Why is it important to look at what is happening to small steel players? Because the Indian steel industry is undergoing a tremendous systemic change and is becoming increasingly institutionalized. What happens to these players (good or bad) will affect the fortunes of the larger listed entities. Today, not only do larger players command a huge market share and are price leaders, but they are also looking at penetrating the retail market (a traditional forte of the smaller enterprises) and are using their enormous financial muscle to edge out small and medium sized units and even traders and middlemen. While this is good for the large players in the long term, going by India’s demand and supply scenario (enormous capacity creation), eventually, only the highly efficient, innovative, and lean SME steel units will survive in India. Here is a Ground Zero look at what is happening in this part of the steel industry…

“90% of the structural mills have shut down in Mandi Gobindgarh,”

– Mr S K Gupta from Delhi who trades in structural steel.

Demand = Nil,” says Mr Vijay Deriwal, a small-sized flat steel trader who has seen his business contracting significantly due to low steel demand and stiff competition from larger companies for higher volumes. The reactions of some of his counterparts dealing in various steel products in North India are similar. Slowing steel consumption and significantly higher competition from primary steel producers have seen the businesses of most smaller steel producers and traders in India contracting.

Primary producers are arm-twisting secondary producers

“90% of the structural mills have shut down in Mandi Gobindgarh,” – says Mr S K Gupta from Delhi who trades in structural steel (steel construction material).

He has shifted his procurement from these smaller mills to JSPL because of the various facilities provided by the larger player. “I don’t need to carry any inventory for structurals as the material is directly dispatched from their factory.” With their financial clout, larger primary producers such as JSPL are systematically edging out smaller producers and traders out of the system. The same scenario is seen repeated across various parts of the country — smaller producers have shut operations or altered their product profile to survive. “40% of structural mills are shut and this has helped primary producers gain market share,” says Mr Chetan Agrawal from Raipur whose structural steel production has come down to zero due to low demand. “Lack of demand from industrial projects has impacted our production which has forced us to shift to other product segments like TMT bars,” he adds.

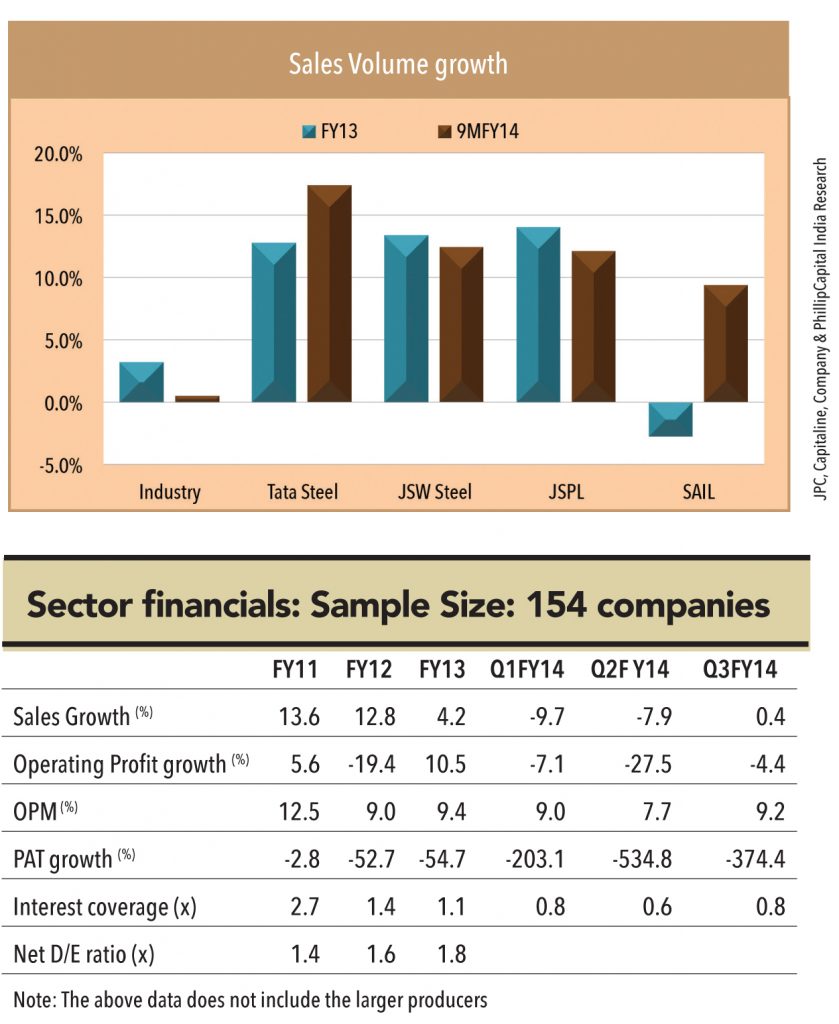

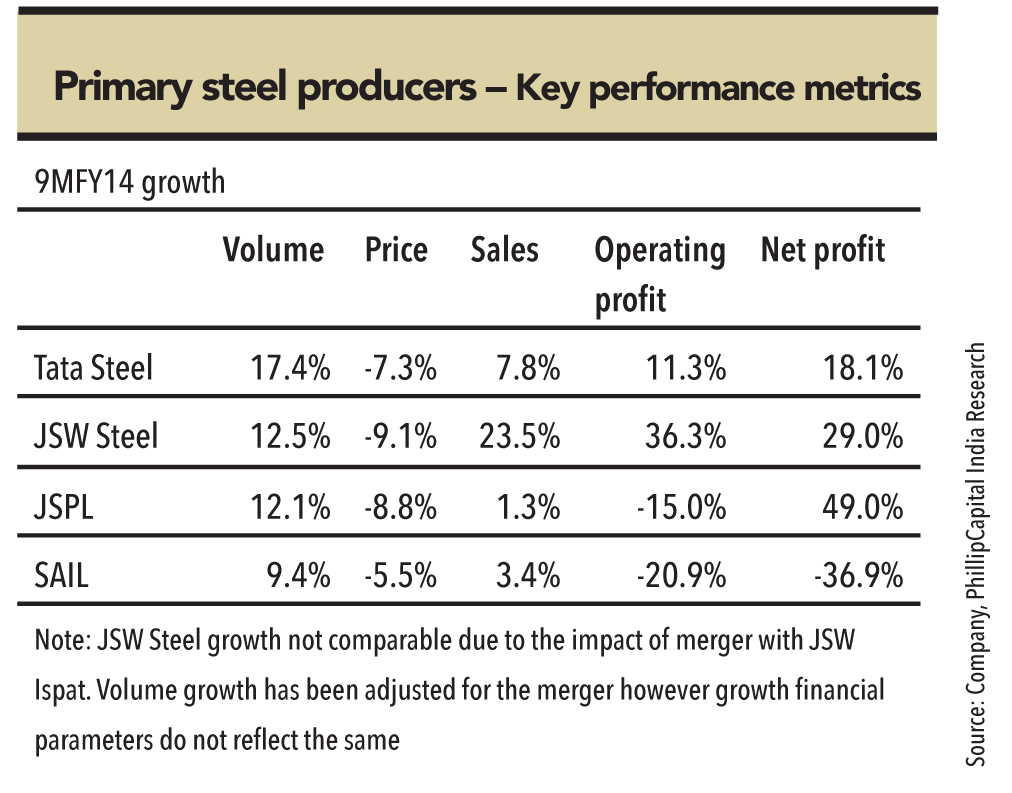

The fact that primary producers are gaining volumes at the cost of the smaller players is reflected in the larger players’ sales volume growth numbers vs. industry consumption growth —these producers’ overall market share has risen from 40% in FY12 to 41% in FY13 and ~48% in 9MFY14.

Primary producers: Branding/direct marketing is the trick

“Direct company sales is impacting volumes,” says Mr. Vijay Deriwal who trades in flat steel and caters to the NCR region. “Our volumes have shrunk and come down to 25-30% of our earlier volumes,” he laments. Lately, primary producers have captured a larger chunk of the retail market because of aggressive marketing — JSW Steel has increased its retail outlets and Tata Steel and JSPL are focusing on branding to gain a foothold in the retail markets, which were once the core forte of secondary producers. In addition to in-creasing their penetration in retail markets, large companies have also increased their direct mar-keting efforts in the SME sector to cut out mid-dlemen and improve margins. As Mr. S K Gupta points out, “Companies like JSPL have started directly entering MOUs for industrial projects and this has helped them ensure volumes”.

Liquidity: An equally important factor impact-ing volumes for the secondary sector

According to the President of Faridabad Iron & Steel Traders Association (in a recent media re-port) 80% of the steel trading happening in Farid-abad is facing payment delays of 2-3 months. This has seen volumes falling due to reducing asset turns. Limited availability of capital and an increasing working capital cycle has started adversely affecting volumes for the entire steel industry. While capital availability has played an important role, there is a sense of unease among the trading community. They would rather not sell than extend credit that may not come back. “We prefer selling less than blocking our money in debtors which could go bad,” says Mr Chandresh Mehta who mostly operates in Maharashtra.

The liquidity factor has driven industry volumes (of secondary producers and the trading community) down materially over the past year. The table above aggregates the financial performance of 154 companies in the sector (excluding the larger players). Declining volumes and increasing leverage (net debt to equity increased from 1.4x in FY11 to 1.8x in FY13) has made the debt servicing (interest coverage reduced from 2.7x in FY11 to 0.8x in Q3FY14) difficult for players over the past year.

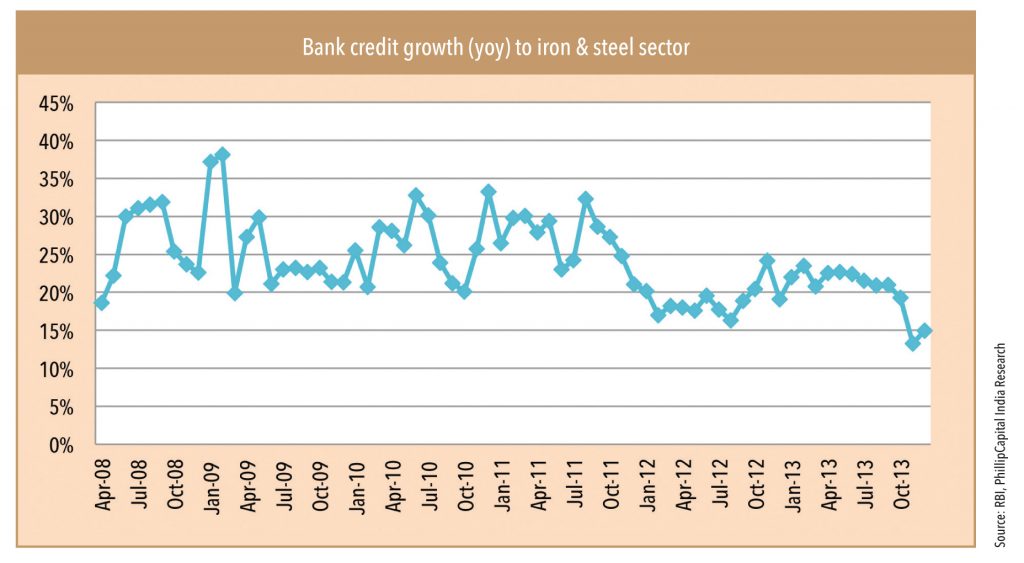

Banks averse to increasing their lending to secondary producers

Mr Chetan Agarwal, a TMT producer from Raipur, believes that he has lower working capital at his disposal because of the overal l poor performance of smaller steel manufacturers in the past cou-ple of years. Declining revenues, poor profitability, and increasing strain on the balance sheet has made Indian banks averse to increasing their lending to this sector. This reflects in the growth in outstanding credit to the sector, which has started coming off sharply over the past few months. As per RBI’s data, outstanding credit to the iron & steel sector grew by 21% yoy in September 2013 vs. a 23.3% yoy increase in the gross debt (as on September 2013) of the primary steel producers. This implies a decline in the debt outstanding for the rest of the sector (other than large players) following a tight stance adopted by the Indian banking sector.

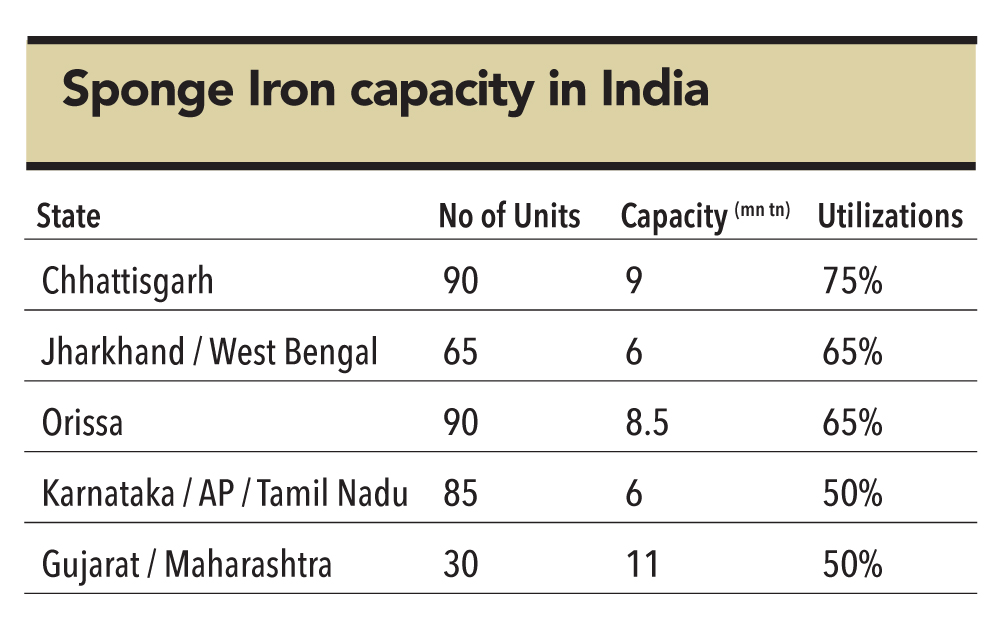

Industry utilizations significantly lower

Tight liquidity and declining profitability has led to volumes falling for the sector except for large players, as can be seen from the capacity utilizations of sponge iron plants across various states, which range from 50-65%. Chhattisgarh is the only exception to this. However,excluding JSPL’s sponge iron production, average utilizations for Chhattisgarh would also be around 65%. This has benefitted primary producers the most because they could capture a larger pie of the volumes due to their stronger balance sheets.

Primary producers: Volume growth is the savior

Volume growth helped primary producers sail through tough market conditions (falling prices and flat domestic demand). Large players’ volumes were not only at the cost the small producers but also some major producers like Essar Steel whose liquidity issues saw its production fall by 24% in 11MFY14. Its steel production in this period was 2.8mn tonnes vs. its capacity of 10mn tonnes. Falling profitability and leveraged balance sheets affected Essar Steel’s production.

As seen in the table below, the profitability of primary players would have been under severe pressure but for volume growth. The operating profit growth for all players (except JSW Steel) has been lagging volume growth due to subdued pricing.

Subscribe to enjoy uninterrupted access