Indian agriculture is highly dependent on the monsoon, whose progress and distribution plays a key role in determining crop production and farmers’ incomes. The performance of the kharif season sets the outlook for agriculture and its allied sectors. Kharif planting starts with south-west monsoons in June.

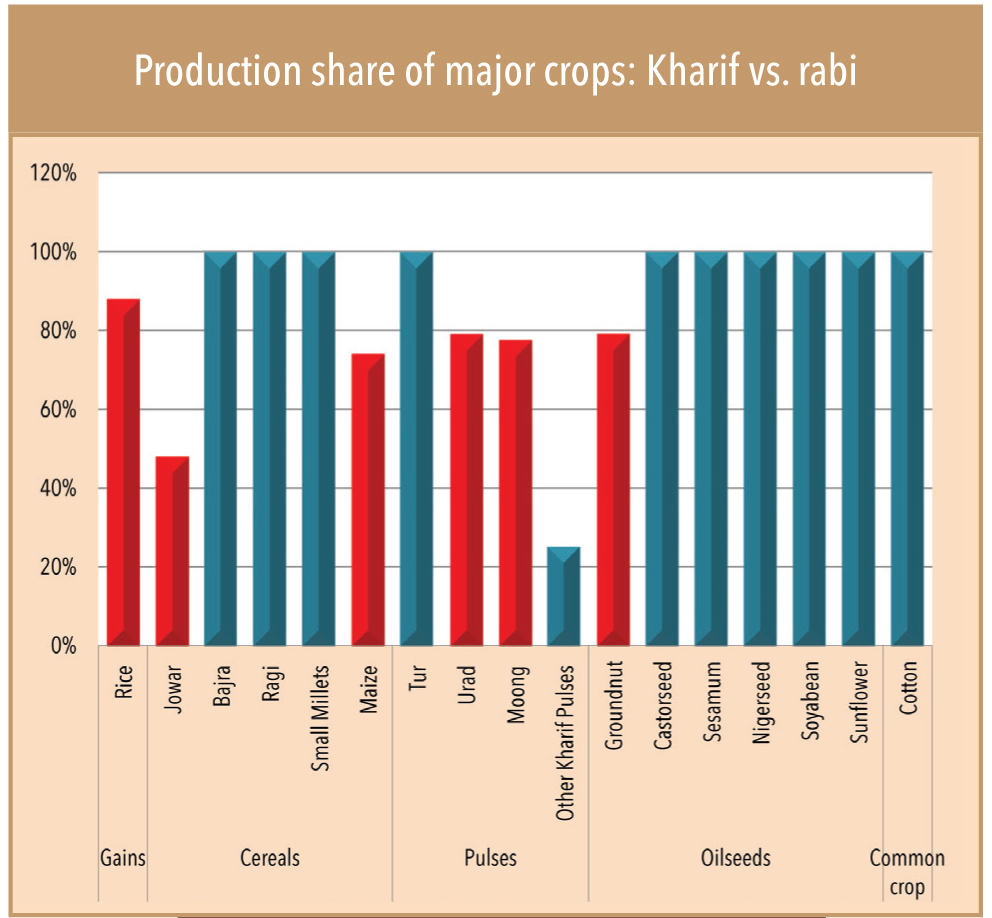

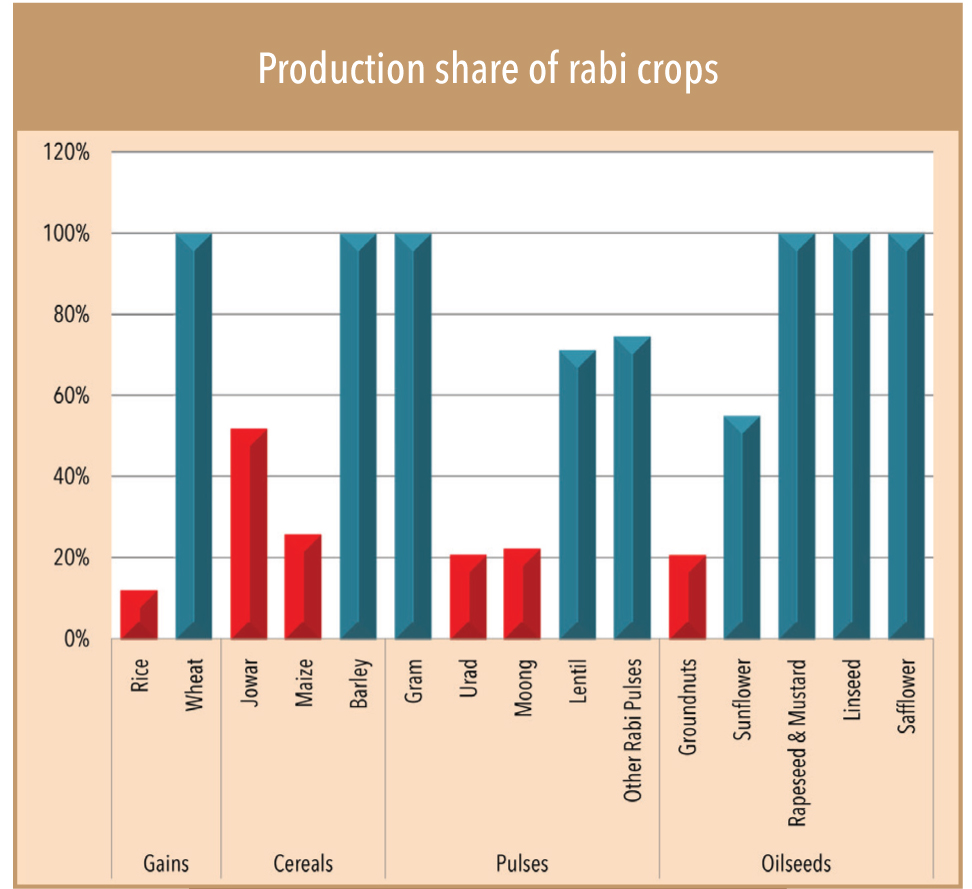

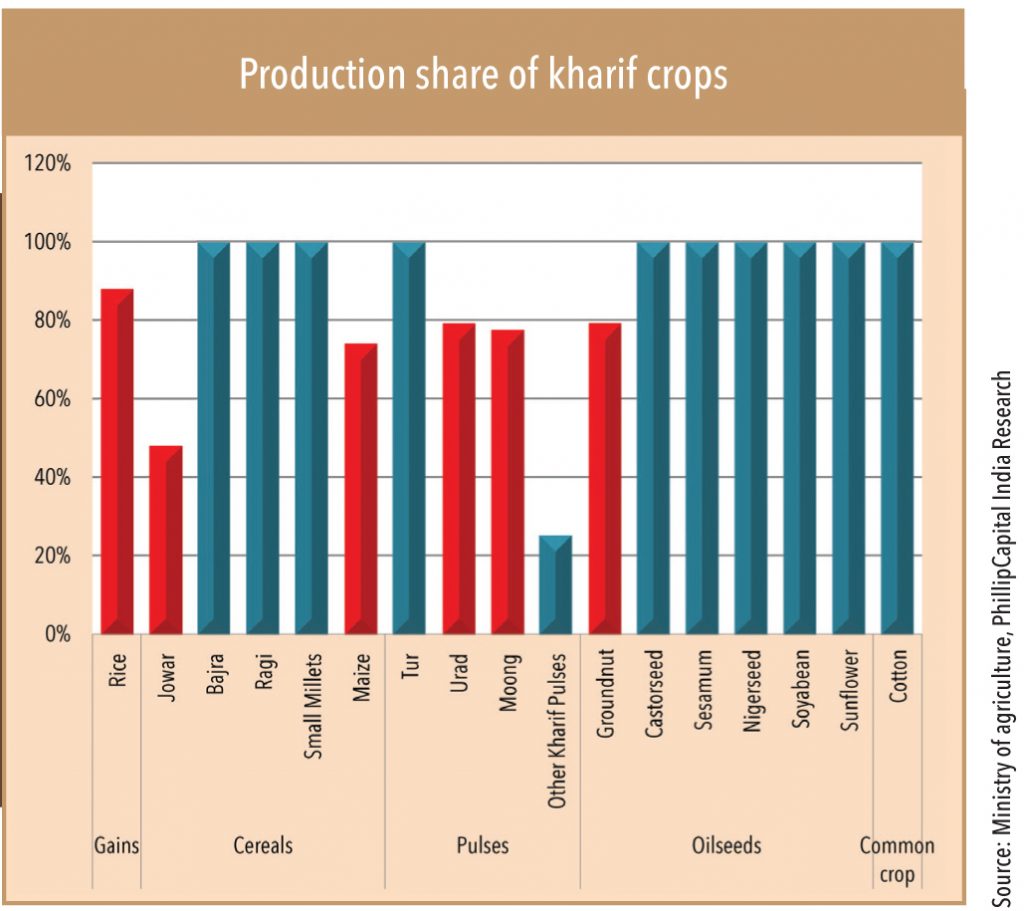

Different crops are sowed in the two seasons, kharif and rabi, but share of production is largely equally distributed between them in terms of food grain (rice, wheat, cereals and oilseeds). Kharif predominantly includes paddy (rice), bajra with major cereals such as ragi and small millets, pulses (maize, urad, moong, groundnut), some fruits/vegetables, and common crops such as cotton and sugarcane.

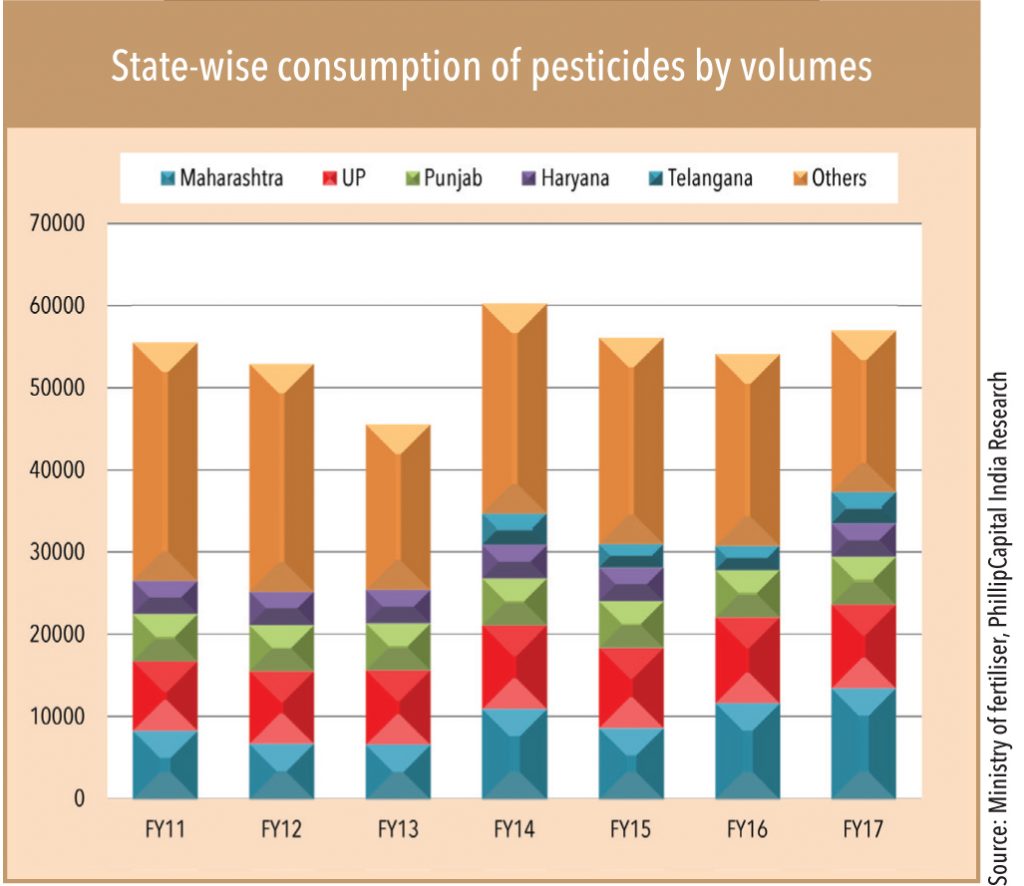

The consumption prospects of agriculture inputs are highly correlated to crop dynamics and the monsoon’s performance. For agrochemicals, kharif is important because paddy and cotton cover a large share of pesticides demand.

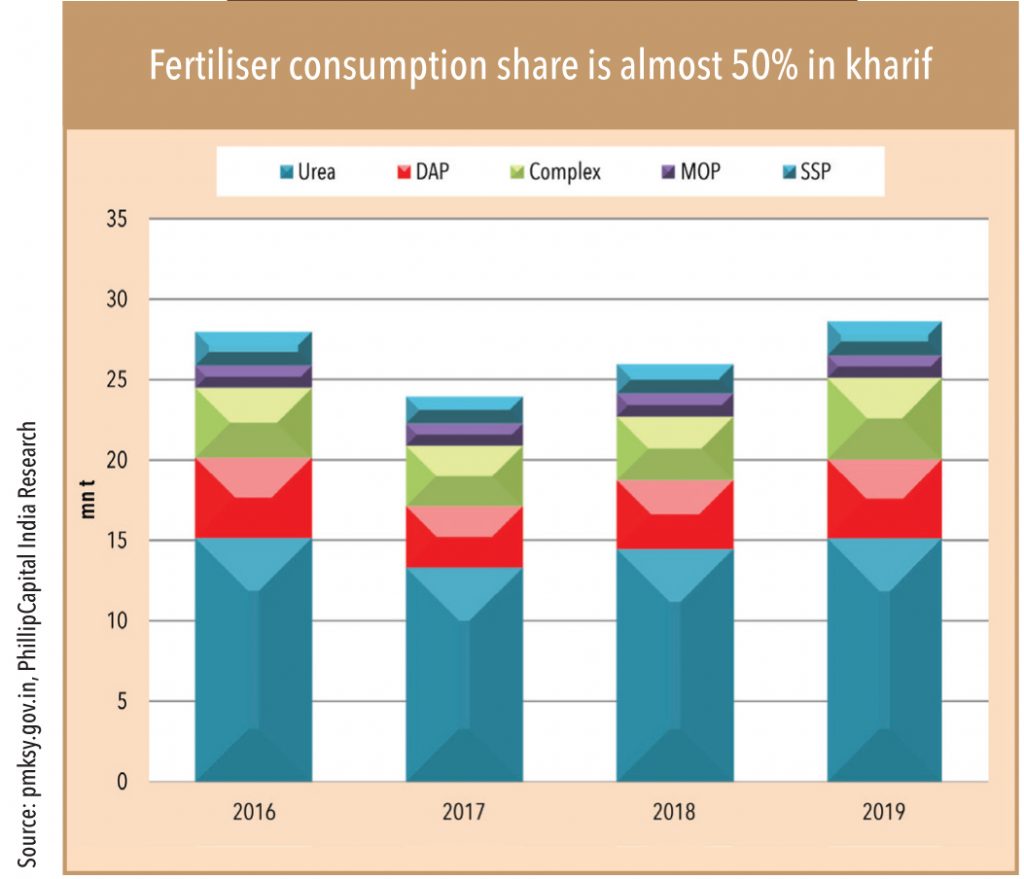

Monsoon becomes somewhat more important for non-urea fertilisers than urea, but it is more or less evenly distributed over the two seasons. “Ultimately, fertilisers are a nutrient and necessary for plant growth. Demand is affected to some extent for complex grades due to higher MRPs, but not urea,” said Mr Arora, a senior marketing officer at one the largest P&K fertiliser groups in India.

“Paddy and cotton constitute 60-70% of pesticide consumption, so kharif season is very important to our industry, …Pesticides are consumed at a later stage of sowing. Erratic rainfall discourages farmers from using agrochemicals,”

Mr Rane, Indofil Industries Ltd.

Agri input consumption in Kharif 2019 hurt by erratic monsoon

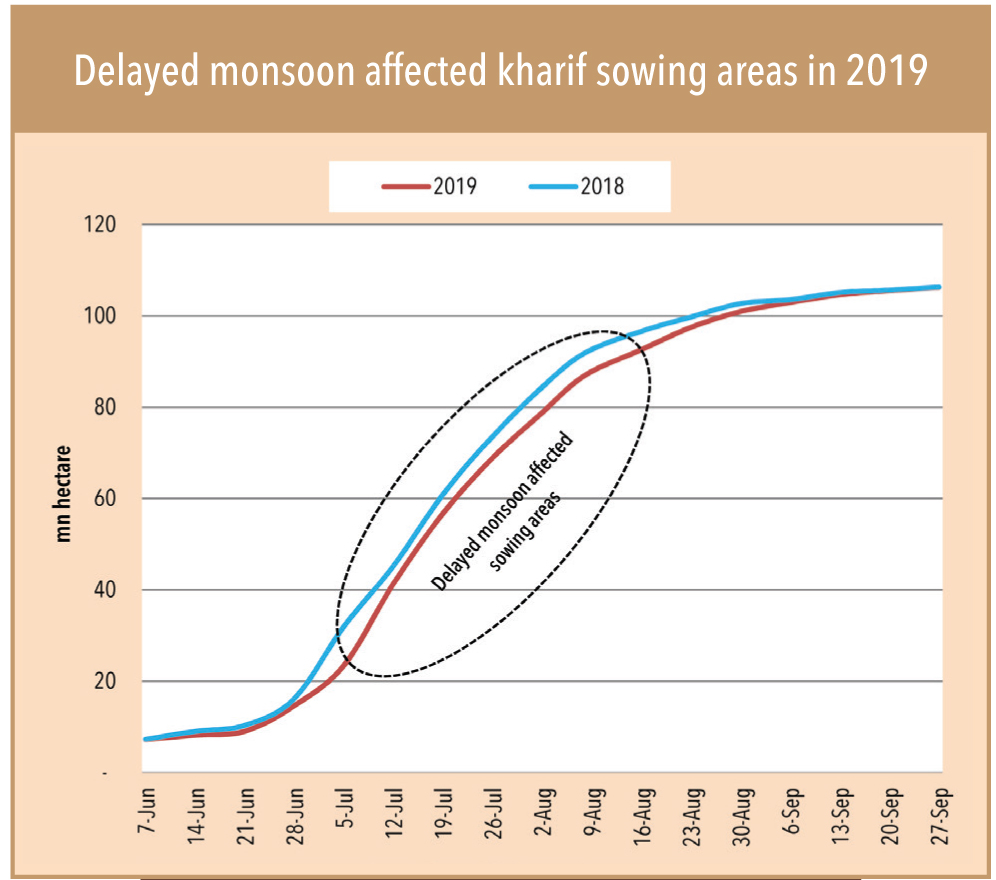

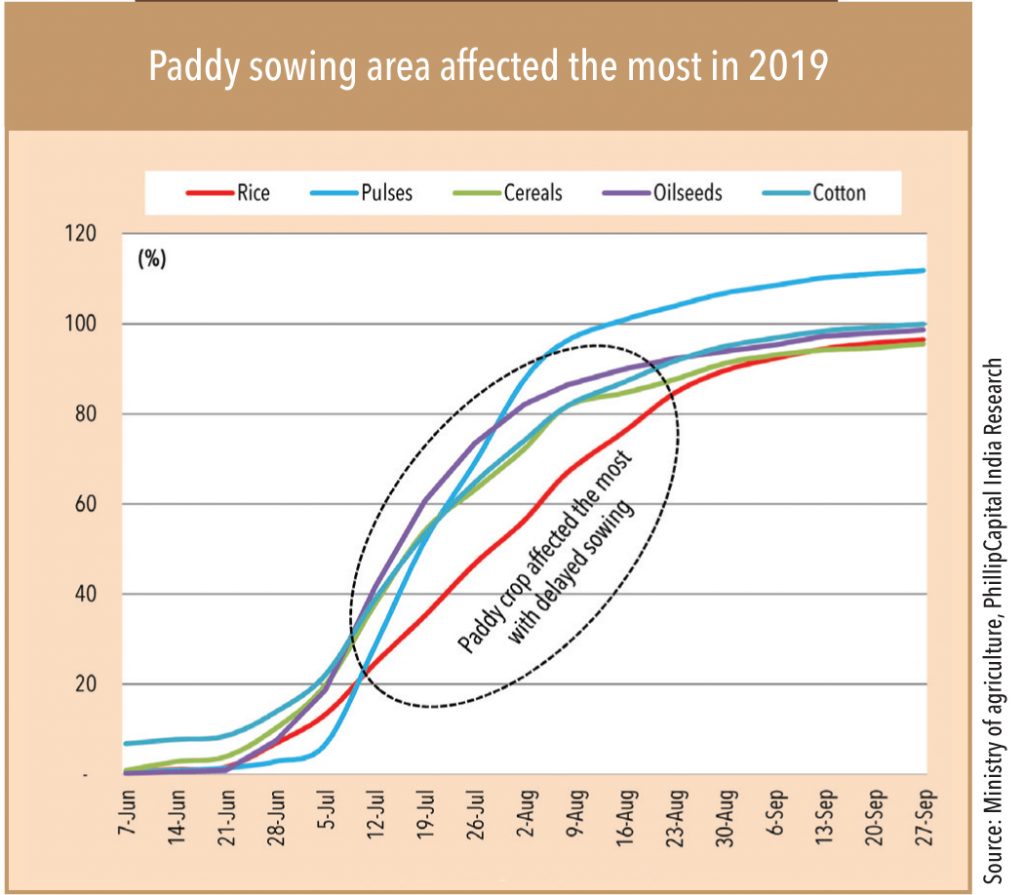

2019 kharif saw erratic monsoon, delayed start by a month, and a one-month extension. Farmers started with limited kharif sowing areas, which gradually improved after August. By the end of the season (September), planting areas had reached 100% with support from cereals, cotton, and oilseeds, but there was major decline in areas from the main (usual) kharif crops – paddy and pulses.

Erratic weather affected the consumption of agriculture inputs, particularly, agrochemicals. “This time kharif impacted us a lot. Late and untimely rain with poor distribution dented our volumes by 20-25%,” said Mr Sharma, a sales manager at Hindchem Corporation, an agrochemicals company based out of Mumbai. Like Hindchem, other large companies saw sales volumes dropping. Insecticides products were hit due to less pest incidences and herbicides/fungicides products were dented by lesser sowing areas.

Fertiliser consumption for kharif improved for major products such as urea (+3% yoy) and DAP (+2% yoy). It was stable for other complex grades and potash consumption. “Farmers buy 50-60% of their (fertiliser) requirement ahead of the (sowing) season. Poor monsoon has limited impact on consumption, unless channels inventories are high. Continued fall in MRPs and healthy inventories support a rise in sales,” said Mr Khare, former chairman of Madras Fertiliser.

Rabi is doing exceptionally well

While the progress of the Rabi (winter sowing) season and its performance largely depends on the distribution of the monsoon, planting, and harvesting during kharif. Rabi mainly covers wheat, cereals (barley), pulses and some fruits/vegetables. Mr Agarwal, one of largest distributor of fertiliser and agrochemical in Amritsar, Punjab, explained – “Normal or extended monsoon always helps larger sowing areas for rabi crops because soil contains higher moisture, supporting all winter crops.”

Normally, sowing is done by October and harvesting is complete by February/March across various states. In this season, agriculture inputs consumption is at lesser risk, as rabi demand is already pre-determined based on kharif’s performance. “Our fertiliser consumption in rabi season is similar to what it is in kharif. For pesticides, rabi contributes 20-30% of our annual sales. This time, rabi off take has been exceptionally good. Our volumes are 10-15% higher than last year,” said Mr Agarwal. Mr Agarwal said that kharif crops paddy and cotton determine 60-70% consumption of pesticides. Good volume growth so far in the rabi season clearly suggests pesticide consumption will be higher this year in the rabi season compared to last year’s rabi.

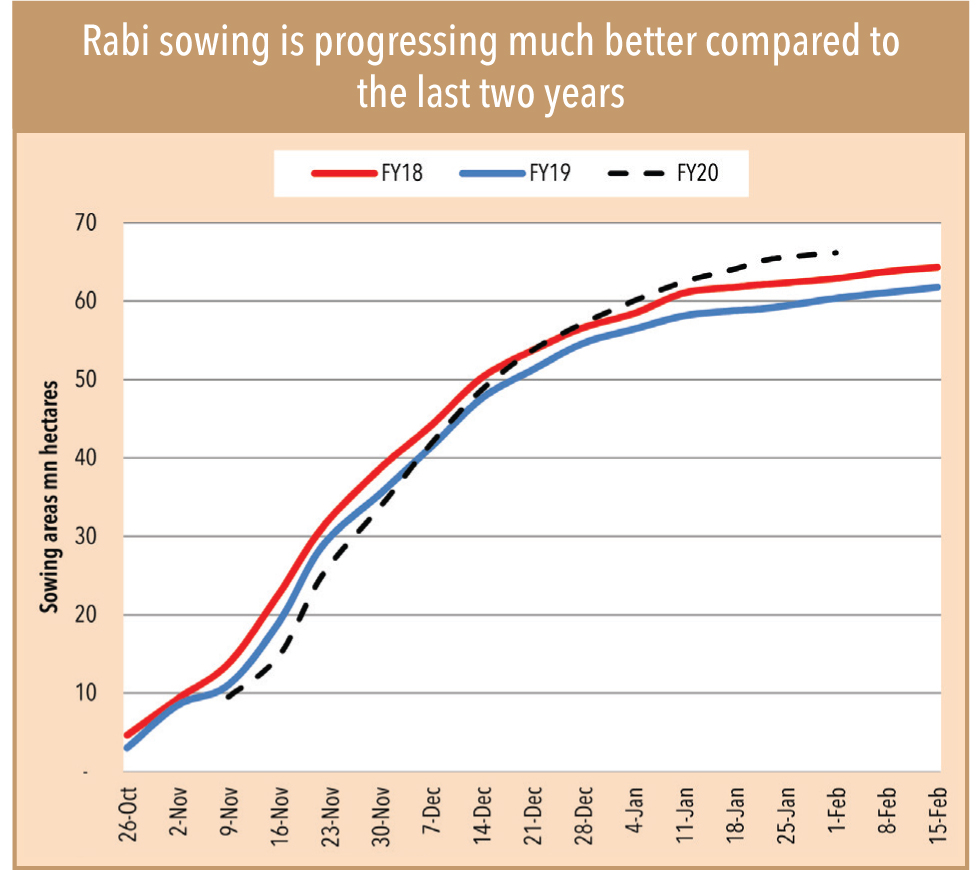

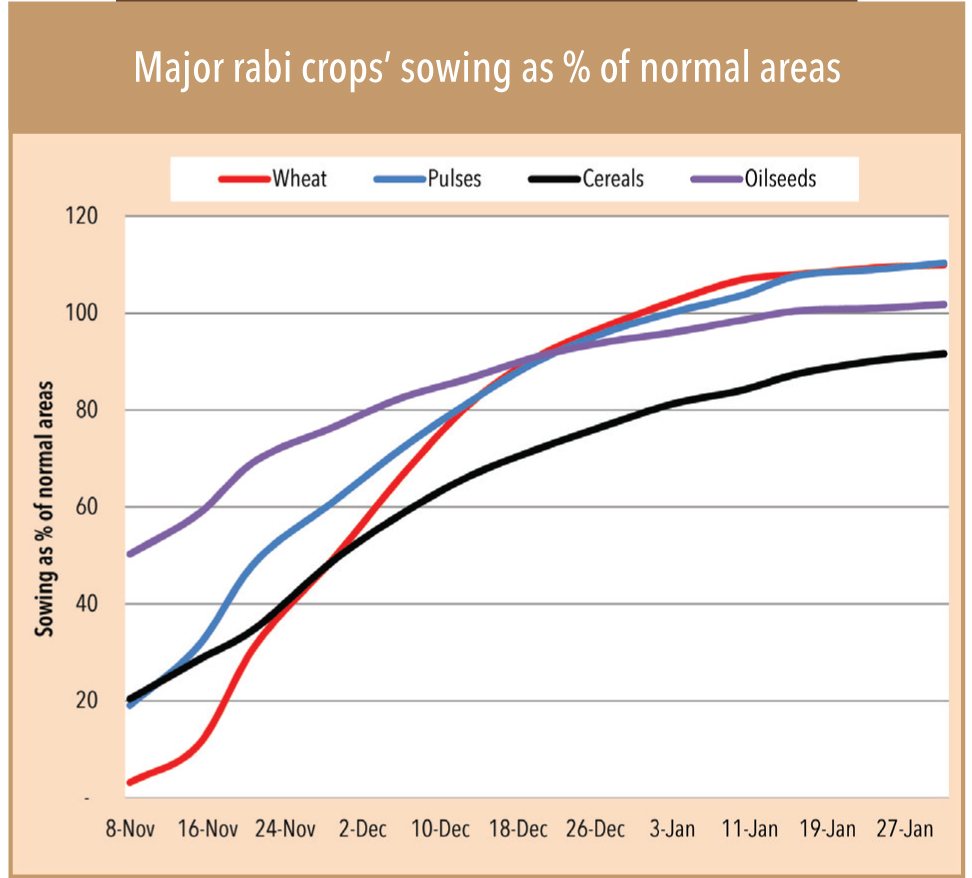

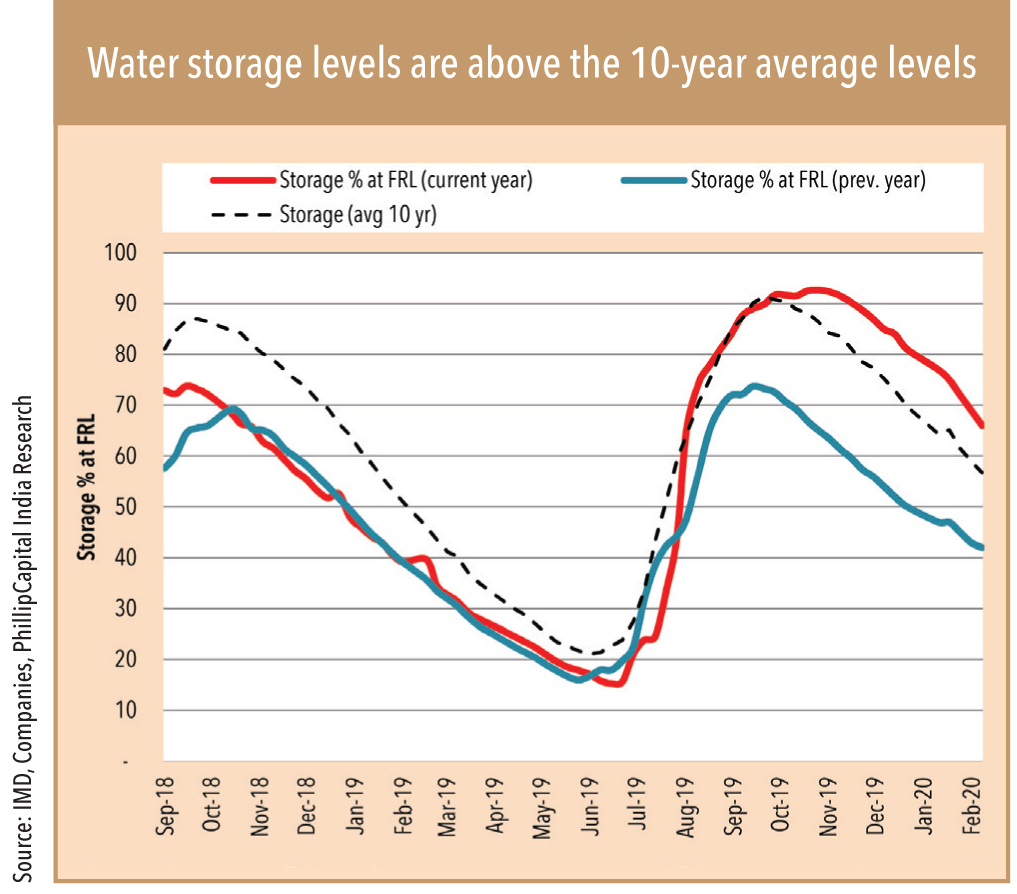

Rabi season is almost over. So far, planting areas improved by 10% to 66mn hectares this year, touching 104% by the end of January 2020 compared with 95% in the previous year. All major crops, including wheat, pulses (gram, lentil), cereals (corn, jowar, and barley), oilseeds (mustard) and fruits/vegetables (onion/potato/grapes/apple/chilly) have seen sowing areas growing by 6-15% compared to last year. An extended monsoon also helped to have water storage at 91 BCM (billion-cubic meters), much above the 10-years average and compared to 2018, and is likely to support farmers for double planting ahead of kharif 2020.

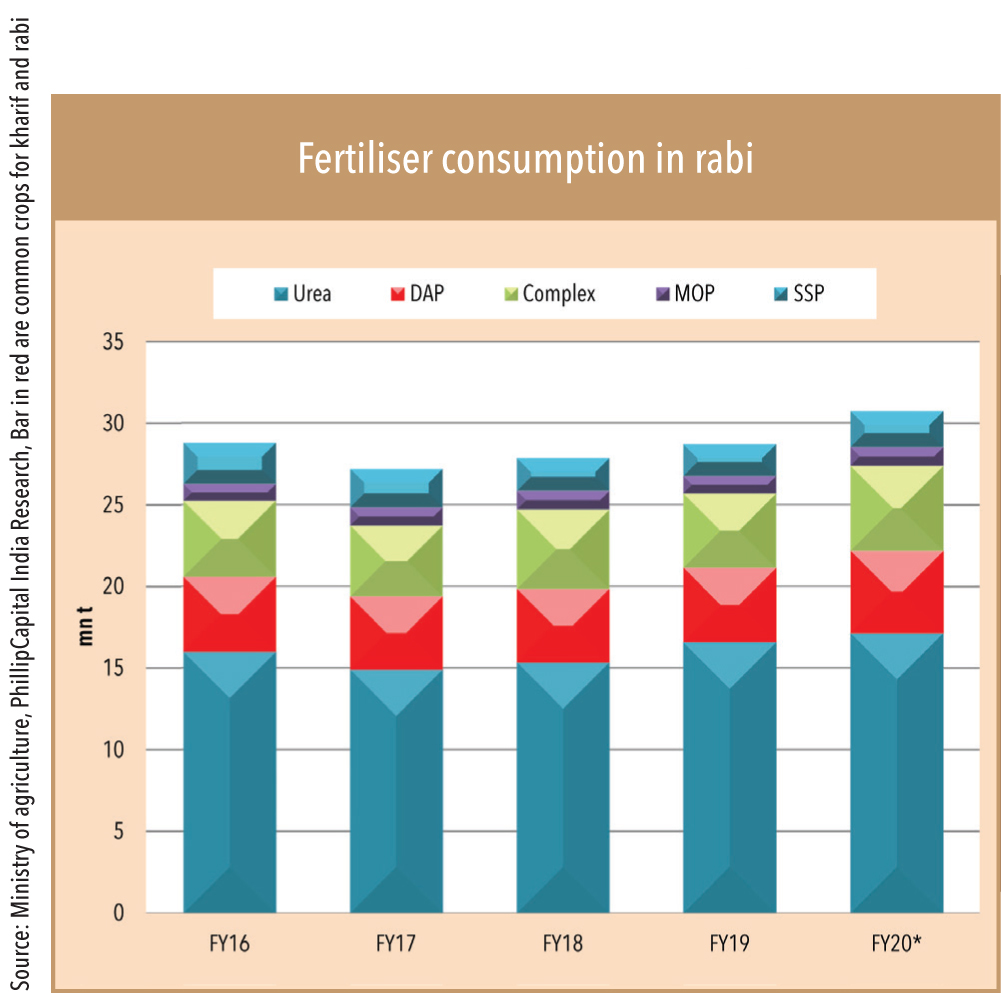

The bumper sowing supported consumption of agriculture inputs. So far, fertiliser (urea, DAP, complexes, MOP and SSP) consumption grew by 20% to 18mn tonnes in the first three months (Oct to Dec 2019) of rabi compared to 2018. Pesticides sales volumes also improved by 10-15% compared to last year’s rabi. “The season (rabi) is good. Herbicides and fungicides have seen 10-15% growth so far and we expect it to grow much higher,” said Mr Gupta, a large dealer of pesticides in Bhopal, Madhya Pradesh.

Better rabi is driving consumption

Good water reservoir levels with higher moisture content in the soil have supported consumption of agriculture inputs so far this year. It also supported companies in recovering some sales-volume losses incurred in kharif 2019.

“Rabi has been exceptionally good so far. Crop production and yields should be much better for farmers,” said Mr Pradeep Dave, Chairman of AIMCO Pesticide Ltd and President of Pesticide Manufacturer & Formulators Association of India (PMFAI). “See, kharif covers 60-65% of pesticide consumption. It was a not a good season for the industry, but now a good rabi is helping to recover some of the losses,” he added.

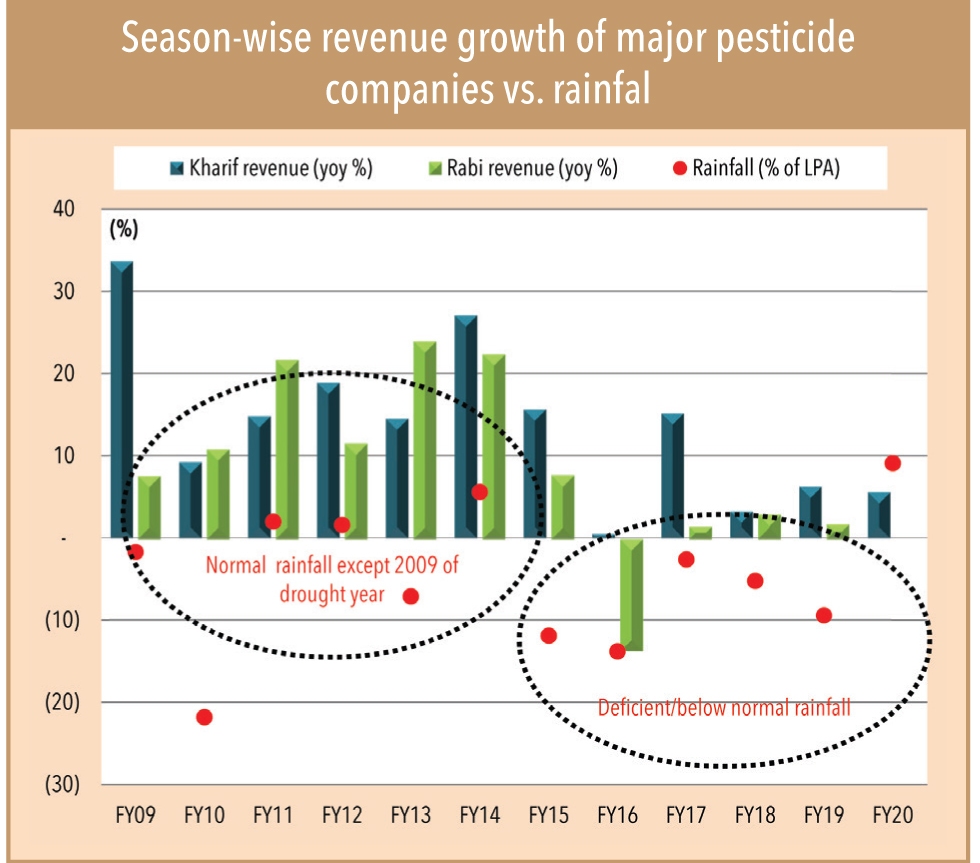

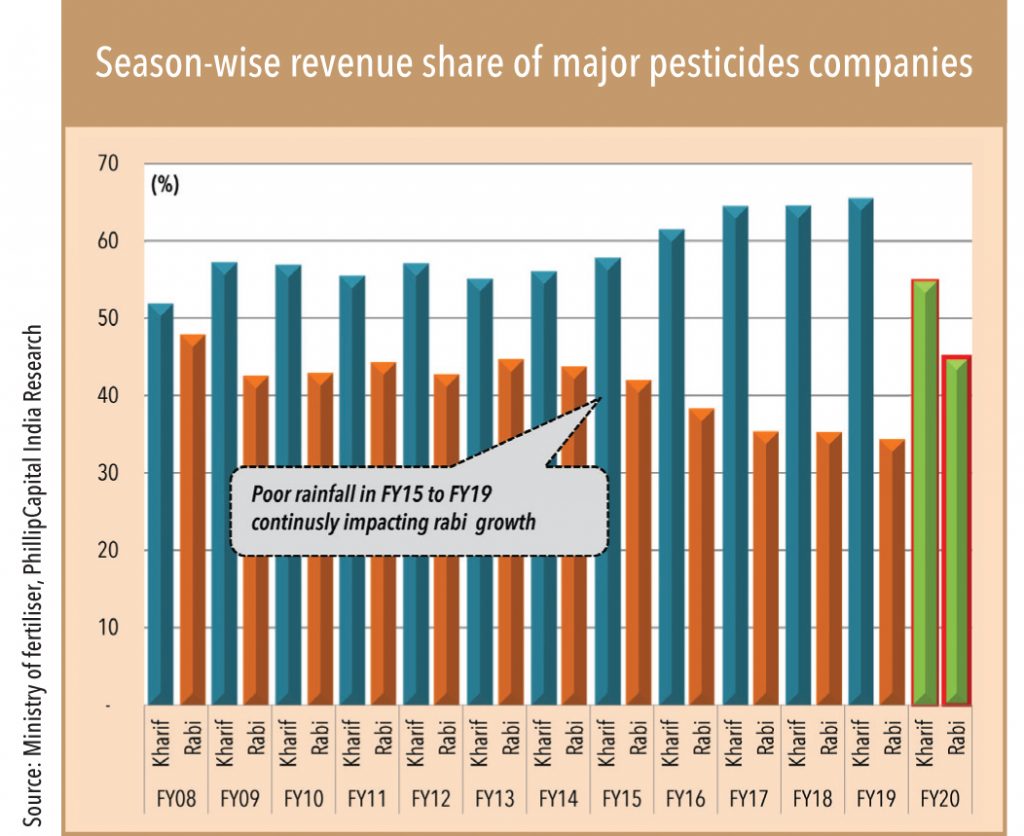

If we look at domestically driven agrochemical companies’ revenue in FY16-20 in the light of rainfall, revenue growth of both kharif and rabi have remained negative or in single digits, primarily due to deficient or below-normal rains. Similarly, normal rainfall in FY09-15 (even though FY10 was a drought year) supported 10-25% revenue growth in kharif and rabi seasons.

Rabi’s revenue share in pesticides was 45% in FY09-14, which gradually declined to 35-40% due to poor rainfall. However, it appears that this trend may change as monsoon has been above normal in 2019 after five years. Mr Rane of Indofil Industries point to better water levels (stored) this year, which should prove supportive in case of delayed rains this year.

“The past 3-4 years have been challenging for the pesticides industry mainly due to the rains,”

Mr Pradeep Dave, Chairman of AIMCO Pesticide Ltd and President of Pesticide Manufacturer & Formulators Association of India (PMFAI).

Will the government’s various measures to improve farmers’ income indirectly aid agriculture inputs companies in the short term or longer term?

Consumption of agriculture inputs clearly show that changes are visible

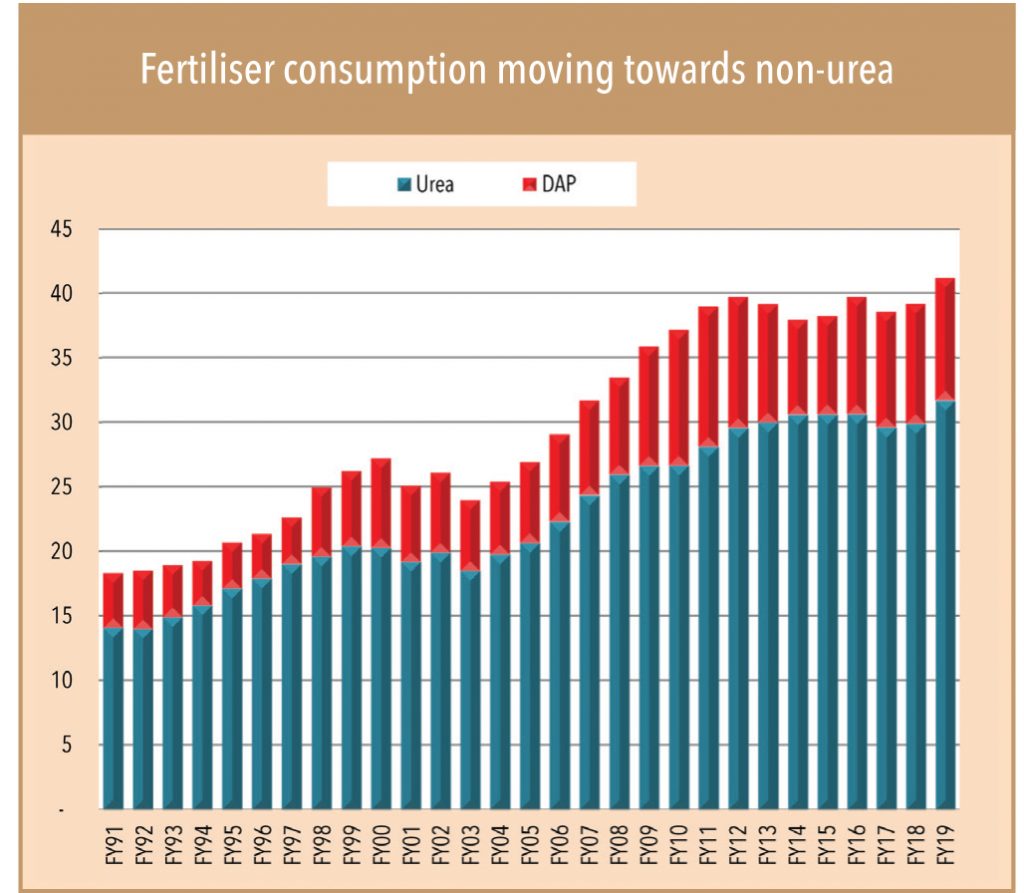

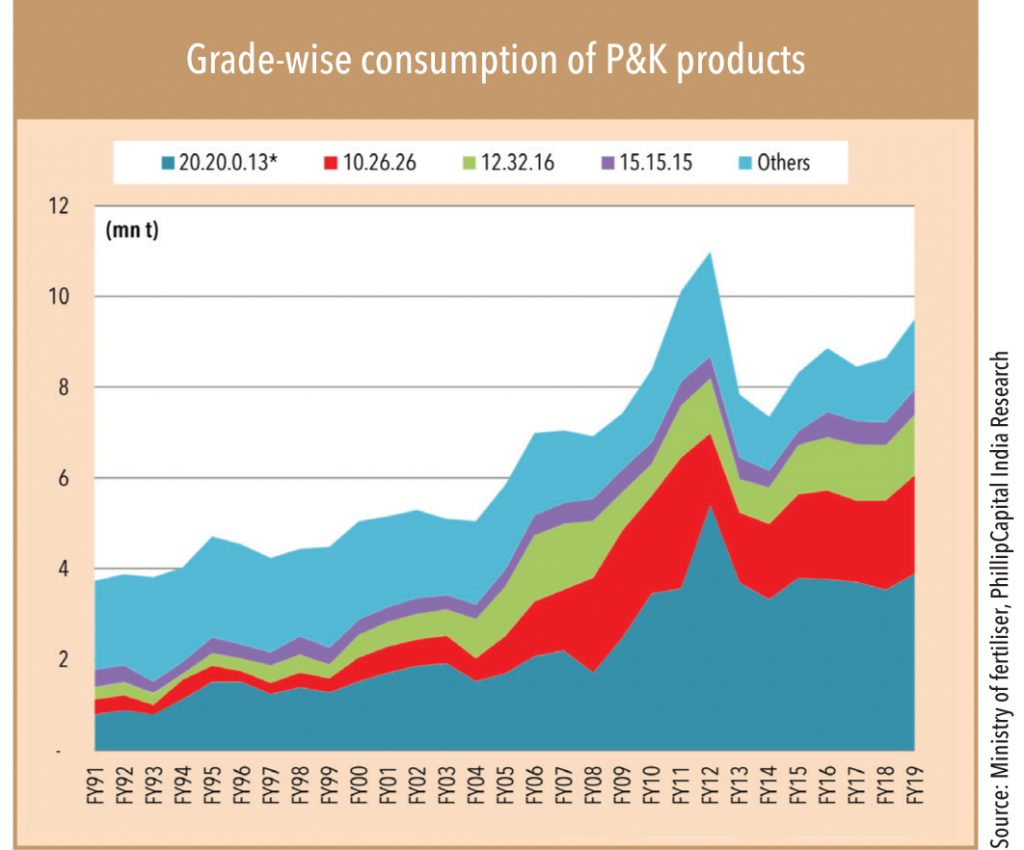

For instance, fertiliser consumption saw a CAGR of 3% in the past three decades, largely driven by urea, but interestingly, within non-urea grades, three popular grades (20-20-0-13, 10-26-26 and 12-32-16) saw a higher CAGR of 6%. “NPKs are becoming popular. Lower prices compared to DAP and extra nutrient content is supporting their growth. Also, consumption of fruits/vegetables and pulses is rising, helping better growth for non-urea products,” said Mr Sharma, a marketing manager of Indian Potash, the largest fertiliser importing company in India.

Agrochemicals consumption touched c.US$ 2.8bn, 9% CAGR in a decade

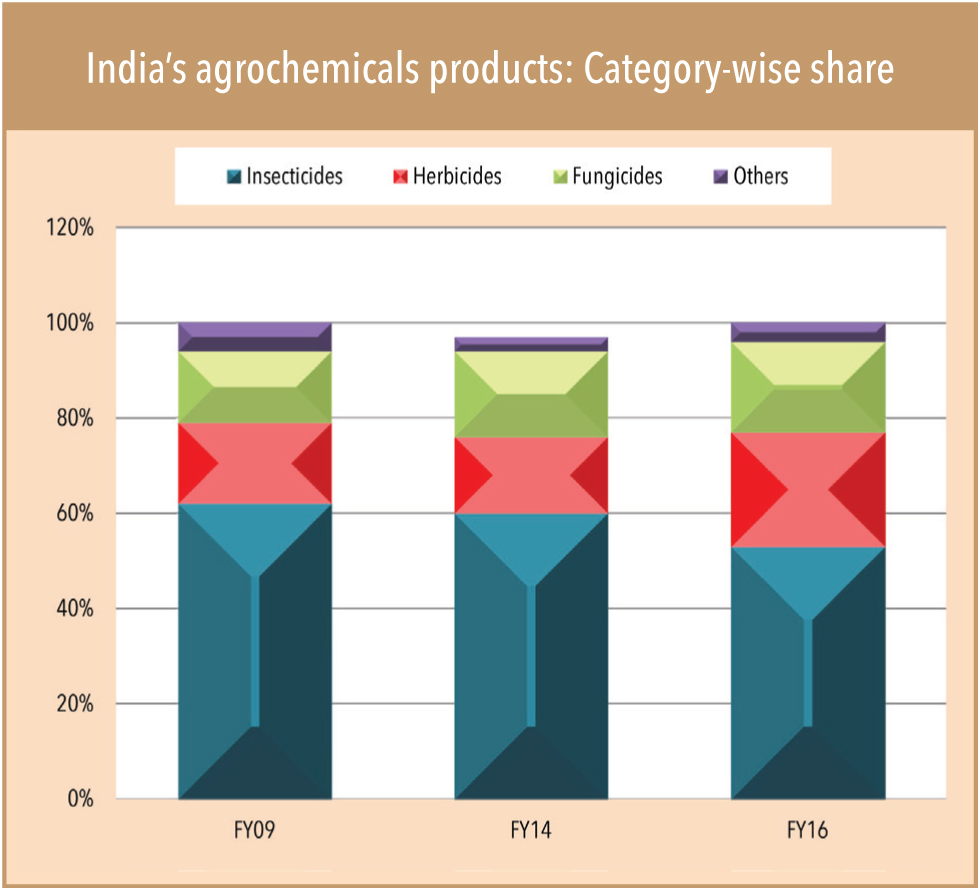

The usage of herbicides and fungicides products is rising and moving in line with global trends. “Labour cost is the major reason for the increase in herbicides, but weather and cropping patterns have also contributed to this rise,” said Mr Rane of Indofil Industries.

The consumption of agriculture inputs is rising, but also shifting towards quality products or bio products with increasing awareness among farmers to improve yield and crop production. A gradual shift towards specialty crops and the government’s efforts to support farmers clearly suggests better growth prospects for agriculture inputs over the medium to long term. “There is no option for us but to grow, as India is the lowest consumer of pesticides and fertilisers among comparable countries. Policies and technologies should be the key drivers,” said Mr Dave of PMFAI.

Other changes also support growth

Beyond government factors, other structural changes that support the consumption of agrochemicals are climate change, rising population, farm labour shortage, adoption of farm technologies, and most important, exports opportunities for pesticide companies. “Exports are a big opportunity for India for faster growth. China’s zero-growth approach has started benefiting India,” said Mr Sharma, a marketing officer at one of the largest pesticide exports companies in India. The Indian agrochemicals market is valued at US$ 5.0-5.5bn; exports are valued at c.US$ 3.0-3.5bn. Exports have seen 10% CAGR over the past five years with their share moving close to 50%. Many global agrochemicals companies are gradually shifting their outsourcing businesses to India, largely due to China’s green initiatives over the past few years.

“Innovators always look at reliability, quality of products, and assurance while outsourcing manufacturing, and India is seen as the best fit to take over from China,” said Mr Sharma. Certainly, India has becoming a strong partner with innovators considering its core advantages in terms of manufacturing capability, R&D facilities, skilled manpower, and support and trust of global innovators for outsourcing opportunities. In fact, results are visible – one has to just see some of the companies’ exports growth. For example, PI’s export revenue CAGR was 29% vs. domestic revenue CAGR at 9% over the past decade. Similarly, UPL’s was 15% vs 12%.

The China angle

In addition to China deliberately slowing down industries detrimental to its environmental health, the US-China trade war and erratic weather dented the global agrochemicals market over the past few months. However, the recent US-China trade situation is likely to improve in coming months. The US is the largest exporter of agri products to China (c.50% share of soybean). With the signing of Phase-One of the trade deal last month, US agriculture exports have the potential to growth 5x because of China in the next two years, which should improve consumption of US agrochemicals and indirectly support the growth of Indian exporters.

Subscribe to enjoy uninterrupted access