India’s rank as the third-largest cancer capital of the world, its steady rise in cancer incidence, and wide unmet demand in cancer care are unpleasant facts — but the flip side is that because of these reasons, the Indian government and private players have upped their efforts to provide affordable care — this in turn has created a huge business opportunity for both drug manufacturers and healthcare service providers.

With a revenue base of about Rs22bn, the Indian oncology pharmaceuticals market is the fourth-largest in terms of volume in the world and the eighth-largest in value. It has seen an annual growth of 20-25% in recent years. The market is expected to show strong growth driven by the continued rise in cancer incidence, better diagnosis,improved access to cancer therapies, better health insurance coverage, and more importantly, rising awareness in rural and interior areas.

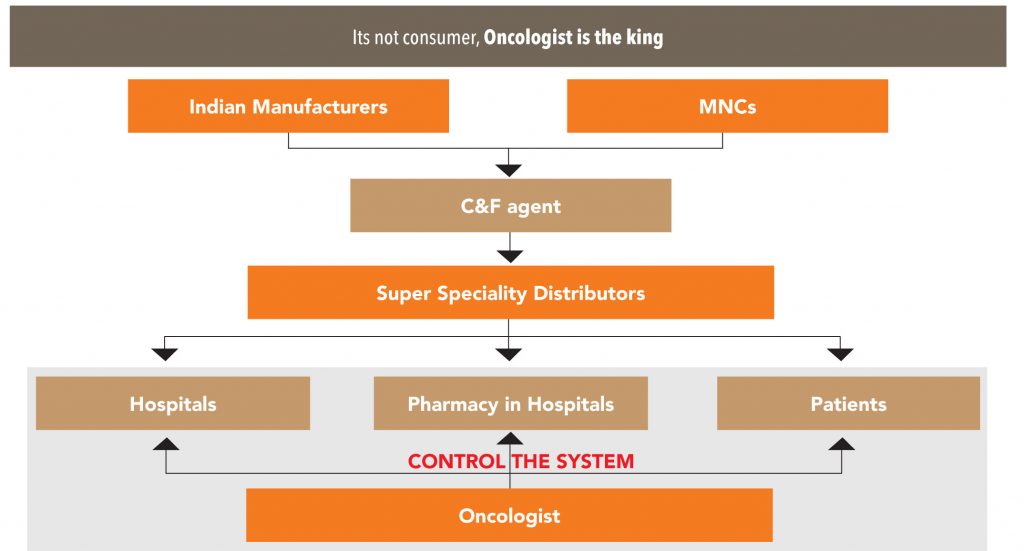

Around 80% of the oncology drugs are supplied directly to hospitals and the rest to patients and trade (trade means independent pharmacies associated with corporate hospitals) – so the oncology pharmaceutical markets is largely oriented towards hospital supply. This is mainly due to the specific pre-requirement of cold storage and extremely high-value inventory. Therefore, oncology drugs are supplied directly by either the C&F agent or specialty distributors to hospitals or patients. As a result, the procurement and distribution of thesedrugs follows a lean distribution structure compared to that of ethical pharma drug distribution in India.

“Most of the leading cancer institute follow a tender process to procure oncology drugs in India. Specifically, the tender process in Tata Memorial Hospital goes through a technical bid and a financial bid. The technical bids are assessed by the drugs committee of the hospital where they scrutinise various parameters such as R&D strength, manufacturing capability, GMP practice, originality of molecule, and qualifications of the suppliers. Subsequently, the financial bids from qualified suppliers are invited and finalised based on the price of the offer,” says Dr HKV Narayan, the medical superintendent of Tata Memorial hospital.

Basically, what it means is, at the end of the day, the oncologists of a particular cancer care centre are the ones who take decisions about drug procurement.

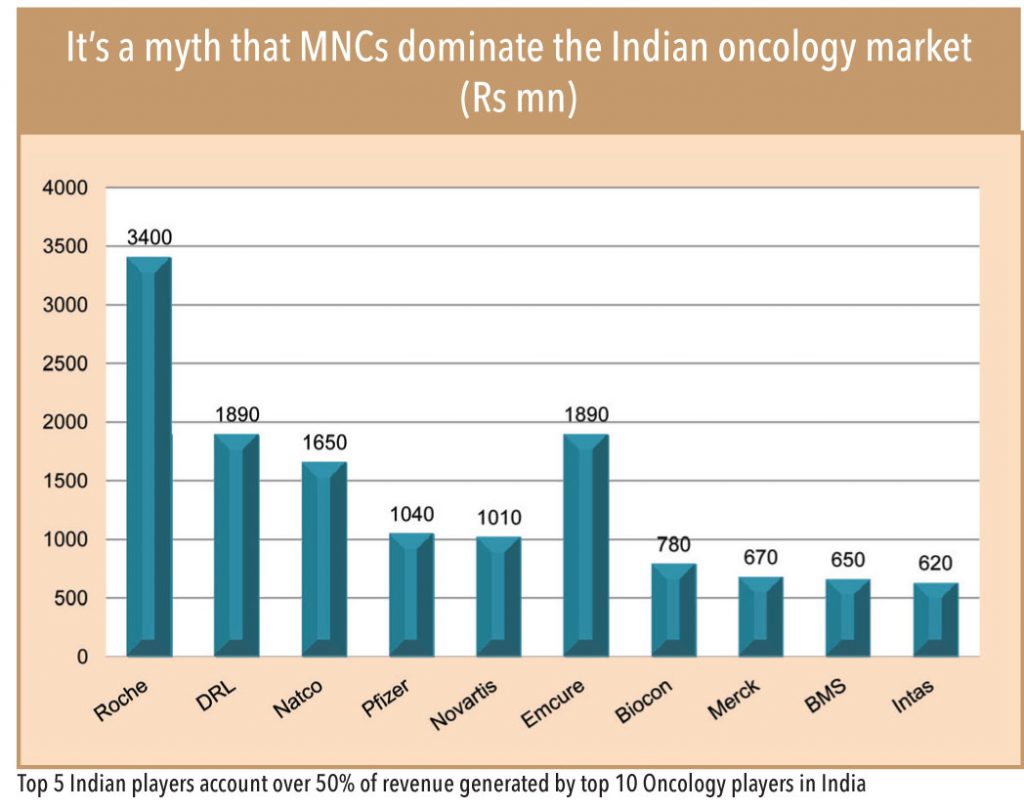

There are a large number of foreign as well as domestic drug manufacturers in the Indian oncology market, making it a highly fragmented one (just like the Indian ethical pharmaceutical market)—there are about 125 competitors. While majority of this competitors are traders (who arenotallowed to participate in many leading hospital tenders), only about 30-35 players are actual manufacturers and marketers of oncology drugs.

While innovative global MNCs like Roche, Novartis, Bayer, Fresenius Kabi, Pfizer, GlaxoSmithKline, and Sanofi-Aventis play an active role in offering cancer treatment in India, domesticpharma peers provide enough competition to their MNC counterparts. Amongst Indian players, Dr Reddy’s leads in the oncology market, followed by Natco Pharma, Emcure, Biocon, and IntasPharma. Other active Indian participants include Sun Pharmaceuticals, Cipla, Lupin, Zydus Cadila, Glenmark, and Reliance Life Sciences.

Since biologics need very specific research, developmental,and manufacturing capabilities, there are limited players in this field. So, in India, while the competition is stiff in the traditional cancer treatment segment, it is limited in biologics. Within Indian players, Dr Reddy, Biocon, Emcure, IntasPharma, and Reliance Life Sciences are standouts. Other new entrants (biologic/biosimilar cancer drug manufacturers) are Cipla, Lupin, Zydus Cadila and Glenmark.

Because biologics seems like the future of cancer treatment, a lot of companies are working on developing new therapeutics, kits and drugs— these include, Intas Biopharma, Biocon, Dr Reddy’s Laboratories, Transgene Biotek, Inbiopro Solutions, IMGENEX, Panacea Biotec, Mitra Biotech, Bharat Biotech, and Shantha Biotechnics.

With the participation of many domestic companies and major multinationals in the domestic oncology market and their fight to strengthen their foothold in the country has made the competition in this segment cutthroat. The price control mechanism in the country has put additional pressure. Due to this, the growth of the market moderated to 15-18% most recently vs. 25% in the past.

While price control has put a bit of pressure on growth, the growth potential is strong. Improved early diagnosis, better access to cancer therapies, better health insurance coverage, increasing awareness in rural and interior areas, higher government expenditure on health, and better access to cancer drugs will drive growth.

According to an expert in the field, “Though the average life expectancy and the cancer detection rates have steadily gone up in India over the past decade, leading to increasing number of patients on cancer treatment, the market growth seems to have moderated of late. The access to quality oncology healthcare and availability of affordable medicines to large tracts of the rural population remains a key challenge for public health administrators. However, this could be a big opportunity for exploring public-private partnerships.”

According to Mr Shukrit Chimote, Vice President & Head, Branded Formulations (India), Biocon,growth has moderated due to increasing competition in traditional drugs and regulatory price controls in both traditional and biologic/targeted therapy drugs. However, the targeted-therapy-drugs segment is growing at 20-25% and traditional small-molecule segment at 12-15% and this trend is likely to continue.He believes that new differentiated product launches from the R&D pipeline of leading Indian pharma companies will fulfil unmet needs in cancer care and drive growth for the oncology market.

Oncologists believe, since there were limited number of new anticancer drug introductions in thelast decade, the launch of existing drugs with differentiated delivery techniques will drive growth in the medium term. Specifically, it is the emergence of novel drug delivery techniques such as nanoparticles and liposomes (which make the existing drugs safer and more effective) and combination therapies (existing chemotherapy drugswith biologic drugs) which will drive value growth for the Indian oncology market. However, the R&D investmentneeded in developing such differentiated delivery techniques remains a key challenge for industry peers.

In cancer treatments, biologic products include targeted therapies like monoclonal antibodies as well as supportive therapy products like GCSF, EPO, and interferon alfa. Normally cancer cells divide fast and grow at an abnormal rate by overriding apoptosis (cell death) and become immortal. Biological therapy focuses on blocking the signal that tells the cancer cells to grow. It makes cancer cells undergo apoptosis.These can also make the cancer cells more recognizable to our own immune system, which can then seek out and destroy the abnormal cells, says Dr Seema Gulia. Since the biologic monoclonal antibodies directly hit the cancer cells without having side effects, they are called ‘targeted’ therapies.

Though the targeted therapies cure cancer patients with minimal side effects, the complexity around developing such drugs often become a key challenge for generic manufactures. These drugs require an investment of over US$100mn each, years of clinical development, and prohibitive regulatory challenges — all these factors create strong entry barriers.

Experts believe that biologic therapies characterised by low toxicity and better treatment results will be the future of oncology even though chemotherapy and surgery are the most prevalent treatment options today. With the increasing acceptance of targeted therapy drugs by the upper-income segment,a gradual increase in insurance coverage, and limited price competition, biologics are currently growing twice as fast as traditional oncology drugs. Recent R&D developments towards combination therapies (biologics combined with chemotherapy) to achieve a better response rate will further ensure long-term growth for biologics.

Subscribe to enjoy uninterrupted access