The seeds of this unusual saga were sown more than 70 years ago in Anand, a small town in Gujarat in western India. The exploitative trade practices followed by the local milk trade cartel triggered off the co-operative movement. Angered by unfair and manipulative practices that were followed, farmers of the district approached Sardar Vallabhbhai Patel for a solution. He advised them to get rid of middlemen and form their own co-operative,which would keep procurement, processing, and marketing under the farmers’ control. In 1946, farmers of Anand went on a ‘milk strike’, refusing to be cowed down by the cartel. Under the inspiration of Sardar Patel, and the guidance of leaders like Morarji Desai and Tribhuvandas Patel, they formed their own cooperative in 1946, which later evolved into a state-wide dairy cooperative – today known as Amul.

Amul is credited with spurring the ‘milk revolution’ of India, which propelled the country to becoming the world’s largest producer of milk

Amul’s iconic hoardings

Biggest and the best!

Amul, flagship brand of Gujarat Cooperative Milk Marketing Federation (GCMMF), is the most successful co-operative brand in the country, and India’s largest fully integrated food brand. With 21% CAGR in last five years, Amul posted revenues of Rs 207bn in FY15. Its product portfolio includes liquid milk and value-added products like infant nutrition, cheese, and butter. Amul has a pan-India presence with 56 sales offices, 10,000 dealers and a million retailers. It handles 15mn kg of milk per day (~4% of India’s total dairy volumes and 25% of organised sector volumes) and is also India’s largest exporter of dairy products.

Strong brand backed by stronger distribution

Amul’s retail sales are driven by liquid milk, which accounts for around 50% of production volumes. Liquid milk acts as the carrier brand for its value-added products such as infant milk food, cheese, paneer, flavoured milk, and ghee. Milk is the largest contributor to its revenues (Rs 80bn PC estimate). Its second-largest category is infant milk food, Amul Spray, which has revenues of Rs 42bn. Other important categories include butter (market share of >90%), ghee, ice creams, and cream. Because of its strong brand equity and retail portfolio,Amul operates on cash-and-carry principle and has negligible receivables (two days). In comparison,companies like Kwality Dairy, Prabhat Dairy, and Parag Milk Foods have major institutional presence and receivables days of 40-80.

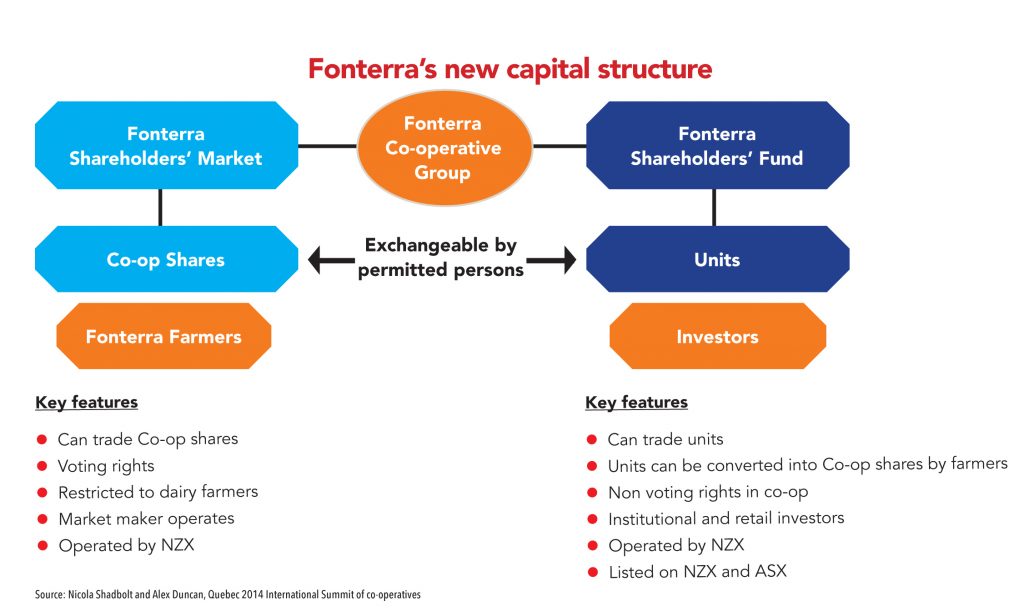

Listed cooperative: Fonterra case study

Fonterra Co-operative Group Ltd. is a New Zealand dairy co-operative owned by 10,500 farmers. It is the world’s largest dairy co-operative and exports 95% of its local production to over 100 countries. The company is also known for being one of the few dairy cooperatives listed on a stock exchange.

Until November 2012, Fonterra shares were owned only by its milk-producing members in the ratio of amount of milk produced by each member.Members could then redeem these shares if their production declined, and the cooperative was obligated to buy back the shares from these members. In 2007-09, due to volatility in milk prices,Fonterra faced severe redemption pressures from struggling farmers.

In November 2012, Fonterra implemented a capital structure that allowed it to list its shares on New Zealand’s stock exchange, while letting farmer members retain ownership of shares. As per the structure, derivative units of underlying cooperative shares are available to investors and these units entitle investors to receive economic rights to the shares (dividend and gain/loss in unit value). The units could be transacted freely on the stock exchange. However, since farmers retain ownership of shares of the cooperative, voting rights were made available only to them. The structure also allows farmers to purchase shares worth two times than previously available for their three-year average production. This helped increase market depth. Fonterra shares currently trade at more than 19 times trailing earnings and the company has a market capitalisation of US$ 6bn (NZD 9.1bn).

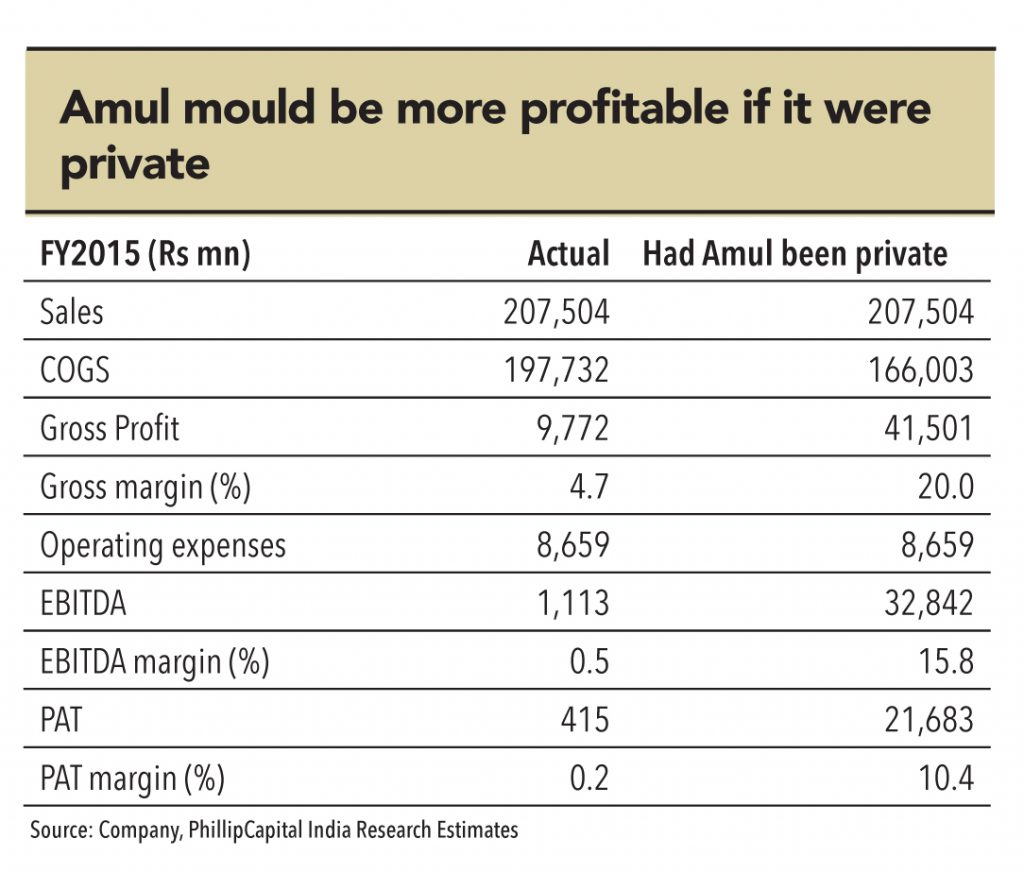

How big would Amul be if it were private and listed? (Hint – a lot!)

A large dairy company with a stable of strong brands can command FMCG valuations if it is able to exhibit lean working capital management and if a bulk of its business comes from retail. Amul is one of the most admired brands in India and has a track record of consistent growth. GCMMF, in a hypothetical scenario of operating like a private dairy company, would command valuations of a large FMCG company in India. It is even likely that it might command a scarcity premium because of dearth of investable candidates in the dairy space.

Based on the gross margin profile of listed players and Amul’s product portfolio, its gross margins would be around 20% (instead of 4.7% currently) had it been private. Amul currently makes lower gross margins because it buys milk at higher prices (in line with its objective of input cost maximisation) than most private players and private milk collectors, and it has a mandate to buy all the milk supplied by farmers no matter what the demand, which leads to overspending. With higher gross margins and other costs remaining the same, Amul would have generated profits of Rs 21bn in FY15 instead of reported profits of Rs 0.4bn. At an FY15 profit of Rs 21bn, and a conservative trailing P/E multiple of 30x, Amul would have a market capitalisation of Rs 630bn (~US$ 9bn) – one and half times the size of Fonterra!

Amul would have a market capitalisation of Rs 630bn (~US$ 9bn) if it were private and listed

Subscribe to enjoy uninterrupted access