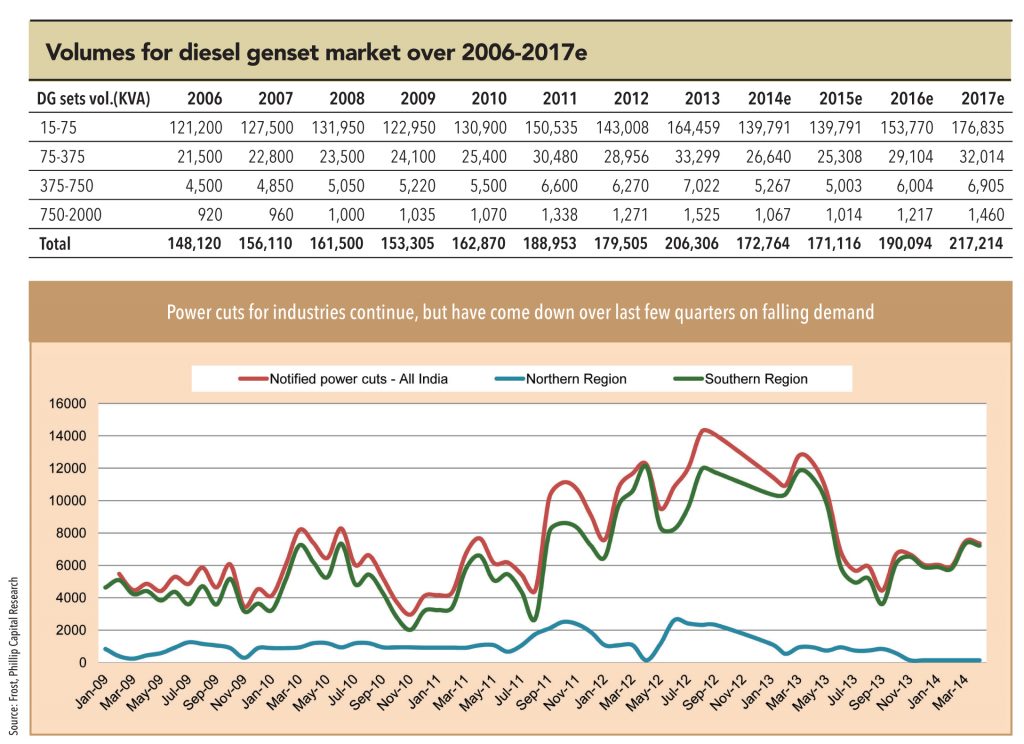

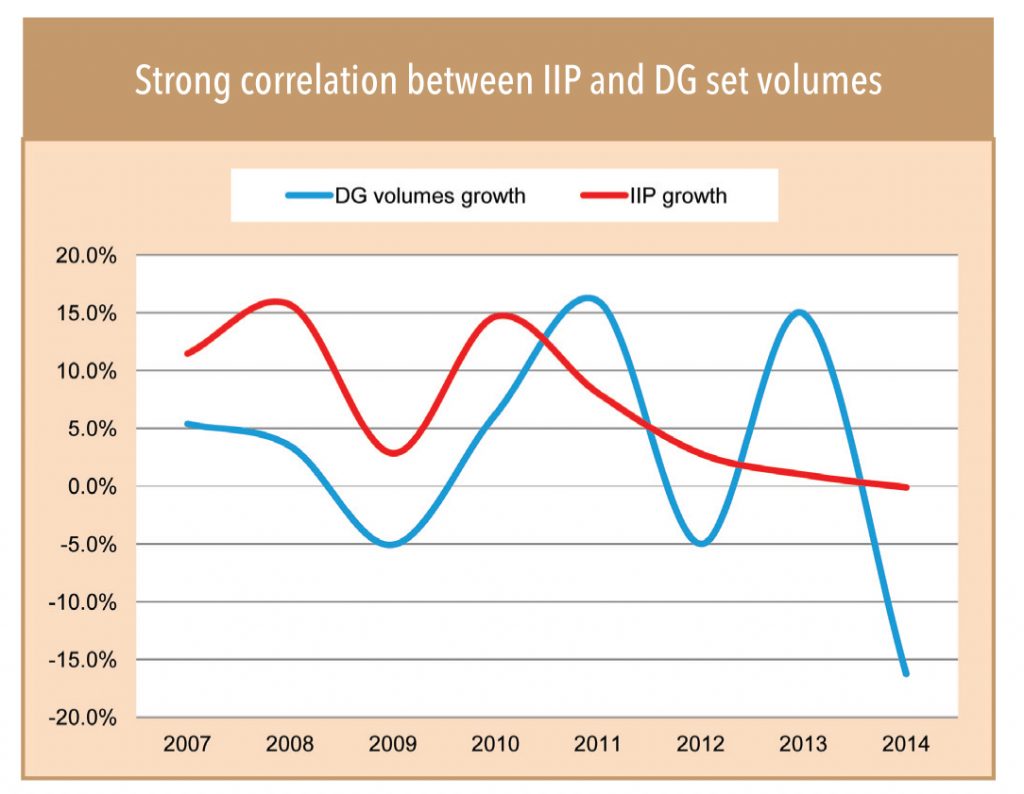

After seeing strong growth in volumes over FY05-08, DG set volumes saw a sharp slowdown in FY09 because of a liquidity squeeze due to the Lehman crisis. While there was a sharp recovery in FY13, primarily driven by high deficits in the Southern region (DG volumes up 40% YoY for Cummins India in Tamil Nadu and Andhra Pradesh), FY14 has seen a sharp collapse.

Our interactions with various industry participants including engine manufacturers, OEMs, dealers, and end users indicates that there has been a significant slowdown in demand over the past year. The reasons are varied – a slowdown in industrial capex, a slump in commercial and residential real estate, and a sharp slowdown in infrastructure capex in roads, airports, metros. All of these has led to a fall in industry volumes in FY14 (down 15-20% YoY, with a larger decline in mid- and high-kva segments) — going by current demand trends, there should be only a flattish growth over FY15e, at best. In any case, most engine manufacturers are predicting a fall in volumes to the tune of 5-10% YoY for FY15e.

Power deficits certainly help revive demand in the short term (note the current surge in volumes in North India and the sharp jump in volumes in Tamil Nadu and Andhra Pradesh in FY13). However, a repeat of the sustained growth in volumes (as seen in 2005-2008) requires a revival of spending on infrastructure, real estate, and industrial capex.

Our interaction with various industry participants indicates that FY15 could be the bottom for the market and it should revive from FY16. There is a belief that the new government at the centre would help revive economic growth via increased infra spending — this will in turn benefit DG set manufacturers.

Our interaction with various industry participants indicates that FY15 could be the bottom for the market and it should revive from FY16. There is a belief that the new government at the centre would help revive economic growth via increased infra spending — this will in turn benefit DG set manufacturers.

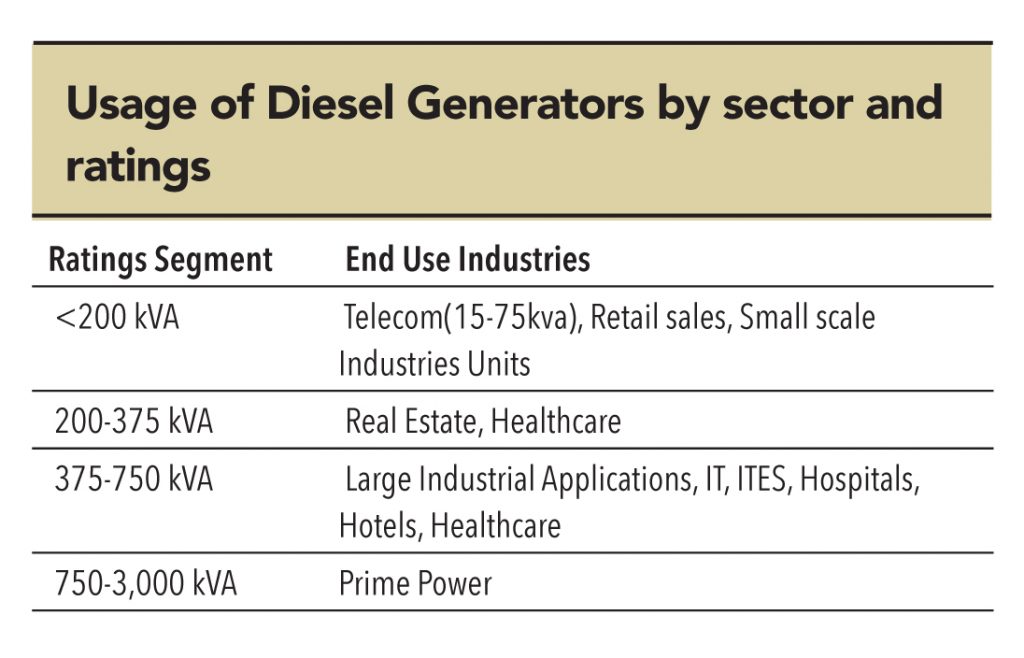

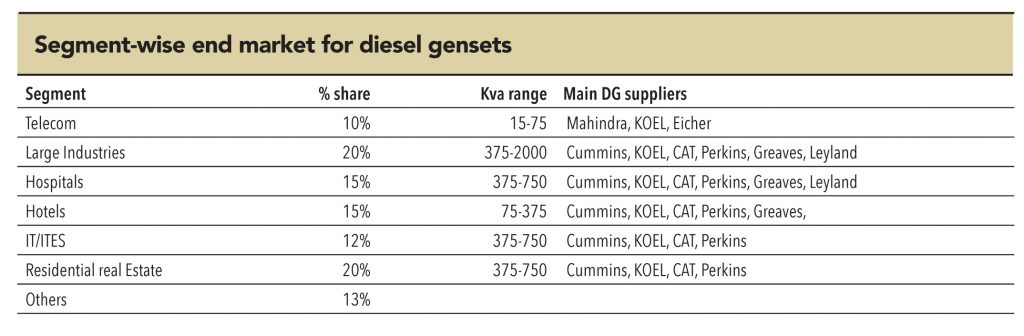

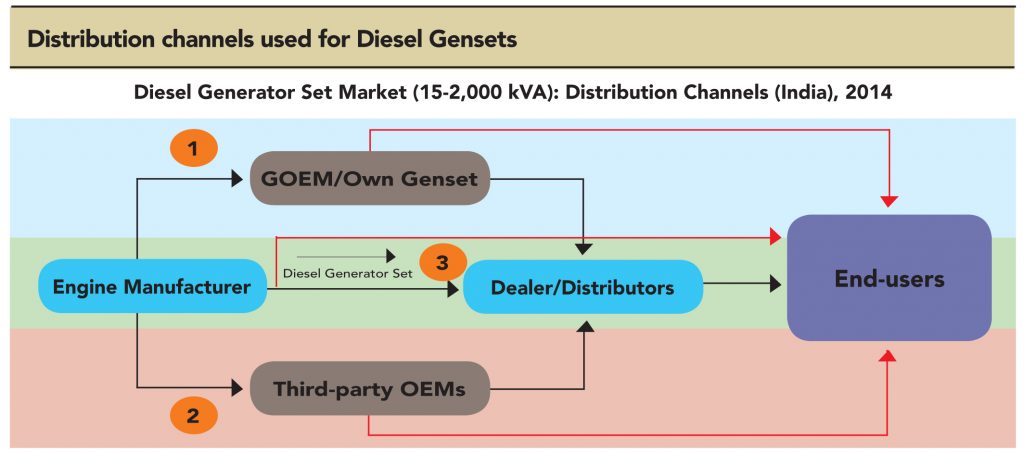

1. Engine manufacturers supplies engine to exclusive GOEM, which later integrates engines, alternators and panels and markets them to end users through its dealer network/distributors (for e.g. Cummins India Ltd, KOEL and Caterpillar.)

2. Engine manufacturers supplies engine to third-party assemblers and OEMs, which later sells the generator sets to end users through its service dealers/distributor network (for example Mahindra, Eicher, Excorts, Ashok Leyland, and so on)

3. Engine manufacturers assemble generator sets at their end and sell to the end users either through dealers or directly to the end-users (for e.g., Greaves Cotton Ltd and also in limited cases suppliers such Mahindra and KOEL)

Subscribe to enjoy uninterrupted access