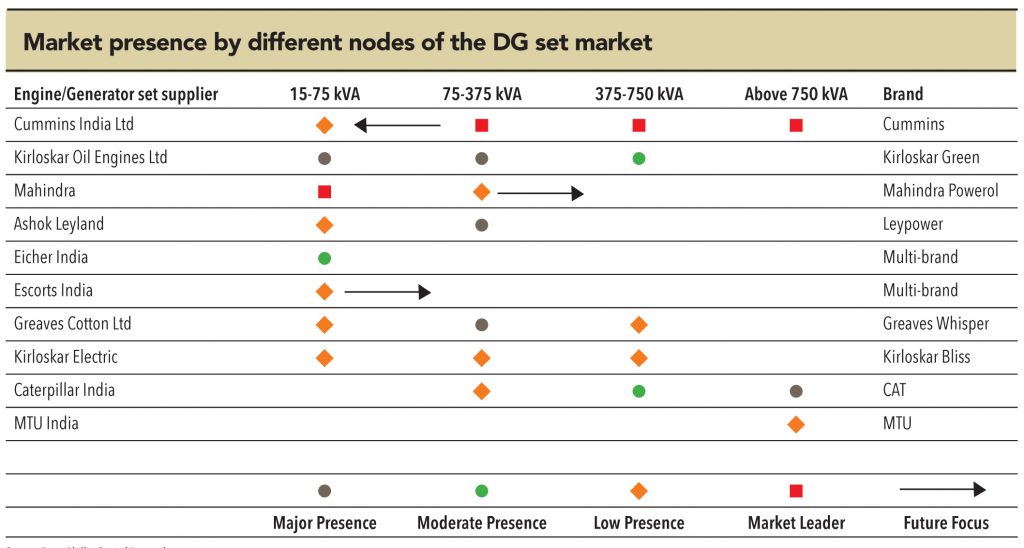

After a sharp slowdown in FY14, the Indian diesel genset industry is set for a rebound from FY16 onwards. This would be lead by a revival in infrastructure spending and get a further boost as commercial and residential real estate picks up alongside industrial spending. Stagnant to muted coal production growth is expected to lead to higher power deficits and increased DG demand. The competitive dynamics of the industry are also set to see a sea change with the new CPCB II norms – more so in the lower kva (<180kva) where the unorganized sector has ~15-20% of the market. These players may be forced to exit the industry and their market share taken by players such as Cummins India, KOEL and Mahindra.

In 2003, the Indian government had set a target of “Power for all” by 2012. It was expected that the Electricity Act would usher in a new era of private participation in power, open up access, and cause a sharp reduction in T&D losses and hence availability of cheap power to the masses.

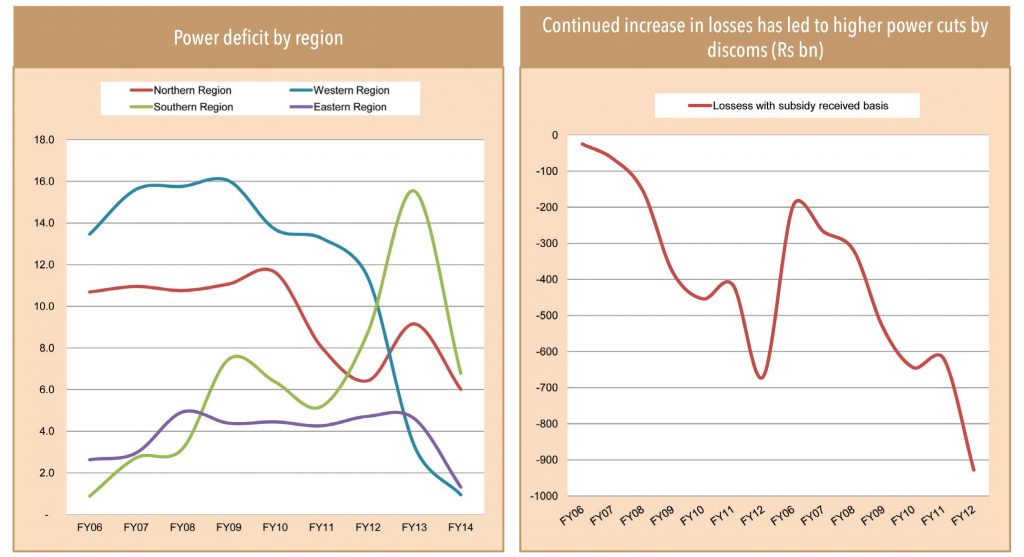

While much water has flown under the bridge since then, India remains a power-starved country with many states continuing to face severe power shortages, especially in the summers; this is particularly true for the Southern states (Tamil Nadu and Andhra Pradesh — now Telangana and Seemandhra), Uttar Pradesh, Haryana, and Bihar. Availability of 24/7 reliable power from the grid remains a dream in most states even today, and the poor financial condition of SEBs implies further power cuts for the consumers and the industry.

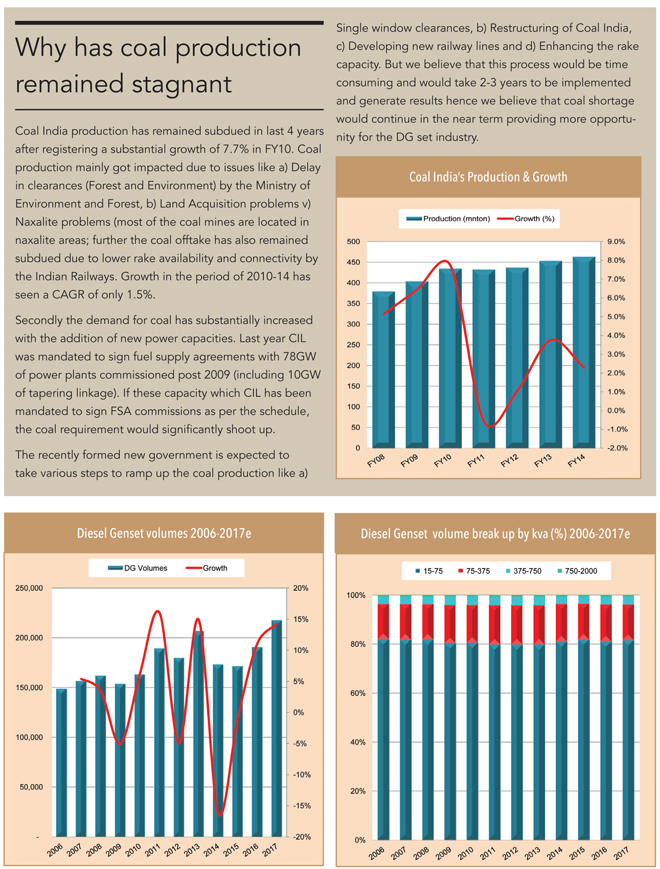

This in turn has provided a huge opportunity for diesel genset manufacturers, who continue to add around 9GW of capacity every year. To put it in perspective, over the last three years, India has added 17-18GW of power capacity every year (ex-renewables), but a large portion of the new capacity continues to operate at around 60-65% utilization levels, not because of lack of demand, but mainly because there is a shortage of coal to fire the power plants. We believe that DG set manufacturers could be in a sweet spot over the next two years if economic growth revives and Coal India is unable to ramp up capacity significantly– this may result in higher power deficits and increased demand for backup power.

Key players operating in the Indian DG industry include Cummins India, Kirloskar Oil Engines, Mahindra Powerol, Greaves Cotton, Ashok Leyland, Eicher, and Caterpillar/Perkins. While Cummins India dominates the mid- to high-kva segments (ratings >180kva), Kirloskar Oil Engines is a market leader in the low- to mid-kva segments.

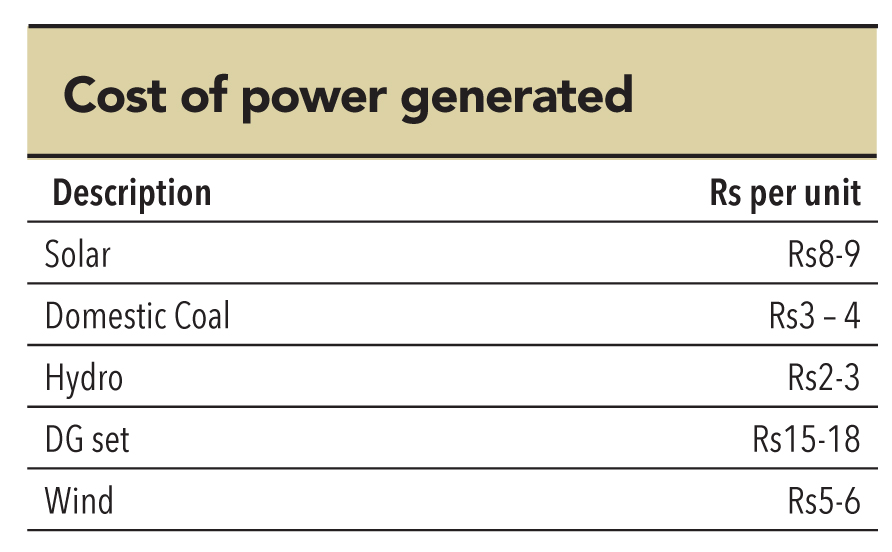

With bulk diesel prices linked to the market from last year, cost of power generation using diesel gensets has gone up to Rs15-18/unit, which appears to be quite expensive vs. traditional sources of power generation such as coal, hydro, wind, gas, and solar, whose cost of generation is in the range of Rs3 to Rs9 per unit. However, given the poor quality of grid power, the dependency on DG sets for backup power has continued to increase in India.

Subscribe to enjoy uninterrupted access