Mr S K Gupta who trades in long and flat steel is optimistic about the new government driving industrial demand, but is savvy enough to realize that business will revive only if a stable government comes with a clean majority. Chetan Agarwal from Raipur shares his sentiment and says, “I expect demand to improve after 6 months with the new government taking initiatives for growth.”

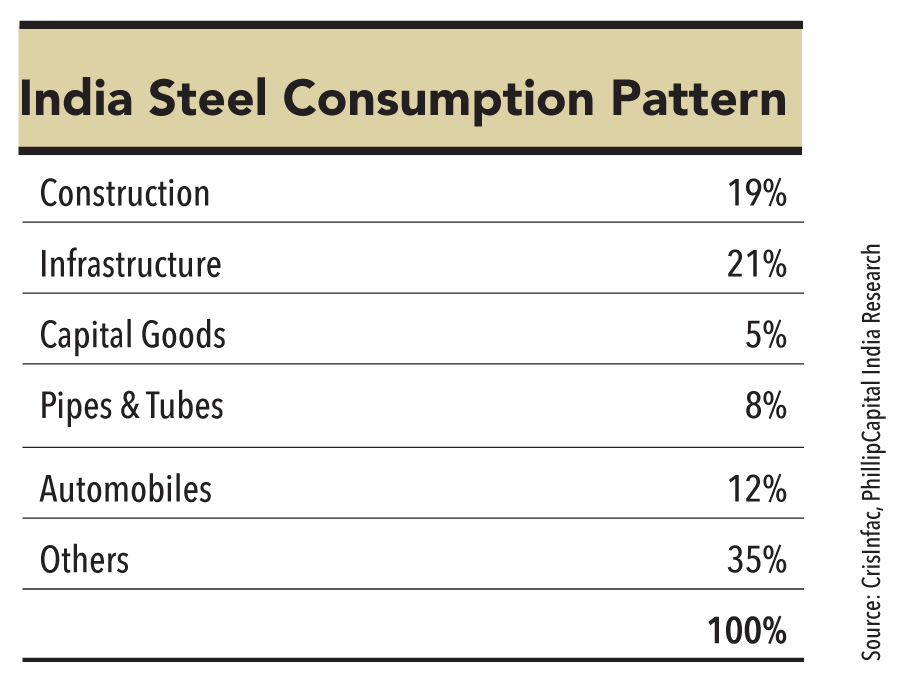

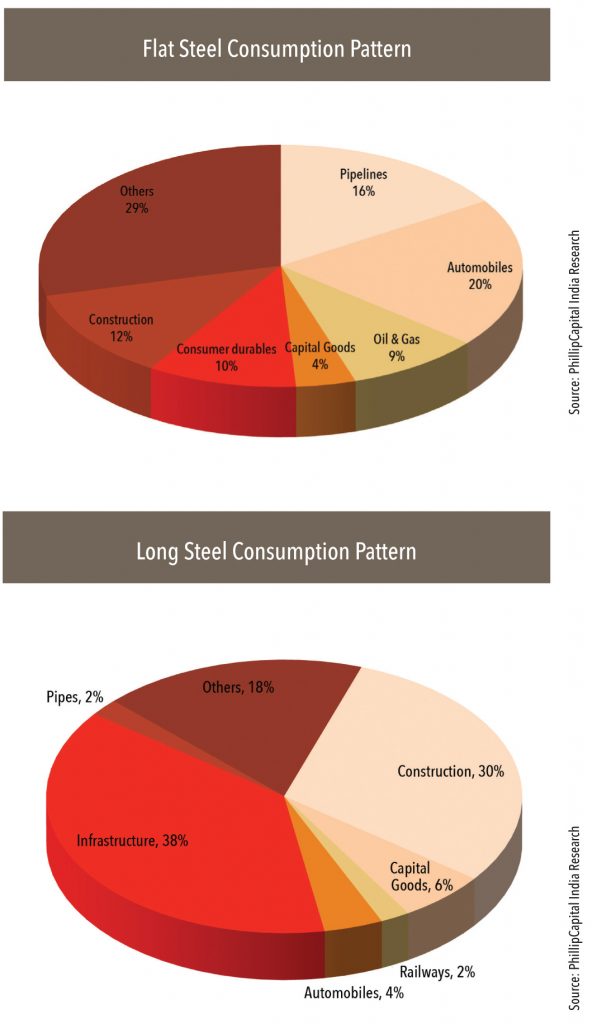

The fortunes of many small- and mid-sized players hinges on a new progressive government at the center. It is clear that most of these players expect demand to pick up after elections — they believe a stable government will fast-track work on investments in the infrastructure sector, thereby boosting steel consumption in India. As seen from the charts alongside, more than 50% of India’s steel consumption depends on the infrastructure- and construction-related sectors.

While expectations continue to stay high, steel consumption in FY15 will not see any material movement and any positive impact of possible policy initiatives by the new government will largely be felt from FY16.

“I expect demand to improve after 6 months with the new government taking initiatives for growth.”

– Chetan Agarwal, Raipur

Projects are only on paper and there is no major execution happening on these.

Mr Sameer Mehta, who operates a steel service centre in Maharashtra,

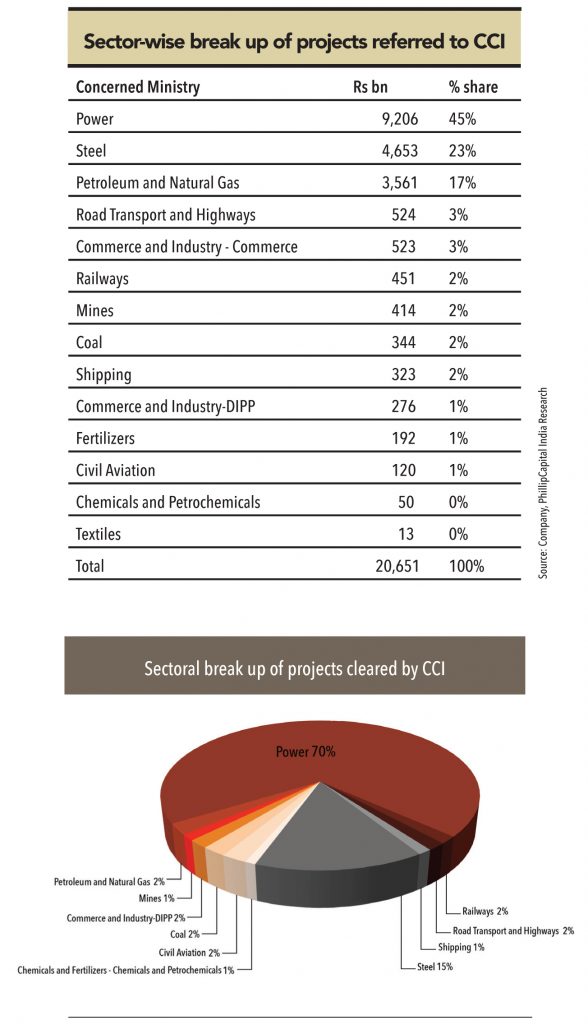

The current UPA government formed a Cabinet Committee on Investments (CCI) to fast track implementation of various stalled projects — 427 projects worth Rs 20tn were referred to the committee, of which projects in the power, steel, and oil & gas sectors accounted for ~83%.

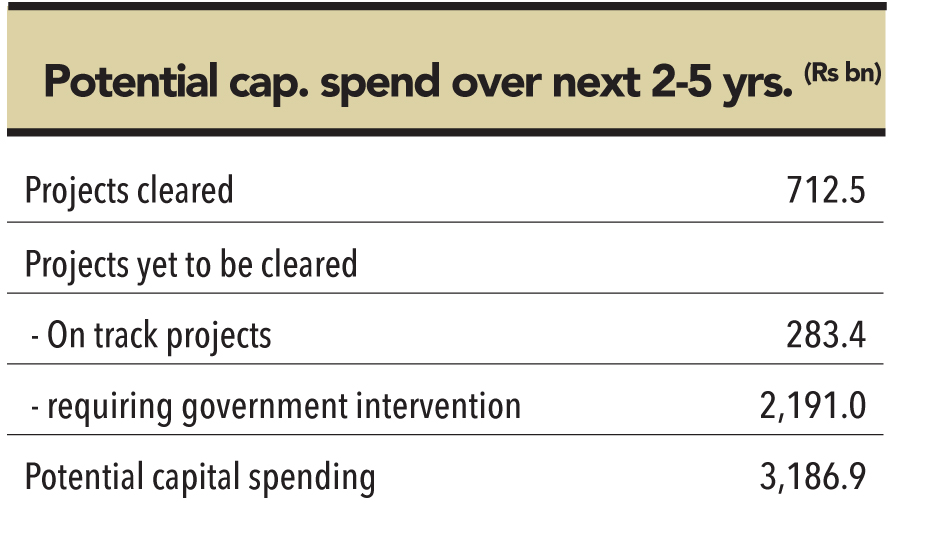

Out of the 427 projects, the CCI has cleared only 146 projects worth Rs 5.4tn (26% of the projects by value) until February 2014. Our review of around 100 projects out of these 146, representing 91% of value of projects cleared, reveals a spending potential of only Rs 0.7tn. Out of the Rs 5.4tn worth of projects cleared, 70% are from the power sector (as seen from the chart) where the plants have been built but are stranded due to no fuel availability. The power sector projects were cleared on fast track primarily to save the Indian Banking sector from a significant jump in the NPAs. Mr Sameer Mehta, who operates a steel service centre in Maharashtra, acknowledges this fact saying he does not expect any increase in demand before CY15 as the projects are only on paper and there is no major execution happening on these.

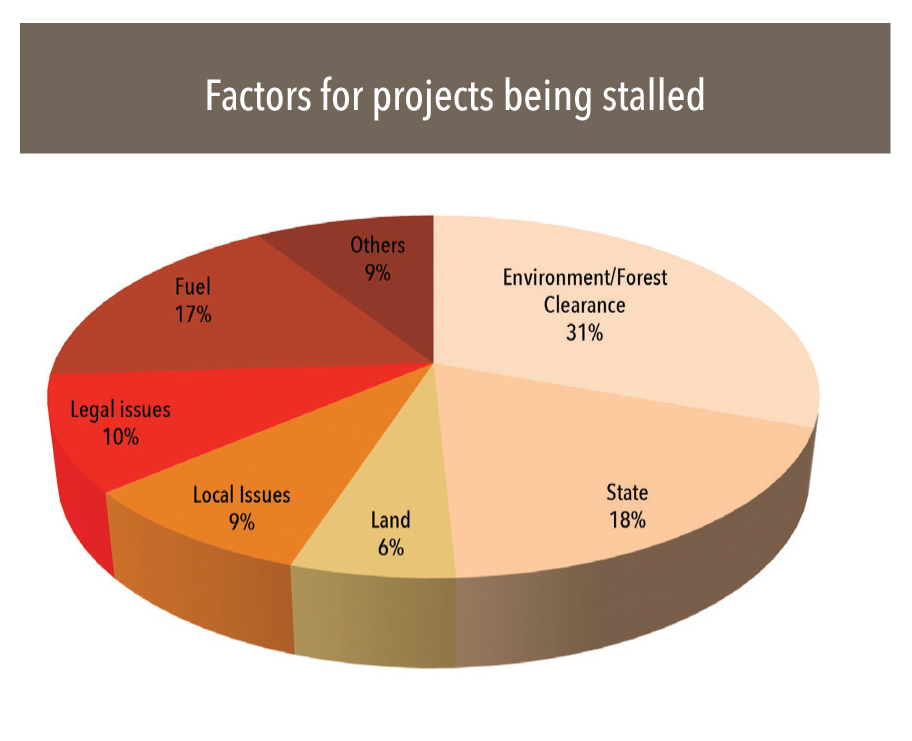

If it wants to, the new government can play a major role to free up many tied-up projects, which could trigger further spending and revive steel consumption. Out of the pending projects, the central government can have a direct role in untangling around 50%, while the other 50% are stalled due to issues at the state government level, local issues, and legal problems. About 30% of the projects are delayed for want of environment and forest clearances and 17% are stuck due to no fuel availability. The government’s approach to these issues will determine the pace at which these projects come online and thereby improve steel demand.

A PhillipCapital India study across 80% of the projects yet to be cleared amounting to Rs 12tn shows that projects worth Rs 5.5tn are not likely to start in the near term. Projects worth Rs 1.9tn are currently on track and can see a total spending of roughly Rs 283bn over the next 2-5 years. Projects worth Rs 3.1tn would need government interventions from both the state and the center, which could lead to a total spending of about Rs 2.2tn over the next 2-5.

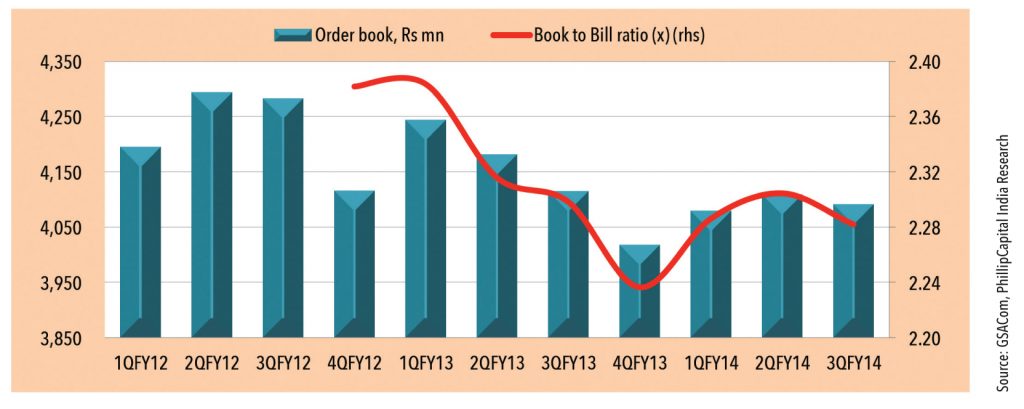

PhillipCapital estimates a total capex of around Rs 3.2tn over the next 2-5 years commencing majorly from FY16 onwards. This amounts to only 15% of the value of total projects referred to the CCI. While the spending looks huge in absolute terms, it looks quite miniscule when you juxtapose it with the orderbook position of major companies from the capital goods and construction sector — the potential capital spending accounts for only 75% of the orderbook of the top-16 companies in the sectors. The total orderbook of these companies (Rs 4.1tn) has seen a CQGR of -0.3% since the start of FY12. Book-to-bill ratio has declined from 2.38x at the end of FY12 to 2.28x in Q3FY14.

The order book and the potential spending reflect a weak demand scenario in FY15, which has the potential to decline further in the near term before any material growth starts only from FY16 onwards. This does not augur well for overall steel demand in India, which derives ~50% volumes from the industrial and infrastructure sectors. Overall demand growth is likely to stay subdued in FY15 vs. 8.2% CAGR over the past decade and 5.6% CAGR FY10 till date.

Subscribe to enjoy uninterrupted access