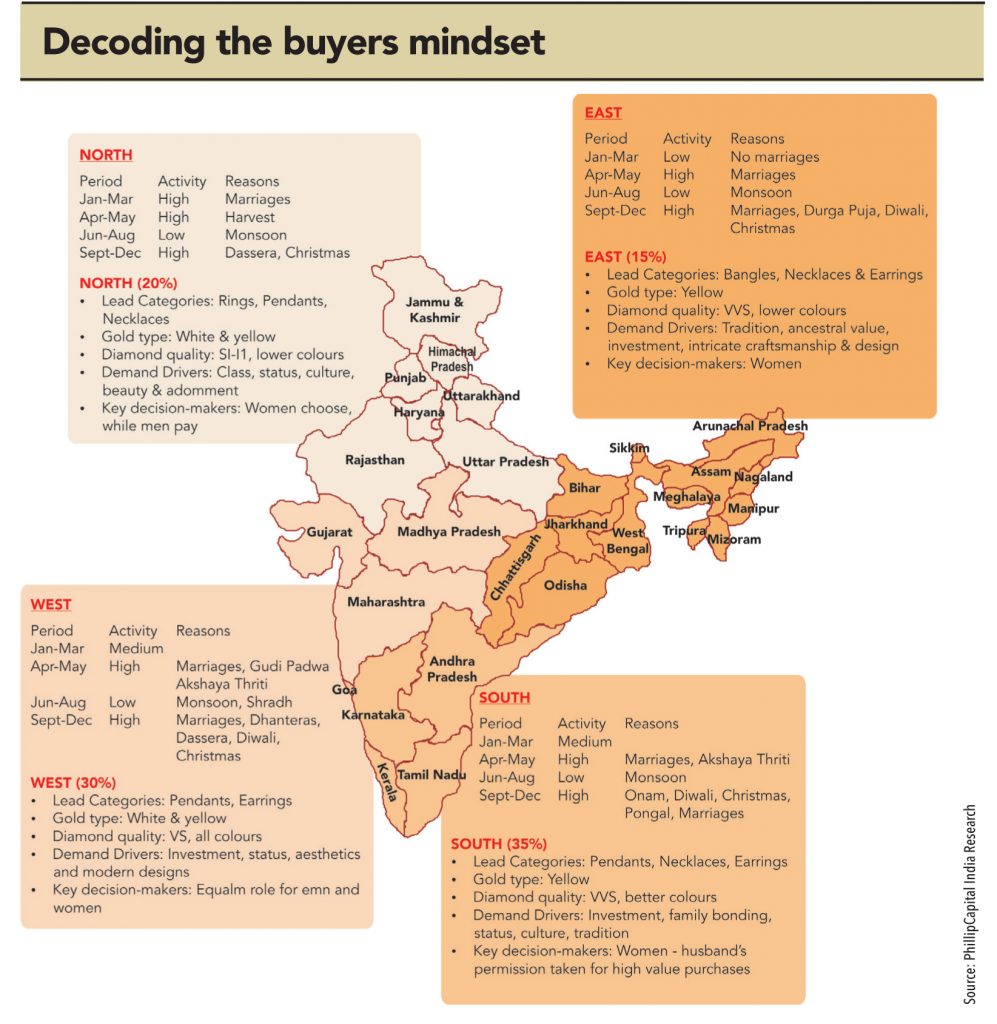

While south India remains the largest consumer of gold within India, some of the biggest southern players have entered the north. Malabar Gold, Kalyan Jewellers and Joyalukkas (incidentally all from Kerala) have been aggressively expanding outside south India. All three put together have an estimated turnover of Rs 300bn. As they venture into north India, Ground Zero explores the differences between the operating environment in the two regions and the strengths and weaknesses of these players and tries to answer the question — will southern players succeed in the North?

We explore some of the largest gold consuming cities of south India to look at current demand trends and buying behavior. We also try to understand the operating environment and business models of south jewelers as they go north. We found uncanny similarities and stark differences. Ground Zero research came across very interesting nuances peculiar to individual states where breaking the barrier doesn’t seem all that easy. Trust, cultural beliefs, designs, and loyalty would test the business models, while the willingness to adapt and establish robust supply-chain management would determine sustainability. This story is about a confluence of cultures — a challenge to move towards de-centralized control of business. Mirroring Bollywood, our south meets north story evokes excitement, but has its twists, turns, and pitfalls.

“70% of the gold consumed in the country is actually bought on ‘occasions’ (weddings, engagements, festivals, etc.)”

– Amresh Acharaya, Director Investments, World Gold Council (WGC).

As per the WGC, 40% of India’s gold consumption is in South India. It is home to the largest gold consuming state (Tamil Nadu) and the highest per-capita gold-consuming state (Kerala).

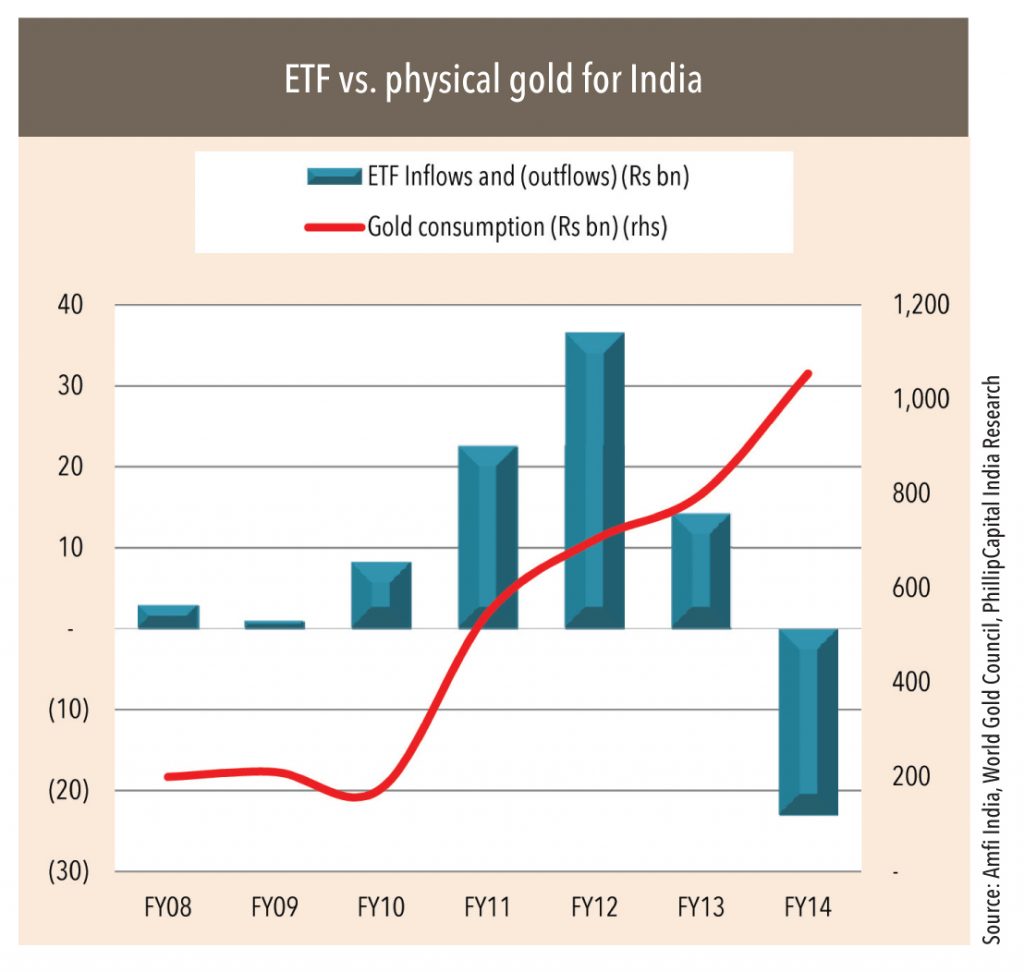

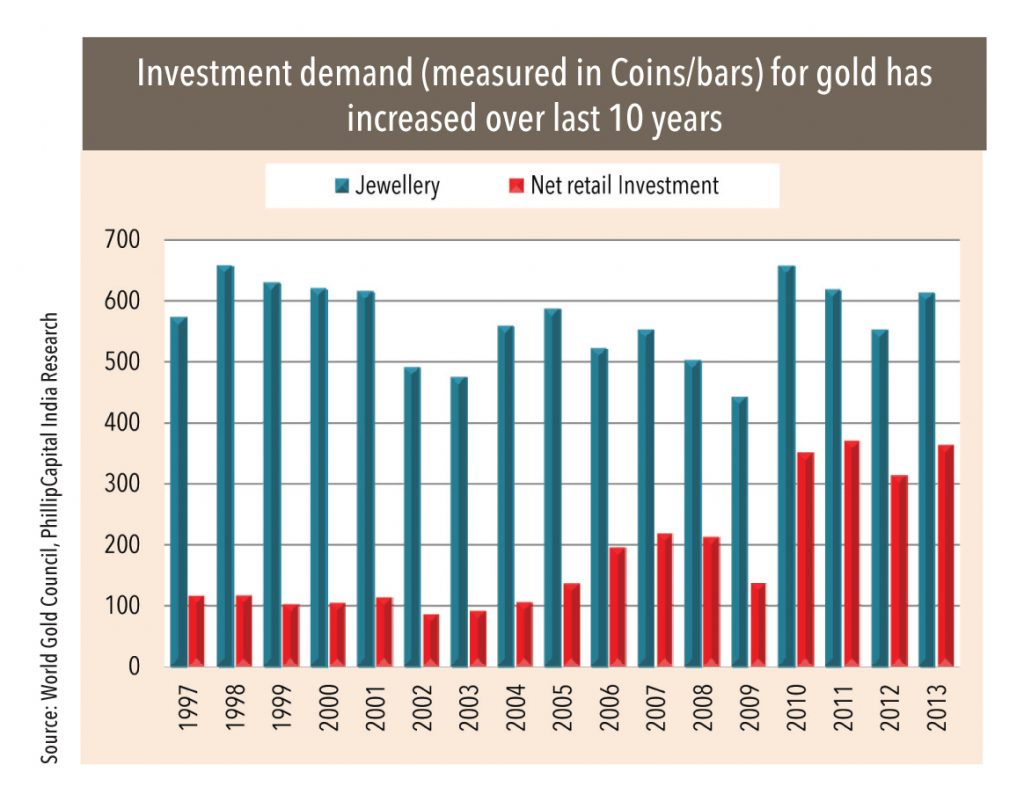

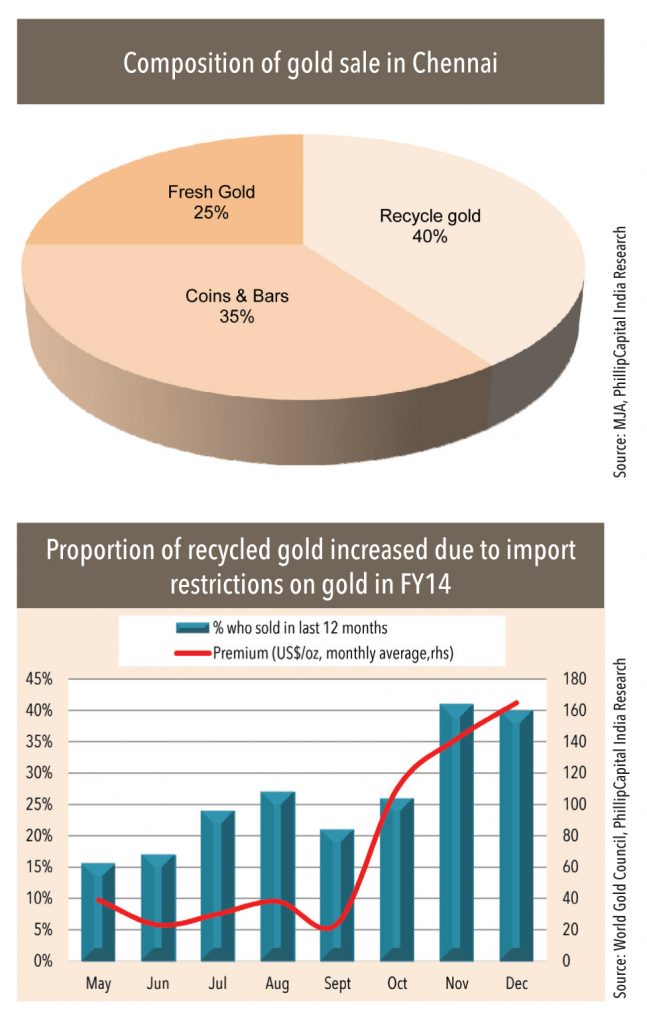

Moreover, south India seems to purchase gold with implicit investment motive. Motive is clearer and more evident in the South as gold coins and bars account for more than a third of gold purchases in many places. Interactions with members of the Madras Jewelry Association (MJA) indicate that around 30-40% of the purchased gold is in the form of coins and bars. As per WGC, 36% of gold is bought in the form of bars and coins. This number was 16% 10 years ago.

“Gold is amongst the top two searched words on the internet. The top-most searched word is stock market. During Akshay Tritiya, gold is the most searched word,”

— Amresh Acharya, WGC.

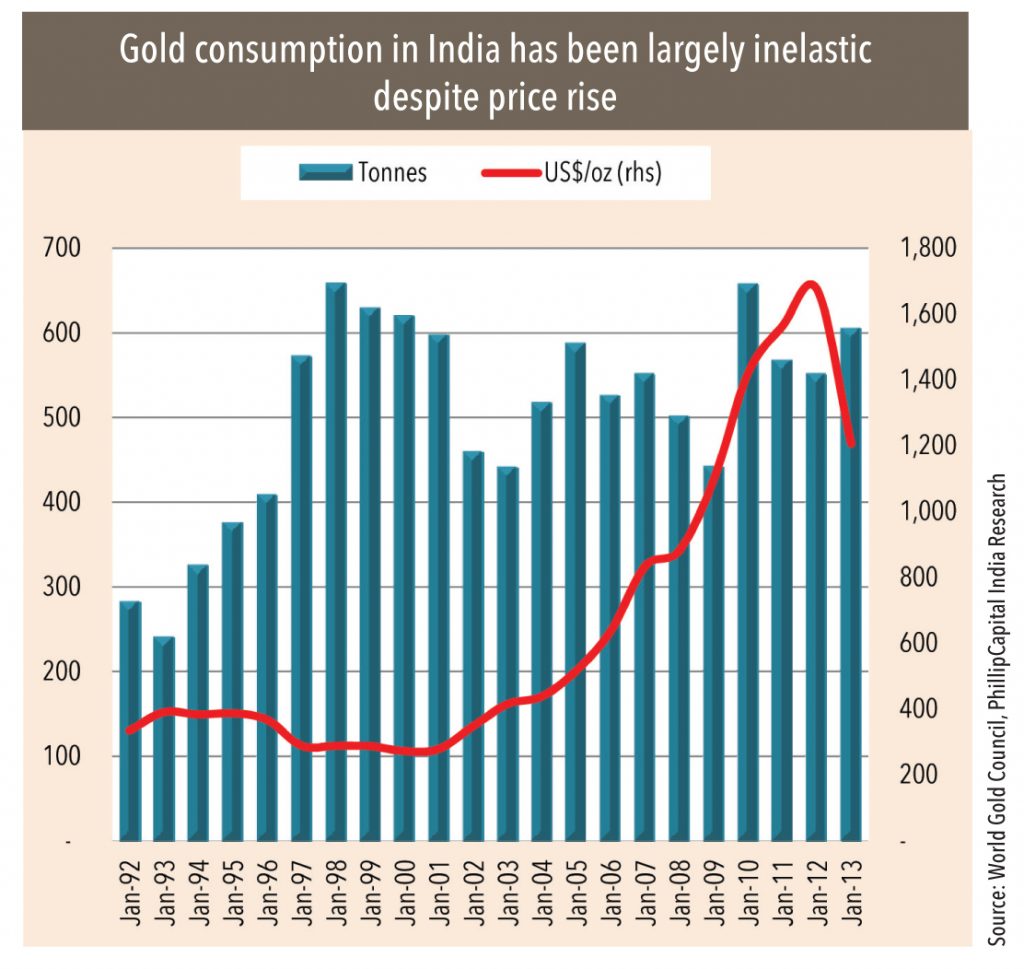

Gold continues to be perceived as an investment — at the very least it straddles both savings and investment. Mr. Acharya explains, “People don’t consider gold to be an expense. More than 50% gold is bought in rural areas where they have limited avenues to invest their savings. Only 40% of people have access to banking services. In India, 5% of savings is in physical gold and the percentage has been maintained over the years. 55% of savings are physical in nature and the rest are financial.” The perception of gold in tier-3, 4, and 5 towns continues to be skewed towards investments compared to cities.

“In cities there are more avenues and distractions such as cars, luxury goods to spend money on, whereas these avenues are limited in smaller towns and cities. Hence propensity to consume gold there is higher.”

— Mr. Rajesh Vummidi, member of the Madras Jewelry Association (MJA) corroborates

So what drives the sales of coins and bars? “We can’t classify gold as investment as it’s seldom sold,” says Mr. Acharya of WGC. Most coins and bars are bought as a planned purchase for weddings in the family rather than as a pure financial investment.Trying to explain the buyer’s mindset Mr. Vummidi of the MJA says, “As wedding jewelry designs change with time and can’t be planned 25 years in advance, families in TN buy gold in the form of coins and bars at regular intervals. This helps the family mitigate gold price inflation over this duration and is the most cost effective way of procuring gold as it entails very little making charges.”

“We can’t classify gold as investment as it’s seldom sold,”

— says Mr. Acharya of WGC.

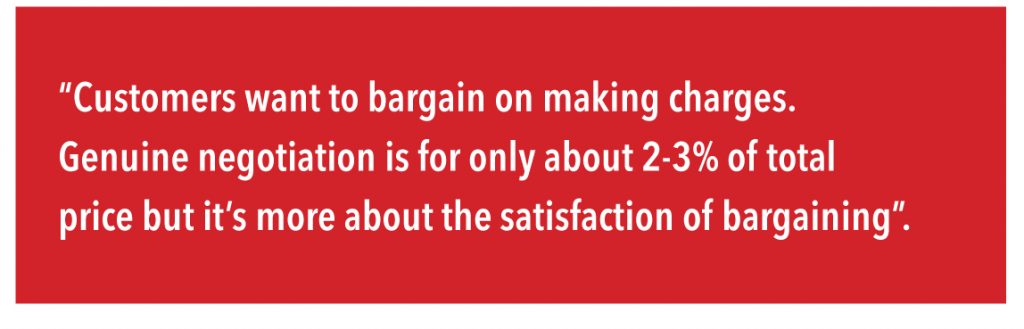

Therefore, recycling gold is a popular trend. Tamil Nadu has the highest share of recycled gold jewelry. Interactions and surveys across largest players firmly indicated that over 40% of the jewelry sales are from recycled gold. While this number does look high, it should be read keeping in mind the high share of coins/bars, which eventually get recycled mostly for weddings.

“Over 50% of the country’s gold is bought for marriages or associated with marriages. It’s seen as a way of giving wealth to the daughter or daughter-in-law”

— Amresh Acharya, WGC.

However, the timing and planning of gold purchase varies from state to state. In Kerala, the wedding jewelry is purchased closer to the wedding date and does not entail as much planning, says an associate of one the largest south-based jewelers. He further adds, “In Kerala, wedding purchases happen just before the wedding, hence it can be tracked, whereas in TN it’s a planned purchase.” Basically, purchases of gold are planned from the day a child is born into the family — a leading south jeweler said that the initial purchase of gold (in TN) will be in the form of coins and bars, not jewelry.

In this robust and intriguing market what drives the choice of the jeweler?

Buyers in south India, especially Kerala and TN, are extremely quality conscious and are well aware of purity and hallmarking.All the jewelers surveyed, including some family jewelers,in these states clearly said that purity was of paramount importance.

Purity and quality is a first and foremost parameter for a consumer when it comes to the choice of jeweler,”

-says Mr. Vummidi, MJA.

Buyers are willing to pay a premium for purchases from reputed regional and national chains. Regional players in the south, especially in Kerala and Chennai, have kept pace with the customer’s awareness and almost all the large players are considered to offer quality (purity). However, awareness and practice both would be lower in the smaller towns.

Preference for only gold, traditional and heavy designs; diamonds a distant runner up

The south India jewelry market is skewed towards gold and traditional designs; it is also extremely competitive. Consequently,the consumer awareness of making charges is very high. Unusually low making charges usually mean that there have been compromises on quality of workmanship by reducing man-hours.

The average making charges in south India for gold jewelry is around 10-15% and 15-25% for diamonds. However, the designs are more traditional and heavy. As one regional jeweler stated, “Customers want to bargain on making charges. Genuine negotiation is for only about 2-3% of total price but it’s more about the satisfaction of bargaining”.

Jewelers concur that on some differentiated products one can charge higher making charges. The average gold consumed during a wedding in Chennai is 100gms. However, there are signs of change in the South from heavy gold jewelry to lighter weights. As Mr. Vummidi of MJA pointed out, “Now the focus is on light-weight jewelry, even in weddings. Earlier a wedding kasu mala (neckwear) used to weigh 60gm. Now the new designs in kasu mala weigh only around 30gms and the balance 30gm is used for light-weight jewelry, which can be used more frequently/daily.”

In the south, barring major cities such as Chennai and Hyderabad, diamonds are not very popular. “In the south, diamonds have to be colorless as colored ones are considered inauspicious”, says Mr. Vummidi of MJA. He believes that diamonds are slowly gaining popularity in the south; existing gold buyers are willing to try diamonds. However, diamonds are still only 15-20% of the market.

Another Kerala-based player added that diamond jewelry would be approximately 7-10% of the market and studded (with stones) jewelry is growing fast. His view is that Kerala is a modern market and studded jewelry will gain share there over a period of time.

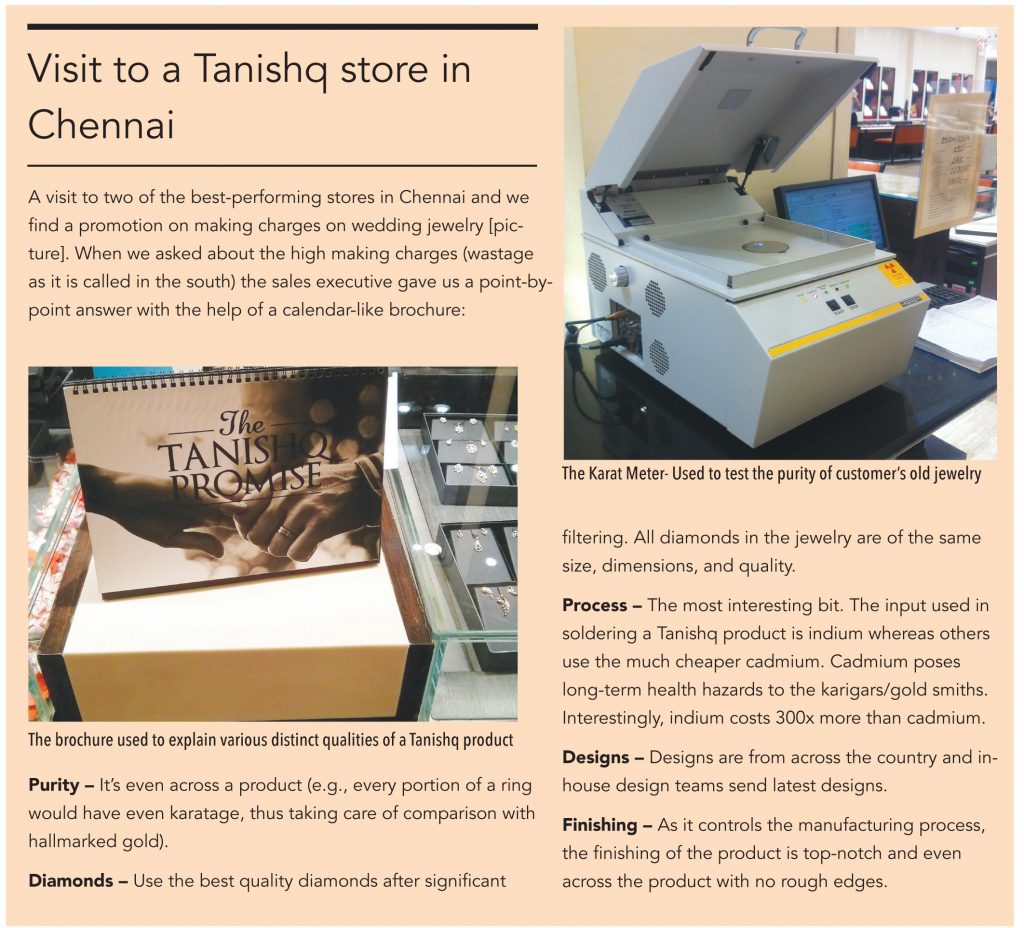

In general, most regional/local jewelers indicated that the large players such as Tanishq and Malabar have higher making charges. We delved deeper and had an insightful interaction with an ex-employee of Tanishq who is now employed with a competitor.

The gentleman who obviously does not want to be named stated that 60% of the designs in a Tanishq store are unique — the main reason given to customers about why their making charges seem high. Other regional players have common vendors and hence design is not necessarily unique. One of Tanishq’s major competitors (south-based) also agreed that Tanishq’s designs are unique and contemporary and hence the clientele base is different. Tanishq has its own state-of-the-art manufacturing unit and karigar (craftsman) park and in-house design team.

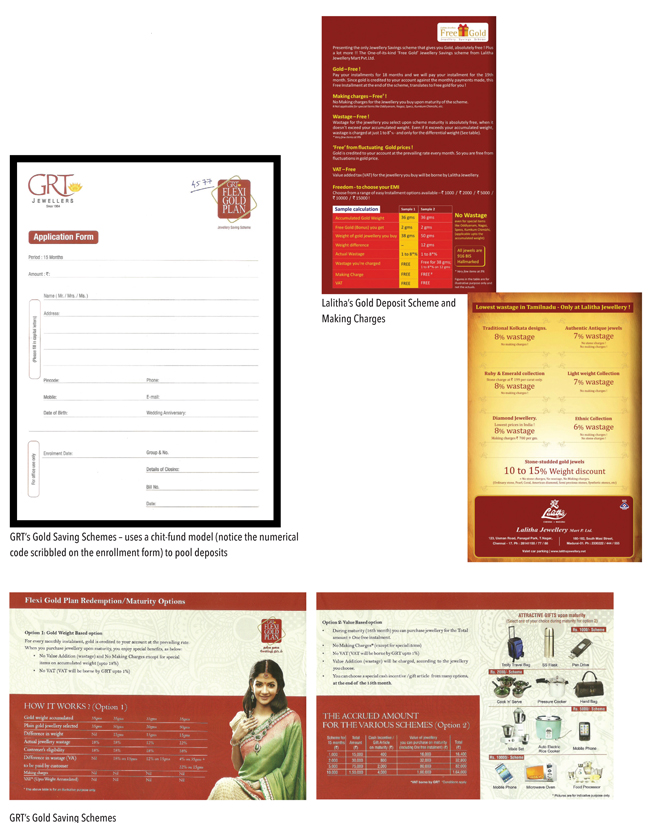

Another intriguing aspect of the market is the tremendous customer loyalty that regional jewelers there enjoy. As gold and jewelry are planned purchases down south, jewelers have adapted and grown through a variety of monthly gold deposit schemes, where at the end of tenure, the buyer can purchase jewelry/gold for some discount or freebies. It is estimated that there are 11,000 gold savings schemes in the country.

Gold deposit scheme first originated in TN and GR Thangamaligai (GRT) is one of the largest players there. Customer loyalty in TN is largely through the monthly gold deposit schemes. “Chennai is perhaps the most matured market for gold jewelry. The array of deposit schemes and competitiveness in pricing and promotions is tremendous,” says Baidik Sarkar, a finance professional and native of Chennai. He further adds, “In a GRT jewelry store, I can coax him into reducing the price further by saying Anna (means brother) konjum (some) discount… this way I have built a relationship with the jeweler over the years.”

One family jeweler claimed that 20-25% of his business comes from deposit schemes. The average size of deposit is Rs 5,000 per month. Some schemes allow the buying of coins while schemes that waive off the one-month deposit are only for buying jewelry.Interestingly, the quantum of up-trading by his customers was in the range of 20-25% of the total deposit amount.

It is quite evident that market in the South is mature with customers making systematic allocations towards gold purchases (as an asset or for weddings), high level of awareness of purity and making charges, and an array of deposit schemes and strong loyalty to the regional jewelers.

Subscribe to enjoy uninterrupted access