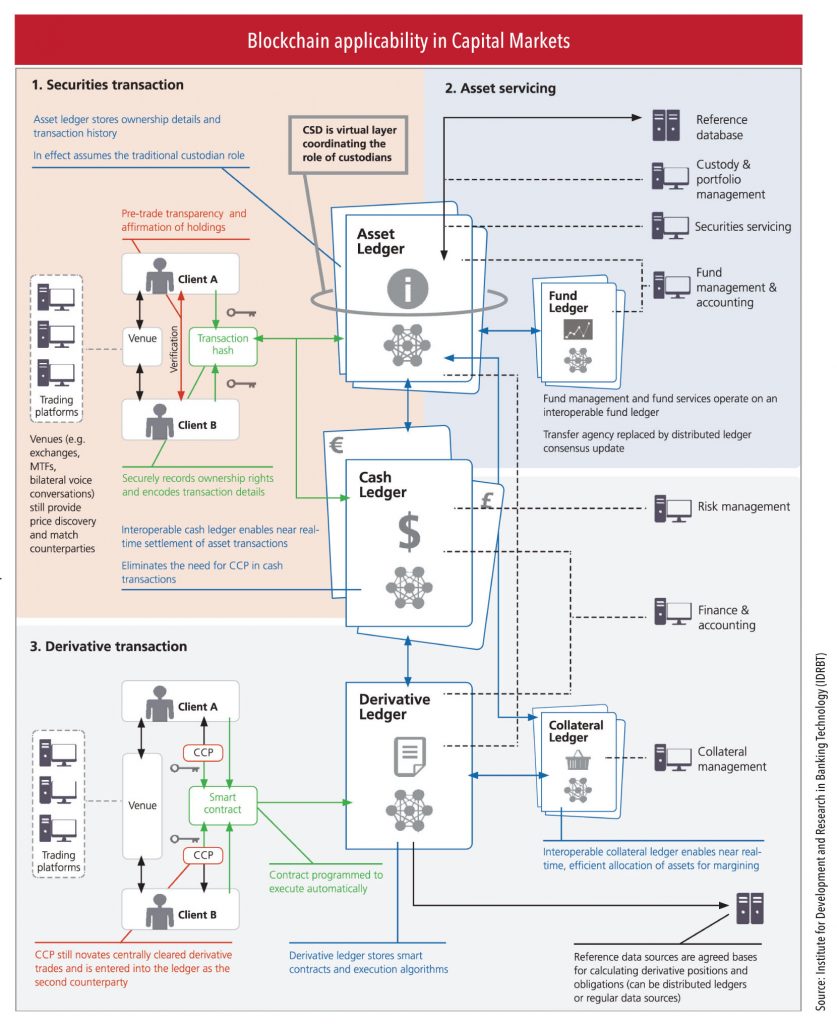

There are many intermediaries involved in a trade – exchanges, depositories, brokers, custodians, and investment managers. These intermediaries have to update their ledgers in real-time to complete transactions without any error. However, due to the involvement of many parties, the process faces delays, increasing costs.

Blockchain will benefit capital market services at all stages of trade and securities servicing.

Pre-trade: Blockchain, through smart contracts, stores and facilitates KYC data, reducing cost and eliminating the number of KYC checks. It will also help in the transparency and verification of holdings, leading to reduced credit exposures.

Trade: Blockchain ensures a secure, real-time transaction matching, and immediate irrevocable settlement; it also helps in more transparent supervision for market authorities, establishing higher anti-money laundering standards.

Post-trade: As there are no intermediaries involved in the transactions, it results in reduced margin or collateral requirements, resulting in faster and efficient post-trade processing.

Custody & Securities Servicing: Securities are directly issued onto a Blockchain, through smart contracts, to the parties. Fund subscriptions and redemptions are processed automatically making it simple for accounting, allocations, and administration.

Pre-IPO share allotment: NASDAQ, in Oct 2015, announced that it has issued its first investor shares on the platform Linq, a Blockchain-based service, to issue pre-IPO shares of companies.

Everledger, a London-based start-up specialising in tracking and protecting valuable assets throughout their lifetime journey, has developed a Blockchain platform that helps companies track the origin of diamonds, allowing buyers to screen for stones mined in those regions where forced labor is common or where proceeds from previous sales were used to fund violence. Everledger is also building systems to record the movement of diamonds from mines to jewelry stores and has been using various blockchain tools, including Bitcoin’s ledger. Everledger is testing IBM Blockchain for a global rollout possibly by the end of the year.

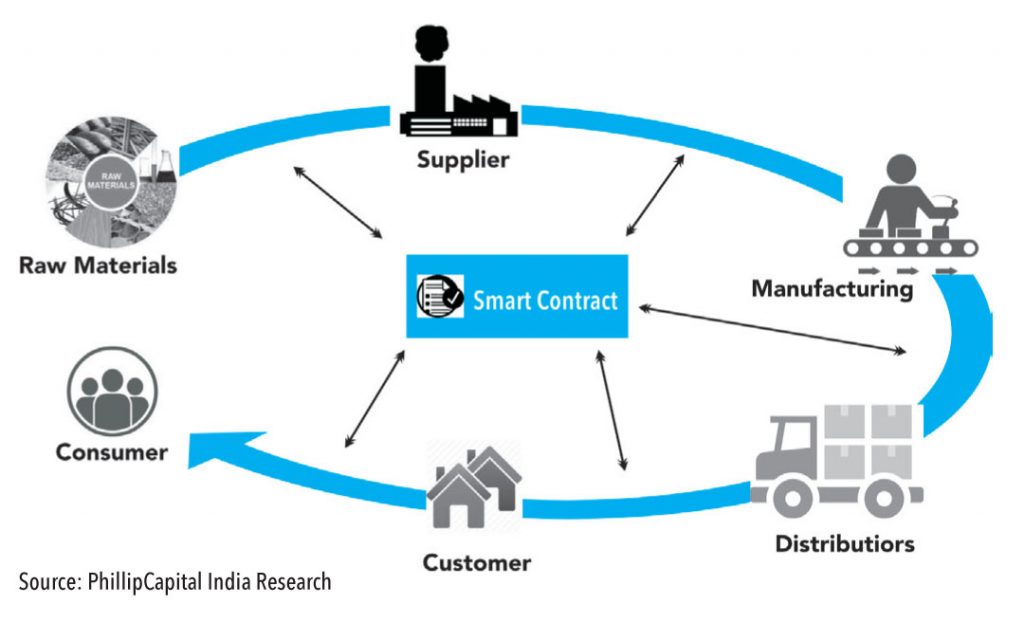

The IBM business unit deals with 4,000 suppliers, financing customers and partners who conduct about three million transactions per year, worth US$ 44bn. As per estimates, about 25,000 disputes on an average arise annually over various issues like wrong number of computer parts in an order or delay in deliveries. These would take an average of

44 days to resolve. Also, there were 6-7 different software applications to verify steps taken in the arrangement as well as having to call banks, financial institutions, and associated partners. IBM, with the use of DLT, recorded transactions faster and accurately than its traditional resources, resulting in issues resolving in 10 days.

Today’s healthcare processes depends on reconciling medical data among clinics, hospitals, labs, pharmacies, and insurance companies manually. The shortcoming of this process is that there is no single list of all the places data can be found or the order in which it was entered. Also, though data standards are better now compared to the earlier times, each electronic health record (EHR) stores data using different workflows.

To overcome this, MIT researchers Ariel Ekblaw, Asaf Azaria and Thiago Vieira are developing a cryptocurrency-backed technology MedRec. MedRec doesn’t store health records. It links patient’s medical records across the different doctor’s databases. It stores the digital signature of the records on the Blockchain. The benefit of the signature is that an unaltered copy of the record is obtained by the concerned entities. The miners for MedRec are medical researchers who are rewarded with access to census-level data of the medical records. Similar to the census, the individual privacy of the person is protected, and the aggregate data is used for critical research.

By using the blockchain in healthcare system, it avoids adding another organisation between the patient and the records. It also adds due consideration to a time-stamped, programmable ledger.

Subscribe to enjoy uninterrupted access