Ground Zero interacted with Pankaj Agrawal of Capitel Partners to understand the strategies that operators may follow in the mega-spectrum-renewal auctions to be held in February 2015.

Pankaj is a Director with Capitel Partners, an investment advisory that conducts due diligence for telecom, digital media, and internet companies. Until recently he was the co-head and board member of Analysys Mason India where he was responsible for the India, Bangladesh, and Sri Lanka markets. Before that he has worked with the TMT strategy team at Deloitte Consulting and with BDA China across multiple markets including the US and the Middle East. Between 2003 and 2006, he was the national head of revenue planning and pricing management for Bharti Airtel’s mobile business. He has had significant exposure to corporate planning and strategy formulation, including in investments, operating plans, and tender offerings.

Following are excerpts of Ground Zero’s interaction with Pankaj:

A: The February 2015 auctions are critical — they are do-or-die for Idea Cellular, Reliance Communications, and Vodafone India, as these players will have to win back spectrum in several circles to be able to sustain operations after their spectrum licenses expire.

The quantum of spectrum that is up for renewal – 900MHz – is very large. Globally, sub-1-gigahertz -frequency bands are a vital ingredient in operators’ coverage plans and it is the same for India. 900MHz spectrum is very important in the upcoming auctions as the circles that are seeing licence renewal are geographically large (unlike the metros in the February 2014 auctions). In metros, due to high population density, an operator with 1800-MHz spectrum is able to cater to its customers with just 1.0-1.2x the sites that a 900MHz operator has. But this equation changes dramatically in rural and semi-urban areas where the site count escalates to 2x vs. similar telecom coverage in the 900-MHz band.

And since 900MHz is likely to be used for 3G services (along with its traditional voice usage), we might see fierce bidding for this spectrum.

A: It is not fair to compare 3G over 900MHz vs. over 2100MHz. One must compare 900MHz with 700MHz, as sub-GHz frequencies are far superior to other bands. Given the lack of clarity on the availability of 700MHz spectrum, 900MHz becomes very important for the data growth prospects of incumbents. Additionally, 3G over 850/900MHz has a broad ecosystem compared to Long-Term Evolution (LTE).

Vodafone has stated that it will deploy 3G aggressively rather than look at 4G and will use 900/2100MHz to do this — 900MHz for coverage and 2100MHz for capacity.

The price of the 900-MHz spectrum will also reflect the prospects of 3G services in the respective circles.

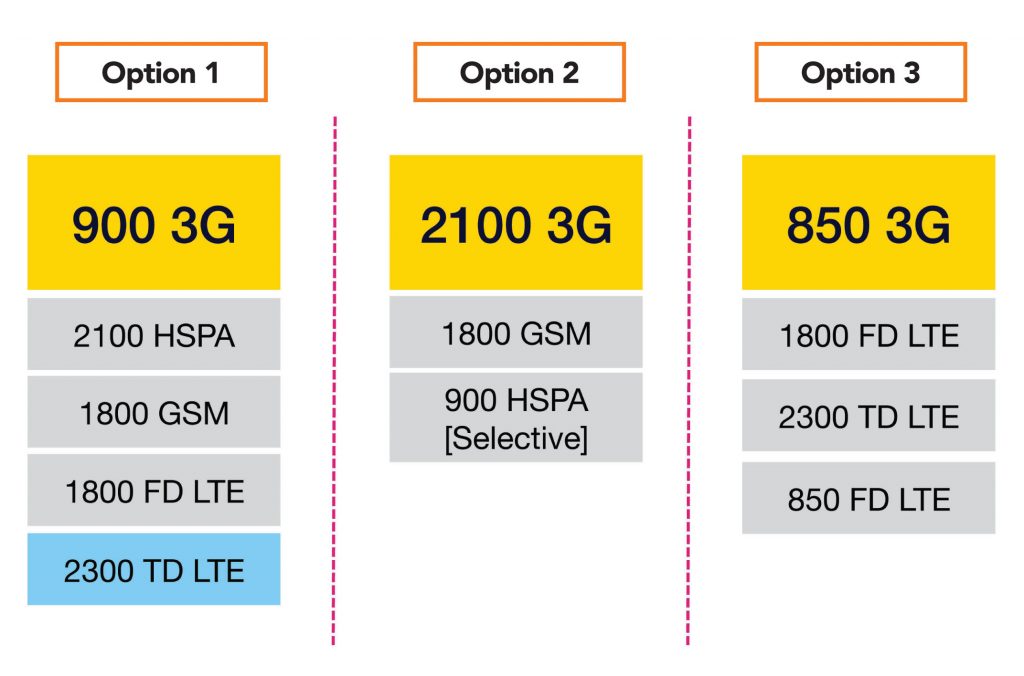

A: As was the case in the February 2014 auctions, Jio is unlikely to be aggressive in acquiring 900MHz spectrum. At best, it will acquire this spectrum in patches. Jio would much rather acquire non-contiguous spectrum in the 800MHz band, combine it with RCom’s spectrum, and launch voice and 3G services in 850MHz (option 3 of the graphic above). Its strategy would be to use 850 3G for voice and data coverage while 1800 FD-LTE and 2300 TD-LTE for data needs, especially in urban and dense urban areas.The 850MHz band is also likely to see FD LTE support in the future, as this frequency band is seeing investments by global technology vendors.

Options 1 and 2 are natural choices for incumbents resulting in high relevance of 900MHz spectrum for them, while Jio would choose option 3. Jio’s economics in the 850-MHz band are much more favourable than a business strategy where it would have to acquire 900-MHz spectrum. This is because there are no takers for the 800-MHz spectrum in upcoming auctions as the spectrum is non-contiguous. Jio can pay the discovered market rate (which will be low due to lack of takers) for RCom’s spectrum, liberalise it, and create contiguous 5-MHz blocks in 850MHz.

The spectrum that RCom possesses has a validity of 7 years, unlike new spectrum from auctions that have a 20-year validity,and are therefore very expensive.

A: In the 900-MHz band, supply will matter more than the reserve price. Reserve prices are more relevant when supply of spectrum is more than the potential demand.

Availability of 5MHz contiguous blocks of spectrum will be a key factor in deciding the auction price. Only one circle – Punjab, has 3 blocks of contiguous 5-MHz spectrum in the 900-MHz band. In major ‘A’category circles there are only 2 blocks of contiguous 5-MHz spectrum in the 900-MHz band while several ‘B’&‘C’category circles have only 1 contiguous block.

RCom and Idea Cellular could end up forsaking 900-MHz spectrum in some circles, as their market shares do not justify a very high bid in those circles. There is a possibility that RCom could lose its 900MHz spectrum in MP and the C-circles;Idea might see this in Gujarat and Karnataka.

In the February 2014 auction, Vodafone bid for 2 blocks of 5-MHz contiguous spectrum in the 900-MHz band in Mumbai.If it were to repeat this in the upcoming auctions, then the auction price could be very high due to the limited spectrum supply. Airtel, too, is likely to bid for 900-MHz spectrum in circles where it is losing ground and where it does not have 2100MHz spectrum for 3G services.

A: With the spectrum renewal auctions, 3G will start getting deployed in 900MHz and 4G in 1800MHz. Operators could shift from 900MHz to 1800MHz thereby driving tenancies, while 3G deployments over 900MHz would largely be loaded on existing tenancies. This could add 45,000 tenancies. The tri-band spectrum strategy of Jio – 850MHz for coverage, 1800MHz for urban coverage, and 2300MHz for dense urban capacity — is likely to result in 25,000 open-market tenancies. Finally, operator consolidation could take away 20,000 tenancies. Thus, the industry tenancy growth could be 50,000-60,000 from FY14-17.

Subscribe to enjoy uninterrupted access